Economy on Track to Post Strong Growth in Q3, Defying Slowdown Fears

2024.09.25 09:10

The odds continue to look favorable that the US will dodge an NBER-defined recession through the end of the third quarter. Q4 still looks more challenging, but that’s guesswork at this point. By contrast, the case for expecting a positive trend to endure in Q3 reflects a rising set of published economic data to date.

CapitalSpectator.com’s analysis/forecast that US growth will continue in Q3 has been largely consistent over much of the past two months. On Aug. 6, for example, : “US Isn’t In Recession Now, But Downturn Risk May Be Rising.” The following week that the “Latest Economic Data Suggests US Expansion Continues.”

A broad review of data extended the net-positive analysis into early September. Two weeks ago, this site that “US Q3 GDP Data Still Expected To Post Solid Growth.” Last week’s reaffirmed the upbeat outlook for Q3.

The point is that by monitoring a broad, diversified set of indicators, a relatively clear profile of the US macro trend usually emerges. This approach contrasts with the warm and fuzzy analytics, or rank speculation, that’s too often thrown around by the usual suspects. The primary errors that lead to misreading the near-term outlook include cherry-picking one or two indicators and/or making forecasts too far into the future to pass the smell test.

Alternatively, routinely focusing on a wide set of indicators provides a robust approach for minimizing noise and maximizing signal. At the core of our methodology is the deep and wide analytics of nowcasting the business cycle via the weekly updates of The US Business Cycle Research Report.

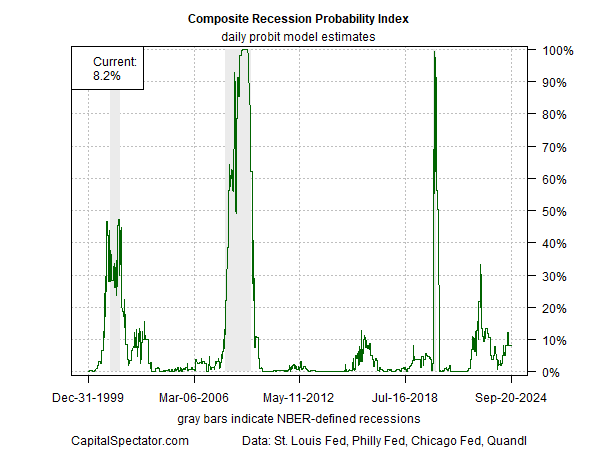

The newsletter’s primary recession indicator (which summarizes multiple proprietary and third-party business-cycle benchmarks) continues to estimate the real-time probability of an NBER-defined recession at less than 10% (as of Aug. 20).

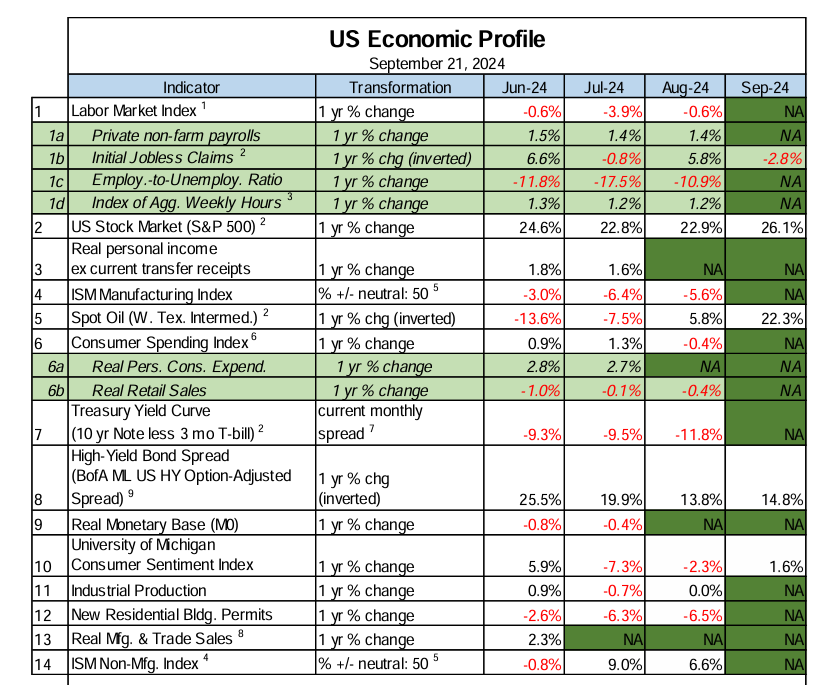

Another facet of the newsletter’s analytics is modeling and monitoring more than a dozen US economic and financial indicators that collectively provide a robust proxy of the broad macro trend.

The main takeaway from these and other indicator analytics featured in The US Business Cycle Risk Report: recession risk remains low. Near-term projections that fill in the missing data points through October strongly suggest the US economy will continue expanding.

Once you start looking at November and beyond, the potential for high-confidence analytics falls sharply. And to be fair, there are reasons to wonder if the current growth bias will survive through the end of the year and into early 2025. Unfortunately, there’s little if any hard data at the moment to make confident forecasts on that front. Of course, that doesn’t stop the usual suspects from trying.