Economic Tailwinds Fade: Savings Depletion, Declining Lending Raise Concerns

2023.07.20 04:31

Back in March, I wrote about the pandemic-era savings glut and why it was premature to discuss an impending recession as long as it remained.

But have no doubt, that massive $2.1-to-2.3 trillion build-up in consumer savings post-2020 is vanishing.

And it’s nearly gone at this point.

This excess was a huge tailwind for growth – as consumers splurged with their built-up government handouts and pent-up savings.

But it couldn’t last forever.

Or put simply, it was on borrowed time.

And even if it reverts to 2019 (pre-pandemic) levels, that’s still a considerable decline in consumption as consumers must stop drawing down their savings and instead rebuild them.

Why?

Because when there’s more debt outstanding, it requires more income and savings to repay it. Meaning less consumption.

Remember, you can only do things with a single dollar. Save or dissave (consume/repay debts).

But there’s another way consumers can keep spending – and that’s with debt (which is negative savings).

Thus it’s important to take a look at both the excess savings estimates and bank credit trends.

And with both declining quickly, I believe the second half of 2023 and early 2024 could show increasing fragility. . .

So let’s take a closer look. . .

The Pandemic Era Excess Savings Is Near Depleted

To give you some brief context, after the COVID-19 pandemic began in Q1-2020, the U.S. household saw an ungodly surge in savings and financial support.

The U.S. government gave out roughly $5 trillion in handouts – through direct stimulus checks, expanded unemployment insurance, child tax credits, business loans (PPP loans), and various other programs.

Meanwhile, the Federal Reserve poured gas on the fire by cutting interest rates and launching massive bond-buying programs. Expanding their own balance sheet to over $4.9 trillion within two years.

Thus liquidity was more than plentiful. And U.S. households saw a dramatic rise in buying power.

And over time, consumers began spending this dramatic build-up in savings.

This fueled ‘demand pull’ inflation (aka when there’s greater buying relative to supply) and economic growth.

But after two-and-a-half years, that tailwind is nearly gone. . .

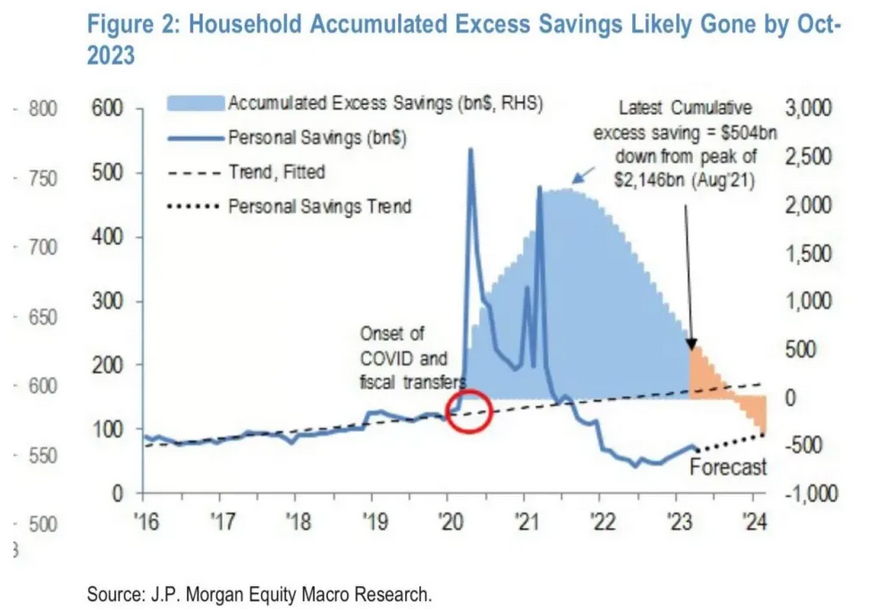

For instance – according to JP Morgan – household accumulated excess savings is roughly $500 billion as of Q1-2023. Down from the $2.15 trillion peak in August 2021. And will most likely run out by October 2023 (at this current pace).

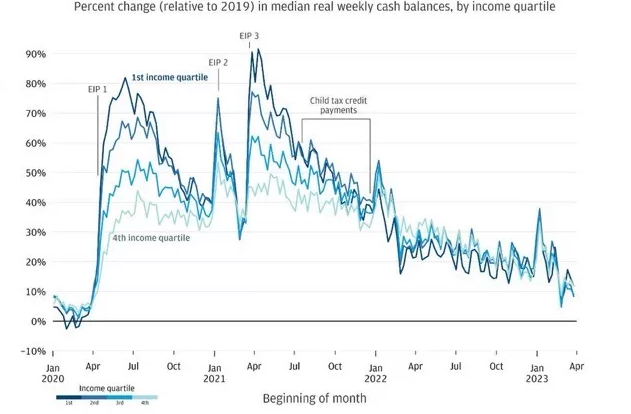

JP Morgan further notes that the percentage change in median ‘real’ (adjusted for inflation) weekly cash balances across income groups is now just 10-15% above 2019 levels. Compared to over 90% in early-2021.

Percentage Change in Weekly Cash Balances

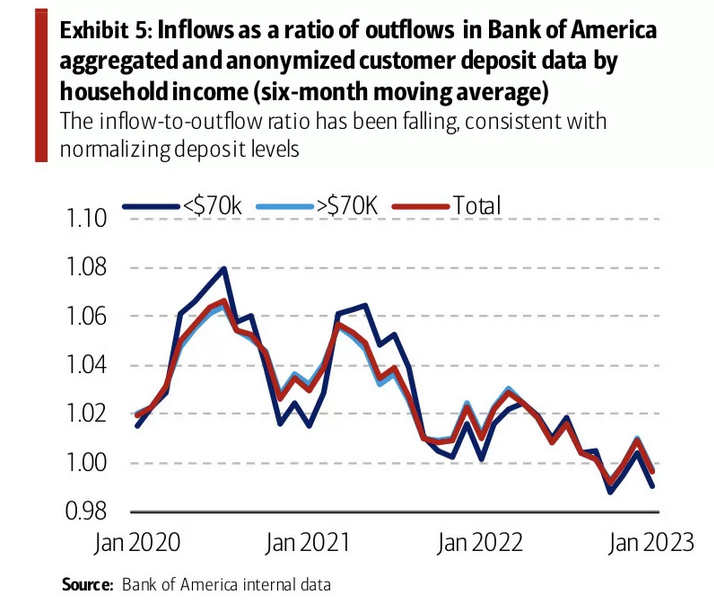

And Bank of America (NYSE:) echoes this trend.

The bank’s March consumer checkpoint report showed that the ‘inflows-to-outflows’ ratio in savings/checking accounts has declined steadily since late-2020.

Thus indicating a gradual decline in savings buffers across income groups.

Bank of America Internal Data

Bank of America Internal Data

Or – putting it simply – more cash is leaving accounts than what’s coming in.

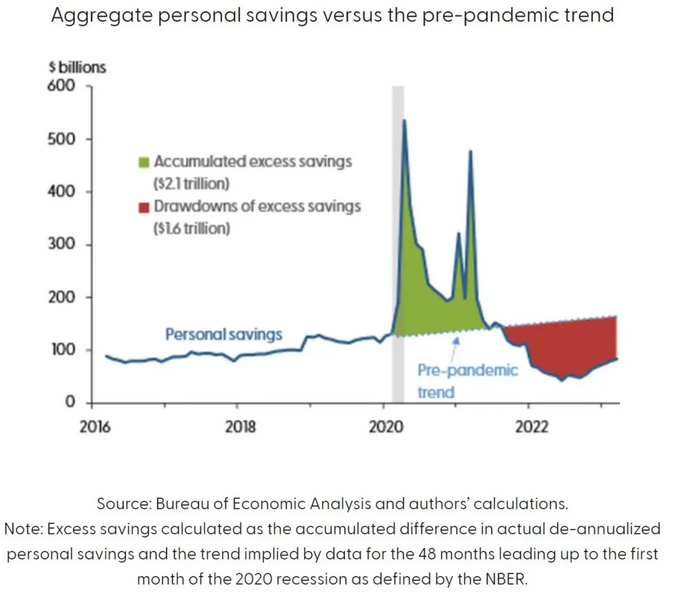

Meanwhile, the San Francisco Federal Reserve Bank published a piece in May further highlighting this rundown in savings.

According to their analysis, total personal savings has plunged below the pre-pandemic trend since August 2021 – where it’s remained – signaling a drawdown in the excess savings.

Aggregate Personal Savings

Aggregate Personal Savings

The bank noted that, “Cumulative drawdowns reached $1.6 trillion as of March 2023 (red area), implying there is approximately $500 billion of excess savings remaining in the aggregate economy. Should the recent pace of drawdowns persist—for example, at average rates from the past 3, 6, or 12 months—aggregate excess savings would likely continue to support household spending at least into the fourth quarter of 2023. . .”

Thus as this drawdown in savings continues (all else equal), it will eventually exhaust.

And whether it went towards consumption or buying assets or debt servicing, that’s excess money that won’t continue flowing.

Eventually, households must revert from depending on this finite savings and instead use wages to sustain buying or debt repayment. Which would be negative at the margin.

But there is another way households can keep spending. And that’s with credit.

But credit growth is slowing steadily as both banks tighten lending and consumers shy away from higher borrowing costs.

And with diminishing credit growth comes weaker demand. . .

Bank Credit Growth In The U.S. Is Declining Across The Board

The rate of bank credit (loans) has declined sharply over the last year.

I touched on this last week in more detail – highlighting the fading credit impulse and money supply – but here’s some context.

As of July-5th – bank credit growth from commercial banks is just 0.2% year-over-year. And likely will fall negative in the coming months. Marking the first time it’s dipped negatively since 2009-2010.

It’s important to note that total bank credit is weighted with 30% securities (bank asset holdings) and the other 70% is lending.

And since bank assets have taken a record massive hit (they’re sitting on over $500 billion in unrealized losses), this has impacted total bank credit.

But bank lending is also fading, , ,

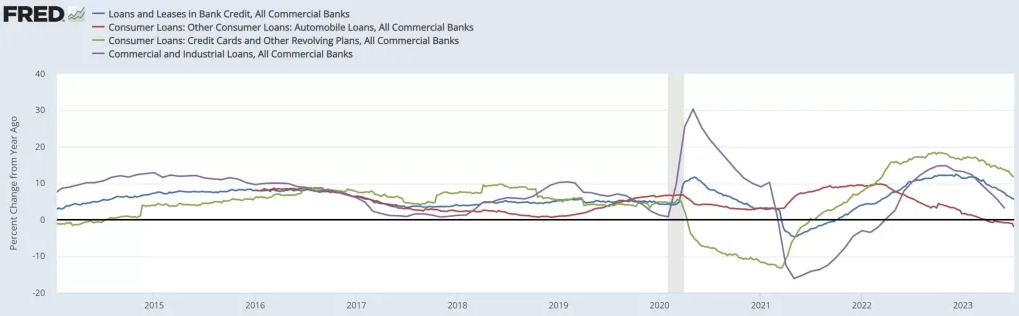

For perspective, bank lending across the board has declined over the last year. From loans-and-leases and consumer credit cards to auto loans and business loans.

In fact, commercial bank auto lending growth (red line) is now negative.

One could argue it’s reverting back to the pre-pandemic trend.

And that is possible. But still, even reverting back to 2019 levels would be a shock to demand at this rate.

Making matters worse is that bank deposits have plunged the most on record in year-over-year terms (reaching roughly -4% as of July 5th).

Deposit – All Commercial Banks

Deposit – All Commercial Banks

Much of this outflow in deposits came amid the Silicon Valley Bank failure – as money poured from regionals and into money-market funds and bigger banks. But deposits were fleeing even before then as the Federal Reserve forced short-term interest rates higher. (Why keep deposits in a 0-1% yielding checking account when money-market funds offered 5%).

But if deposits fall, banks must reduce lending to match their weaker assets and declining liabilities. . .

Thus as long as deposits are leaving the commercial banking system – bank lending should stay weak.

And judging from the current rate of change and loss of momentum, this decline should persist.

And less credit is less demand somewhere else.

In Conclusion

The powder keg of excess savings post-2020 had its ‘boom’ – but is now nearly exhausted.

And what was once an economic tailwind will shift into a headwind.

Same with credit.

After the double-digit annual gains in bank lending in 2022, it has since eroded.

So – going forward – one must ask:

1. Can wages alone without excess savings carry growth? I’m doubtful.

2. Will households start organically rebuilding their savings, deferring consumption? Likely.

3. Will households tap into their asset equity (such as homes that saw huge price gains) to consume? Unknown.

Many economists now believe that the ‘soft’ economic landing is in play.

But these same economists believed a ‘hard’ landing was coming last year.

It’s premature to gauge the health of the economy as long as the excess savings drawdown continues to subsidize spending.

But once that’s gone, the real picture becomes more clear.

Thus, as always, I remain skeptical.

PS – there are many variables that drive an economy, and I’m just highlighting a few points I believe are grossly discounted.