Financial market overview

E-Mini Loses Momentum, Forms Small Wedge

2023.07.17 09:59

The loss of momentum is represented by the overlapping price action in the last 5 weeks. It also formed a small wedge (Jun 16, Jun 30, and Jul 14). The bulls need to create follow-through buying to increase the odds of higher prices. The bears want a reversal down from a failed breakout above the August high, a trend channel line overshoot and a wedge top.

S&P500 Emini futures

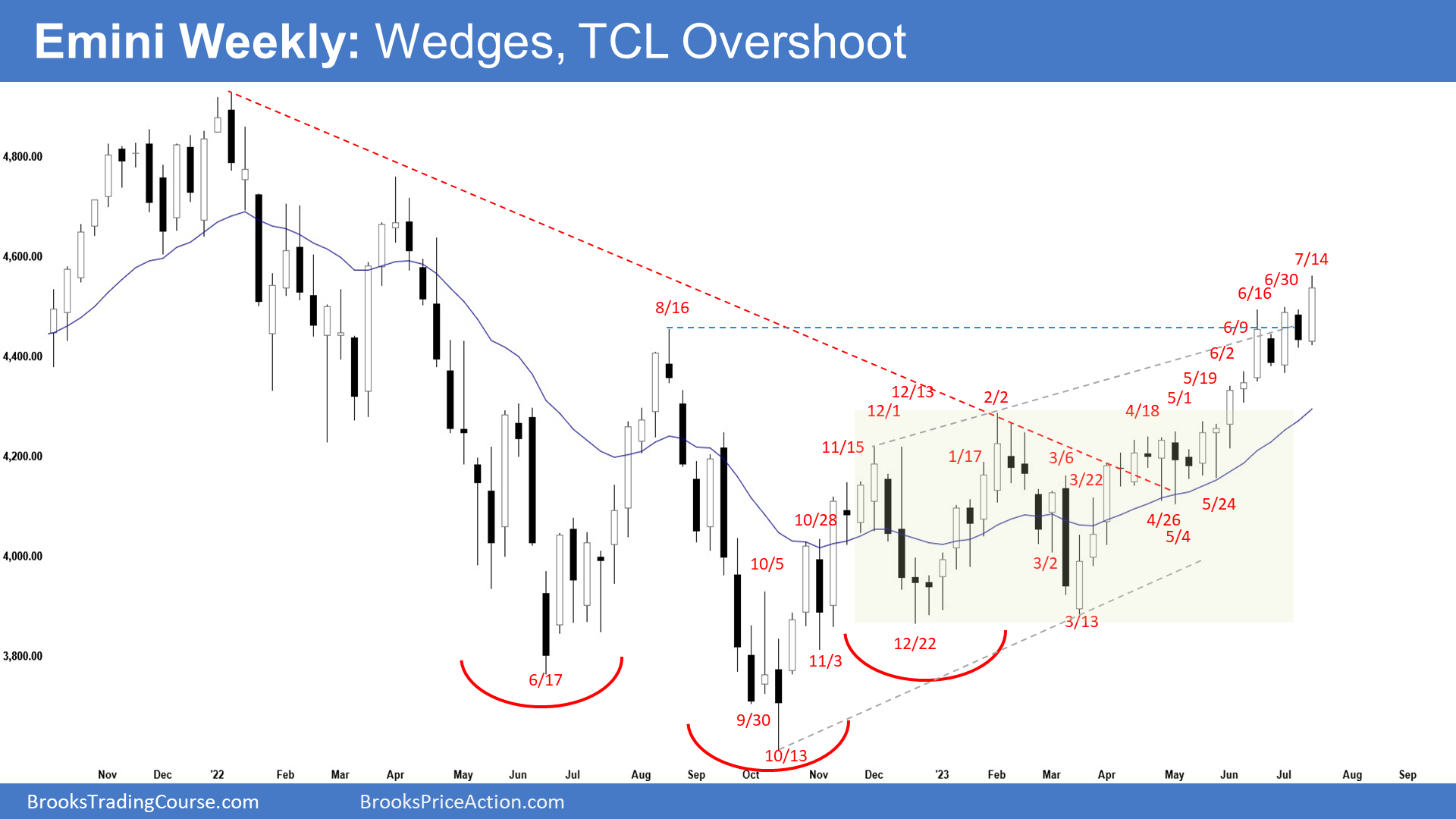

The Weekly Emini chart

- This week’s Emini candlestick was a big bull bar closing in the upper half with a small tail above.

- Last week, we said that the odds slightly favor the market to still be Always In Long. However, the Emini may still need to trade sideways to down a little while more to work off the recent overbought conditions.

- This week traded higher and broke above the bear inside bar.

- The bulls got a strong leg up creating the large wedge pattern with the first two legs being December 13 and February 2.

- They want a breakout trading far above the August high followed by a measured move using the height of the 6-month trading range which will take them to the March 2022 high area.

- Since this week was a breakout above the bear inside bar, the bulls need to create strong follow-through buying next week to increase the odds of a successful breakout.

- The bears want a reversal down from a wedge pattern (Dec 13, Feb 2, and Jul 14) and a trend channel line overshoot.

- They hope to get a failed breakout above the August high. If there is a failed breakout, it would usually occur within 5 bars after the breakout.

- They also see a smaller wedge forming in the last few weeks (Jun 16, Jun 30, and Jul 14).

- At the very least, they want a larger pullback from the trend channel line overshoot.

- The problem with the bear’s case is that they have not been able to create strong follow-through selling since the March low. They failed to create follow-through selling again this week.

- They will need to create consecutive strong bear bars closing near their lows to convince traders that a deeper pullback could be underway.

- Since this week was a bull bar closing near its high, it is a buy signal bar next week. It is not a strong sell signal bar.

- Odds continue to slightly favor the market to be in the sideways to up phase.

- However, the move up is also slightly climactic. The last 5 candlesticks had a lot of overlapping price action. That means a loss of momentum.

- A minor pullback can begin within a few weeks.

- If there is a deeper pullback, a reasonable target would be the 20-week exponential moving average.

- Odds are there will be at least a small second leg sideways to up to retest the current leg extreme.

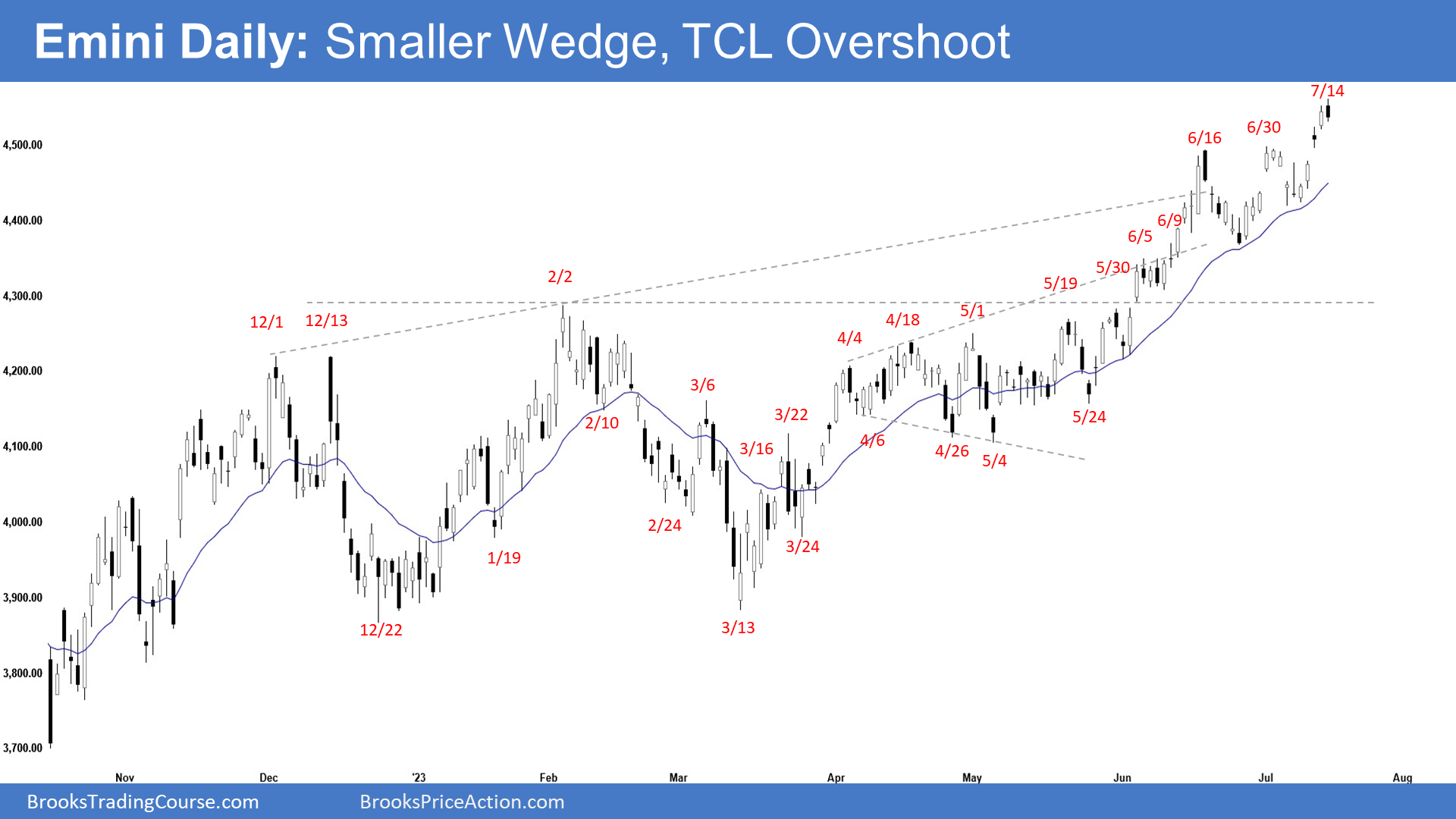

The Daily S&P 500 Emini chart

- The Emini traded higher for the week.

- Last week, we said that while the market is likely still Always in Long, the Emini may need to trade sideways to down a little while longer to work off the recent overbought condition.

- The bulls want a measured move up using the height of the 6-month trading range which will take them near the March 2022 high.

- They will need to break far above the August high with follow-through buying to increase the odds of reaching the measured move target.

- The move up since March 13 low is in a tight bull channel which means strong bulls.

- However, it has also lasted a long time and is slightly climactic.

- The market may need to trade sideways to down to work off the recent overbought condition.

- If there is a deeper pullback, odds slightly favor at least a small sideways to up leg to retest the current leg extreme.

- The bears have not yet been able to create credible selling pressure.

- They want a failed breakout above the August high and a reversal from a trend channel line overshoot. They also see a smaller wedge forming (Jun 30, Jun 16, and July 14).

- They will need to create consecutive bear bars closing near their lows, trading far below the 20-day exponential moving average to increase the odds of a deeper pullback.

- While the market continues to slightly favor sideways to up, the move up has lasted a long time and is slightly climactic.

- The market may need to trade sideways to down to work off the recent overbought condition. A minor pullback can begin within a few weeks.

- Traders will see if the market continues the climactic move up or will a pullback phase begin soon.