Financial market overview

E-Mini Follow-Through Bar Above 20-Week EMA

2023.04.10 10:04

Market Overview: S&P 500 E-mini Futures

The formed a weak follow-through bar after closing above the 20-week exponential moving average. While the move up since March 13 low is in a tight bull channel, it could simply be a bull leg within a trading range until there is a strong breakout above February high with follow-through buying.

E-mini futures

The Weekly S&P 500 E-mini chart

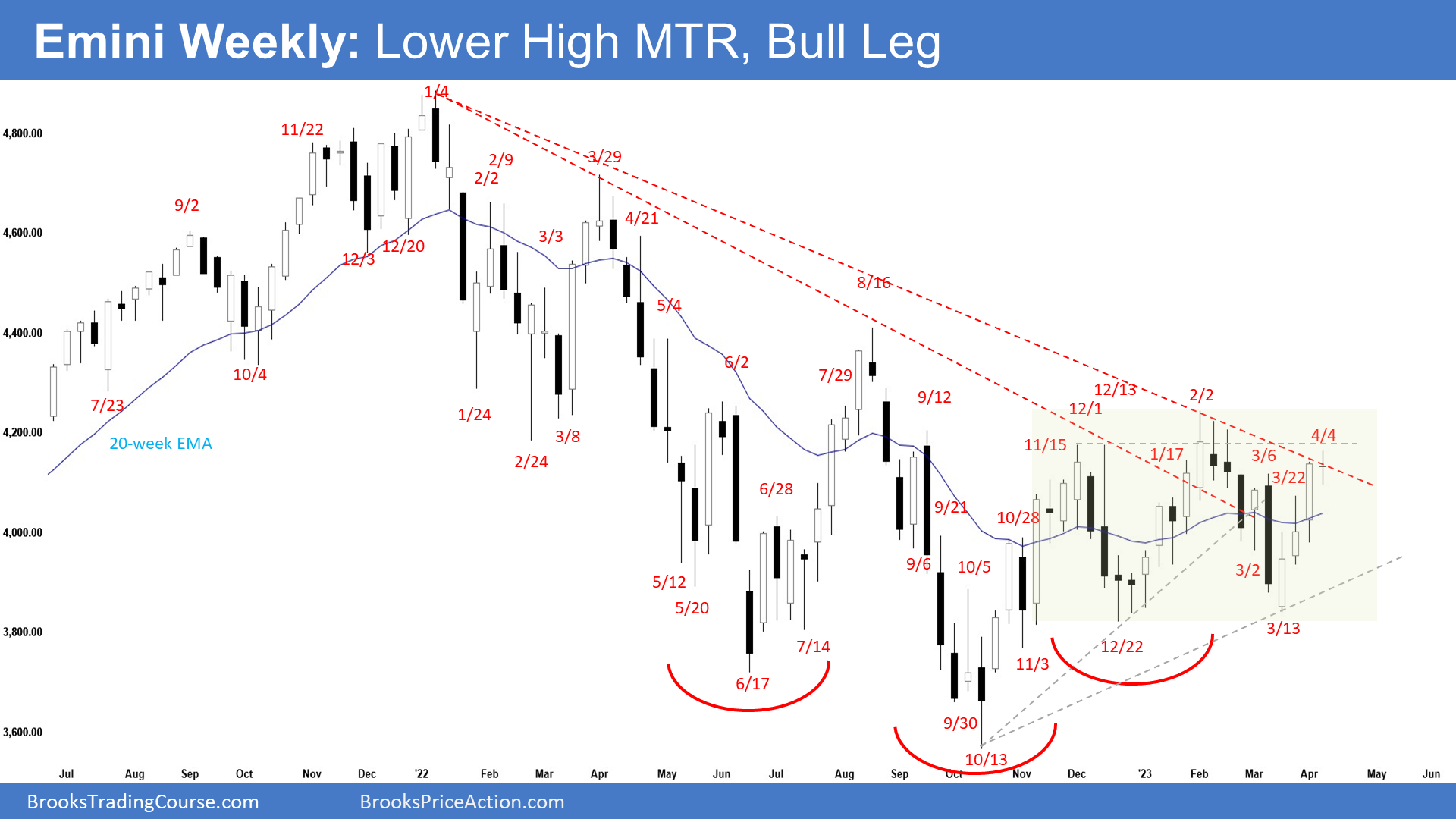

Weekly S&P 500 Emini Chart

Weekly S&P 500 Emini Chart

- This week’s E-mini candlestick was almost a perfect small doji bar.

- Last week, we said that the odds slightly favor the E-mini to trade at least a little higher.

- The E-mini traded slightly higher but closed below last week’s high.

- While weak, it was a follow-through bar following last week’s close above the 20-week exponential moving average.

- The bulls got a reversal up from a double bottom bull flag with the December low (Dec 22 and Mar 13).

- By breaking above the December high (in February), they hope the bear trend of successively lower highs and lower lows has ended.

- More likely, they will need to break far above the December and August highs to signal the end of the selloff.

- The bulls want another strong leg up completing the wedge pattern with the first two legs being December 13 and February 2. The third leg up is currently underway.

- At the very least they want a retest of February high.

- The bears got a reversal down from a higher high major trend reversal in February.

- They then got a second leg sideways to down from a lower high major trend reversal (Mar 6).

- However, they were not able to create follow-through selling in March.

- The bears hope that the current pullback is simply a buy vacuum retest of the February high. They want a reversal down from a lower high major trend reversal or a double top with February 2 high.

- Because of the strong move-up, the bears will need a strong sell signal bar or a micro double top before they would be willing to sell more aggressively.

- The E-mini is in a smaller 24-week trading range around 3750 and 4200. Traders will BLSH (Buy Low, Sell High) within a trading range.

- As strong as the current move up is, it could simply be a bull leg within a trading range until there is a strong breakout above the February high with follow-through buying/selling.

- For now, odds slightly favor the E-mini to still be in the bull leg phase.

- Traders will see if the bulls can continue to create bull bars to test the February high or will the E-mini trade higher, but the bears get a decent sell signal bar within the next few weeks.

The Daily S&P 500 E-mini chart

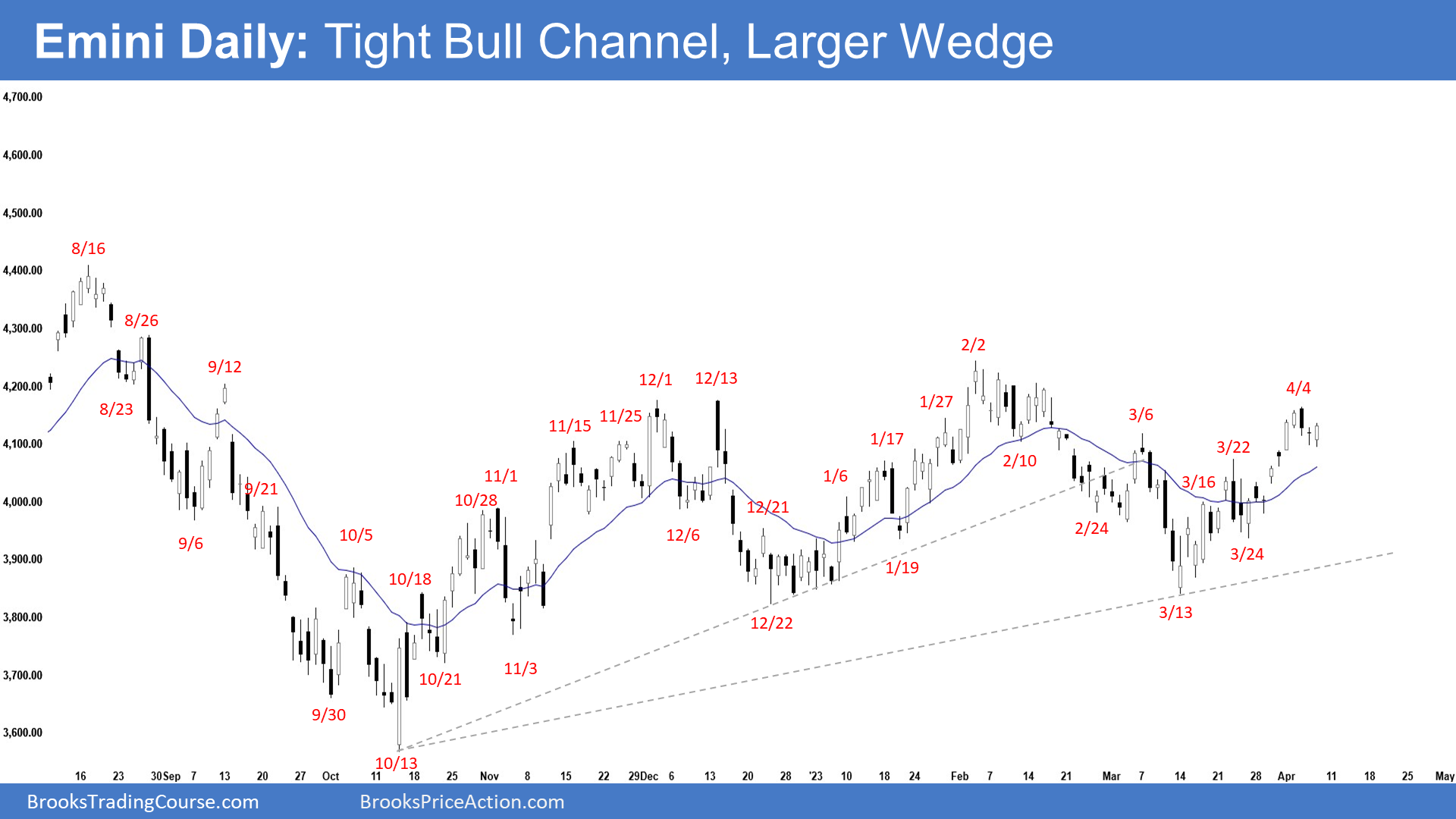

Daily S&P 500 Emini Chart

Daily S&P 500 Emini Chart

- The E-mini traded sideways for the week.

- Previously, we said that odds slightly favor the E-mini to trade higher and traders will see if the bulls can get sustained follow-through buying, or will the market trade slightly higher but reverse down from a double top bear flag (Mar 6).

- So far, the E-mini has traded above March 6 high with some follow-through buying.

- The bulls got a breakout above the December high (in February) but did not get sustained follow-through buying.

- By trading above the December high, the bulls hope that the bear trend has ended, and the market has either transitioned into a trading range or a bull trend.

- More likely, the bulls will need to break far above the December and August highs, to convince traders that the bear trend from January 2022 has ended.

- Recently, the bulls got a reversal up from a double bottom bull flag (Dec 22 and Mar 13).

- The current leg up from March 13 low is in a tight bull channel, which means persistent bulls.

- They want a retest of the February high followed by a breakout and another big leg up, completing the wedge pattern with the first two legs being December 1 and February 2. It is currently underway.

- The bears see the move up from October 2022 simply as forming a larger double top bear flag (Aug 16 and Feb 2) within a broad bear channel.

- They determined that the August high is the last major lower high, therefore, believe that the E-mini is still in a bear trend.

- They want a retest of the October low from a lower high major trend reversal or a double top (Feb 2).

- The problem with the bear’s case is that the buying pressure since March 13 low is stronger with bull bars closing near their highs and bear bars having little follow-through.

- They need to create consecutive bear bars closing near their lows to increase the odds of lower prices.

- For now, odds slightly favor the E-mini to trade at least a little higher, possibly retesting February high.

- The E-mini is in a smaller 24-week trading range around 3750 and 4200 within a larger trading range.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction with follow-through buying/selling.