Drought in Key Regions for Major U.S. Crops

2023.04.11 03:05

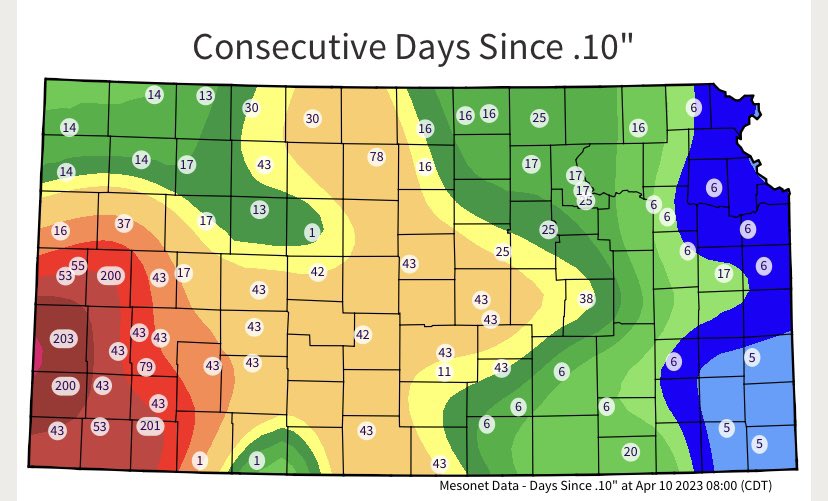

The chart shows how many days since any significant rain in the major crop growing regions in the U.S.

Consecutive Days Since 10 Inch Rain

Consecutive Days Since 10 Inch Rain

Initial yield estimates for this year’s US winter wheat crop have been hammered by persistent drought.

12 Southwest Kansas counties dominate the area of drought.

Wheat, corn, and oats are the major crops.

Yet, the futures prices do not reflect these growing (double entendre intended) concerns.

Part of the reason is that Russia, the main exporter of wheat, is selling the grain at a huge discount.

However, a couple of weeks ago on March 28th, we the Invesco DB Agriculture Fund (NYSE:) as a buy opportunity.

And over this past weekend, our Market Outlook mentions that one huge risk off indicator is that:

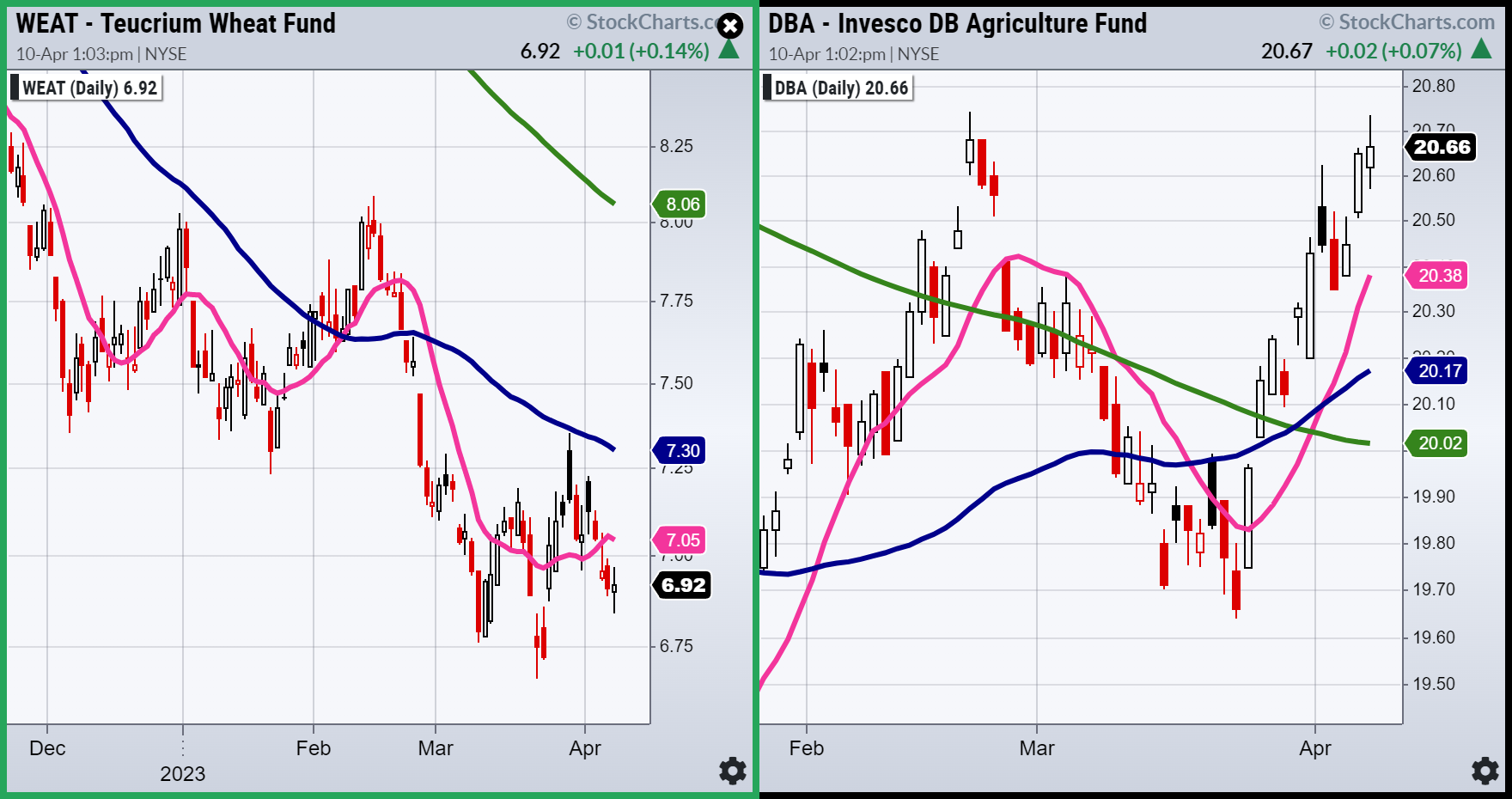

“Soft Commodities (DBA) made a golden cross right as they are running into multi-month technical resistance and are already at potentially overbought levels on both price and momentum according to Real Motion. However, if DBA takes out the $21 level, then it would signal a breakout of a multi-year base.”

So here we are with drought, technical resistance and another very low risk entry for or Teucrium Wheat (NYSE:), the ETF.

The chart on the left is of WEAT the ETF for wheat futures. In a daily timeframe, it is in a bearish phase. Nevertheless, it is holding the March low and through the cyan line, could set up for a long with a very good stop point.

DBA, in a strong bullish phase, has now 2 tops at 20.75. (Today and in February).

Should that clear, 22.00 next target.

ETF Summary

- (SPY) 405 support and 410 pivotal

- Russell 2000 (IWM) 170 support- 180 resistance still

- Dow (DIA) Through 336.25 could go higher

- Nasdaq (QQQ) 325 resistance 314 10-DMA support

- Regional banks (KRE) 41.28 March 24 low held and now has to clear 44

- Semiconductors (SMH) 247 is the most significant support

- Transportation (IYT) Held weekly MA support and now must clear 224

- Biotechnology (IBB) Great job changing phases to bullish but must confirm over 130

- Retail (XRT) Don’t want to see this break under 59.75-and best if clears 64.50