“Doom & Gloom” Stock Market (and Sentiment Results)…

2023.10.26 10:39

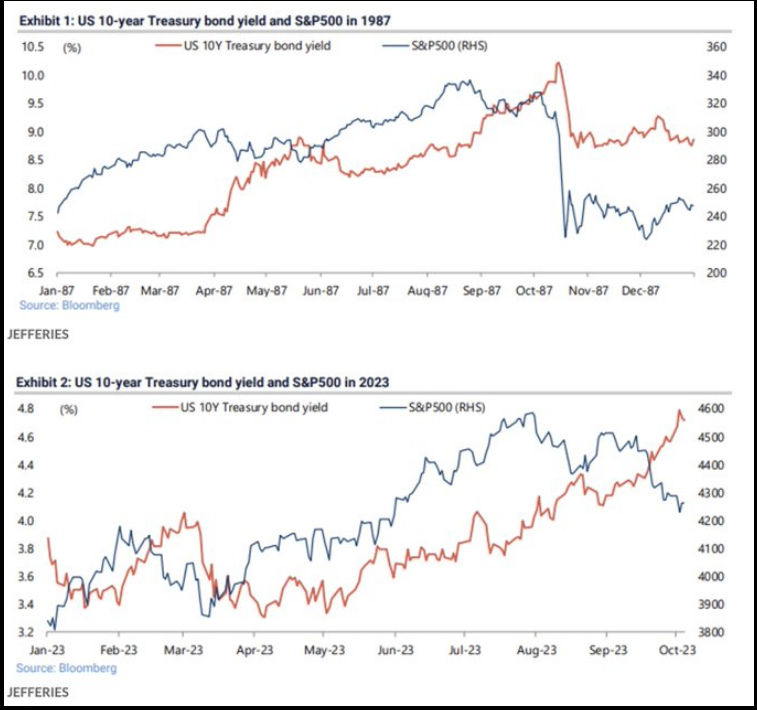

This week, the Wall Street Journal published an article entitled “Another Black Monday May Be Around the Corner.”

Fortunately, they wrote it this Sunday (22nd) and it (Black Monday) didn’t take place on Monday (23rd)! Unlike Paul Tudor Jones who called it “Black Monday” the Friday (Oct. 16th) before it actually occurred in 1987 (Oct. 19th), these two academics lack the market understanding for a repeat. They are running out of October Mondays…

Here’s what the nervous Nellies are focused on:

Treasury bond yield and S&P 500

Treasury bond yield and S&P 500

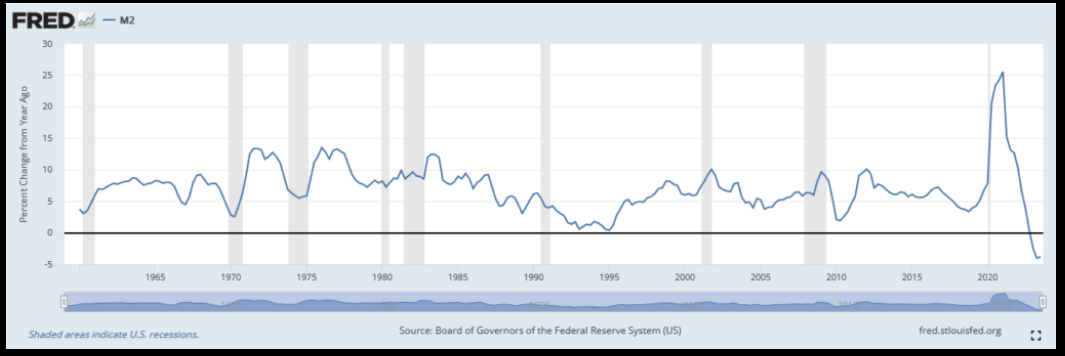

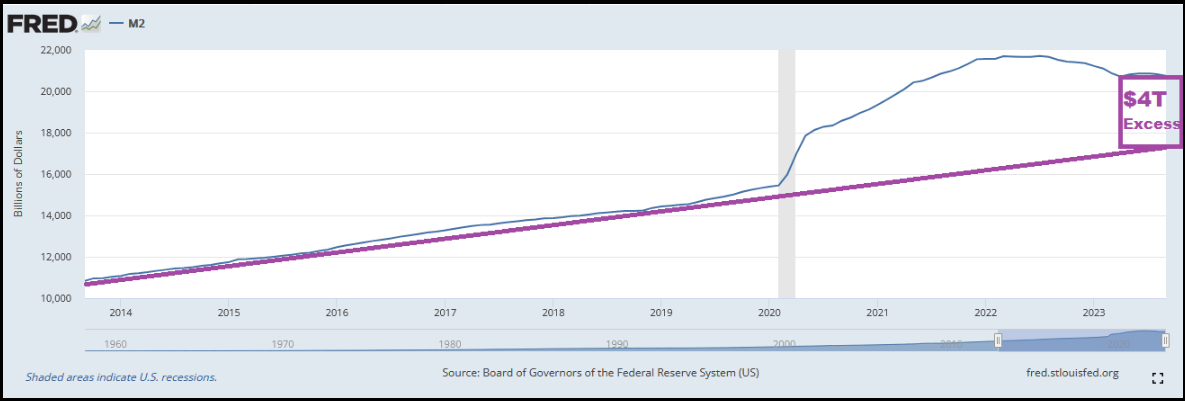

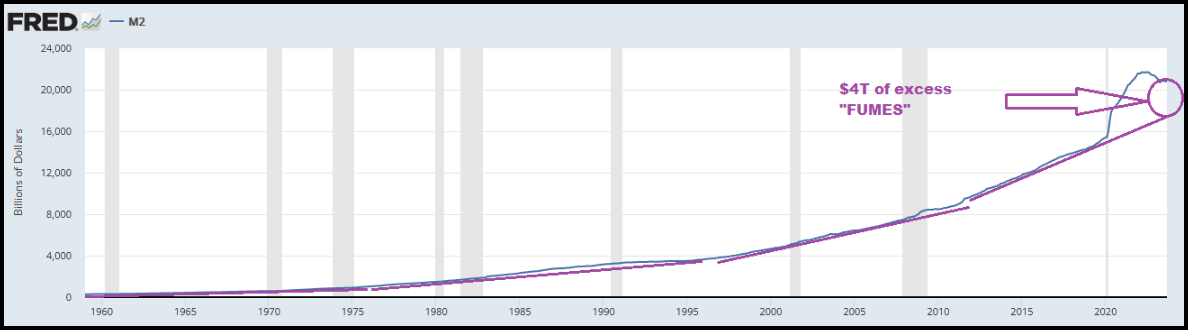

They point to the fact that because M2 Money Supply has contracted on a yoy basis, we are in “real danger.”

Unfortunately this is the intellectual equivalent of focusing exclusively on the liabilities in a balance sheet and not the assets. They go on to say “Because of the sustained decline in the money supply, the economy is in real danger. So far, only the remaining excess money the Fed created between 2020 and 2021—the cumulative excess savings from the Covid handouts—has been keeping businesses hiring and consumers spending. The effects of the excess money are still giving the economy a lift, but that extra fuel is almost exhausted. When it dries up, the economy will run on fumes.”

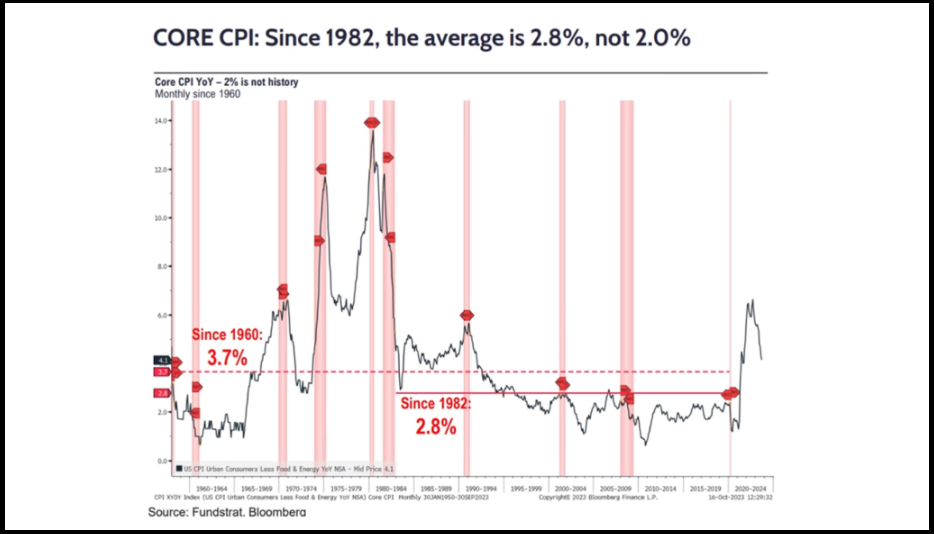

What they fail to acknowledge is there are $4 TRILLION of excess “fumes” from an unprecedented increase in Money Supply – due to an unprecedented shutdown in the global economy in 2020-2021. I drew “trend lines” so you can see just how aberrationally “above trend” we are.

In other words, money supply will have to contract for multiple years just to come back to the long-term uptrend. This is one of the reasons we believe inflation should run above trend (in a reasonable range of 3-5%) for a few years.

Like losing weight, there is an equation. The “easier” the loss (pill or needle) the greater the chance of impermanence or side effects. The “harder” the loss (healthy eating and lifestyle) the greater the chance of sustainability and improved health. We had “easy” printed money for a few years, now we are getting involuntarily taxed (through inflation) in arrears (at the checkout counter) for that benefit received. Every equation has an equal sign. If you want greater returns over the long term, you have to assume greater concentration and volatility in the short term. Anyone who tells you otherwise, run away.

The key way to sit with equanimity when others are selling in the hole and running for the hills is to look at each BUSINESS you own (not stock), BUSINESS. Ask yourself the following question for each company: “If I owned this business in a private equity portfolio, is there anything that has changed about the business operations or ability to generate cashflow over the long term, that would require me to mark the value of the business DOWN in the portfolio?” If your answer was, “someone sent me a chart of 1987 and I’m scared” that is not the correct answer and you should find another hobby.

Here’s what we are focused on:

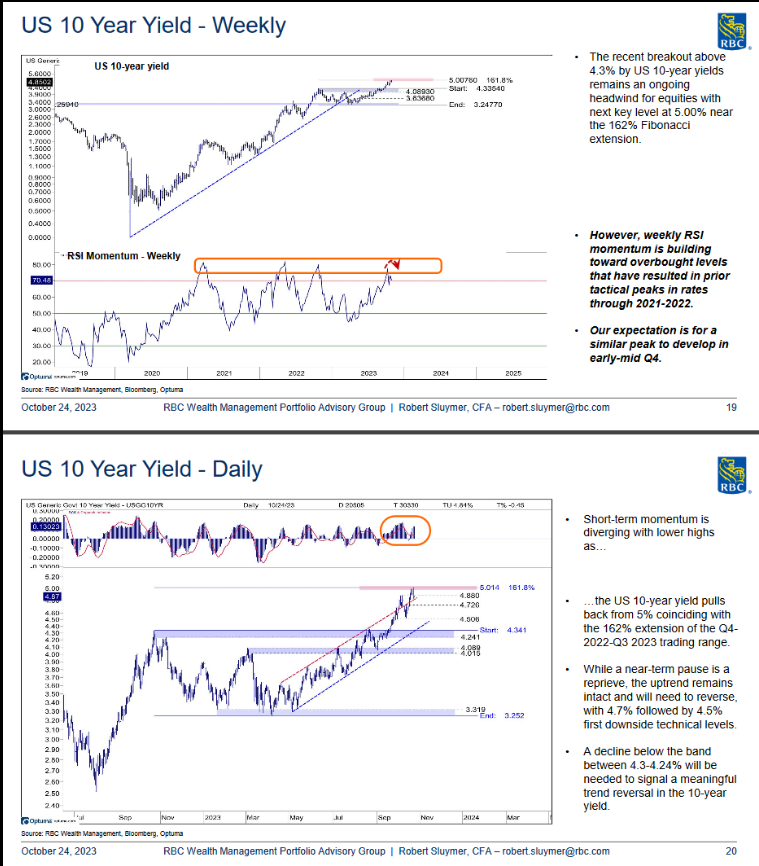

The 10yr yield achieved an “Outside Day” on Monday. The 2yr yield presaged this occurrence last Thursday. “An outside day is a daily price action that has a higher high and a lower low than the prior price bar. An outside day also has an open and close that both fall outside the prior open and close. When the price bars move in opposite directions, it’s called an outside reversal (Investopedia)”:

10-Year US Treasury Yield

10-Year US Treasury Yield

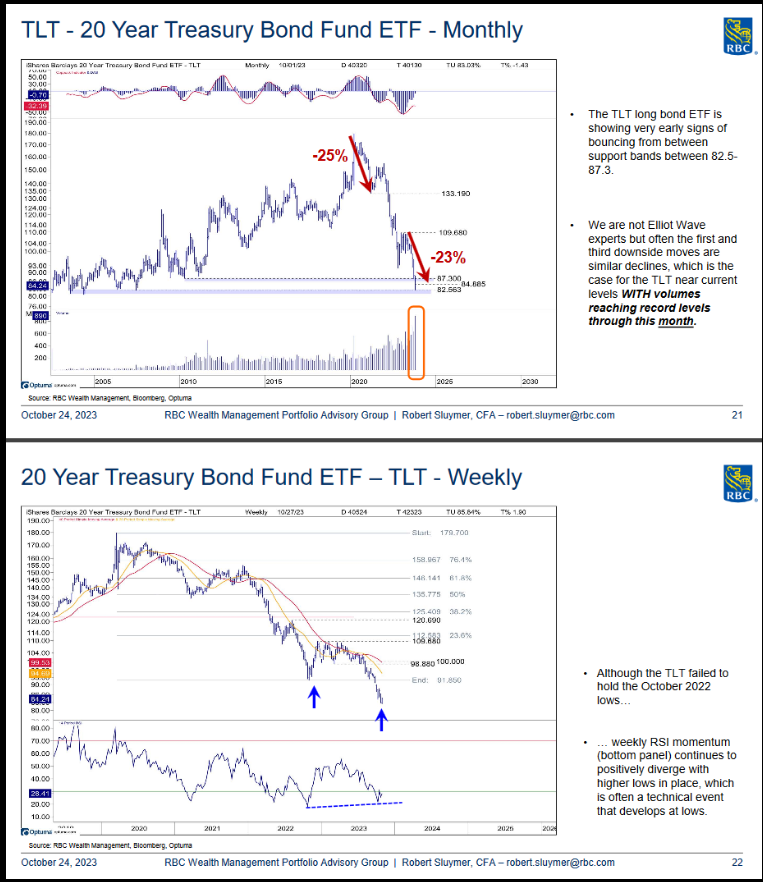

20 Year Treasury Bond Fund ETF

20 Year Treasury Bond Fund ETF

Dollar Bounce Running Out of Steam?

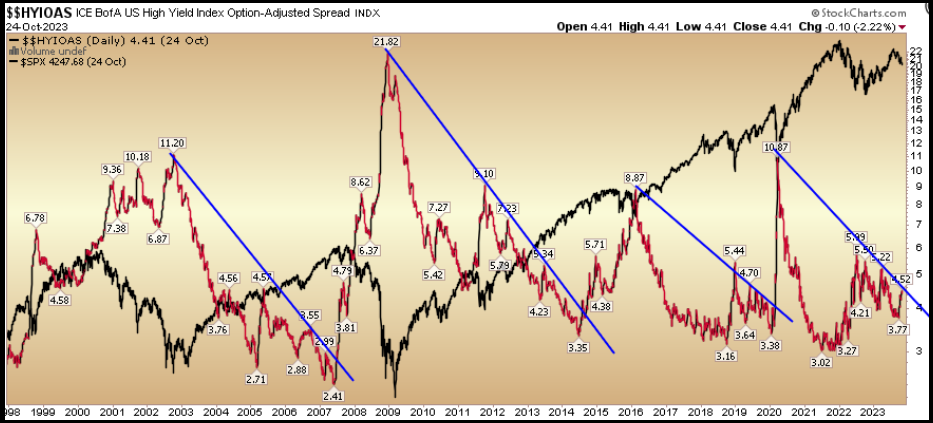

High Yield Credit Spreads Still Okay:

ICE BofA US High Yield Index

ICE BofA US High Yield Index

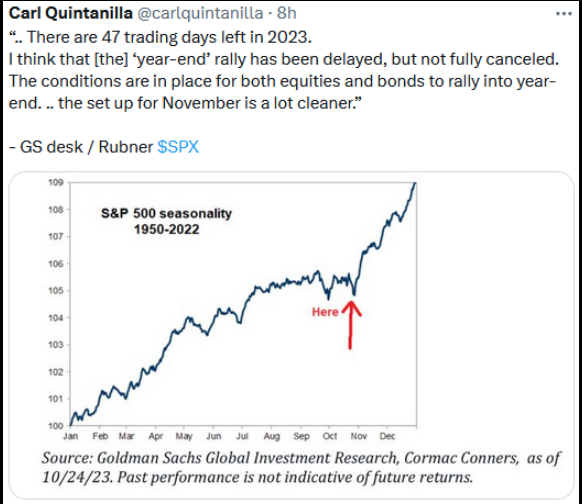

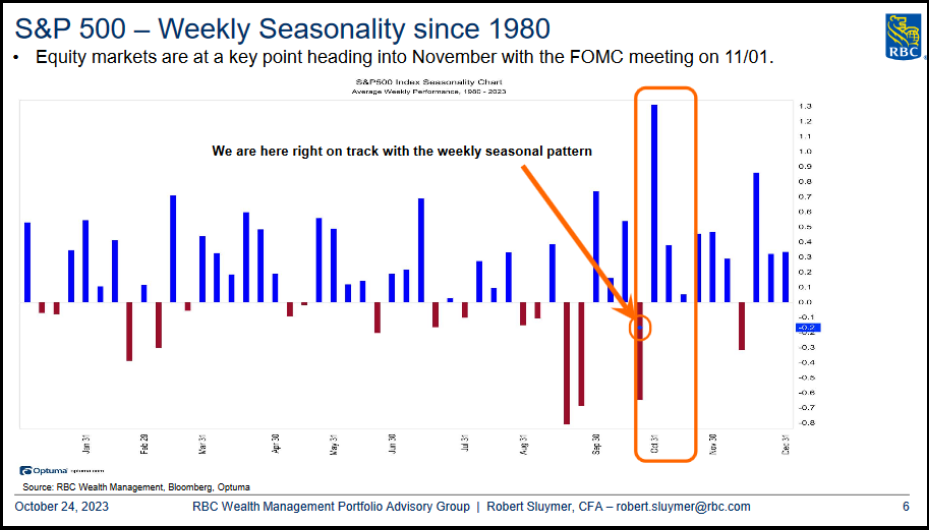

Seasonality Still On Point:

S&P 500 seasonality

S&P 500 Weekly Seasonality

S&P 500 Weekly Seasonality

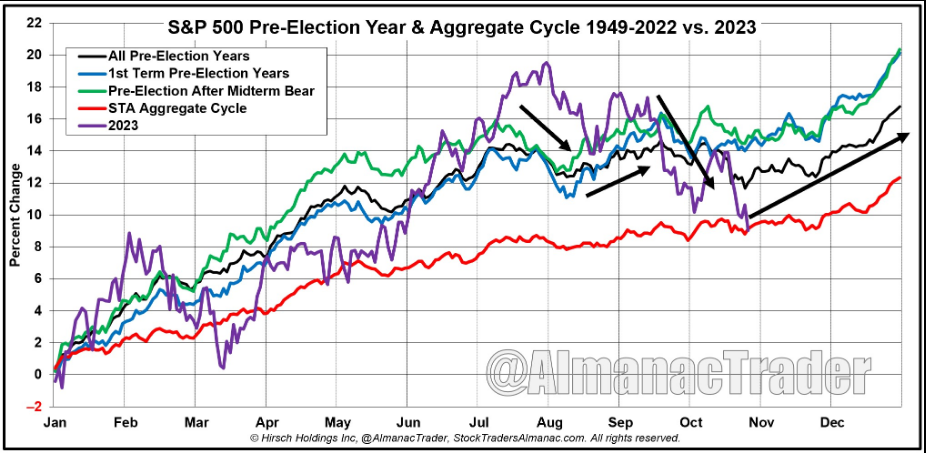

S&P 500 Pre-Election Year & Aggregate Cycle

S&P 500 Pre-Election Year & Aggregate Cycle

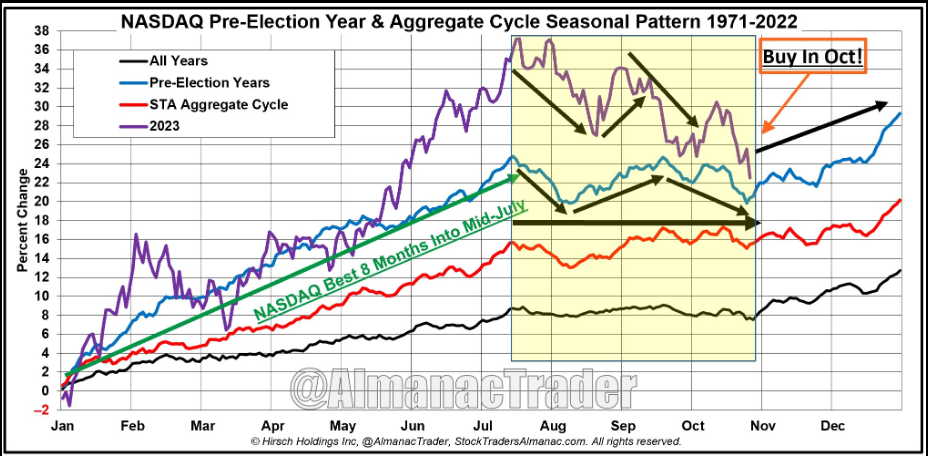

NASDAQ Pre-Election Year & Aggregate Cycle

NASDAQ Pre-Election Year & Aggregate Cycle

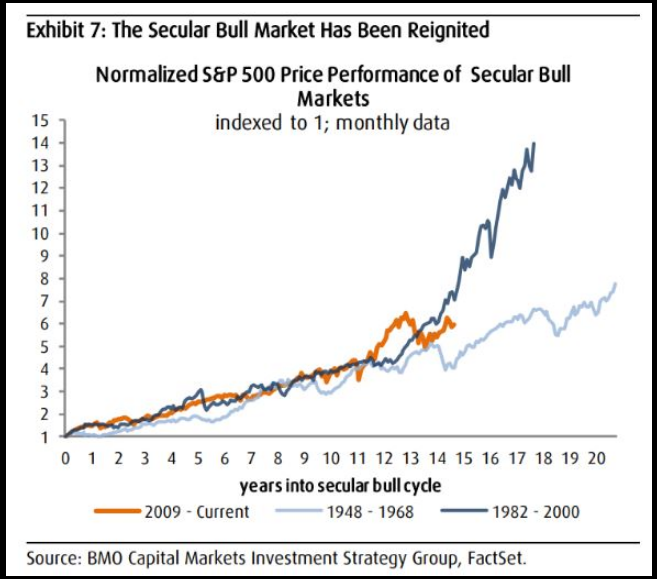

The Antithesis of “1987:”

Normalized S&P 500 Price Perfomance of Secular Bull Markets

Normalized S&P 500 Price Perfomance of Secular Bull Markets

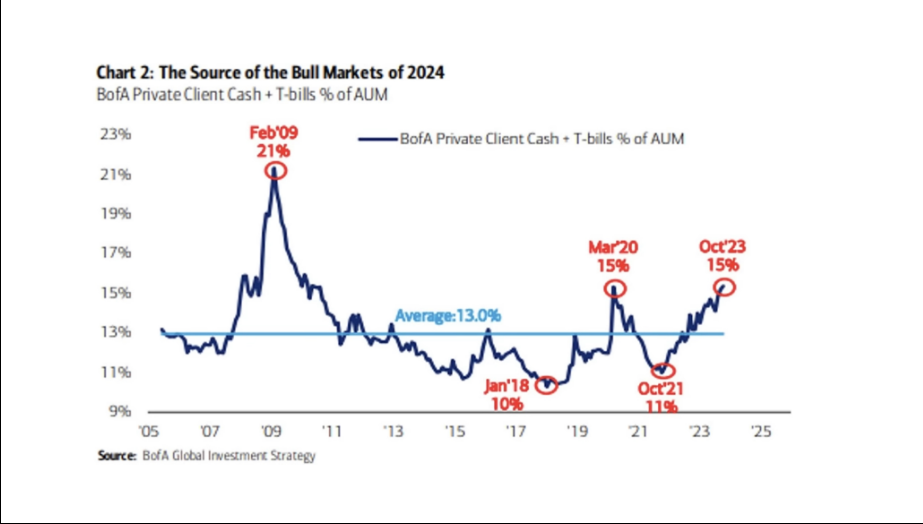

Cash is Trash:

The Source of the Bull Market of 2024

The Source of the Bull Market of 2024

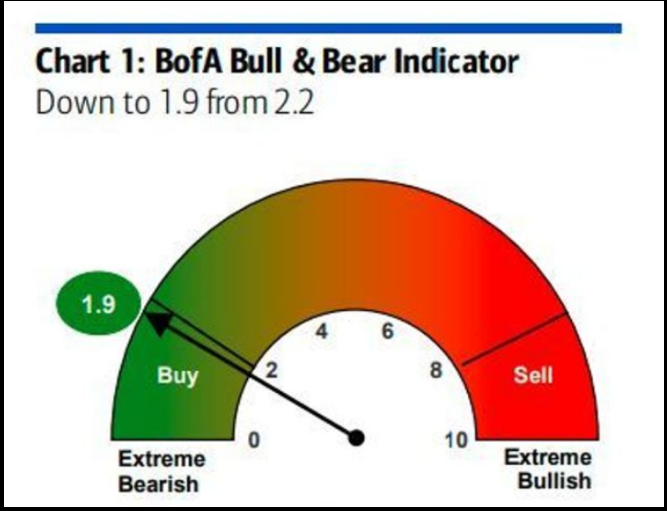

BofA Bull & Bear Indicator

BofA Bull & Bear Indicator

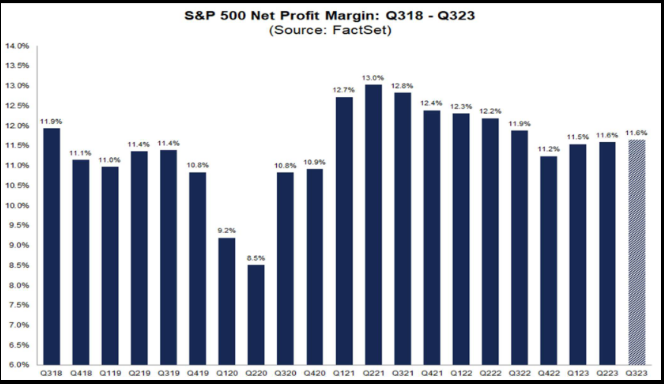

Earnings and Margins:

S&P 500 Net Profit Margin

S&P 500 Net Profit Margin

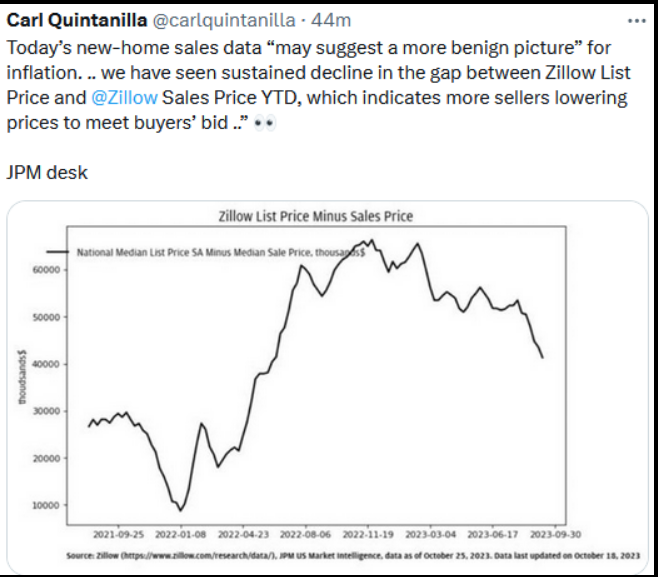

Fed’s Real Target (NYSE:):

Zillow List Price Minus Sales Price

Zillow List Price Minus Sales Price

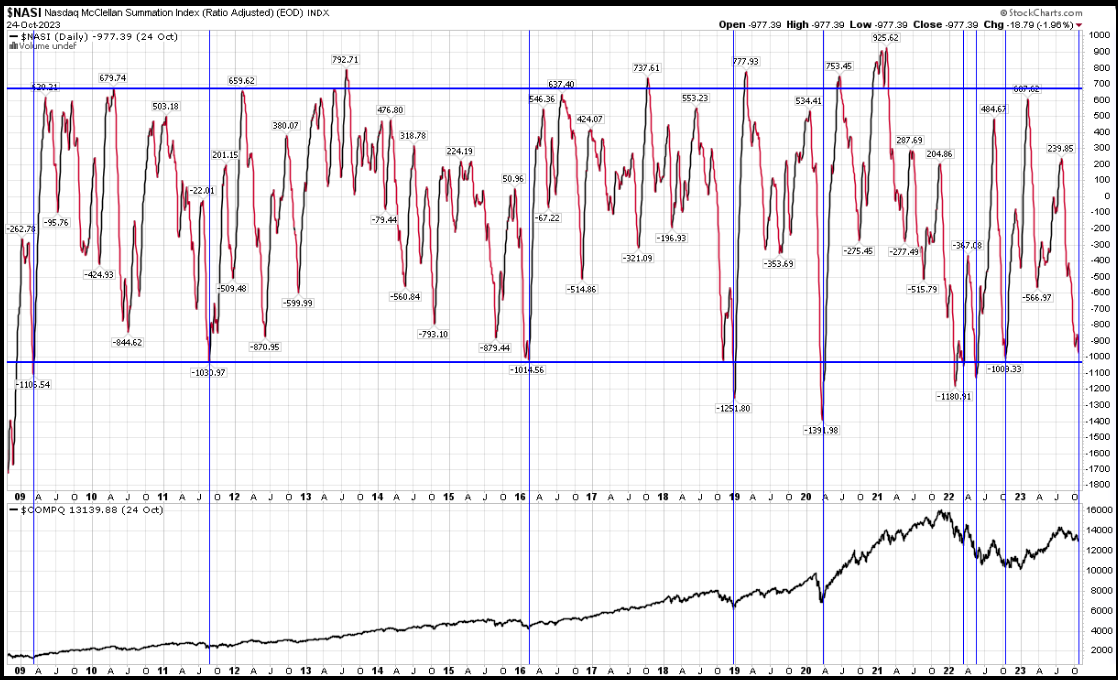

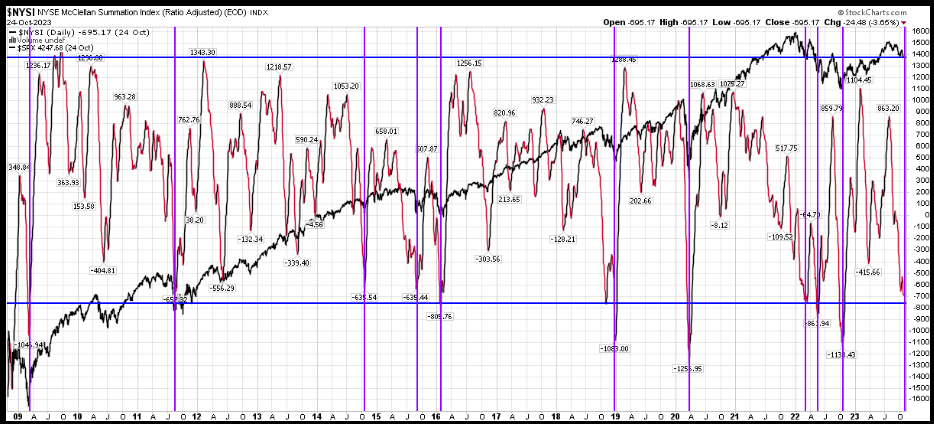

Getting Stretched (McClellan Summation):

Nasdaq McClellan Summation

Nasdaq McClellan Summation

Massive Digestion Of 2020-2021 Gains. 0% gains in S&P for 31 months. As a general rule, markets don’t “Top” over three years, they tend to “Top” more abruptly. Markets consolidate/digest large gains over years before taking the next leg higher:

Massive Digestion Of 2020-2021 Gains. 0% gains in for almost 3 years:

0% gains in Small Caps for over 5 years:

Emerging Markets continue to be ignored, just as signals point up:

MSCI Emerging Markets Free Index

MSCI Emerging Markets Free Index

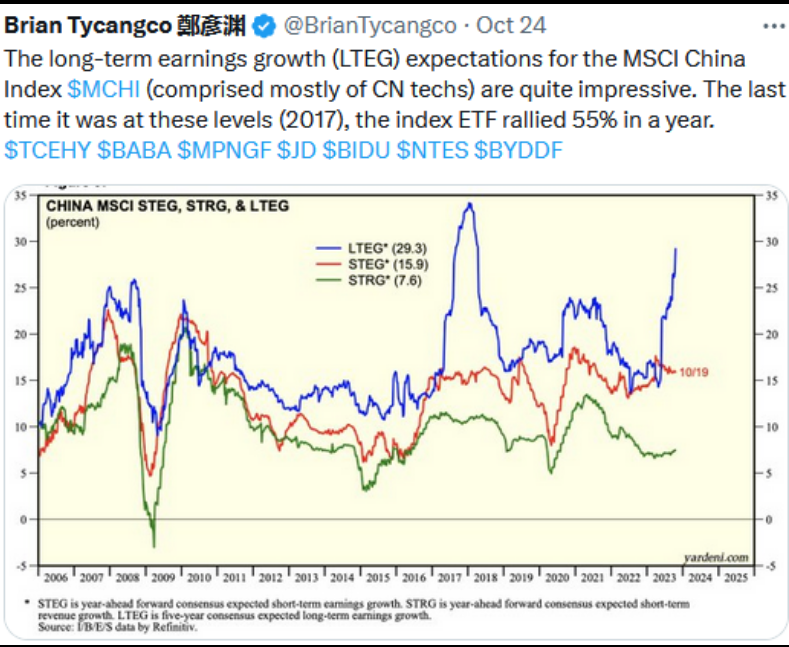

China Earnings:

China MSCI STEG, STRG & LTEG

China MSCI STEG, STRG & LTEG

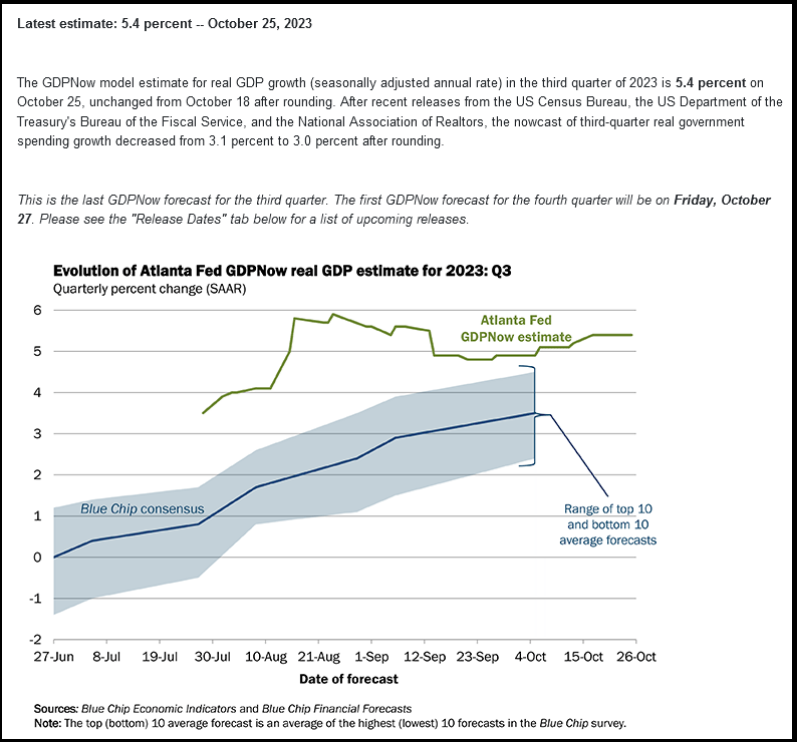

Economy Tracking:

Evolution of Atlanta Fed GDPNow real GDP estimate

Evolution of Atlanta Fed GDPNow real GDP estimate

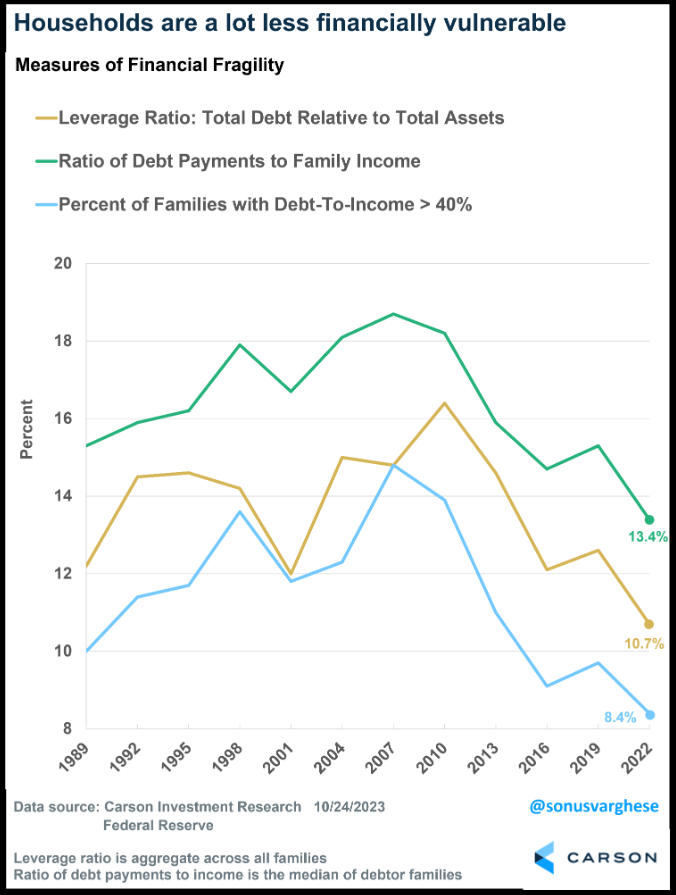

Households Strong:

Household are a lot less financially vulnerable

Household are a lot less financially vulnerable

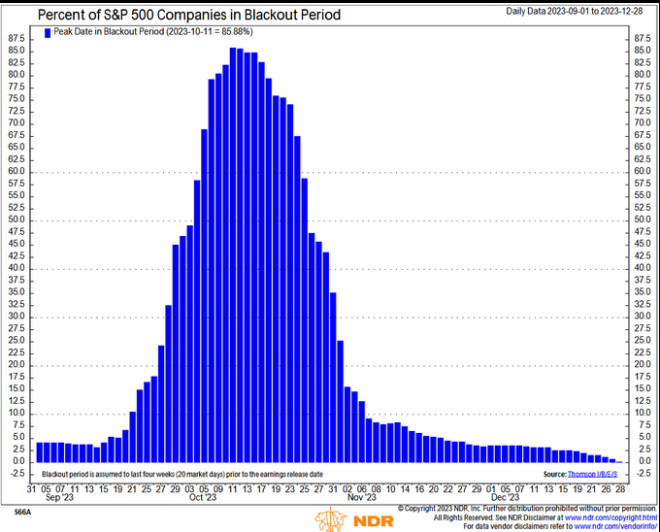

Blackout Periods Ending. Buybacks to commence:

Percent of S&P 500 Companies in Blackout Period

Percent of S&P 500 Companies in Blackout Period

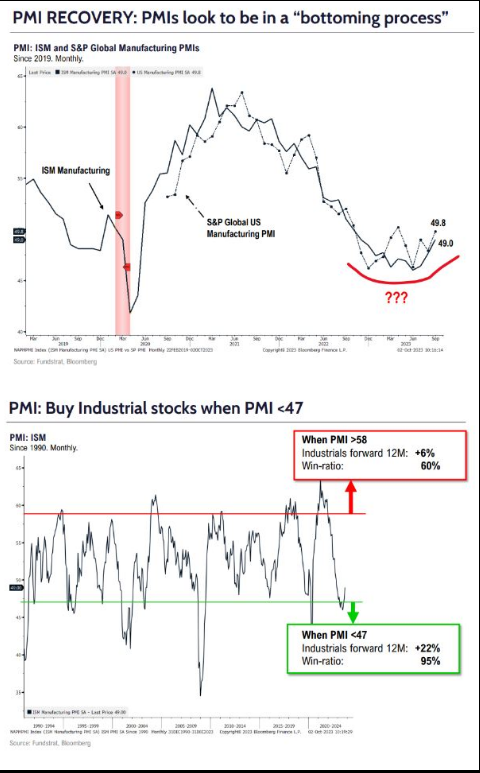

PMIs bottoming:

PMIs bottoming

10 Day Moving Avg Put/Call Coming Off The Boil:

Equity Put/Call Ratio 10-DMA

Equity Put/Call Ratio 10-DMA

History Rhyming?

EMA of Advance-Decline Ratio

EMA of Advance-Decline Ratio

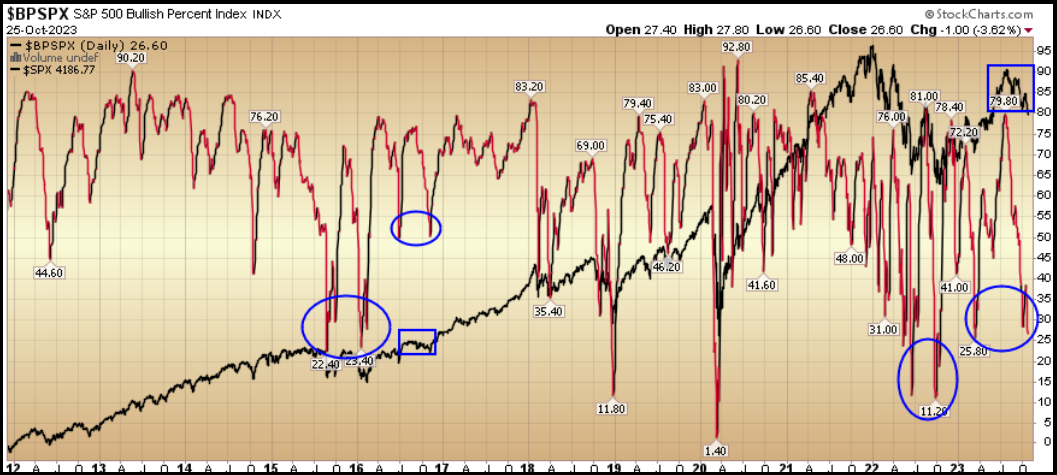

S&P Bullish Percent:

S&P 500 Bullish Percent Index

S&P 500 Bullish Percent Index

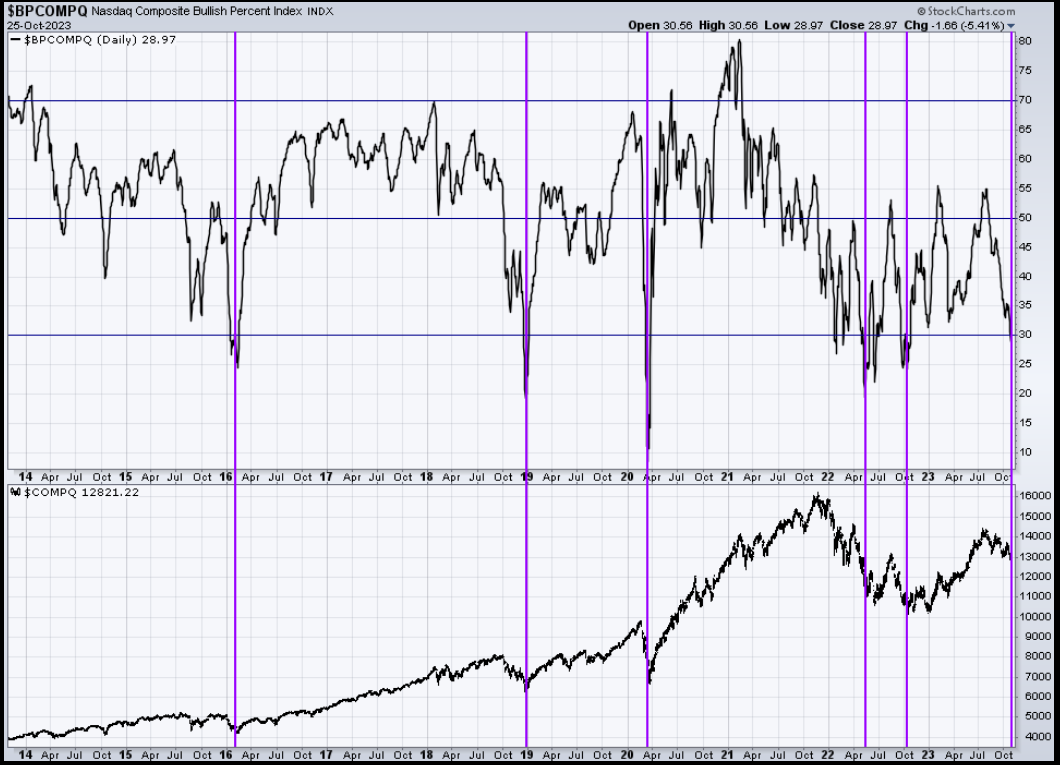

Bullish Percent:

Nasdaq Composite Bullish Percent Index

Nasdaq Composite Bullish Percent Index

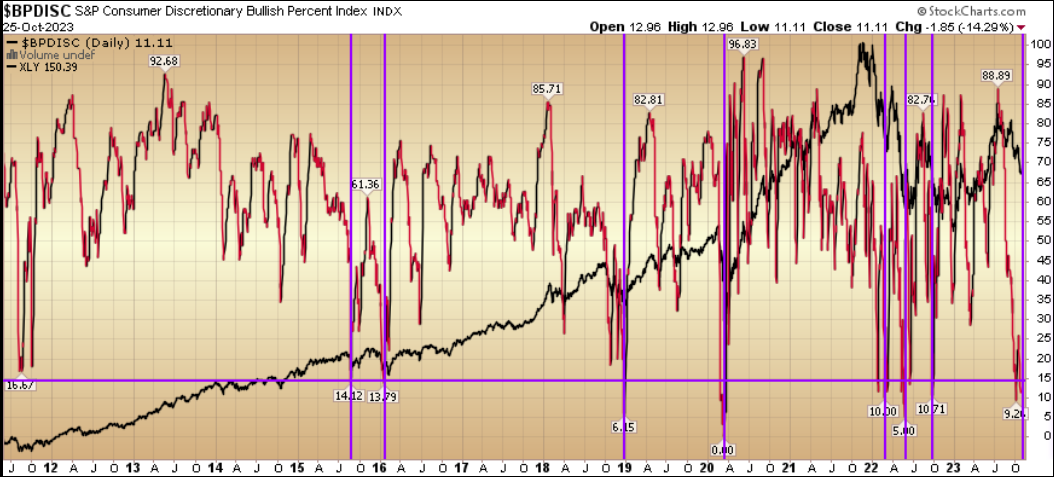

Consumer Discretionary Bullish Percent:

Consumer Discretionary Bullish Percent

Consumer Discretionary Bullish Percent

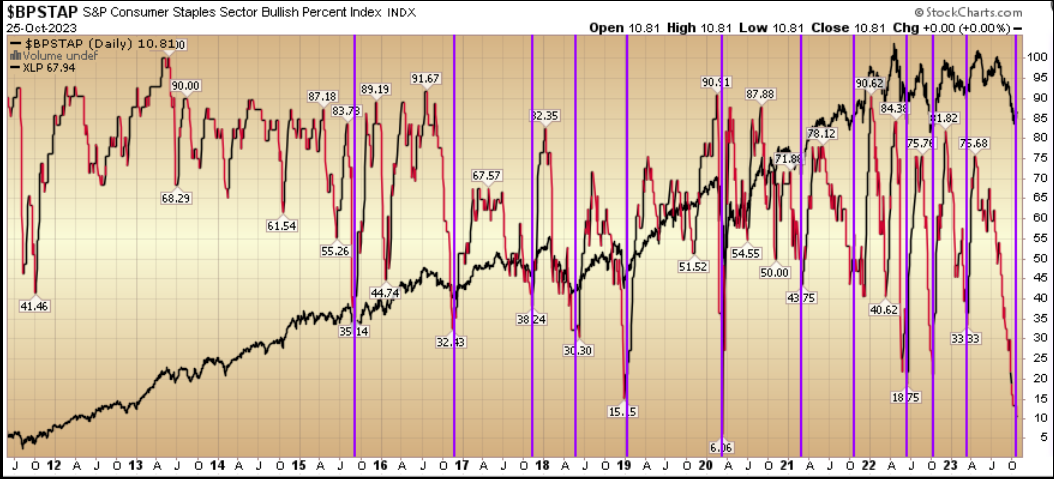

Consumer Staples Bullish Percent:

Consumer Staples Bullish Percent

Consumer Staples Bullish Percent

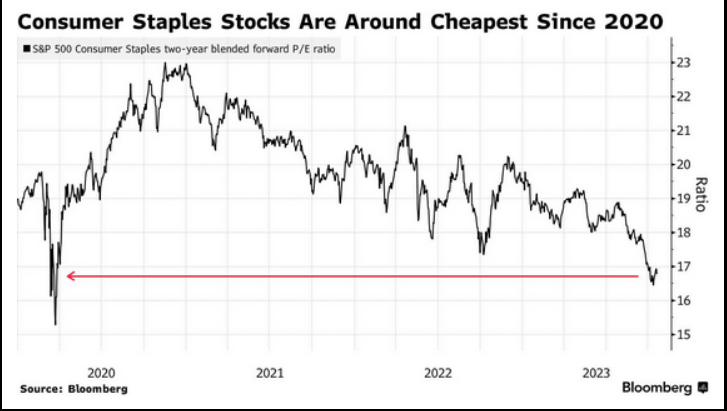

Consumer Staples Stocks Are Around Cheapest Since 2020

Consumer Staples Stocks Are Around Cheapest Since 2020

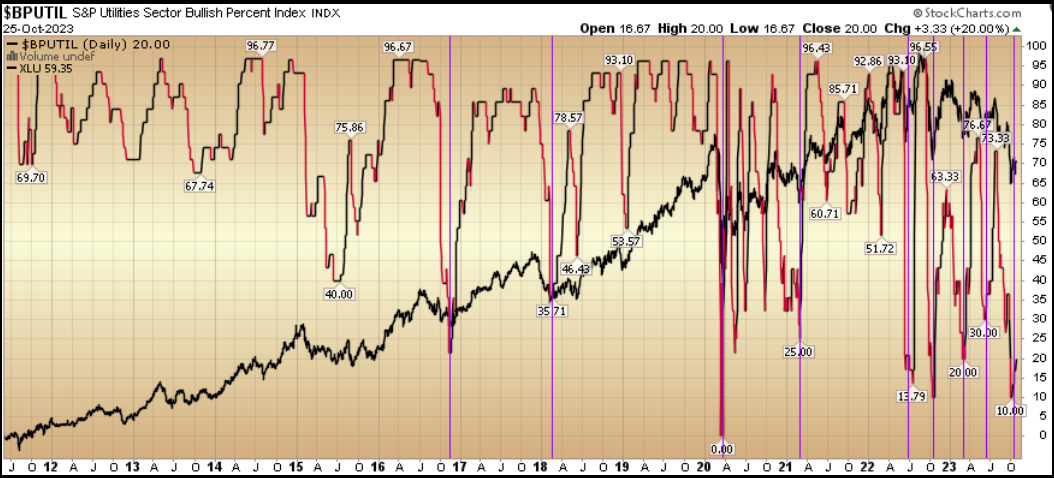

Utilities Bullish Percent:

Utilities Bullish Percent

Utilities Bullish Percent

Healthcare:

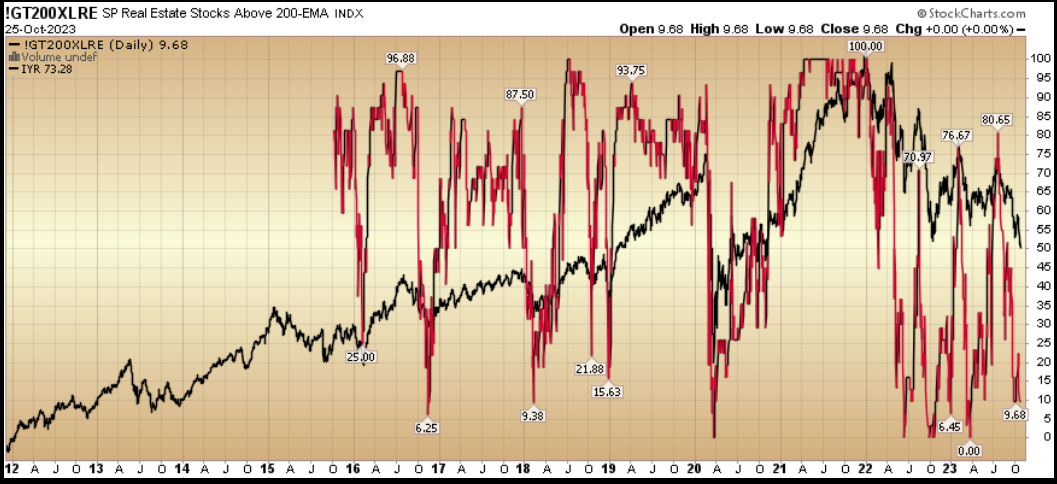

Real Estate:

Cooper Standard Reports on November 2:

Now onto the shorter term view for the General Market:

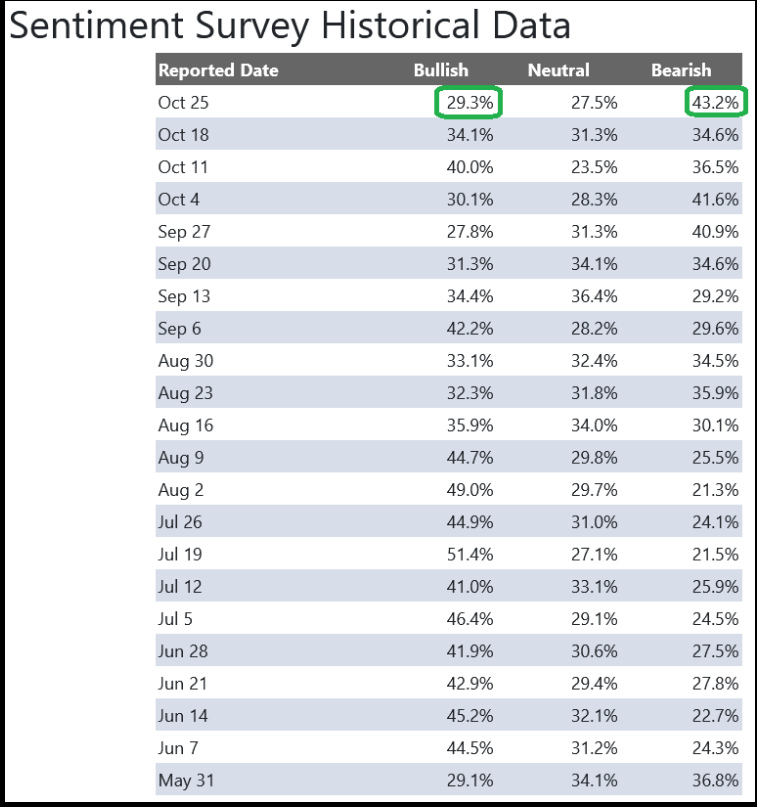

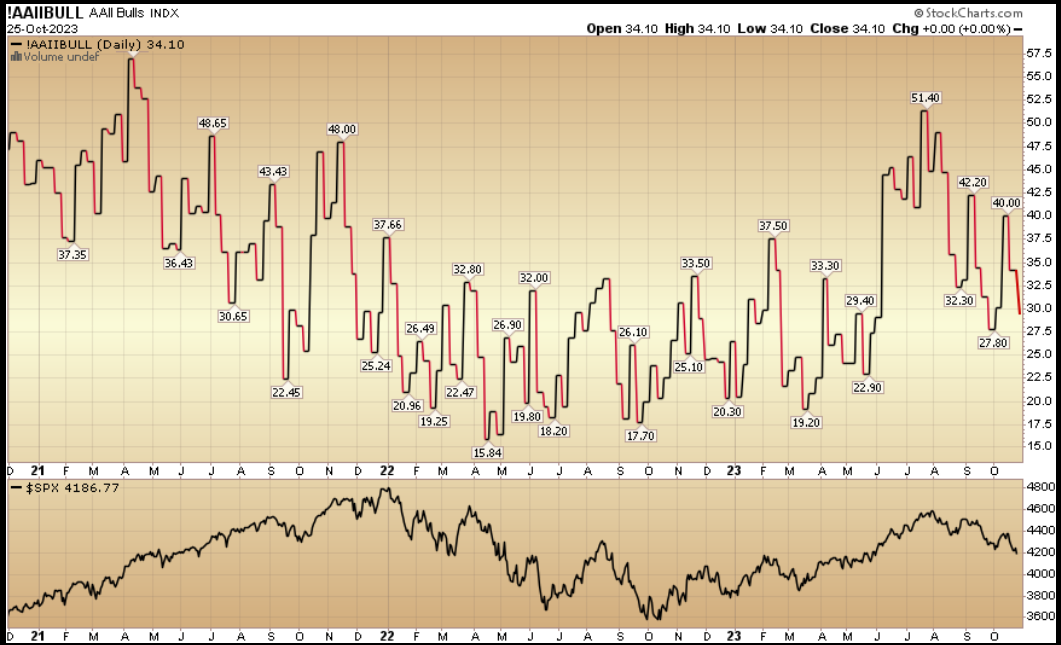

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 29.3 from 34.1% the previous week. Bearish Percent moved up to 43.2% from 34.6%. Retail investors are nervous.

Sentiment Survey Historical Data

Sentiment Survey Historical Data

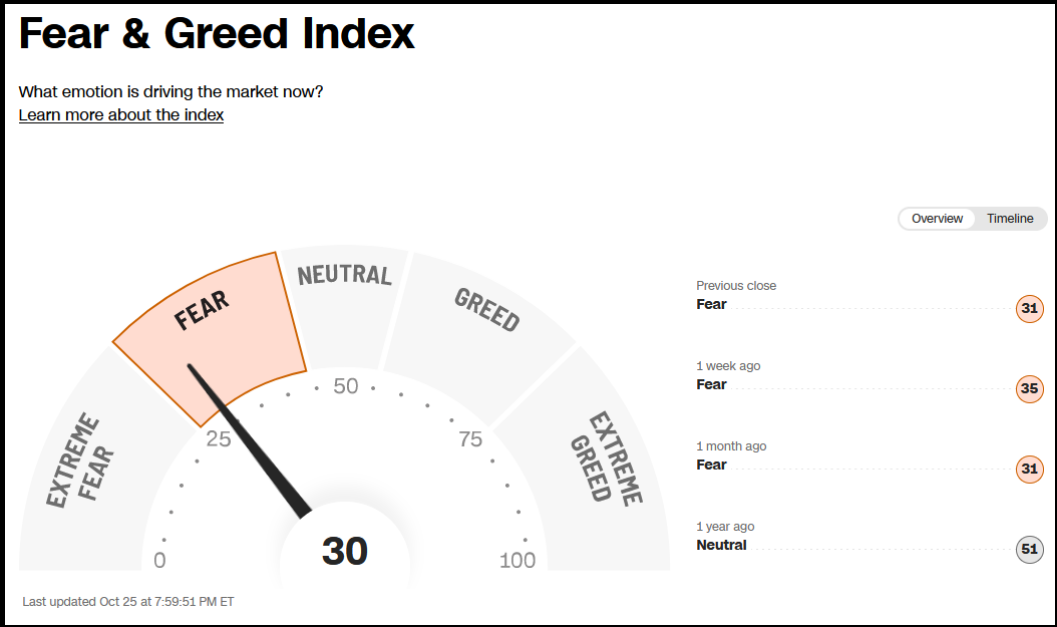

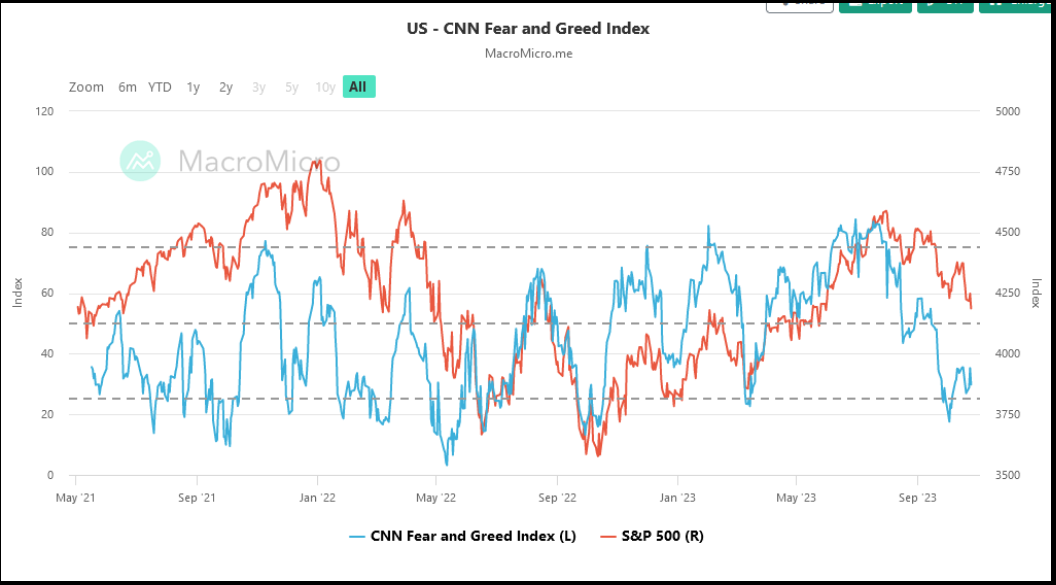

The CNN “Fear and Greed” dropped from 35 last week to 30 this week. Investors are fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

US – CNN Fear and Greed Index

US – CNN Fear and Greed Index

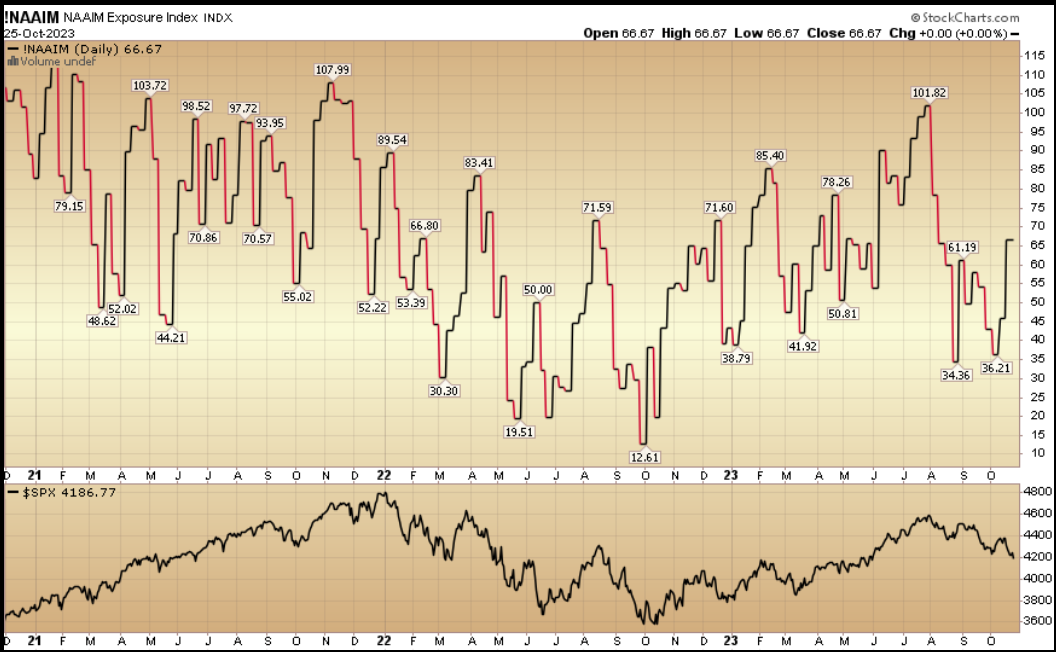

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 66.67% this week from 45.80% equity exposure last week.

This content was originally published on Hedgefundtips.com.