Dollar strengthens ahead of Fed meeting

2023.01.31 11:23

Dollar strengthens ahead of Fed meeting

Dollar gains ahead of the Fed’s decision tomorrow

Spain’s inflation rises for the first time in six months

The euro may fall, but the outlook remains positive

Treasury yields rise, putting pressure on Wall Street.

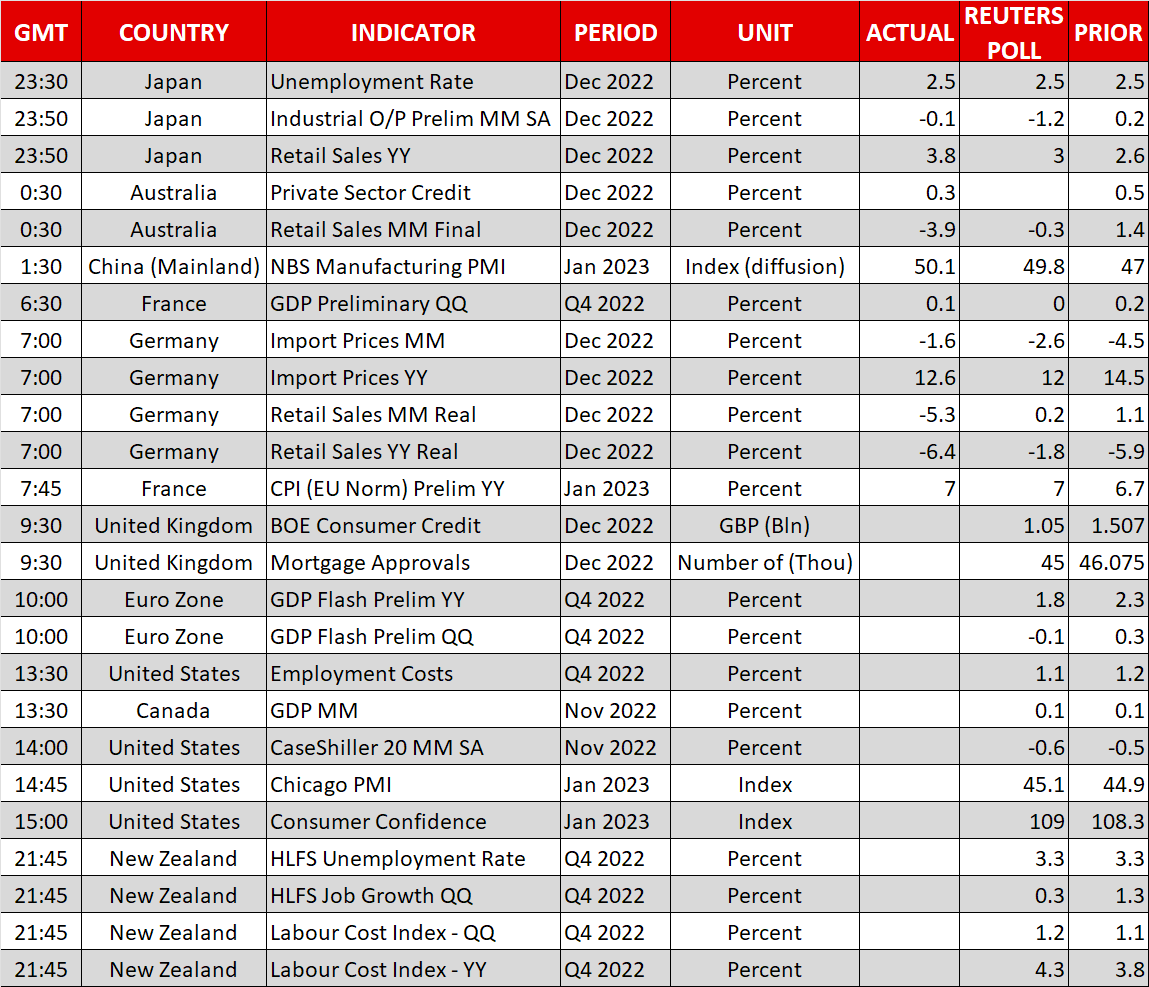

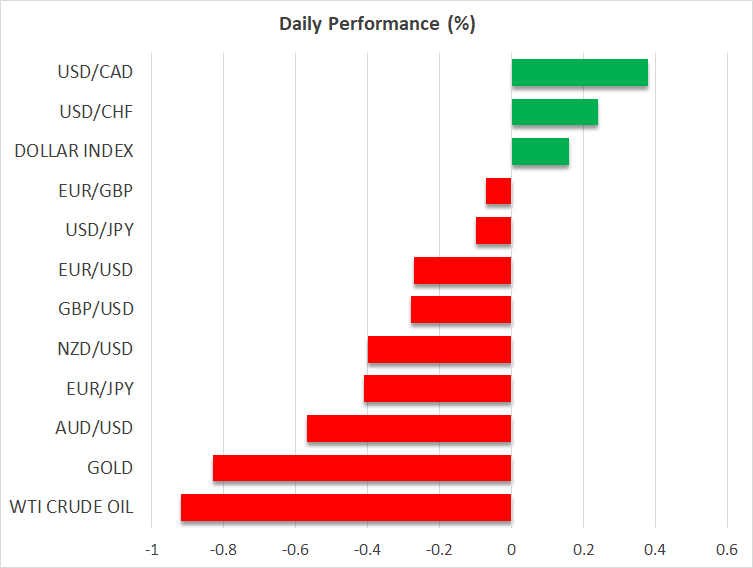

On Monday, the US dollar rose against all major currencies, and it gained ground against most of them again today.

It would appear that traders are selling short positions ahead of tomorrow’s FOMC decision because there were no significant data releases or events that drove the dollar yesterday. The Committee is likely to increase by 25 basis points, and several officials have recently acknowledged that such a slowdown seems appropriate.

The message in the accompanying statement and Fed Chair Powell’s press conference may, however, have a hawkish flavor due to the fact that the majority of them remain steadfast in their belief that interest rates should rise to above 5% and remain there for an extended period of time thereafter.

The market expects a peak slightly below 5% and nearly two quarter-point cuts by the end of the year, despite the fact that participants in the market and the Fed agree on the size of tomorrow’s hike.

As a result, a hawkish message might make it possible for the dollar to gain some more. However, recent experience has demonstrated that market participants are not as excited to buy when economic releases surprise to the upside, but they are willing to sell dollars aggressively when data enhances their pivot view.

Therefore, the dollar is unlikely to soar, and given that the euro/dollar is by far the largest component of the, an excessively hawkish ECB on Thursday, which confirmed expectations of additional 50bps rate increases beyond February, may also limit any strength of the dollar.

After data showed that Spain’s inflation accelerated for the first time in six months, European equities came under selling pressure and ended in the red. This gave credence to the belief that the upcoming ECB gatherings will see additional double hikes.

Concerns may have been heightened by additional data indicating that the German economy unexpectedly contracted in the fourth quarter. However, given that the preliminary PMIs released in January indicated that the economy of the Euro area as a whole returned to growth, these concerns are likely to soon dissipate.

Although a recession is still possible in the Eurozone, it is likely to be milder than initially anticipated. Therefore, this, in conjunction with a further acceleration of underlying inflation in the euro area on Wednesday, is likely to maintain elevated expectations of a hawkish ECB and permit the euro to continue moving north.

Even if the euro/dollar corrects lower this week as a result of a hawkish Fed and a relatively good employment report, the slide may be viewed as providing a fresh opportunity for buying, with a possible rebound laying the groundwork for a test of 1.1175 in the not-too-distant future. The ECB may need to sound more dovish on Thursday than anticipated in order to call into question the most recent uptrend of the pair.

Wall Street had a bad day as a result of rising Treasury yields and the US dollar. The Nasdaq, which is more sensitive to rates, lost almost 2% of its value across all three of its primary indices.

Although both the Nasdaq and the S&P 500 are currently trading above their previous downtrend lines, it is still unclear what investors’ longer-term plans are. It appears that market participants are already pricing in a hawkish message from Fed Chair Powell and his colleagues.

It’s possible that Apple’s (NASDAQ:) profits, NASDAQ: Alphabet likewise, Amazon (NASDAQ:) Although the S&P 500’s aggregate earnings are expected to fall 3% on Thursday, even if the overall result still appears bad, anything pointing to a smaller decline could permit some further recovery.

Having said that, a recovering US economy is unlikely to last very long if data continue to deteriorate, as a weak economy is not good for businesses and their earnings in the future. The area where the bulls may be able to give up on the S&P 500 may be around 4150.