Dollar stalls, stocks given a lifeline as rate hike bets scaled back

2022.06.24 13:50

- European and US PMI data underscore recession risks, dampen price outlook

- Falling commodity prices add to reduced inflation expectations

- Investors go back to the drawing board for central bank rate hike paths

- Stocks rejoice as yields slip too, but dollar consolidates

Recession risks loom large

Speculation that the major economies in Europe and America are on the verge of tipping into a recession continues to intensify as the flash PMI reports for June have provided fresh evidence that growth is stalling. The Eurozone’s composite PMI is at the lowest since February 2021. Business activity in the US was the weakest since January, with new orders registering their first drop in two years according to S&P Global. The UK’s composite gauge held unexpectedly steady in June, but underneath the hood, the details weren’t very encouraging.

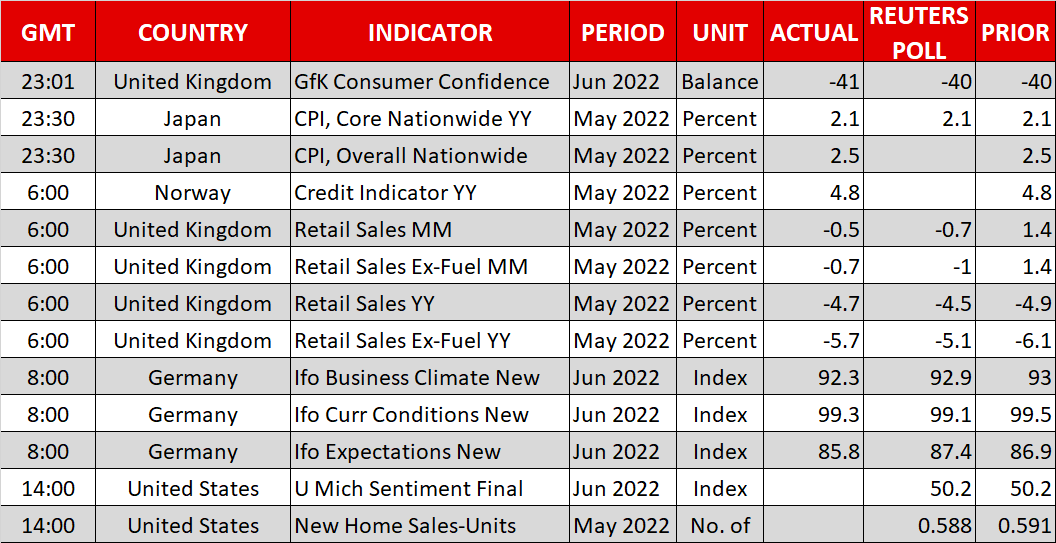

Other data haven’t been particularly great either. Weekly jobless claims in the US have been slowly edging higher since April and yesterday’s marginal dip hasn’t done anything to alter this trend. Investors will likely be keeping a close eye on new home sales due later in the day as well as for any possible revisions to the University of Michigan’s final consumer sentiment reading for June.

Meanwhile, retail sales in the UK fell again in May, following a brief downwardly revised pickup in April.

Inflation expectations have gone into reverse in June

Although it’s not yet set in stone that a recession is unavoidable, all the doom and gloom has taken the shine off the aggressive tightening expectations that market participants had priced in for the major central banks. Investors have switched from scaling up their rate hike bets to downgrading their predictions of the terminal rates.

The Fed funds rate is now expected to peak in March 2023 at about 3.5%, which is almost 50 basis points lower than what was being predicted just 10 days ago.

Measures of inflation expectations in the US and Europe have also subsequently fallen. But it’s not just the deteriorating demand picture that’s leading the decline in price expectations.

Commodity prices have tumbled in June and the drop has been pretty broad-based, so it’s not solely been about oil’s pullback. Wheat futures have touched their lowest since late February and COMEX copper futures slumped to 16-month lows today. Other raw material prices have also pared back all or most of their post-Ukraine war gains.

Wall Street set for weekly rise

As unnerving as the threat of recession is for investors, there is cause for optimism as long as the rising risks are accompanied with declining rate hike expectations. Hence, stocks have been able to make some headway this week.

The S&P 500 has recovered about 3.5% as of Thursday and its e-mini futures were last indicating a further 0.6% gain today. Shares in Europe haven’t been able to stage much of a rebound amid the higher risk of a severe downturn on the continent and in the UK.

In addition, countries like Germany that are highly dependent on Russian gas face the prospect of having to ration their gas consumption this winter, while over in Britain, there is renewed political uncertainty after Boris Johnson’s Tory party lost two seats in a by-election, raising fresh question marks about his future as prime minister and party leader.

Nevertheless, most European indices were catching up today, rising by about 1%.

Improved mood weighs on dollar and bonds

The brighter tone helped bond yields to steady on Friday. Fed Chair Jerome Powell reiterating his “unconditional” commitment to getting inflation down on his second day of testimony before Congress yesterday likely put a floor under yields too.

Government bonds have dramatically come back into fashion over the past week as the growing fear of a recession has revived their safe-haven status. It’s unclear if the rally in Treasuries and other bonds can be sustained under the current monetary policy backdrop but it has taken a pause for now.

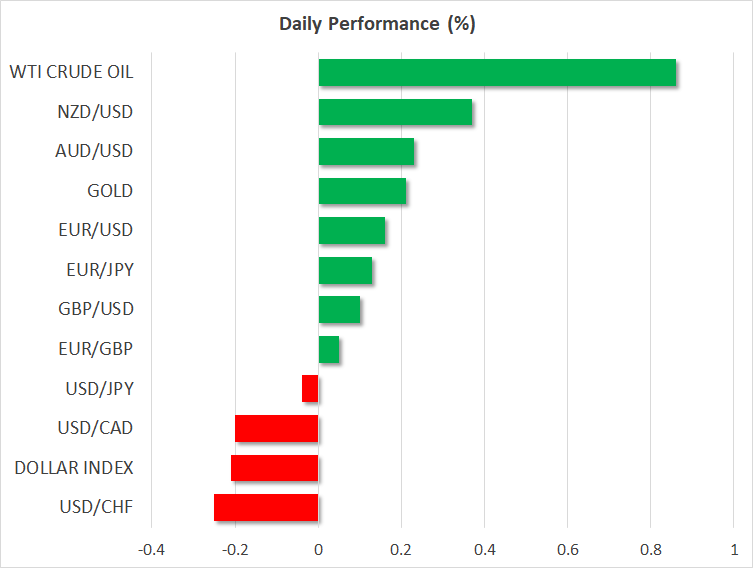

Despite that, the US dollar was struggling today, slipping against all of its major peers. The dollar index has been forming a pennant over the past week and a breakout looks imminent, though, the direction is less clear.

The New Zealand dollar is the biggest gainer against the greenback today. The euro and pound climbed modestly, and the yen retreated slightly versus most of its peers. Data out earlier showed Japan’s core CPI rate met expectations of 2.1% y/y, reinforcing the view that the Bank of Japan can afford to wait a little longer before beginning to tighten policy.