Dollar Pulls Back Ahead of Key US Data

2023.08.29 05:53

- Dollar traders turn cautious ahead of important data

- Yen stays pressured as yield differentials stay in the spotlight

- Wall Street records gains as Powell refrains from committing to more hikes

Traders await key US data, Friday’s NFP the highlight

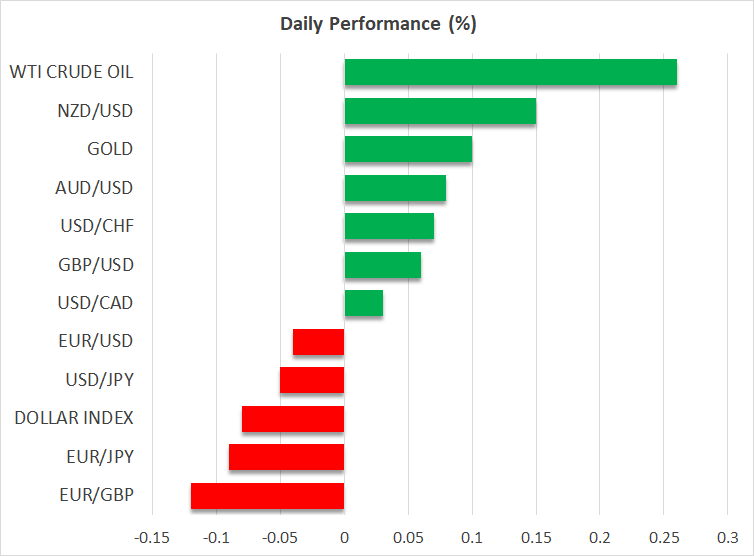

The dollar pulled back against most of the other major currencies on Monday, extending gains only against the Japanese yen. Today, the greenback is trading lower or unchanged.

Following the balanced remarks by Fed Chair Powell at Jackson Hole, who left the door open to more hikes but refrained from pre-committing to any action, dollar traders may have turned cautious at the start of this week in anticipation of important data that could well reshape market expectations regarding the Fed’s future course of action.

At the press conference following the last Fed meeting, Powell stressed that they will closely monitor incoming data and take decisions on a meeting-by-meeting basis. Since then, US data have been largely coming in on the bright side, which combined with Powell’s Jackson Hole comments allowed market participants to assign around a 65% probability for another hike by November and scale back a notable amount of basis points worth of anticipated rate cuts for next year.

This week’s data include the JOLTs job openings for July that are coming out today and the core PCE index for July on Thursday which is always accompanied by the personal income and spending numbers, but the highlight will likely be Friday’s employment report for August.

Anything pointing to a still-strong labor market and sticky inflation could prompt investors to add to their hike bets and/or take off the table more basis points worth of rate cuts for next year, which could drive Treasury yields higher and thereby add more fuel to the dollar’s engines.

The core PCE index is forecast to have ticked up to 4.2% y/y in July from 4.1%, while wage growth is forecast to have held steady at 4.4% y/y in August, which could translate into more price pressures in the months to come. These forecasts tilt the risk towards a higher dollar, but they also suggest that any disappointment may result in a strong reaction in the opposite direction.

Yen slides in absence of intervention warnings

The yen was once again the big loser, staying victim to yield differentials. Yes, US Treasury yields pulled back yesterday, but their strong prevailing uptrends combined with the BoJ’s caps on Japanese government bond yields suggest that the gap may further widen if this week’s US data add more credence to the view that the Fed funds target rate is likely to stay high for longer than previously estimated.

Dollar/yen continues to trade above 146.00, and around 12% up since the beginning of the year. Due to the absence of intervention warnings by Japanese authorities, traders do not appear concerned about current levels, which means they may be willing to continue driving the pair higher. However, as the uptrend continues, intervention at higher levels, perhaps at around the 150.00 mark, could become a more likely scenario.

Equities gain as Powell says they ‘will proceed carefully’

Despite Fed Chair Powell leaving the door open to more hikes, it seems that Wall Street traders cheered the fact that he did not commit to any action and his remarks that the Fed will proceed carefully as they decide whether to tighten further. The fact that, despite raising the implied path, the market is still expecting interest rates to finish 2024 around 90bps below current levels may be also helping equities.

The high-growth tech firms that have been the main drivers of the latest rally on Wall Street are usually valued by discounting free cash flows for the quarters and years ahead. Thus, the fact that participants are still expecting a decent amount of rate cuts next year keeps the net present values (NPV) of those firms elevated.

Strong US data this week could weigh on equities, but as long as numerous rate cuts for 2024 remain firmly on the table, any continuation of the slide that started on July 27 could still be seen as a deeper correction within a broader uptrend.