Dollar pulls back after weaker US jobs growth

2023.08.07 05:55

- US NFPs increase by less than expected in July

- Dollar, Treasury yields slide, traders add to rate cut bets

- Loonie suffers, BoJ debates prospect of sustained inflation

- Wall Street extends correction after US employment report

Dollar comes under pressure as NFPs miss estimates

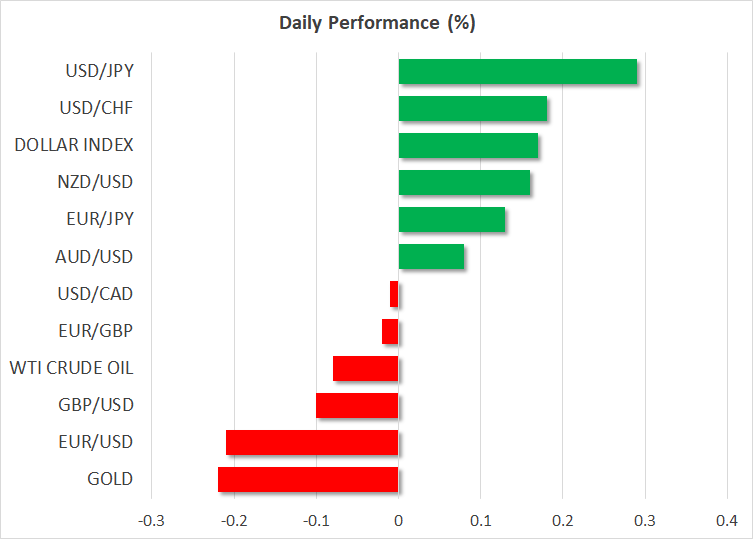

The US dollar slid against all but one of the other major currencies on Friday, but it is showing signs of stabilization at the start of this week.

What prompted dollar traders to liquidate their long positions on Friday may have been the lower-than-expected jobs growth for July. The US employment report revealed that the world’s largest economy added 187k jobs instead of 200k as the forecast indicated, a number accompanied by downward revisions in the May and June prints.

Although the unemployment rate ticked down to 3.5% and average hourly earnings grew by more than anticipated, investors were not tempted to raise bets that another hike by the Fed may be required. Alongside the US dollar, US Treasury yields pulled back as well, while according to 30-day Fed funds futures, there are more basis points worth of rate reductions priced in for 2024 than prior to the release.

The next big test for the greenback may be the US CPIs for July, due to be released on Thursday. With the prices charged subindex of the ISM non-manufacturing PMI rising by more than expected and the S&P Global PMI surveys saying that the stickiness in price pressures remains a major concern, the risks surrounding the CPIs may be tilted to the upside. Friday’s higher-than-expected wage growth adds more credence to that view.

An upside surprise in the all-important CPIs may prompt market participants to reconsider the possibility of a hike in September and scale back some of their rate cut bets, which could help yields and the dollar rebound again. The opposite may be true in the case of a miss.

Loonie falls on Canadian jobs data, BoJ debates sustained inflation

The Canadian dollar was the only currency against which the dollar did not lose ground. That may be due to the weakening more after Canada’s jobs report revealed that the economy lost 6.4k jobs in July instead of adding 21.1k as the forecast suggested, solidifying investors’ view that the BoC is unlikely to raise rates at the upcoming meeting.

Although it enjoyed two days of gains on Thursday and Friday, the Japanese yen is on the back foot again today. At the beginning of the day, traders got the Summary of Opinions from the latest BoJ meeting, in which it was revealed that policymakers debated growing prospects of sustained inflation, with one member adding that wages and prices could continue growing at a pace “not seen in the past.” Despite this view implying that officials may be now more willing to further phase out stimulus in the coming months, the yen did not extend last week’s recovery.

Wall Street fails to hold onto job-related gains

Wall Street jumped higher after the US employment report revealed a lower-than-expected NFP print. However, equity investors were not willing to close the week with increased risk exposure, liquidating some of their positions and forcing all three of the main US indices to tumble again and extend their prevailing correction.

Although increasing Fed-cut bets are positive for the stock market, both the technical picture and valuation multiples point to a market stretched to levels at which only very few will be willing to buy. Therefore, a decent correction at this stage appears more than justified.

However, calling for a bearish trend reversal now seems premature and unwise. For that to start being examined, market participants need to scale back a noteworthy amount of rate cuts for 2024. Thursday’s CPIs may be the starting point, but future data and Fed rhetoric also need to corroborate the “higher for longer” narrative. If investors remain convinced that the Fed will proceed with massive reductions, even after Thursday’s CPIs, the uptrend in equities may resume.

The pullback in the US dollar and Treasury yields allowed gold to trade somewhat higher on Friday, although it is surrendering those gains today, while oil prices extended their recovery, which is mainly driven by the pledge of major producers, like Saudi Arabia and Russia, to keep supply subdued for another month.