Dollar Gets Sidetracked as BOC Joins RBA’s Hawkish Tilt

2023.06.08 06:33

- BoC delivers second surprise hike of the week, and shine

- Markets forced to reassess their understanding of a ‘pause’

- Dollar slips amid confusion over Fed policy, tech rally hit by un-pause fears

Markets rattled by renewed higher-for-longer push

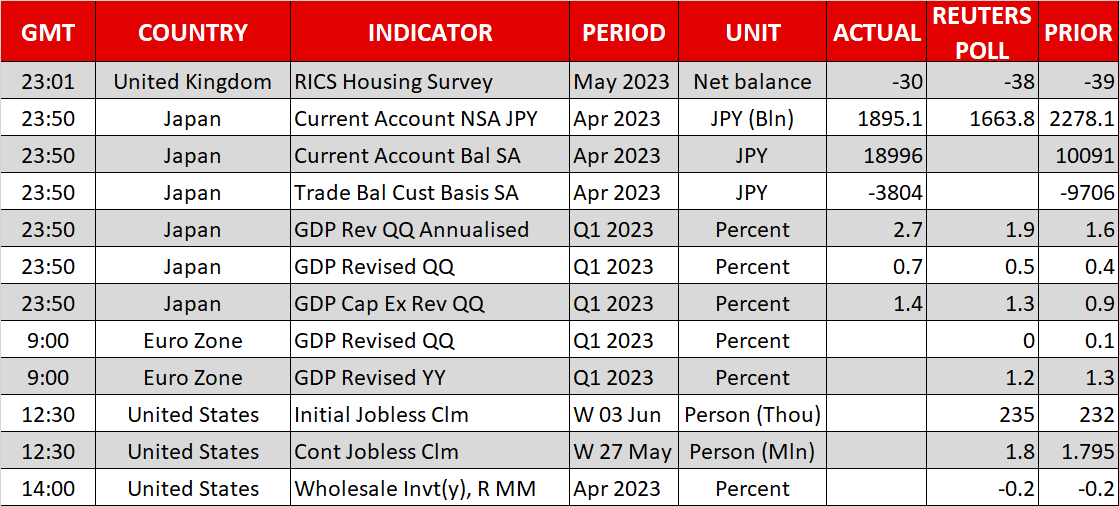

The Bank of Canada became the second central bank to hike interest rates this week, joining Australia’s Reserve Bank in upping the battle against persistently high inflation. More significantly, Wednesday’s 25-basis-point hike marked an end to the Bank of Canada’s pause period that began in January.

Policymakers in Western economies have been taken aback by the consistent upside surprises in both the inflation and economic growth data. Even now after the policy mistakes by almost every major central bank over the notion that this surge in inflation will be transitory, policymakers seem to be underestimating the full impact of the price shocks stemming from the pandemic, the Ukraine war as well as the global labour shortage phenomenon.

However, with the RBA and BoC not only stunning markets with their policy responses this week, but also by signalling they may not be done with rate increases, investors have had a major wake-up call ahead of the Fed’s own decision in just under a week’s time.

Dollar struggles in the face of Fed policy uncertainty

Pricing for the Fed funds rate in futures markets has been very erratic lately as traders are trying to outguess the Fed on three fronts: skipping a rate rise in June, hiking and then pausing in July, cutting rates in December.

After the hawkish tilts from Canada and Australia, investors are once again on the verge of completely pricing out a rate cut by year end. But one final hike in July or possibly in September is not yet full priced in. At the same time, there are still sizeable odds of an increase in June.

This probably explains why the US dollar has lost its sense of direction and has been somewhat drifting lower over the past week as investors just can’t seem to make up their minds over what the Fed will do next. There is a risk that the FOMC is headed for a split vote next Wednesday and so the dollar dilemma may not get resolved so quickly.

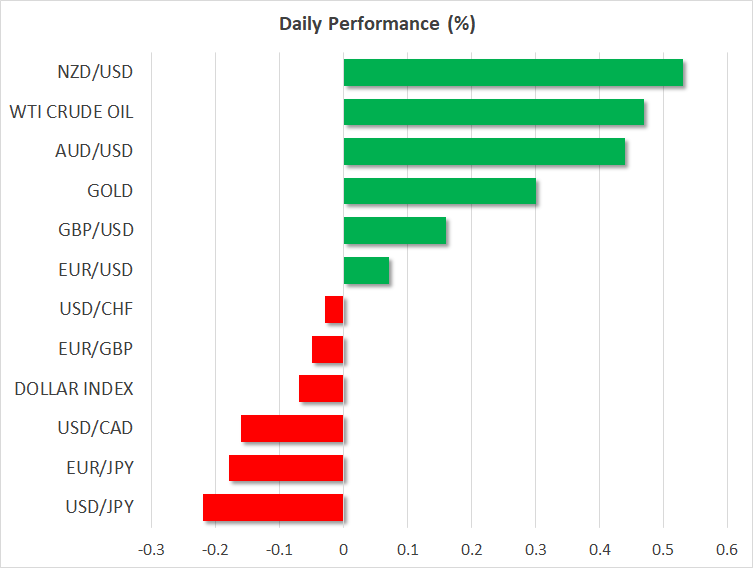

Aussie and loonie get the upper hand

For now, it is time for others to shine and unsurprisingly, the Australian and Canadian dollars are leading the advances against the greenback this week. Both the aussie and loonie are trading around four-week highs, while the euro and pound have been able to reclaim the key levels of $1.07 and $1.24, respectively.

The yen also firmed against the dollar after Japan revised up its Q1 GDP estimate, boosting bets of a tweak in policy by the Bank of Japan in one of its upcoming meetings.

The Turkish lira on the other hand continues to be pummelled and has lost more than 10% of its value so far this week amid uncertainty about how President Erdogan plans to revamp his economic policies following his election win.

Tech rally hits a bump

Meanwhile, equity markets are still reeling from the realization that a pause is not synonymous for a peak in rates and that the higher-for-longer narrative may yet stretch into the second half of 2023. US futures were last trading flat after Big Tech stocks pulled the down by 1.3% on Wednesday.

The expectation that the Fed is nearing the end of its tightening cycle had given stocks on Wall Street a new lease of life this year following the bear market in 2022. Together with the added boost from the tech rally, the S&P 500 is now on the verge of entering a bull market, having rebounded by about 20% from its October lows. The Nasdaq has gained even more.

But investors are now having to rethink the earnings potential of these high-flying stocks as borrowing costs around the world continue to head higher. For the Fed, even if a pause is near, the pricing out of more than 100-bps of rate cuts in 2024 alone could have a detrimental effect on equities and it remains to be seen how long-lasting the AI frenzy will be.