Dollar gains despite increasing Fed cut bets

2023.05.12 05:50

- Jobless claims jump to a 1-1/2-year high

- Dollar attracts haven flows, but too early for reversal

- BoE hikes, revises up inflation and GDP projections

- Dow and S&P 500 reflect worries, Nasdaq stays supported

Dollar takes safe-haven suit out of the closet

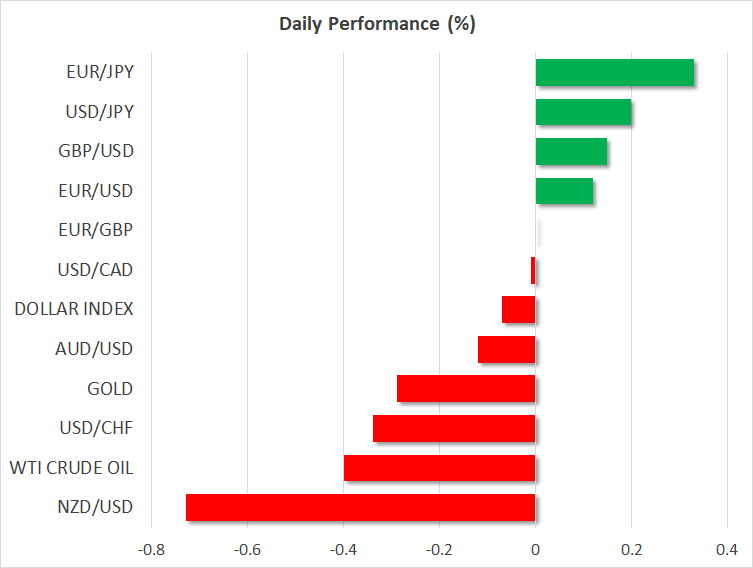

The US dollar outperformed every other major currency yesterday, despite US data adding to worries about the US economy and prompting investors to increase bets with regards to rate reductions by the Fed later this year.

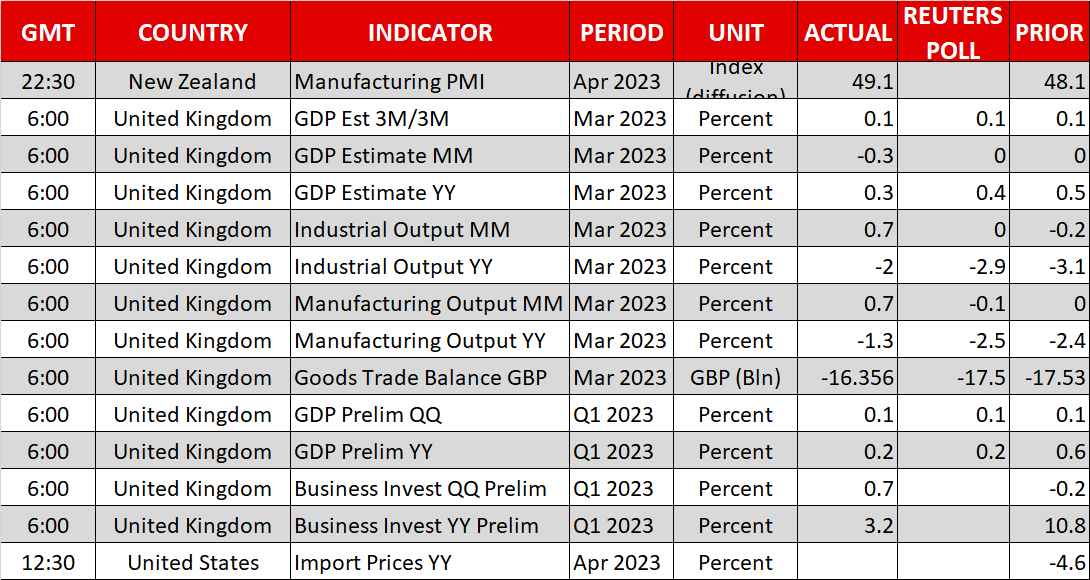

Initial jobless claims for last week jumped to a one-and-a-half year-high, reviving concerns that the labor market may be losing steam, although April’s jobs report pointed to a still-healthy state. Combined with the slowdown in producer prices, which could result in even cooler consumer prices in the months to come, this allowed investors to add to their rate cut bets. At some point during the day, they were convinced that the Fed may need to deliver 85bps worth of cuts. Today, they see around 75bps.

So, why did the dollar rally in the midst of bolstering rate cut bets? Perhaps it has already fallen to levels that made it attractive to investors looking for safety, especially those concerned about the ongoing stalemate in the US Congress over raising the debt ceiling. In other words, the greenback may have taken its dusty safe-haven suit out of the closet, but just for this special occasion. With Treasury yields coming under pressure and investors anticipating three quarter-point cuts this year by the Fed at a time when the ECB and the BoE are willing to continue hiking, calling for a trend reversal in the US dollar still seems premature. Thus, any further recovery may be a corrective wave within its broader downtrend.

For a bullish reversal to start being examined, the Fed may need to disappoint market expectations by delivering another hike in June or by keeping interest rates untouched beyond September, when the first 25bps cut is fully priced in. This is when the market will be forced to start lifting its implied rate path, which would fuel Treasury yields and thereby the greenback.

BoE to “stay the course” in fight against inflation

Yesterday, the BoE decided to raise its benchmark rate by 25bps as it was widely anticipated, with the forward guidance staying more or less unchanged, namely that they may proceed with further tightening should inflation pressures persist. That said, the spotlight was thrown on the upgraded inflation projections and the GDP forecasts, with the Bank abandoning its call for a UK recession.

Blending this with Governor Baily’s remarks that they must “stay the course” to ensure that inflation falls back to the 2% objective, investors were allowed to maintain bets of more rate increases in the months to come. Specifically, they are pricing in another 40bps worth of hikes by the end of the year. Despite not being able to hold onto its decision related gains, the pound could still perform well against its US counterpart due to the divergence in monetary policy expectations between the BoE and the Fed.

S&P500 and Dow Jones slide, Nasdaq gains

The risk-aversion mood was also reflected in Wall Street, with both the Dow Jones and the S&P 500 ending their session in the red. However, the tech-heavy Nasdaq closed 0.18% up, adding to the view that high-growth investors are willing to stay in the market due to expectations of lower interest rates in the quarters and years ahead pushing present values up.

Yes, recession concerns are negative for stocks, especially with Chinese data suggesting that after the post-reopening boost, the world’s second largest economy is also losing momentum. But liquidity and expectations of aggressive rate cuts later this year are acting as life jackets. It seems that investors are confident that if the Fed decides to cut interest rates as they suggest, a recession can be avoided. As with the dollar, a reversal in stocks may enter the discussion when the Fed refuses to obey investors’ calling beyond the summer.