Dollar Fires Up, Pushes Gold Down the Stairs

2023.05.30 05:22

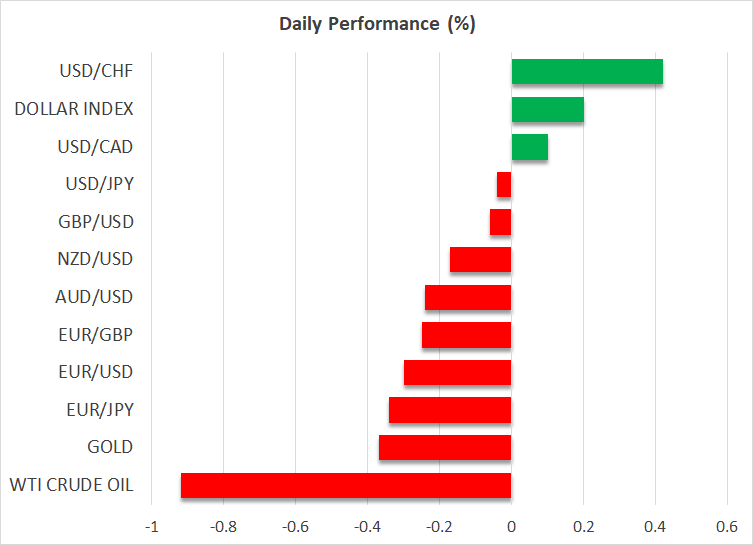

- Dollar continues to recover ground, bolstered by Fed bets

- Gold falls to 6-week lows as debt ceiling deal spreads relief

- Stocks set to open higher, despite looming liquidity drain

Euro/dollar grinds lower

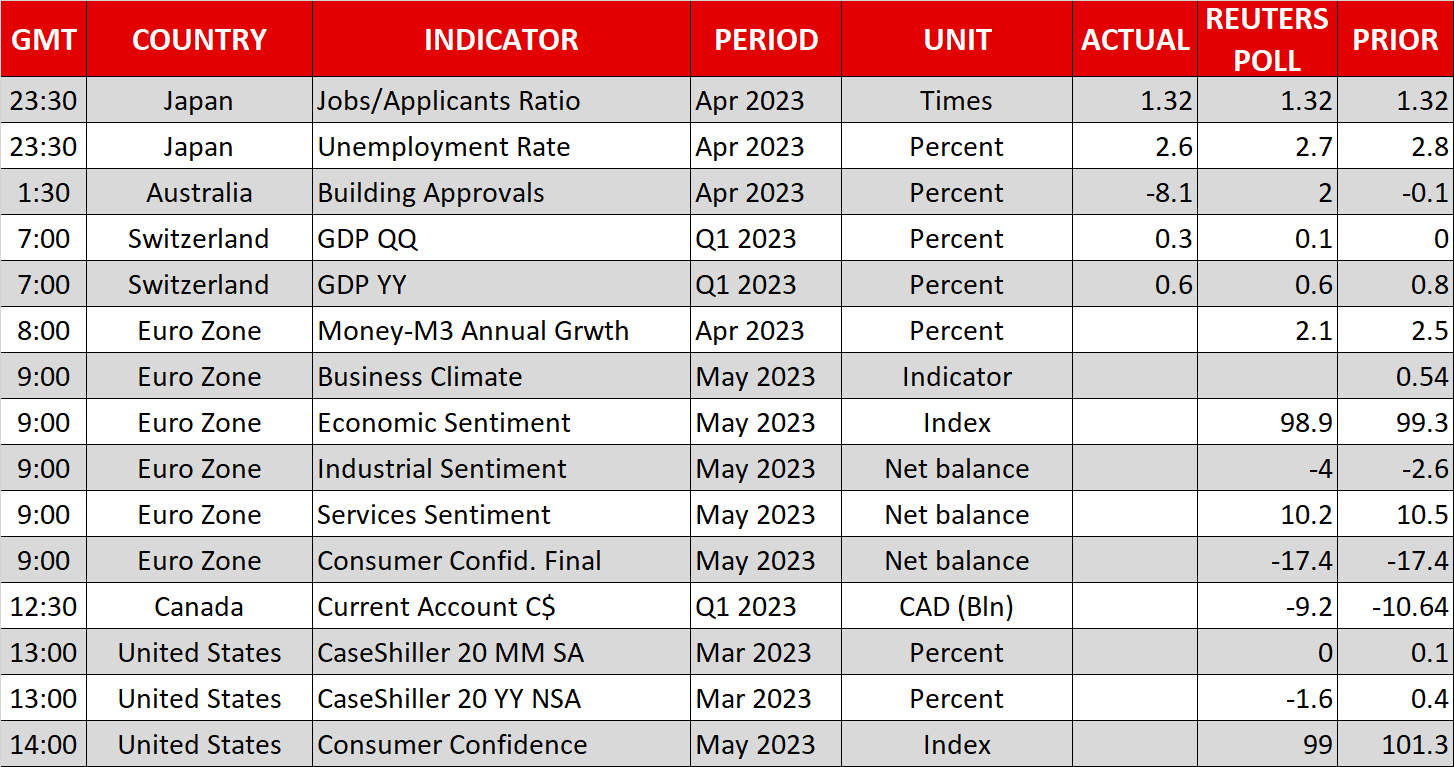

There’s been a change of fortune for euro/dollar this month. A cascade of cheerful US data releases has convinced traders the Fed will push the rate-hike button one final time this summer, while in contrast, the data pulse in the Eurozone has been weakening as the troubles in the manufacturing sector pushed Germany into a technical recession.

Hence, the turnaround in euro/dollar has been built on the foundations of economic divergence, as concerns of an imminent US recession melted away just as storm clouds started to gather over Europe. Reflecting this shift, the Fed rate cuts that were baked into the cake later this year have been mostly priced out.

Looking ahead, the next round of data releases this week could provide more juice for this slide in euro/dollar to continue. Business surveys suggest the US labor market enjoyed another stellar month while inflationary pressures in the euro area seem to be cooling according to the same sources, leaving scope for Fed rate bets to intensify further but ECB bets to taper off.

Gold burned by stronger dollar

A resurgent dollar and relief that a US debt ceiling deal has finally been reached have left their marks on gold, which sliced below the $1,935/oz region earlier today to hit its lowest levels in six weeks.

It’s a troublesome environment for bullion, as the steepening of the Fed’s implied rate trajectory has simultaneously turbocharged the dollar and propelled Treasury yields higher, both of which make the non-yielding metal that is denominated in US dollars less attractive.

On the bright side, the slide in gold has not been massive, indicating that there’s still some underlying demand. Sovereign buying from central banks, spearheaded by the People’s Bank of China, most likely continues behind the scenes.

All told, the retreat in gold could persist for now, especially in the case that the nonfarm payrolls print on Friday exceeds estimates, as it has done 12 times in the last 13 months. For the yellow metal to resume its journey towards new record highs, it might require recession nerves and Fed rate-cut bets to resurface, neither of which is on the immediate horizon.

Stocks push higher, Turkish lira keeps sliding

Wall Street raced higher on Friday, with tech stocks leading the charge as the AI mania continued in full blast. Futures point to further gains today when US markets reopen after a long weekend, following news that lawmakers struck a deal on the debt ceiling, averting a catastrophic default.

The agreement still needs to pass Congress, and that won’t be easy. Some Republicans have already voiced opposition to the deal, arguing it doesn’t moderate debt levels enough, which complicates matters as the Republican majority in the House is razor-thin.

For equity markets, the ‘darker’ dimension of the debt ceiling resolution is the liquidity drain that will ensue afterwards, as the Treasury scrambles to rebuild its cash levels over the summer. With an avalanche of newly-issued bonds hitting the market, the effects would be similar to quantitative tightening going into overdrive. This could make for a ‘cold summer’ in riskier assets that have been flying high this year.

Finally, the Turkish lira hit a new record low today in the aftermath of President Erdogan’s election victory. Investors are betting on another five years of unnaturally low interest rates and inflationary economic policies, which ultimately result in currency debasement.