Dollar extends slide; ECB and BoJ take center stage

2022.10.27 12:17

[ad_1]

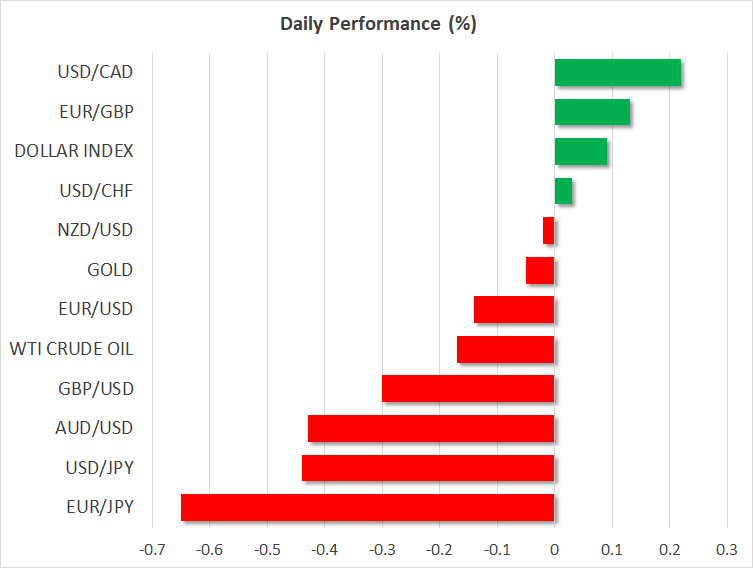

- US dollar drops more on receding bets of Fed rate hikes

- Euro reclaims parity ahead of ECB decision

- BOJ expected to maintain ultra-loose strategy

- EU shares gain but Wall Street falls on disappointing earnings

Dollar adds to losses as BoC shift adds to speculation of a Fed pivot

The US dollar kept sliding yesterday on firmer views that the Fed will slow the pace of its interest rate hiking cycle.

Following Tuesday’s disappointing data, market participants may have become more assertive with regards to the likelihood of a less aggressive Fed due to the BoC announcing a smaller-than-expected 50bps rate hike yesterday and adding that it is getting closer to ending this historic tightening crusade due to projections that the economy could stall over the next quarters.

The tumbled initially against the greenback, but it was quick to recover as the BoC’s decision may have been interpreted as setting the tone for other major central banks, including the Fed. Indeed, although Treasury yields rebounded somewhat today, they extended their Tuesday slide yesterday, with investors further flattening their implied rate path. Yes, they are still convinced that a 75bps hike will be the case next week, but they added to bets of a smaller 50bps hike in December.

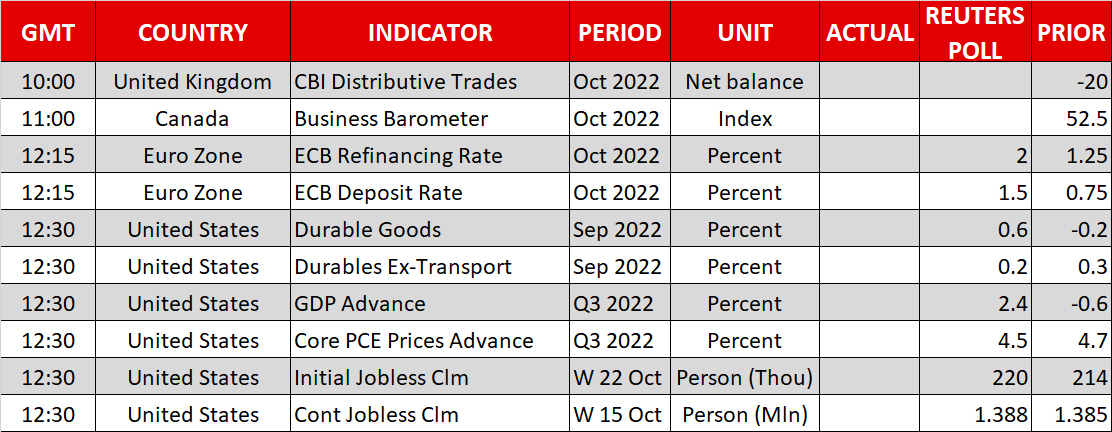

ECB widely expected to hike by 75bps; Focus to fall on language

The dollar’s retreat helped euro/dollar climb back above parity for the first time since September 13, with euro traders locking their gaze on the ECB decision today. A 75bps hike is fully priced in and thus, if this is the case, any market reaction is likely to come from the accompanying statement and/or President Lagarde’s press conference.

With the euro’s weakness hurting the Eurozone trade balance and several policymakers expressing discontent towards that, the language is unlikely to lean towards the dovish side. Rather, officials may attempt to defend the common currency. This combined with a sliding US dollar due to increasing hopes of a less aggressive Fed, may allow euro/dollar to extend its latest recovery for a while longer. Nonetheless, the Fed remains the most hawkish central bank among the majors, while the Eurozone is still on the verge of recession. Thus, a trend reversal discussion remains premature for now.

BoJ unlikely to alter stance; Investors to seek future action hints

During the Asian session Friday, the central bank torch will be passed to the BoJ. Following the second round of intervention by Japanese authorities on Friday and Monday, investors are likely scratching their heads as to whether the Bank could change its mind around monetary policy. Expectations are for no change at this gathering, but traders may look for clues and hints about officials’ future course of action.

With inflation still much lower than in other major economies and the yen recouping some ground against the dollar due to easing Fed hike bets, officials may not be keen to proceed with major language changes. The Bank is under pressure from the government to help the wounded yen, but policymakers themselves have been arguing that currency policy is a job for the Ministry of Finance. Some small tweaks could be the case though, which could help the yen recover a bit more. Still, with interest rate differentials between the US and Japan unlikely to narrow significantly, a deeper slide in dollar/yen may be treated as a larger downside correction that could provide better buying opportunities.

European equities trade in the green but Wall Street tumbles

European shares extended their recovery yesterday, perhaps due to speculation that central banks around the world may start slowing the pace of their future rate increases. However, Wall Street did not cheer the narrative this time, as hopes about a monetary policy pivot were likely overshadowed by disappointing earnings results from Microsoft (NASDAQ:) and Alphabet (NASDAQ:) after Tuesday’s closing bell.

Wall Street is expected to open higher today, despite results from Facebook (NASDAQ:) parent Meta Platforms and Samsung (KS:) electronics in after hour trading yesterday that spurred more worries of a downturn. Nonetheless, although the outlook for the stock market remains blurry, now may not be the time for a new lower low, at least not before next week’s FOMC gathering. The market seems desperate for a Fed pivot, buying on any sign that confirms the narrative. Therefore, a larger recovery in equities during the next few sessions cannot be ruled out.

In the energy market, oil prices rose around 3.75% on Wednesday, boosted by record US crude exports and a weaker dollar. However, the gains were capped today in Asia, which may be indicative of lingering concerns about demand in China.

[ad_2]

Source link