Dollar Extends Retreat Ahead of US Thanksgiving

2024.11.28 07:56

- Dollar traders lock more profits amid Thanksgiving Holidays

- Probability of a December Fed pause eases somewhat

- Yen climbs higher as BoJ hike bets remain elevated

- Euro rebounds on ECB Schnabel’s hawkish remarks

Fed More Likely to Cut in December and Pause in January

It’s Thanksgiving Day in the US and Wall Street will remain closed today. However, the FX market never sleeps and thus, potentially low liquidity due to the holiday may be a reason for some volatility in the .

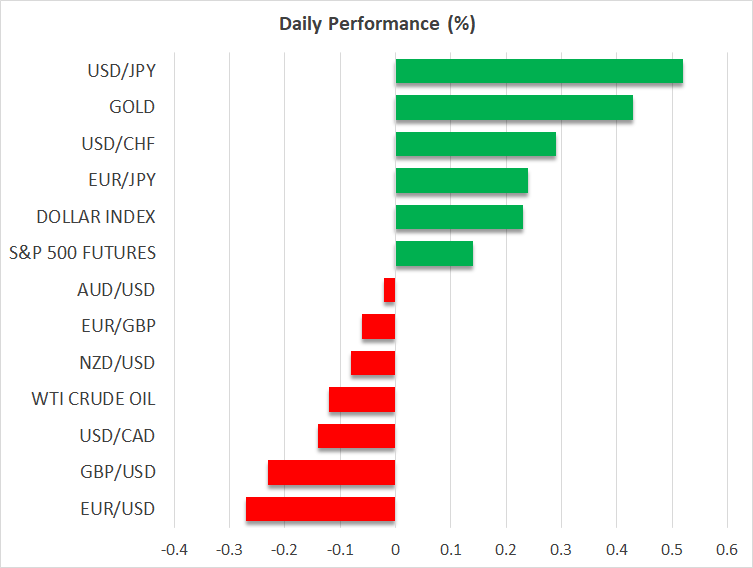

The greenback retreated against all its major peers yesterday, even after the second estimate of GDP confirmed a strong 2.8% q/q growth in Q3, and after the PCE data revealed that inflation accelerated somewhat in October.

The pullback in the dollar could be due to liquidation of long positions before traders leave their desks, but what is strikingly strange is the decline in the probability of a Fed pause in December – from 37%, it dropped to 34%.

Having said that, the chances of policymakers stepping to the sidelines in January rose to nearly 60%, suggesting that investors have not changed their mind on whether the Fed will pause or not, but rather on the timing of the pause. It is also worth noting that the probability of the Fed refraining from hitting the rate cut button at both of the gatherings remained near 30%.

Uncertainty About Trump’s Tariff Policies Persists

It seems that investors are still nervous about the effects of aggressive tariffs by the Trump administration, even after the president-elect said that Mexico’s president Claudia Sheinbaum had “agreed to stop migration through Mexico,” remarks after which the rebounded more than 1%.

Sheinbaum noted that she is planning a migration strategy that would be designed “not to close borders, but to build bridges,” while yesterday, she did not hesitate to state that Mexico would retaliate if Trump indeed imposed 25% tariffs on all Mexican goods.

This is far from suggesting that tensions between the two nations are close to being resolved, and thus, new posts by Trump on trade policy will likely continue being one of the main drivers for the markets.

Yen Extends Rally Ahead of Tokyo CPI Data

The extended its advance, which alongside the recovery in gold, suggests that there are still investors seeking shelter into safe havens. Nonetheless, the yen rally could also be explained by the elevated market expectations that the BoJ will further raise interest rates at the turn of the year.

Tonight, during Friday’s Asian session, the Tokyo CPI figures are scheduled to be released. Those inflation prints tend to have a strong correlation with the nationwide ones and thus, signs of stickiness in consumer prices could very well add credence to investors’ view on rate hikes and thereby allow the yen to climb higher.

Euro Gains on Schnabel’s Remarks, German CPIs Awaited

Besides the dollar’s retreat, was also helped by remarks from ECB’s Isabel Schnabel who said that rate cuts should be gradual, aiming at a neutral rate and not accommodative territory.

This prompted investors to scale back their bets about a bold 50bps reduction at the Bank’s upcoming decision, with the probability of such an action now resting at a mere 15%.

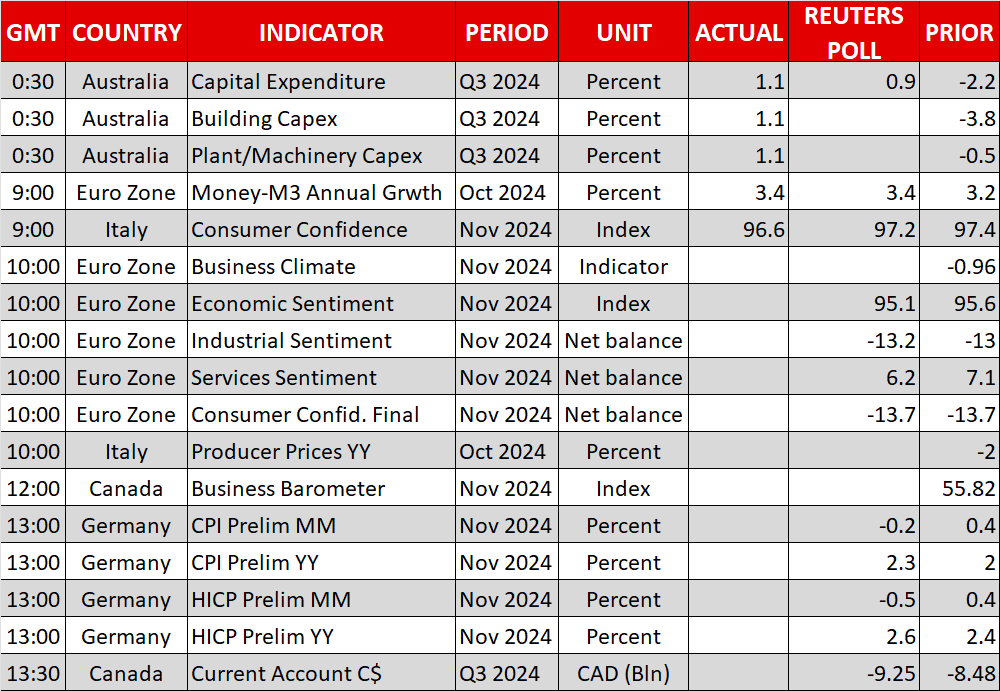

Today, Germany’s CPI inflation data is due to be released, with the regional numbers already out and suggesting some stickiness. This could raise speculation that tomorrow’s Euro area prints will also reveal hotter-than-expected inflation, something that could further weigh on the probability of bold action by the ECB, and thereby allow the euro to extend its recovery for a while longer.