Dollar extends fall ahead of US inflation data

2023.07.12 05:30

- US dollar beaten up as US inflation report looms

- Narrowing yield differentials turbocharge the yen

- RBNZ takes the sidelines, BoC takes the central bank torch

- Wall Street and gold gain on sliding Treasury yields

Dollar traders are positioning for a soft US CPI report

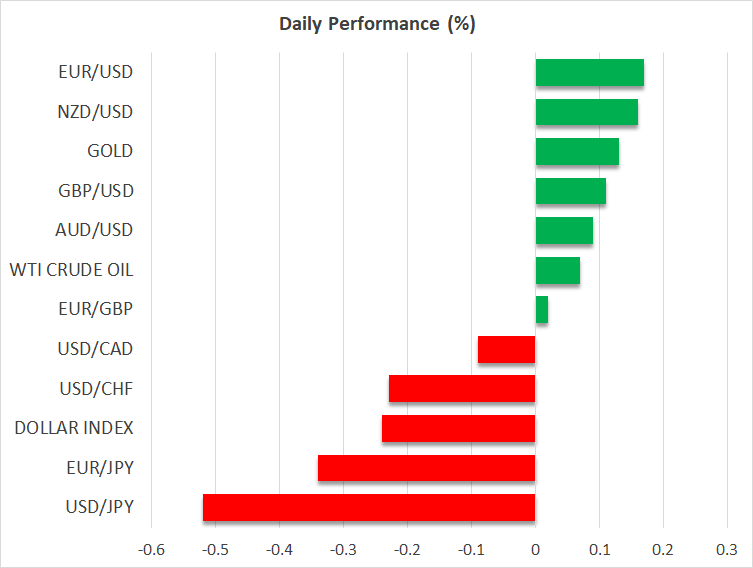

The US dollar continued tumbling on Tuesday and during the Asian session Wednesday, losing ground against all the other major currencies.

Perhaps traders are positioning for another soft US CPI report later today, a view that is corroborated by the slide in Treasury yields and by the lowering of the market’s implied Fed rate path to show more basis points worth of rate cuts next year.

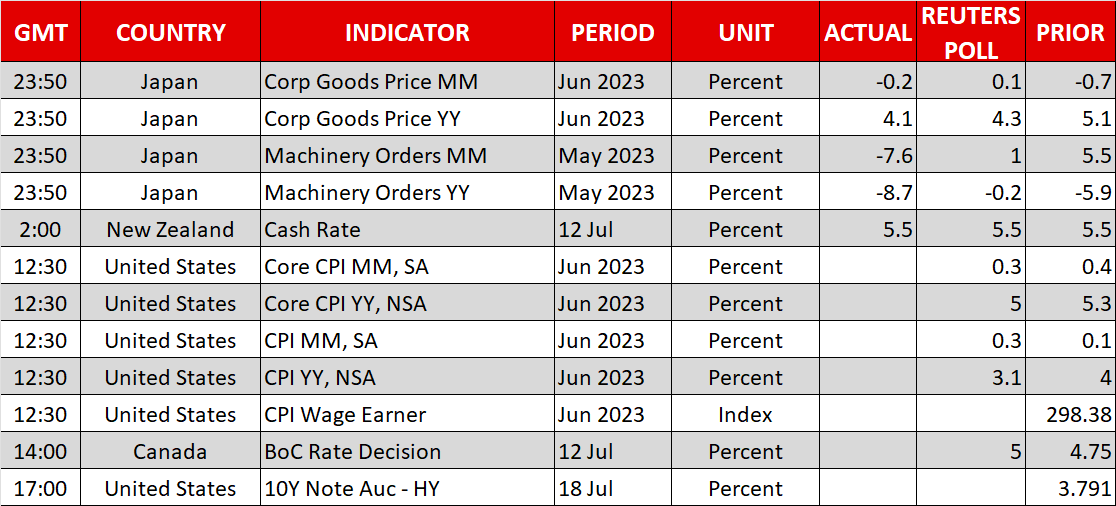

Indeed, expectations are for both the headline and core CPI rates to have declined further in June. Specifically, headline inflation is forecast to slow by nearly a full percentage point to 3.1% year-on-year from 4.0%, while the core rate is anticipated to have slid to 5.0% y/y from 5.3%.

Considering the dollar’s performance heading into the release, the risks surrounding its reaction at the time the actual figures are made public may be asymmetrical. Yes, the dollar could extend its slide should the actual numbers miss their forecasts, but any recovery due to an upside surprise may be larger than any slide extensions due to a small miss.

The latest retreat has taken the closer to the key support zone of 100.70, which has been acting as a floor since February. A potential miss could result in a dip below that strong line of defense, confirming a lower low and turning the broader outlook back to bearish as the inflation data may convince investors that only one more hike may be enough to mark the end of this tightening cycle and that a series of rate cuts for next year are appropriate.

On the other hand, an upside surprise could encourage an intense rebound, which will keep the price action between the 100.70 and 106.50 boundaries, and thereby leave the picture neutral for a while longer.

Yen rally stretches, RBNZ stands pat, BoC expected to hike

With the yield differentials between the US and Japan narrowing even further, the Japanese yen has been in the driver’s seat in the FX market, taking dollar/yen below the 140.00 zone, and confirming the disconnect of the Japanese currency to the performance of the stock market, for which Tuesday was a sunny day.

Due to that, the risk-linked and are also winning against the US dollar today, despite the RBNZ keeping interest rates unchanged and signaling that they may need to be kept there for the foreseeable future.

Later in the day, the central bank torch will be passed to the Bank of Canada, which is largely expected to proceed with its second 25bps hike in a row, after ending last month a pause period that began in January. That said, the larger-than-expected slowdown in Canada’s inflation may result in downside revisions in the Bank’s updated projections, which would add a dovish flavor to a potential hike and may hurt the .

Wall Street closes in the green, gold shines ahead of CPIs

Just a day ahead of the all-important US CPI report, Wall Street enjoyed gains as investors are likely preparing for another cooldown in price pressures. If indeed the report confirms that inflation in the US is coming down faster than previously anticipated, equities are likely to continue trending north for a while longer.

Most tech companies that have been the drivers of the stock rally that started in October are considered very expensive from a valuations perspective. However, expectations of deeper cuts by the Fed next year could keep their present values high and thereby their stocks supported.

The slide in the greenback and the US Treasury yields allowed gold to briefly poke its nose above the key barrier of $1,935/oz. A large slowdown in today’s inflation data could encourage the bulls to clear that level and perhaps start marching towards the next key resistance area at around $1975/oz.