Dollar and oil extend slide ahead of busy week

2023.11.27 06:17

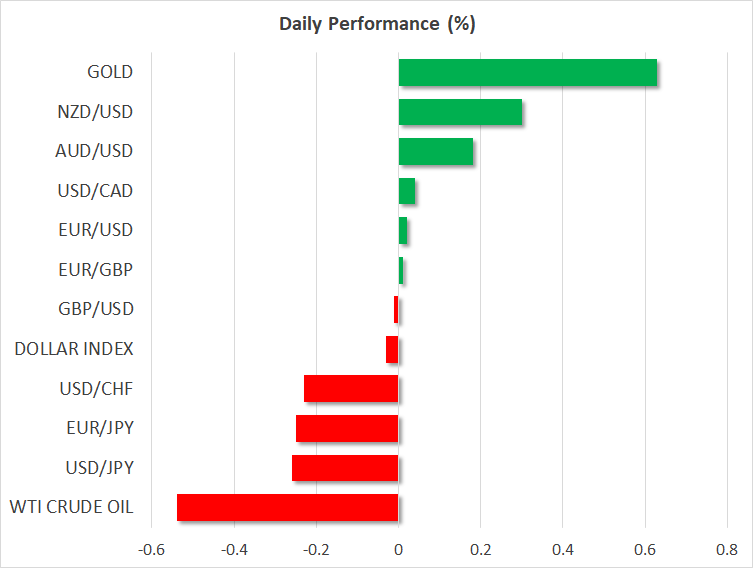

- Major pairs and gold climb to new highs as dollar sags

- Inflation data and Fed speakers awaited for direction

- Oil drifts lower ahead of OPEC+ decision

Markets cautiously optimistic ahead of key data

Trading got off to a cautious start on Monday as investors awaited fresh clues on inflation and the Fed policy path in what looks set to be a more eventful week following the Thanksgiving lull. Although Fed rate cut expectations have been scaled back from around 100 basis points to just over 80 bps over the past week, there is a very strong market consensus that not just the Fed, but other major central banks too will begin slashing rates by the middle of next year.

That poses a bit of a threat to the current bullish wave gripping risk assets as the positive outlook is being almost entirely propped up by the expectation of lower borrowing costs amidst weakening growth in the major economies.

Dollar soft as Fed and US data eyed

The US dollar has been the hardest hit from the rate cuts bets as the Fed has tightened more than other central banks and with US inflation now falling faster as well, it’s seen to be cutting more.

The problem with that narrative, however, is that inflation still has some way to go before it’s settled near 2% sustainably and Fed policymakers that are lined up to speak this week will probably try to get that message across.

The barrage of Fed speak will start tomorrow, culminating with Chair Powell’s remarks on Friday, who gets to have the final word before the blackout period prior to the next policy meeting on December 12-13 begins.

However, as has been the case so far, investors might ignore any push backs against rate cuts if the incoming data continues to support the case for looser monetary policy in 2024 and the forecasts for this week’s releases are not expected to spoil things just yet.

The core PCE price index, which will be the week’s biggest highlight, is expected to point to a further moderation in the Fed’s favourite inflation metric to 3.5% in October.

The greenback remained under pressure on Monday, edging lower against all of its main rivals, even as Treasury yields ticked up slightly.

Major pairs extend rebound, but risks ahead

With the dollar still on the backfoot, the pound, , and the Swiss franc advanced to multi-month highs, while the euro was testing last week’s peak of $1.0964. The pound and Australian dollar shone last week as the BoE’s Bailey and RBA’s Bullock both struck a hawkish tone.

For sterling, the combination of stronger-than-expected UK data and the Bank of England doubling down on its ‘higher for longer’ stance has been a bit of a game changer. Similarly, for the aussie, the RBA’s hawkish turn has thrown a lifeline to the currency amid ongoing doubts about China’s economic recovery. Monthly CPI readings out of Australia on Wednesday will be vital for the aussie’s short-term prospects.

The kiwi was also looking perky ahead of the Reserve Bank of New Zealand’s policy decision on Wednesday even though no further rate hikes are anticipated from the central bank.

In euro land, Thursday’s flash CPI numbers for November pose a downside for the single currency, though the slight risk-on mood was helping it maintain its gains versus the greenback.

Oil and gold head in opposite directions

Oil prices, however, slid again, as investors maintained their downbeat view on the demand outlook even as the major producers are expected to announce an extension of the latest round of production cuts into 2024. The delayed OPEC+ decision is due on Thursday and whilst surprises cannot be ruled out, markets see the disagreements that led to the postponement of the meeting as a sign that there is no appetite for deeper cuts.

Oil futures were last trading around 1% lower, while gold marched higher, hitting a more than six-month high of $2,017.82/oz.

The growing view that the Fed is done hiking rates has turbocharged the precious metal lately as bond yields have pulled back. It seems that expectations of a dovish Fed pivot and weaker dollar are superseding the broader improvement in market sentiment as well as hopes that Israel and Hamas might extend the current truce, in a major de-escalation of the conflict in the region.