Disastrous Risk Management Is Not the Fed’s Fault

2023.03.13 12:45

Silicon Valley Bank went belly up in about 30 hours.

And no, it’s not the Fed’s fault.

It’s the result of a very concentrated funding base, embarrassingly bad market risk management, and a ton of moral hazard at play.

This piece will attempt at answering the questions all of us have been asking:

- What exactly went so wrong for a $200bn+ balance sheet bank to go down so fast?

- How serious are the spillover risks? Is the entire US banking system in trouble?

- How will the Fed and markets react?

Disastrous Risk Management

What SVB did with their investment portfolio is either a signal of enormous incompetence or of outright moral hazard at play – gamble away billions as policymakers will rescue you anyway.

I can’t believe incompetence reaches these levels, and there are some clear hints moral hazard was at play.

First of all: Why do banks buy all these bonds?

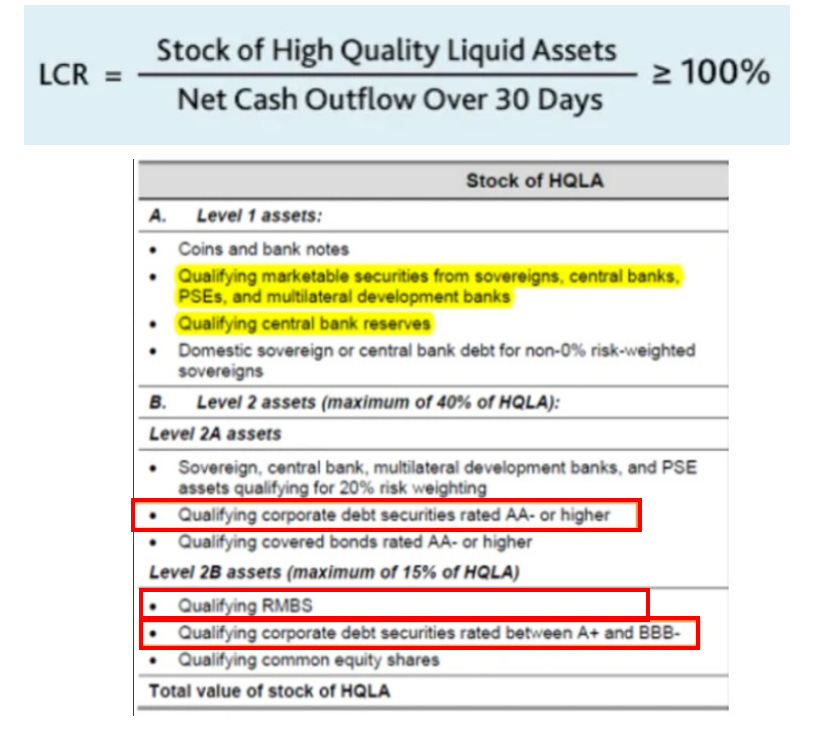

Post GFC, regulators forced banks to own an amount of high-quality liquid assets (HQLA) at least big enough to meet a stressed outflow of deposits for 30 days => Liquidity Coverage Ratio (LCR) above 100%.

What qualifies as HQLA?

Reserves at the Central Bank, Treasuries, but also corporate bonds and MBS to a certain extent.

High Quality Liquid Assets

High Quality Liquid Assets

As a result of LCR regulation, banks all over the world have flushed their balance sheets with trillions of bonds. Such a large amount of bonds on the balance sheet also comes with risks though, right?

Interest rate risk comes to mind: If you purchase Treasuries and yields rise, you lose money. That’s why banks hedge the lion’s share of the interest rate risk coming from their HQLA investments.

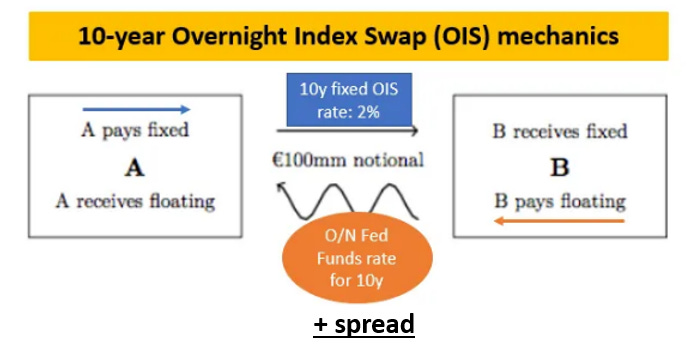

The mechanism is simple. When you buy Treasuries, you lock in a fixed yield you receive and rising interest rates represent a risk. To hedge that risk, you enter into an interest rate swap. This time, you pay away a fixed yield and receive variable payments in exchange.

There you go. You received a fixed rate when buying Treasuries and you pay a fixed rate in the swap – a hedge. Treasuries generally yield a bit more than swaps, and that’s where you make your money (swap spreads).

10-Year Overnight Index Swap

10-Year Overnight Index Swap

In this example, SVB (A) would buy Treasuries and enter into a swap to hedge interest rate risk. SVB (A) pays a fixed 10-year rate (OIS) in the swap and receives the variable overnight Fed Funds rate for the next 10 years plus a spread (swap spread).

This would allow SVB to hedge the interest rate risk and earn a small spread on their HQLA portfolio.

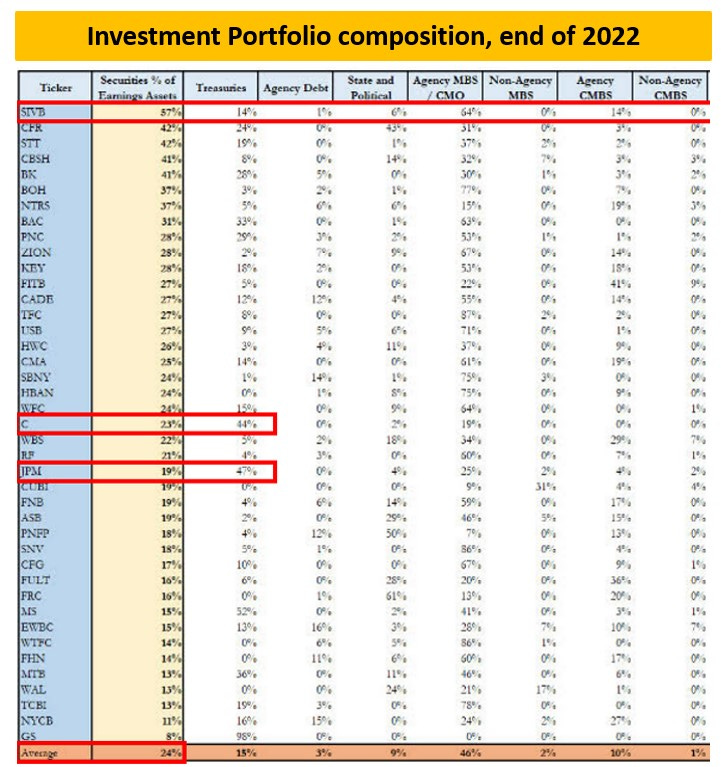

The problems? SVB had a gigantic investment portfolio as a % of total assets at 57% (average US bank: 24%) and 78% was in Mortgage-Backed Securities (Citi or JPM: around 30%)…

Investment Portfolio Composition at End of 2022

Investment Portfolio Composition at End of 2022

…and most importantly, they DID NOT hedge interest rate risk at all!

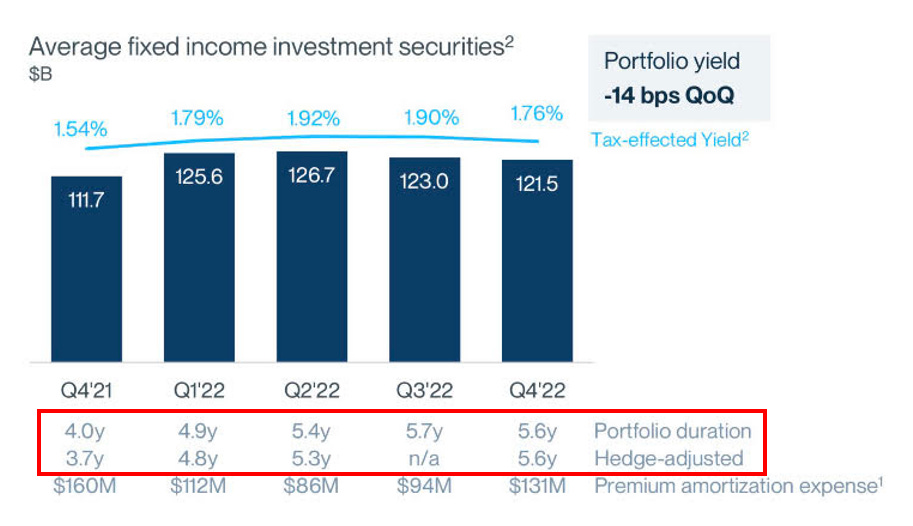

The duration of their huge portfolio before and after interest rate hedges was…the same?!

Effectively, there were NO hedges.

Average Fixed-income Investment Securities

Average Fixed-income Investment Securities

This means SVB was not applying basic risk management practices and exposing its investors and depositors to a gigantic amount of risk.

Economically speaking, a $120 billion bond portfolio with a 5.6y non-hedged duration means that every 10 bps move higher in 5-year interest rate lost the bank almost $700 million.

100 bps? $7 billion economic loss. 200 bps? $14 billion economic loss. Basically, the entire bank’s capital was wiped out.

As the tech/IPO boom faded, deposits stopped coming in 2022. Recently, depositors started taking their money away and forced SVB to realize this huge loss on bond investments to service deposit outflows.

The concentrated nature of the deposit base and awful risk management meant SVB went belly up real quick. Many people are now calling for a blanket bailout. But the evidence that moral hazard was at play is too big to be ignored. And we should not reward moral hazard.

Moral Hazard

Companies go belly up – it happens. Perhaps, it was just huge incompetence at work or bad luck. But please consider the evidence that moral hazard played an important role.

Here are 3 interconnected facts which are hard to ignore:

1. The outrageous use of accounting tricks

HQLA investments can be booked either under the Available For Sale (AFS) or Held To Maturity (HTM) accounting regimes. AFS investment unrealized gains/losses do not hit the P&L of the bank, but they do show up in the capital position of the bank. Booking bonds in HTM instead prevents gains/losses from showing up at all – convenient, right?

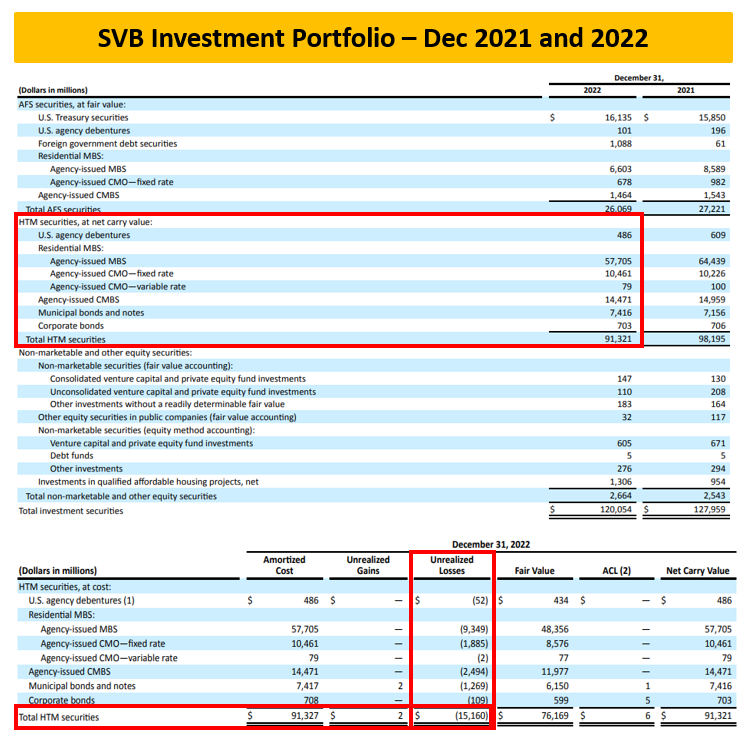

See for yourself: SVB had a gigantic bond book and made unusually large use of the convenient HTM accounting regime.

The unrealized losses as of Dec. 2022 in the HTM portfolio alone amounted to $15 billion, enough to wipe out the bank’s capital but conveniently hidden through the abnormal use of this accounting trick. You don’t book $90 billion of unhedged bonds in HTM by mistake or incompetence – this is a moral hazard.

SVB Investment Portfolio For Dec 2021 & 2022

SVB Investment Portfolio For Dec 2021 & 2022

2. Not hedging; just ignorance, you say?

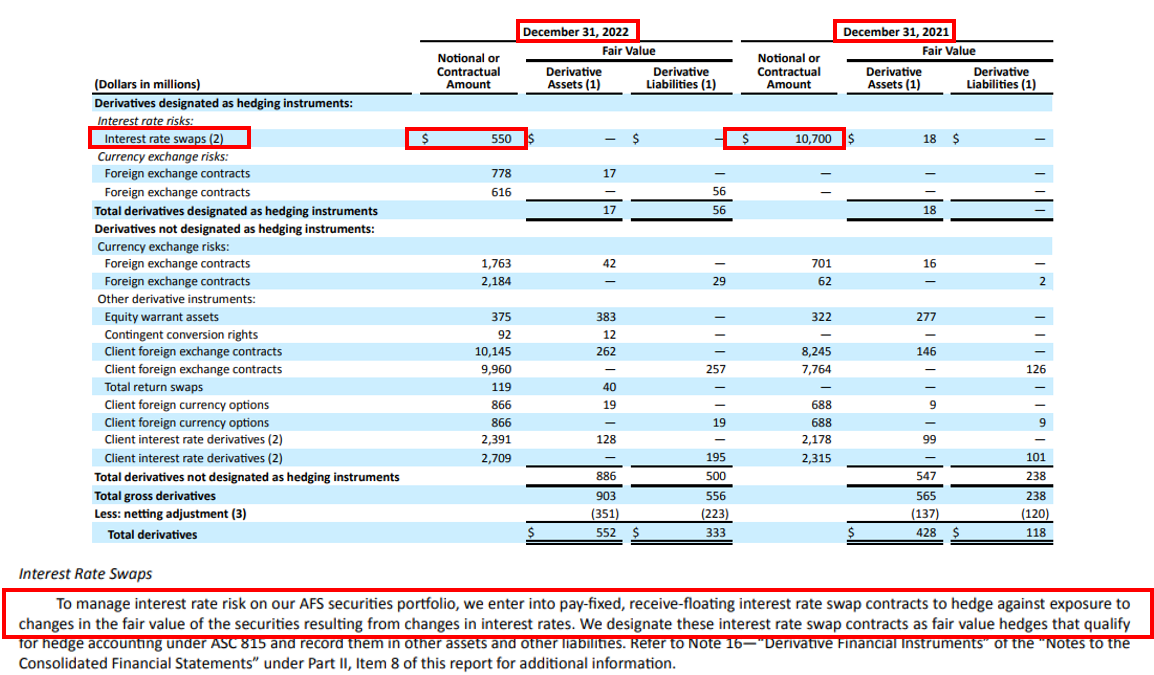

In December 2021, SVB had about $10 billion of interest rate swaps. Probably way too little to hedge the entire interest rate risk, but that’s not my point.

In their financial statement, they show a clear understanding of what these swaps are for (red box below). Fast forward to December 2022, and basically, ALL these hedges are gone.

This is not just ignorance, a vast use of accounting tricks, and a voluntary reduction of hedges.

3. That urge to stay away from tighter regulatory scrutiny

The reason why SVB could get around this terribly risky business model was its size.

You see, banks with assets below $250 billion (and a few more requirements) are not subject to the tighter regulatory scrutiny like big banks: No liquidity ratios (LCR), no net stable funding requirements (NSFR) forcing you to diversify your funding base and light stress tests.

This allowed SVB to run wild with its investment portfolio and funding base concentration.

Well, what’s wrong with that? SVB isn’t the only bank with assets.

Yes, but would it help to know that SVB’s management repeatedly lobbied to increase the cap for lax regulatory scrutiny and conveniently remained $20-30 billion below the $250 billion threshold?

It is hard to deny a decent amount of moral hazard was at play here.

***

This article was originally published in The Macro Compass. Come join this vibrant community of macro investors, asset allocators, and hedge funds – check out which subscription tier suits you the most using this link.