Despite Recent Decline, Stocks Retain Top Spot for Returns

2023.06.26 08:53

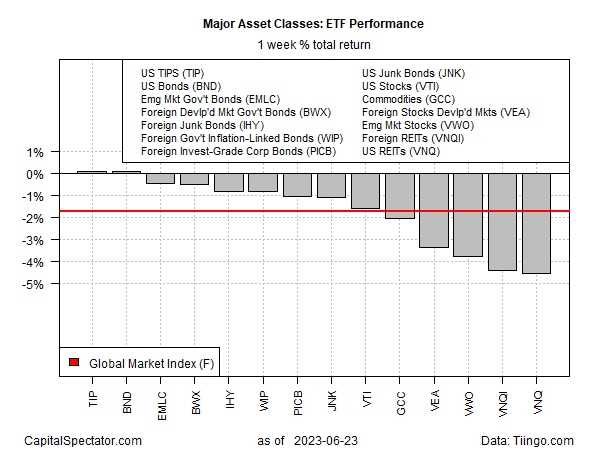

The Global Market Index fell 1.7% last week (through June 23), marking the first decline for this multi-asset-class benchmark since the final week of May.

Equities in Europe and Asia are moderately lower in today’s trading following the failed coup in Russia over the weekend. Energy prices are higher after the turmoil that briefly threatened President Putin.

“The immediate challenge to the Putin regime appears to have receded,” write analysts at RBC Capital Markets in a June 25 note. “However, the risk of further civil unrest in Russia now must be factored into our oil analysis for the back half of the year.”

US bonds were last week’s winners for the major asset classes if only just barely, based on a set of ETF proxies. Inflation-indexed US Treasuries led the way via iShares TIPS Bond ETF (NYSE:), which ticked up 0.1%. Although the fund has posted slight gains in the past two weeks, TIP continues to trade in a narrow range that’s prevailed in recent months.

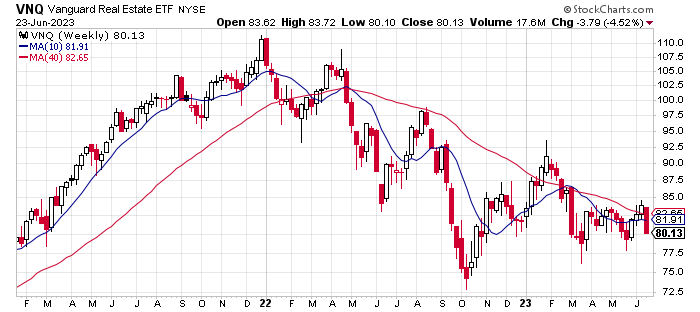

US real estate investment trusts posted last week’s biggest decline. Vanguard Real Estate Index Fund ETF Shares (NYSE:) lost a hefty 4.5%. The selling suggests that the bear market for VNQ is set to continue.

The Global Market Index (GMI.F) lost ground last week, slipping 1.7%, the first setback in four weeks. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

ETF Performance Weekly Total Returns

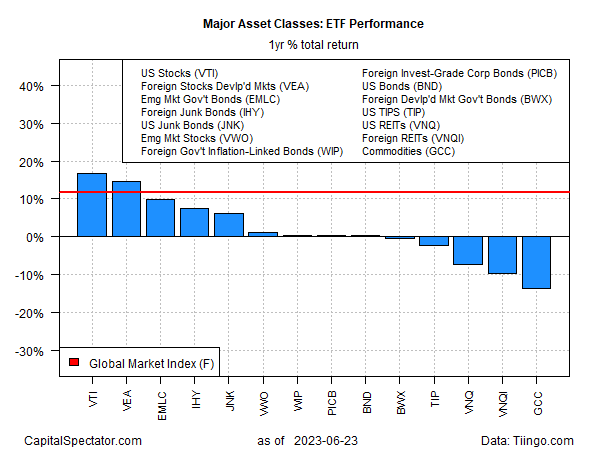

For the one-year trend, Vanguard Total Stock Market Index Fund ETF Shares (NYSE:) continue to hold the lead. Vanguard Total Stock Market Index Fund (VTI) is up nearly 17% vs. the year-ago level, based on total return. WisdomTree Continuous Commodity Index Fund (NYSE:) is the weakest performer, posting a near 14% loss.

ETF Performance Yearly Total Returns

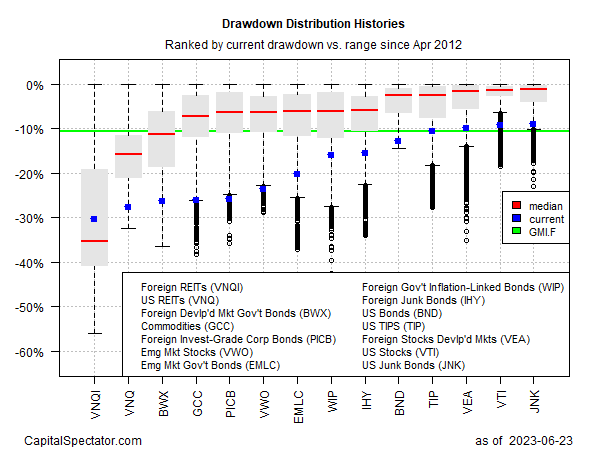

Most of the major asset classes are still posting relatively deep drawdowns. The deepest peak-to-trough decline at the moment: foreign real estate shares () are reporting a near-30% drawdown as of Friday’s close.

Drawdown Distribution Histories