Defying Recent Recession Warnings, Growth Likely to Prevail In Q3

2024.09.18 10:22

The recent run of forecasts from some corners that a US recession is imminent, or possibly already underway, continues to look premature. Although it’s short-sighted to dismiss various risks that are lurking, which could imperil the expansion down the road, recent data continue to support the case that modest growth rolls on.

This is old news for regular readers of my posts. Despite headline-grabbing warnings from various sources in recent months, a careful review of the broadly defined macro trend has consistently pushed back on the idea that an NBER-defined contraction has started or is imminent. The current batch of data published to date reaffirms this view.

Some analysts and pundits have been predicting otherwise, again. But the value of looking beyond any one indicator and developing a broad-based profile of US economic activity is once more proving its worth as a tool for minimizing noise and emphasizing signal.

Recall that in late August, for example, a chorus of warnings arose that a recession had started, or appeared imminent. But as I on Aug. 27, the median nowcast at the time suggested otherwise.

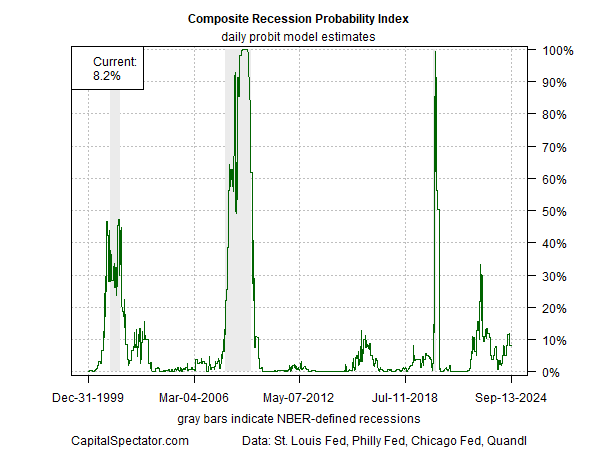

Similarly, in early July, when a recession was a forgone conclusion by some accounts, a multi-factor reading of US economic conditions (CRPI) through July 5 estimated the probability that a downturn was underway at less than 10%.

The source for the analytics is CapitalSpectator.com’s sister publication: The US Business Cycle Risk Report, which reviews and synthesizes a wide array of indicators to assess the real-time odds of growth vs. expansion.

Rather than cherry-picking one or two indicators, or making bold forecasts about what could happen in the months ahead, this weekly newsletter carefully analyzes business-cycle data from proprietary and external sources.

The flagship benchmark is CRPI (Composite Recession Probability Index), which current estimates real-time recession risk at roughly 8% (as of Sep. 13).

As discussed in the current issue of the newsletter, there are hints that a modest firming of economic conditions may be unfolding. Meanwhile, the median Q3 GDP nowcast (from multiple sources) continues to estimate growth at 2%-plus.

Yesterday’s update of August fall in line with the view that while US growth has slowed, the economy still appears on track to post modest growth.

“There does not appear to be any reason for Fed officials to start out with a larger 50 basis points rate cut because whatever stress there is in the labor market, it isn’t translating into weaker economic demand,”

Christopher Rupkey, chief economist at FWDBONDS said.

“If this is an economy on the brink of recession, consumers certainly don’t see it.”

The fourth quarter could be a different story, of course. But as the Q3 numbers continue to roll in, there’s rising confidence that the current quarter will not be the start of a US contraction.

Beyond that, a high degree of uncertainty prevails, although this much is clear: an opaque future won’t stop the usual suspects from making high-confidence forecasts about events and data sets that remain unknown to mere mortals.