Decoding the Inverted Yield Curve: Lessons from Knut Wicksell’s Theory

2023.06.19 05:29

Many financial pundits and analysts often only look at central bank interest rate hikes or cuts.

As if it’s an objective measure across all yields.

They’ll say, “Rates at so-and-so are too tight” or, “Rates at so-and-so are too easy.”

But remember – a central bank only controls the short end of the curve for the most part.

In theory, this should influence the longer end of the curve. Meaning when the Fed hikes, all rates should rise in tandem one-for-one.

But if the market – which controls the longer end of the curve – doesn’t agree with the Fed on where rates should be, the curve will invert (aka when the long end yields less than short-end yields).

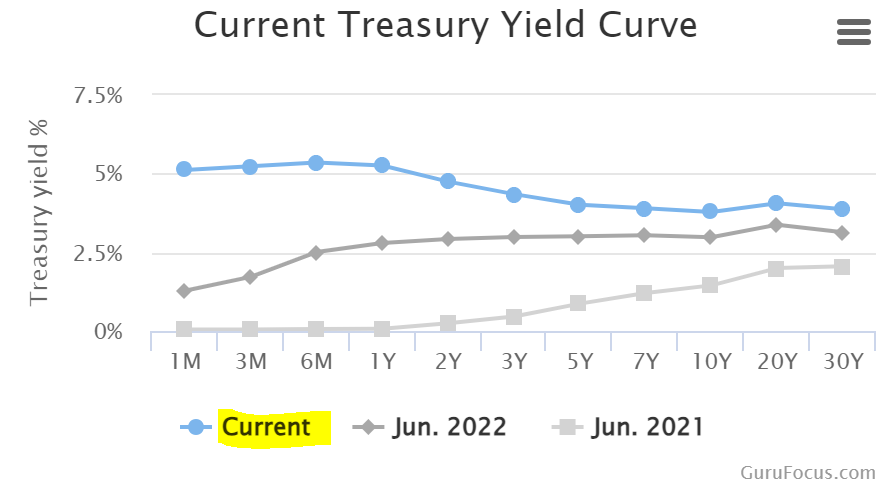

And this is exactly what we’re seeing today.

The U.S. yield curve is completely upside down.

Current Treasury Yield Curve

Current Treasury Yield Curve

This current curve inversion is a telling signal. And historically it’s preceded all 10 U.S. recessions since 1955 (except one in 1965, which was just a deep slowdown).

But the big question here is, “Why?”

While there are many factors that influence this, there’s a big one many discount.

And that’s the spread between the two-interest rates: the ‘natural rate of interest’ (the return on capital) and ‘market interest rates’ (the cost of capital).

These concepts might sound like a mouthful. But it’s actually simple once you understand the difference between the two and how they interact.

So, let’s take a closer look. . .

What We Can Learn From A 19th-Century Swedish Economist On Interest Rates

Knut Wicksell was a Swedish-born economist who lived from 1851 to 1926. And he made significant contributions to the field of monetary economics and interest rates.

And while he wrote many worthwhile books, his best-known work is “Interest and Prices (1898)”.

Because he was the first to really develop the idea of the ‘natural rate of interest’.

Put simply, the natural rate of interest means that in an economy without central banks manipulating rates, interest would still exist. And would most likely equal the return on capital, inflation expectations, and growth.

Or – in other words – the natural rate of interest is the real interest rate that neither stimulates nor contracts an economy.

If growth, returns on capital, and inflation remains low – so too will rates. And vice versa.

Thus, according to Wicksell, as long as the market rate is equal to the natural rate, the desired saving will just equal desired investment. And aggregate demand will therefore equal aggregate supply. Which means price stability will prevail.

But any discrepancy between the two interest rates, however, will cause prices and fundamentals to change.

This is known as the Wicksellian Differential – aka the natural rate of interest minus the market rate of interest.

Wicksell emphasized that it’s this divergence between the natural and nominal market interest rates that drives the business cycle.

So, if the central bank maintains an accommodative monetary policy by setting the nominal interest rate below the natural rate, it can lead to an unsustainable boom characterized by excess credit creation, inflationary pressures, and speculative asset bubbles.

On the other hand. If the nominal interest rate is set above the natural rate, it can result in a contractionary environment, causing a slowdown or recession.

The Wicksellian Differential, therefore, reflects the deviation between the central bank’s monetary policy stance and the underlying economic conditions.

In fact, underrated Austrian economists – such as Ludwig Von Mises and F.A. Hayek – used much of Wicksell’s work to develop the early Austrian Business Cycle Theory (which I believe is a very important concept).

Thus Knut Wicksell’s Wicksellian Differential and natural interest rate theory have had a profound impact on monetary economics and the understanding of the relationship between interest rates, money, and the real economy.

Natural Interest Rates Have Been Declining Globally For Decades – And Will Most Likely Continue To

Now, you may be wondering, “How do you calculate the exact natural rate of interest to know if market rates are stimulating or constricting?”

That’s the tricky part. Because it technically can’t be directly observed as a market interest rate (what banks borrow/loan at).

But there are models that use a variety of economic fundamentals. From demographics and productivity to fiscal policy and investment returns to estimate it.

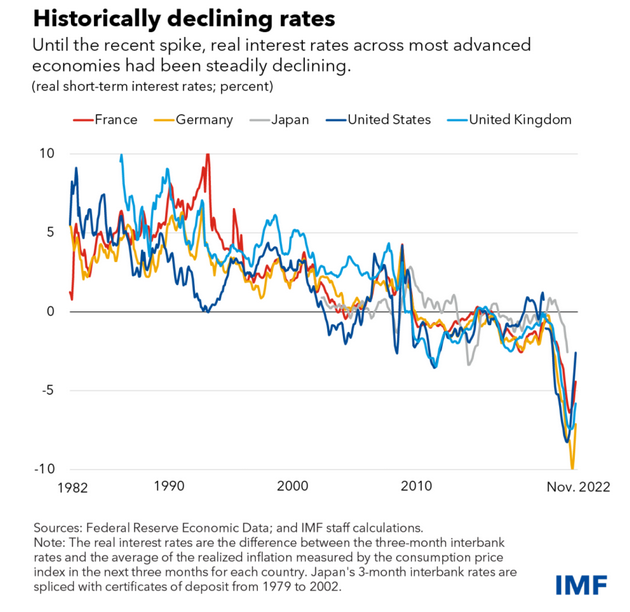

And most show the natural rate has been declining steadily since the 1980s on the back of too much debt, too little growth, relative deflation, diminishing returns, and poor demographic trends.

To put this into perspective – according to the International Monetary Fund (IMF) – ‘real’ short-term rates have trended lower. And even sank negative after 2008 as the natural rate kept declining.

Historically Decling Rates

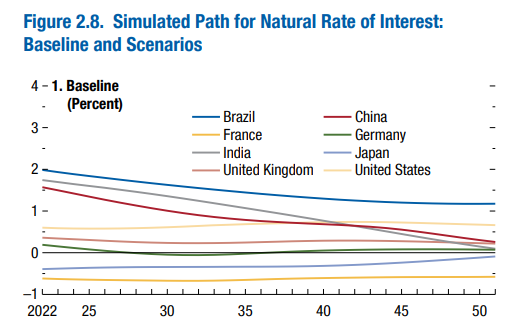

According to another piece by the IMF – the same framework used to understand the natural rate decline post-1980s in developed markets shows that emerging markets will sink into the same decline in the coming decades.

The IMF noted that, “In emerging markets. . . The prognosis is for a significant decline in natural rates. This is the consequence of slowing productivity growth and an aging population.”

Natural Rate of Interest – Baseline and Scenarios

The big issue here is the decline in China – which is the second-largest economy in the world – as they deal with debt deflation and slowing growth.

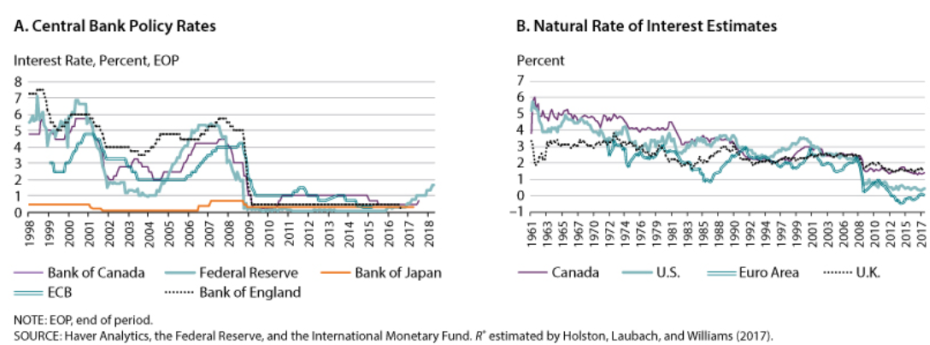

Reinforcing this point – according to research from the St. Louis Fed – the global natural rate of interest has steadily declined since the 1960s.

Central Bank Policy Rates – Natural RoI Estimates

Central Bank Policy Rates – Natural RoI Estimates

This chronic decline in the natural rate of interest has serious implications for central banks all around the world.

For starters, most of these declines are structural issues that will weigh it lower and lower. Meanwhile, central bank policies are cyclical.

Secondly, it limits what these central banks can do to try and stimulate growth.

As mentioned above, if the natural rate is declining, then central banks must keep short-term rates below it to spur growth.

So, let’s say the natural rate is 1%. That means the central bank must keep rates at 0% or even go negative (as we saw in Japan and the Euro area) to stimulate.

This is why central banks went much further with their ‘unconventional’ policies post-2008 – deploying quantitative easing (QE), negative interest rates (NIRP), and yield curve control (YCC) to try and get things going.

But this also has serious issues when central banks want to raise interest rates in “normal” times.

Because if the natural rate is chronically low, there’s a much higher chance a central bank overtightens and restricts growth, pushing them back lower than before.

This indicates that the use of ever-more aggressive central bank policies will continue in the future.

Now, as I mentioned above, the natural rate of interest isn’t actually observable.

But the longer end of the yield curve gives us an idea of where it’s at.

And the global surge in deeply inverted yield curves is an important indicator of central banks overtightening. . .

Global Yield Curves Are Inverted – Indicating Slower Growth And Fragility

As of today – June 16th, 2023 – there are currently 34 countries with inverted yields all across the curve. Most being advanced economies. And another 11 that are flat or partially inverted.

And thus – according to the Wicksellian Differential – this widening gap between higher market rates and lower natural rates will lead to slower growth and capital destruction.

Because as the cost of capital increases relative to the longer end of the curve, banks find it less profitable and attractive to lend.

For instance, as I’ve written about recently, U.S. and Euro-area banks have already scaled back loans sharply across the board.

This is important for two reasons:

First – the post-1980s global economy is fueled by credit to drive growth and asset prices.

Second – banks are the outlets for monetary policy.

See, when a central bank eases, it tries to influence bank lending.

But banks don’t have to lend (aka a liquidity trap).

They can restrict lending on their own – or the private sector’s demand for debt is anemic – rendering the central banks’ easing useless (think of Japan post-1991).

Contrary to many modern macro-economists, banks don’t actually lend because of interest rates. But on confidence of repayment.

Yes, interest rates influence it. But at the end of the day, banks care about making a profit and not suffering loan defaults.

Thus an upside-down yield curve signals that banks are worried about the economic outlook and marginal loans being repaid.

It’s probable – if history is worth anything (I believe it is) – that as banks continue curtailing credit, growth will slow and deflation proliferate. Pushing the natural rate lower.

This increases the potential that the central banks have actually overtightened relative to what the ‘real’ economic fundamentals justify (all else equal).

Or – putting it simply – growth momentum remains to the downside as tightening and uncertainty ripple through. And that returns on capital, inflation expectations, and growth are declining.

In Conclusion

The inverted yield curve is one phenomenon that can be explained through Wicksell’s natural interest rate theory.

And it often serves as a warning sign of an impending economic downturn or recession. As an inverted yield curve suggests that market participants anticipate a contractionary monetary policy in the future. Which can lead to reduced investment and economic activity.

The significance of Wicksell’s ideas lies in their ability to enhance our understanding of the complex relationship between interest rates, monetary policy, and economic performance.

They provide valuable insights for policymakers, central banks, and speculators in assessing the appropriateness and effectiveness of monetary policy measures. And in identifying potential imbalances or risks in the financial system.

Thus as the natural rate of interest continues sinking globally – on the back of serious structural issues – we can expect lower market rates in the future.

Meaning further central bank easing. And greater systemic fragility until then.

But as always, time will tell. . .