Cybersecurity Remains Top Investment Theme

2022.09.22 13:39

[ad_1]

- Earnings trajectory not interest rates primary driver of sector

- Balance between compounders and binary outcomes

Cybersecurity companies reported blowout results, especially considering the challenging macro environment. Most companies guided conservatively for the rest of the calendar year and into 2023, citing elongated sales cycles and uncertain macro conditions.

Interestingly, given the strong reported quarterly results, forward earnings do not have to fall despite the weaker guidance.

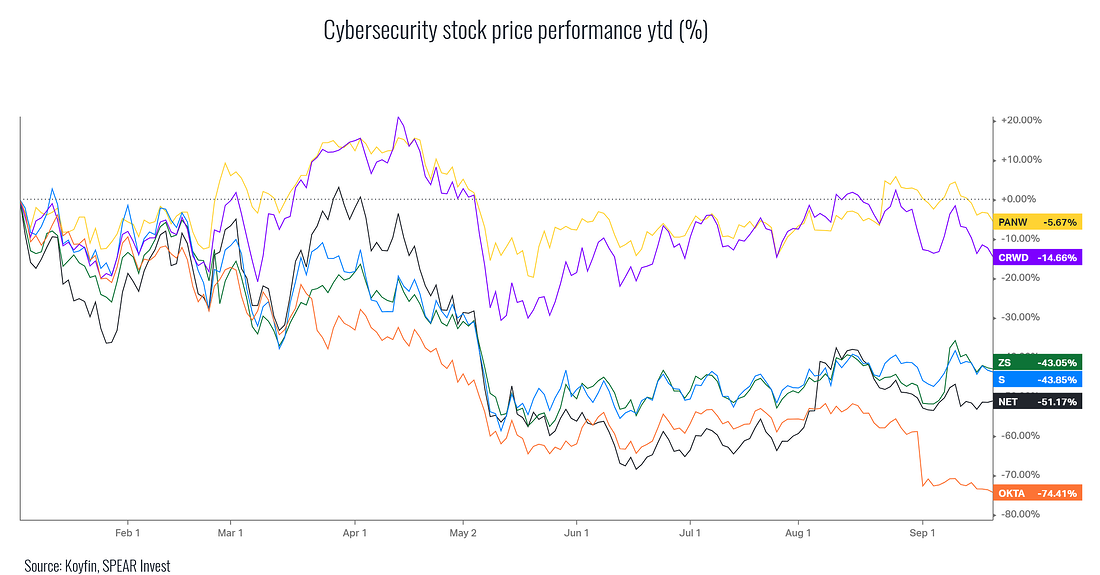

While earnings have been consistently very strong, valuations have come down inline with the interest rate driven technology selloff, which we believe creates many investment opportunities in cybersecurity and broader cloud infrastructure.

In the cybersecurity sectror there is a bifurcation between “legacy” and “next-gen” solutions in each end-market.

We focus our investment universe on “next-gen” solutions which are based on machine learning and provide predictive rather than reactive protection. This sub-sector is characterized by higher growth, and consequently, higher valuation opportunities. Examples include:

- Network Security: firewalls/VPN would be considered legacy, SASE/”Zero Trust” would be considered “next-gen”

- Endpoint Security: antivirus would be considered legacy, extended detection and response (XDR) would be “next-gen”

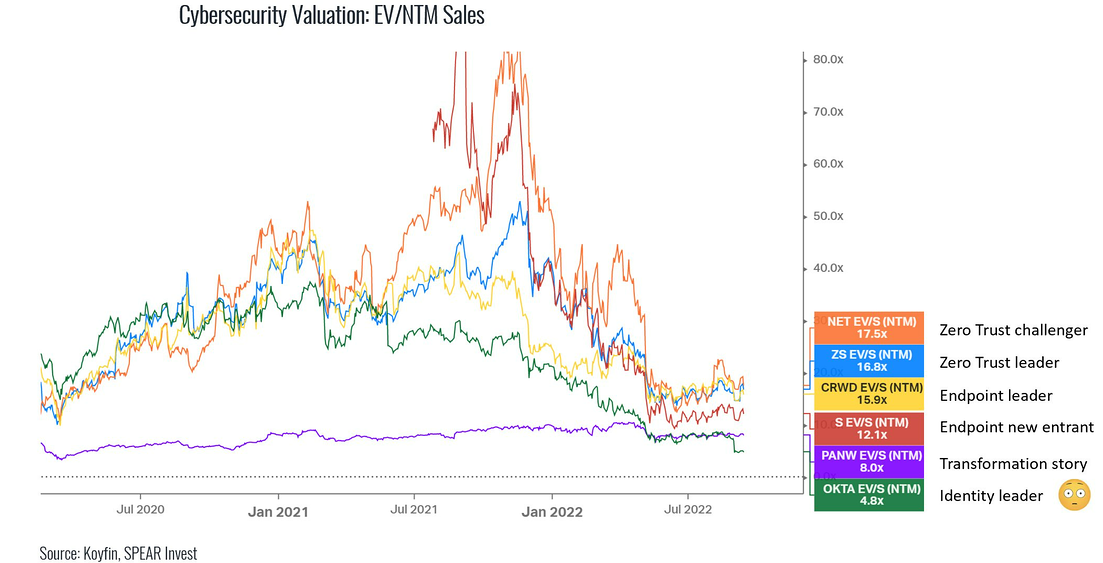

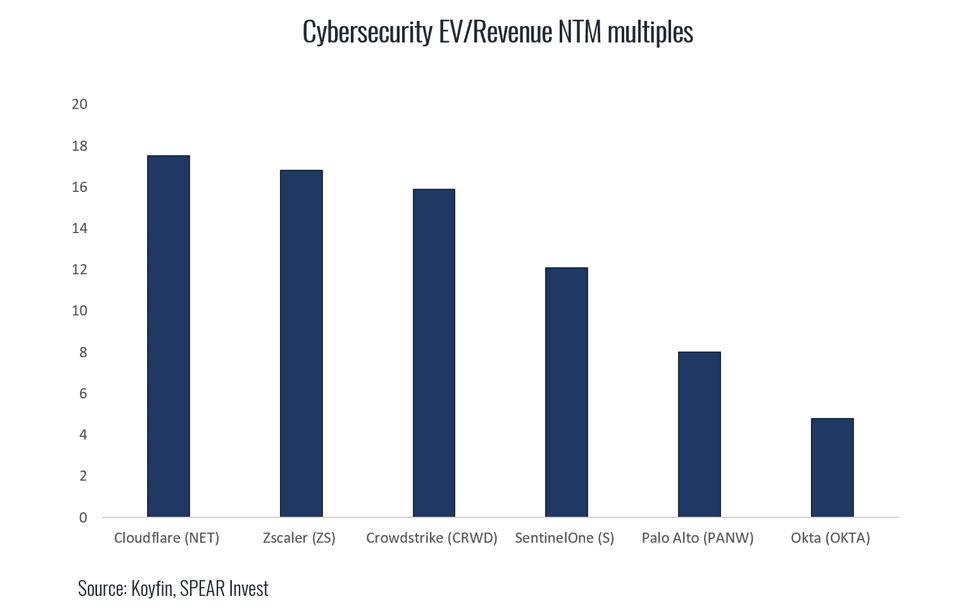

Valuation multiples have declined across the board, but interestingly there has been a significant divergence.

There are two notable trends:

- Companies that do not generate meaningful cashflow e.g., SentinelOne (NYSE:) and Cloudflare (NYSE:) have experienced the most significant peak-to-trough decline in EV/revenue multiples

- Companies that failed to execute were severely punished e.g., Okta (NASDAQ:)

Where do we go next?

While many investors are currently avoiding technology due to higher interest-rates, we believe the driver of the next leg up (or down) will be driven by fundamentals and earnings.

To put this in context, 50 to 100bp higher interest rate hike can result in a 10-15% downside to stock prices. Earnings acceleration/deceleration can drive stocks to double (or half from here).

Looking at our coverage universe, we find it interesting that there is the most risk (upside/downside) to the companies trading at the highest multiples (Cloudflare) and the company trading at the lowest multiple (Okta).

The companies in the middle have demonstrates solid execution (Zscaler (NASDAQ:), Crowdstrike (NASDAQ:), Palo Alto Networks (NASDAQ:)), and consequently, we expect them to trade as compounders.

Binary: High risk/high reward opportunities

Okta was less than a year ago considered the “crown jewel” of cybersecurity and is a leader in Identity Management. The company made an acquisition which seemingly was a great fit, but logistically it was not. Integration issues surfaced on the F2Q23 earnings call, and the stock declined 35%+ on the announcement (70%+ year to date(ytd)).

Okta is now unsure it can deliver 30%+ growth through 2026, and when high flyers go from 30%+ growth to

Cloudflare is a leading content delivery network and DDoS mitigation company. Interestingly, the company can use its current infrastructure and customer base to expand into other areas such as Zero Trust and compete with Zscaler, and “serverless” data storage/application development and compete with the cloud vendors (AWS, Azure, GCP). Even with the company’s high teens EV/revenue multiple,

Cloudflare market capitalization is only $20 billion. If any of the potential opportunities gain traction (and there is some evidence that they are), each one could be a $20-30 billion+ opportunity. But being a newcomer to these highly competitive and sophisticated end-markets does carry significant risk.

Compounder: “Beat and raise” stories at significant scale

Zscaler (NASDAQ:), a Network Security leader, historically growing at 50% beat F4Q22 estimates by 4% growing revenues at 61% yoy. Zscaler provided conservative guidance for 30-31% billings growth, which was better than feared and reflects macro-driven prudence. Net revenue retention remained above 125%, as customers are adopting multiple Zscaler products. More details here: Zscaler: Cybersecurity platform built for the cloud

Crowdstrike an Endpoint Security leader, beat estimates by 4% growing 58% yoy; ARR (its preferred metric) of $2.14 billion grew by 59% yoy. Noted record pipeline but cautioned of seasonally weaker 2H, guiding to FY23 revenue growth of +53% yoy ($2.3 billion at the midpoint)

Palo Alto Networks is a Network Security transformation story. The company is considered to be a legacy vendor, but has been able to put together a “next-gen” portfolio of industry leading solutions that is now reaching ~$2 billion in ARR. The company reported NGS ARR of 60% and guided to NGS ARR growth of 37-40% in F23

Similar to binaries upside for compounders is derived from companies being able to consistently out-grow expectations. Consequently, investors are applying a the same or higher multiple on higher earnings. The compounder group is not without risk. If any of these companies is unable to deliver 30%+ growth, they could significantly de-rate and fall into the other category. It is important to note that interest rate (risk-free rate), is an input into the valuation, but is not expected to be a major driver.

So what does the FOMC rate decision mean for the market and technology sector?

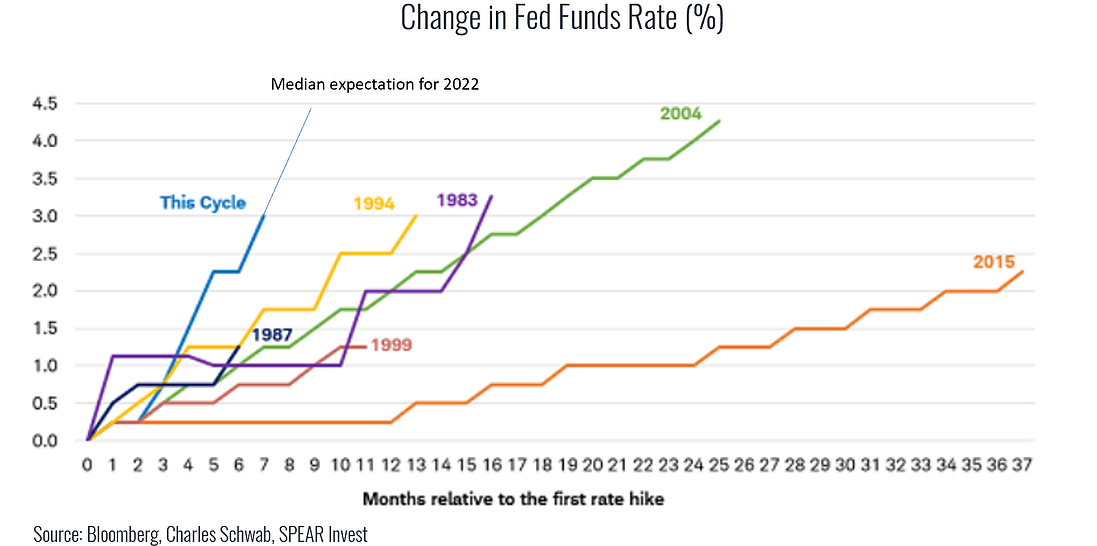

The Federal Open Market Committee raised rates by 75bp to a range of 3% to 3.25%. This was the third consecutive 75bp hike and the fifth increase this year alone.

While the hike was in-line with expectations, the incremental news was that the median fed funds rate projection is for 4.4% rate by the end of 2022 and 4.6% for 2023. This level is ~50bp higher than expectations and ~100bp higher than the June projection. The rate was also revised higher for 2024 to 3.9% from 3.4% in June, and is expected to remain elevated at 2.9% in 2025.

There are two major implications:

- Valuation impact will be largely driven by the treasury, which barely moved on the news questioning the sustainability and credibility of this announcement. While we expect some upward movement in the 10-year, in the worst case, a 50bp higher discount rate has ~7-10% negative impact to stock prices.

- Recession risk and impact to earnings is now elevated and we expect more downside for the economy and cyclical sectors (housing, transports etc.). While the duration of higher rates does not affect tech (as the assumed discount rate is “forever”), one year vs. two year downturn can be meaningful for sectors like housing.

Based on the consumer balance sheet and composition of expenditures, we are skeptical of ~8% mortgage rate as an effective way to fight inflation. Dramatic decisions made by an arbitrary group of individuals can create further dislocations e.g., severe housing slowdown while we don’t have housing oversupply. QE was a multi year process and bringing down inflation will likely be the same.

As for the market, we expect a muted multi-year performance with many idiosyncratic opportunities caused by these dislocations.

For more research and primers, visit our website.

Disclaimer: Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.

[ad_2]

Source link