Crude Oil Retreats From Highs

2022.10.10 10:35

[ad_1]

On Monday, Oct. 10, the commodity market responded to the external background. fell towards $96.95.

In the meantime, the oil sector offers an ideal situation for bulls. On one hand, OPEC+ agreed to cut production by 2 million BPD after all. On the other hand, there were technical signals which allowed optimists to force investors out of short positions.

Last week, bulls had another factor to support them – the “greenback” was weakening. However, the American currency is currently reaching stability.

Last Friday’s Baker Hughes report showed that the in the US dropped two units over the past week, down to 602. In August and September, the indicator barely moved upwards – in July, it was 595 units. Despite high energy prices, shale companies are in no hurry to increase their output because they see serious recession risks.

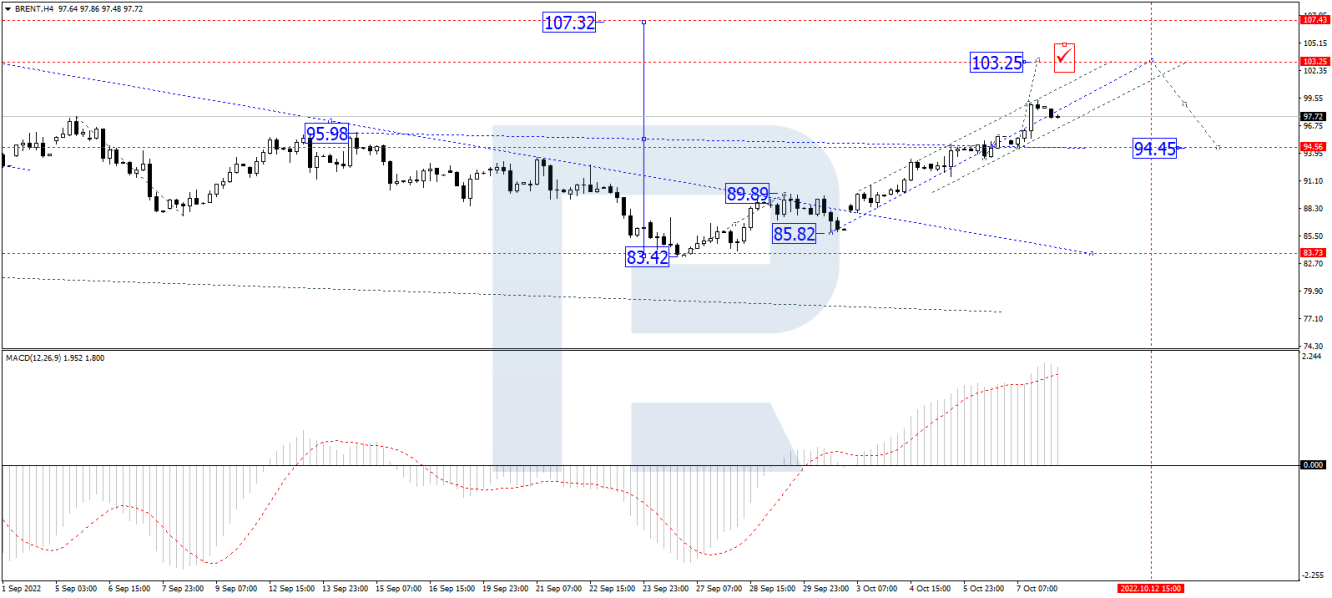

In the H4 chart, after completing the ascending wave at 94.44 and then forming a new consolidation range around this level, Brent has broken it to the upside; right now, it is still growing with the short-term target at 103.30.

Later, the market may correct to 94.44 and then form one more descending structure to reach 105.50. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving above 0 and may later continue its growth to reach new highs.

Brent 4-hour price chart.

Brent 4-hour price chart.

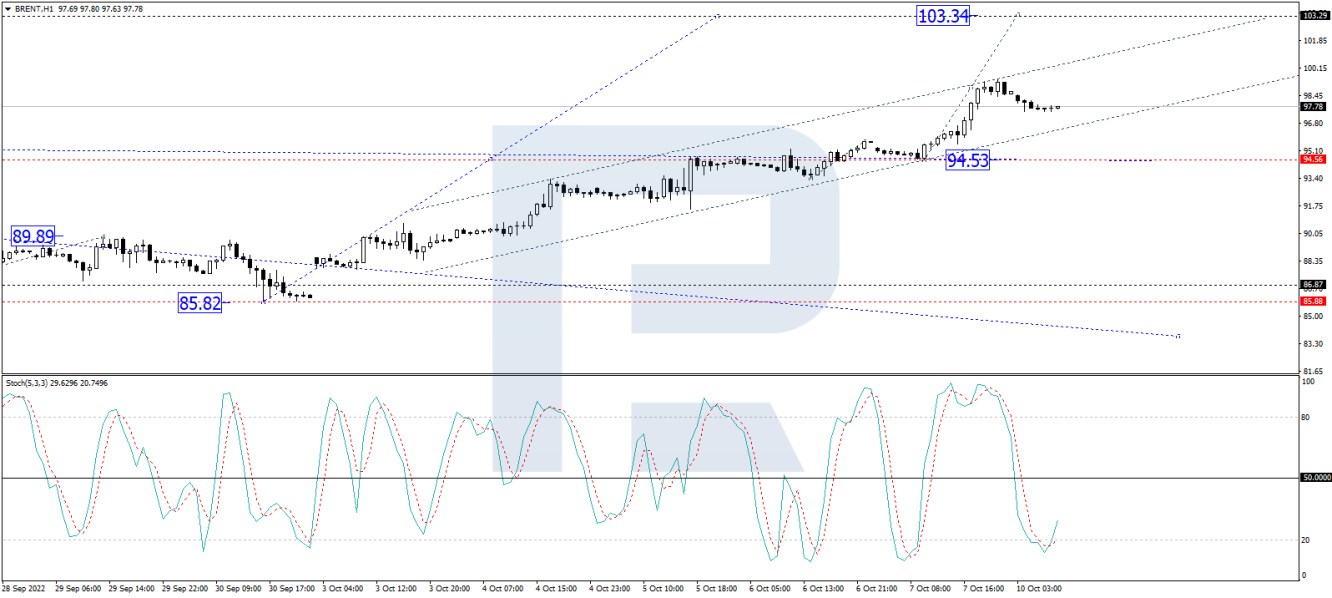

As we can see in the H1 chart, Brent has broken it to the upside after finishing the fifth structure of the ascending wave at 94.50 and then forming a new consolidation range. Brent is extending this wave to reach the short-term target of 103.33.

Brent 1-hour price chart.

Brent 1-hour price chart.

Later, the market may turn towards 94.55 and then resume growing to reach the first upside target of 105.50. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving above 20. Later, the line may move to break 50 and continue growing towards 80.

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews in this article.

[ad_2]

Source link