Crude Oil: Prices Move Up But Look Vulnerable

2024.07.04 11:40

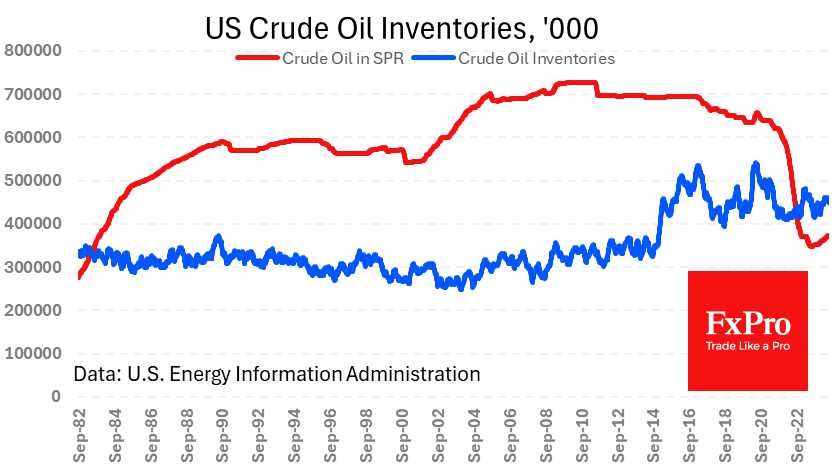

inventories in US commercial storage fell by 12.2 million barrels last week, marking the sharpest decline since last July. The decrease is attributed to preparations for the start of the US driving season. Not only was the change significant, but it was also drastically different from the expected 0.4 million decline, prompting impulse buying in Oil.

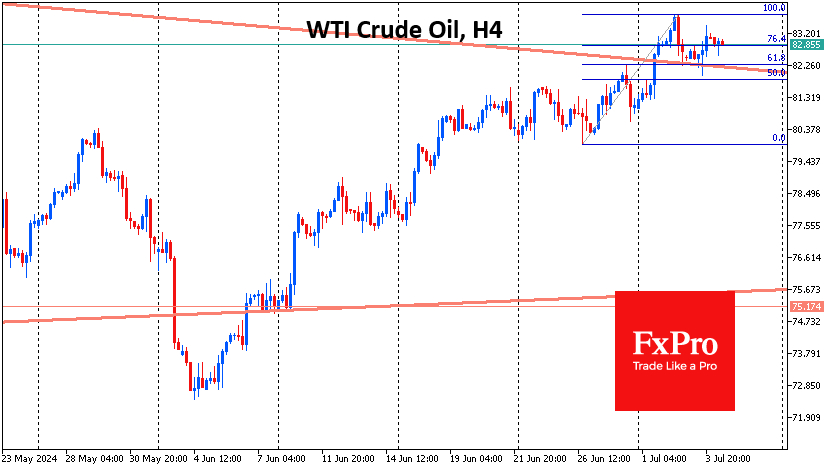

The price went from declining to rising shortly after the data release, swinging the price of a barrel of WTI from the day’s lows at $81.90 to a high at $83.40, likely halting a corrective pullback after a week of gains. Potentially, this strengthens the odds that the price will further update three-month highs in the near term, heading towards $85.

Meanwhile, there have been a few changes in the medium-term picture for Oil so far. Commercial inventories are 0.8% lower than a year ago, well within seasonal norms. Strategic inventories have changed a little, and there have been reports that the administration has been selling oil to meet seasonal demand.

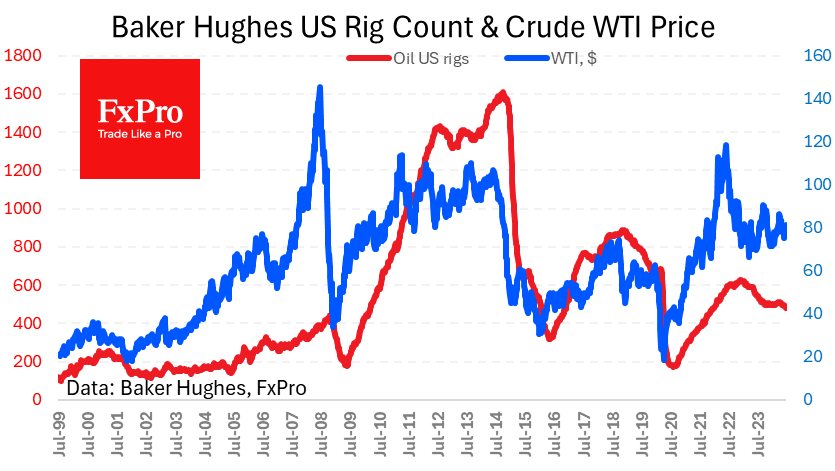

Interestingly, rising US production is not responding to the 15% month-over-month price increase or strong domestic demand. Production rates have remained at 13.2 million bpd for the past nine months.

Meanwhile, drilling activity continues to fall. The number of active oil rigs fell by 6 to 479 last week, the lowest since December 2021. Even with the expectation of improved production efficiency, there is little hope for a significant increase in the US share of global production.

On the chart, Crude price tests the upper boundary of the consolidation triangle, although it started in June with an attempt to break its lower boundary. Oil’s ability to rise above the previous highs, near $86, will confirm the consolidation break. The chances of such an outcome will increase significantly with more dovish signals from the Fed, undermining the dollar’s value.

In addition, it is worth monitoring crude oil and petrol inventories if we see the beginning of a downward trend rather than a one-off release.

History records many instances of June-July being the time when prices peaked for many months ahead. Thus, we should be very careful with oil in the next couple of weeks, as it may be in for a serious bull-bear fight, which will determine the movement’s medium-term prospects.

The FxPro Analyst Team