Crude Oil or Natural Gas: Who’s Lying?

2023.04.17 15:23

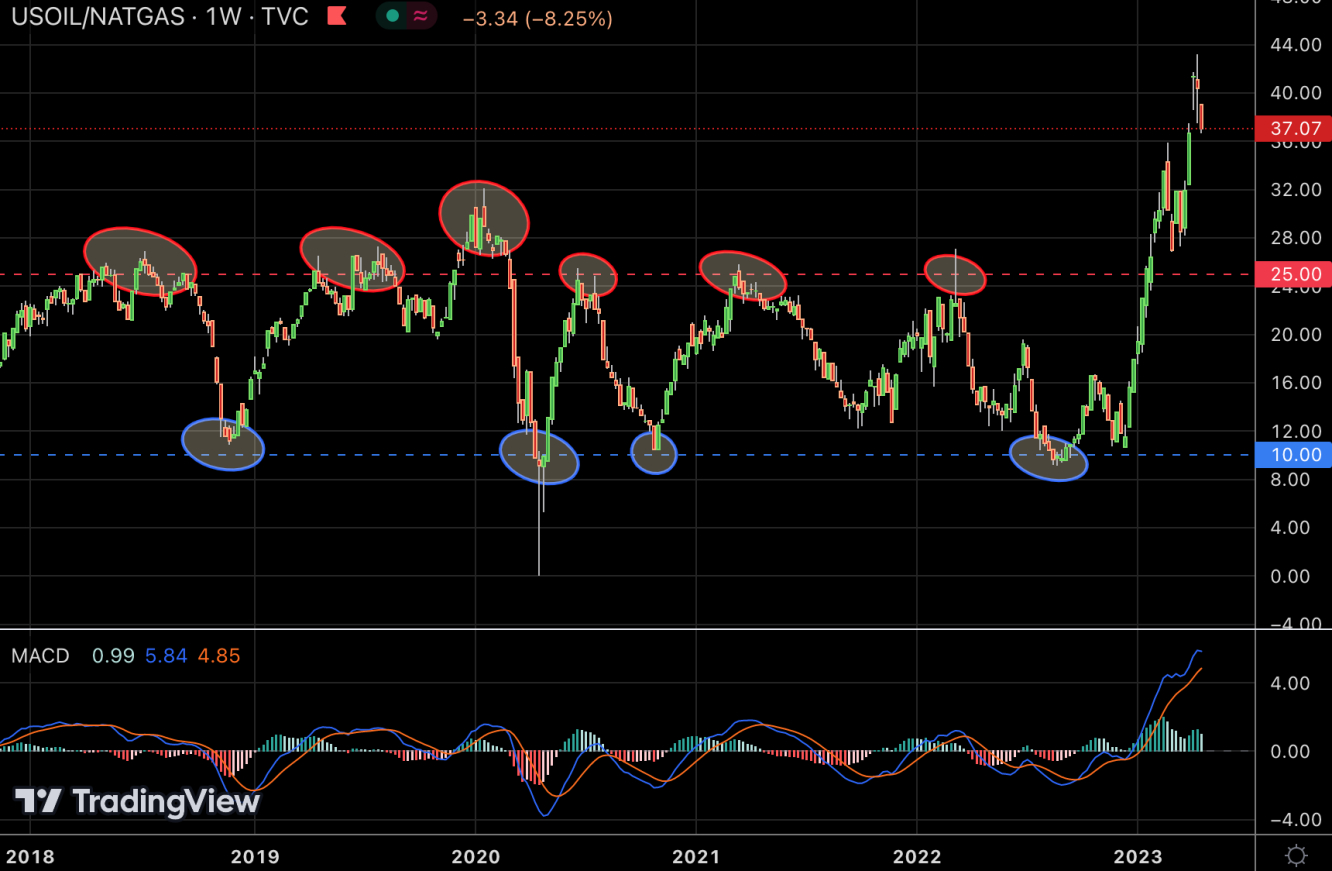

The relationship between and prices has been pretty interesting, especially since mid-January ‘23 when the ratio WTI/NatGas moved up passed its long-term top of 25. It touched 43 early April ‘23 before moving back down, currently around 37:

The spread is, of course, driven by supply and demand for both crude oil and natural gas. For natural gas, a mild weather in the US for the winter period has a lot to do with its recent decline. As for oil, we all know OPEC countries have significant influence over its price through their control over production levels, coordination with other oil-producing nations, and control over oil reserves.

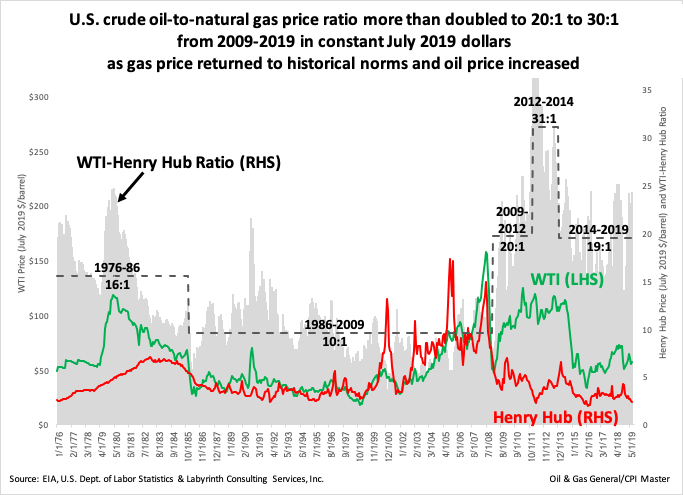

Let’s take a look back and see how the spread evolved historically:

(You need to watch the grey area on the chart)

Historical WTI-NatGas ratio

Historical WTI-NatGas ratio

The data takes us back to 1975. Basically, you see that historically, anything at or above 25 is really “high” for the crude oil-to-natural gas ratio. Now, nothing is ever too cheap or too expensive and, as we all know, “markets can stay irrational longer than you can stay solvent”…

So the questions are:

- Can the ratio stay above 25 for long ?

- Can the ratio go way above 35, like it did in 2012 (up to 54) ?

To better understand the relationship between crude oil and natural gas, it is worth reading this article from CME. As mentioned in the article:

“natural gas is more prone to short-term price shocks and supply imbalances due to seasonality, storage dynamics, and weather-related events”, while “oil has a more geopolitical dimension and responds to global events”.

Also, we clearly see in the chart above that:

“Crude oil and natural gas prices have historically moved in tandem as a result of the linkage between the two commodities on the supply and demand sides. But their price relationship reached an inflection point after 2008 and they have since decoupled.”

Who knows what is going to happen next? Who knows what the Saudis will do? Who knows how the weather will be in the coming months? One thing for sure, the ratio is volatile and that alone should be enough to get traders and mid-term investors hooked on it.

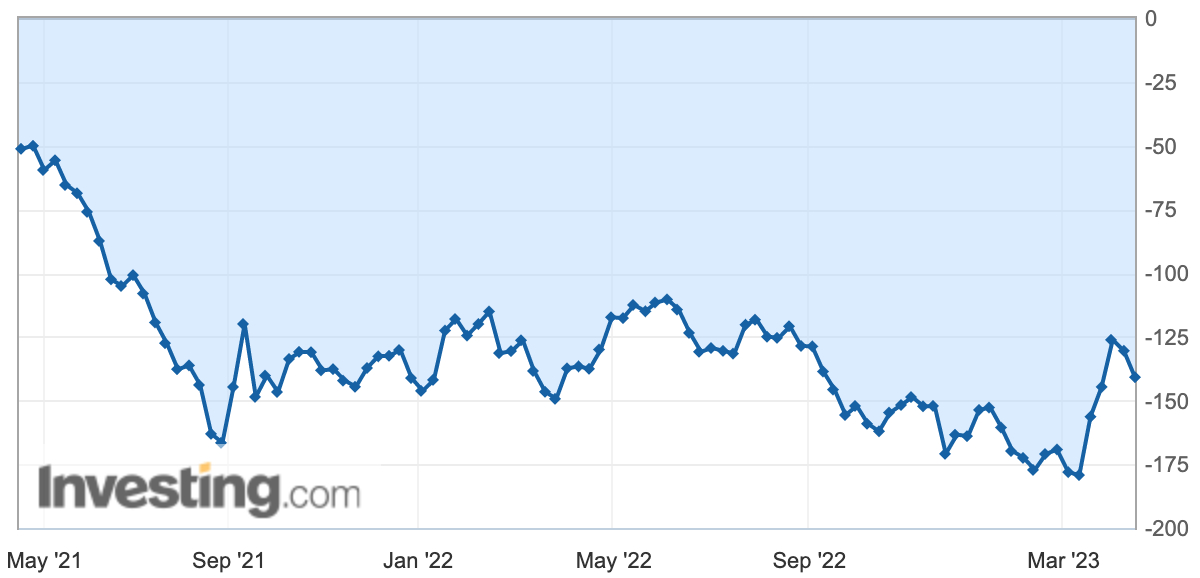

Another way to look at it is with the CFTC speculative net positions.

These are the latest Natural Gas speculative net positions:

And the same for Crude oil:

Net positions for Natural Gas seem to have reached a bottom, about the same which was reached in September ‘21. Since early March ‘23, speculative traders have been reducing their short exposure in natural gas. As for Crude Oil, the global trend since 2021 has been the reduction of a long exposure.

Can all these observations lead to a WTI/NatGas ratio going back under 25 ? Probably. The question is, when?

***

This article was originally published on the Trading & Investing newsletter, read by a community of traders, private and professional investors, financial advisors and hedge funds managers. Check it out here.