Crude Oil Drops to New 2022 Low – What’s Happening?

2022.12.08 15:17

[ad_1]

Macroeconomics

From a macroeconomic point of view, the has maintained its downward trend within its recent regression channel, probably still eyeing the next quarterly S2 pivot just located at the $100 mark.

As we will see in this article, a certain lack of appetite for petroleum products is fueling the general impression of anemic demand, stifled by hikes in key interest rates by central banks (the Federal Reserve, the European Central Bank, the Bank of England, etc.) around the world combined with the slowing economy.

Geopolitical and Fundamental Analysis

The price of a barrel of West Texas Intermediate () closed Wednesday down 3% and went on to trade nearly flat on Thursday. The move comes after falling a moment earlier to its lowest level of the year ($71.75 on the January futures contract).

As geopolitical fears were placed in the background, even the EU’s price cap on Russian oil has not really impacted the market. Given that Russia has made investments into its own fleet of oil tankers, so they have the option to deliver its Urals crude oil by putting its own conditions or even simply finding other clients eventually.

Already resolutely on the downside for several days as concerns over supply risk are gradually evaporating, the black gold market was encouraged to continue in this downward momentum by the EIA’s weekly report on US crude oil inventories.

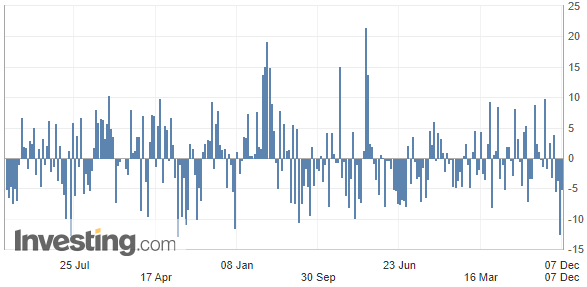

U.S. Crude Oil Inventories

Crude Oil Inventories

Source: Investing.com

Operators ignored the significant contraction of 5.187 million barrels in commercial crude reserves to focus on stocks of refined products to get an overview of US petroleum demand.

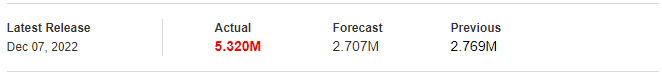

U.S. Gasoline Inventories

U.S Gasoline Inventories

Source: Investing.com

The oil market is sinking due to a significant increase in gasoline stocks, which rose by 5.320

million barrels, nearly doubling expectations (2.7 million barrels).

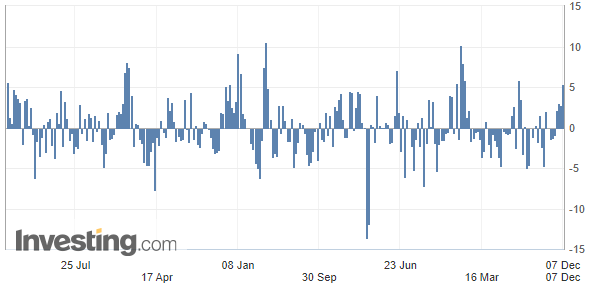

U.S. EIA Weekly Distillates Stocks

Now, regarding the reserves of distilled products – such as diesel, mainly – they also increased significantly, by 6.159 million barrels versus the 2.2 million barrels forecasted.

U.S. EIA Weekly Distillates Stocks

U.S. EIA Weekly Distillates Stocks

U.S. EIA Weekly Distillates Stocks

Source: Investing.com

In fact, this figure has to be compared to the demand for refined products in the United States, which remained, last week, below its level of 2021 at the same time, whereas on average over the past four weeks, the demand for gasoline dropped more than 7% lower than a year ago.

Finally, OPEC+’s decision last Sunday (Dec 4th) to maintain their production and not reduce it further, is another bearish factor.

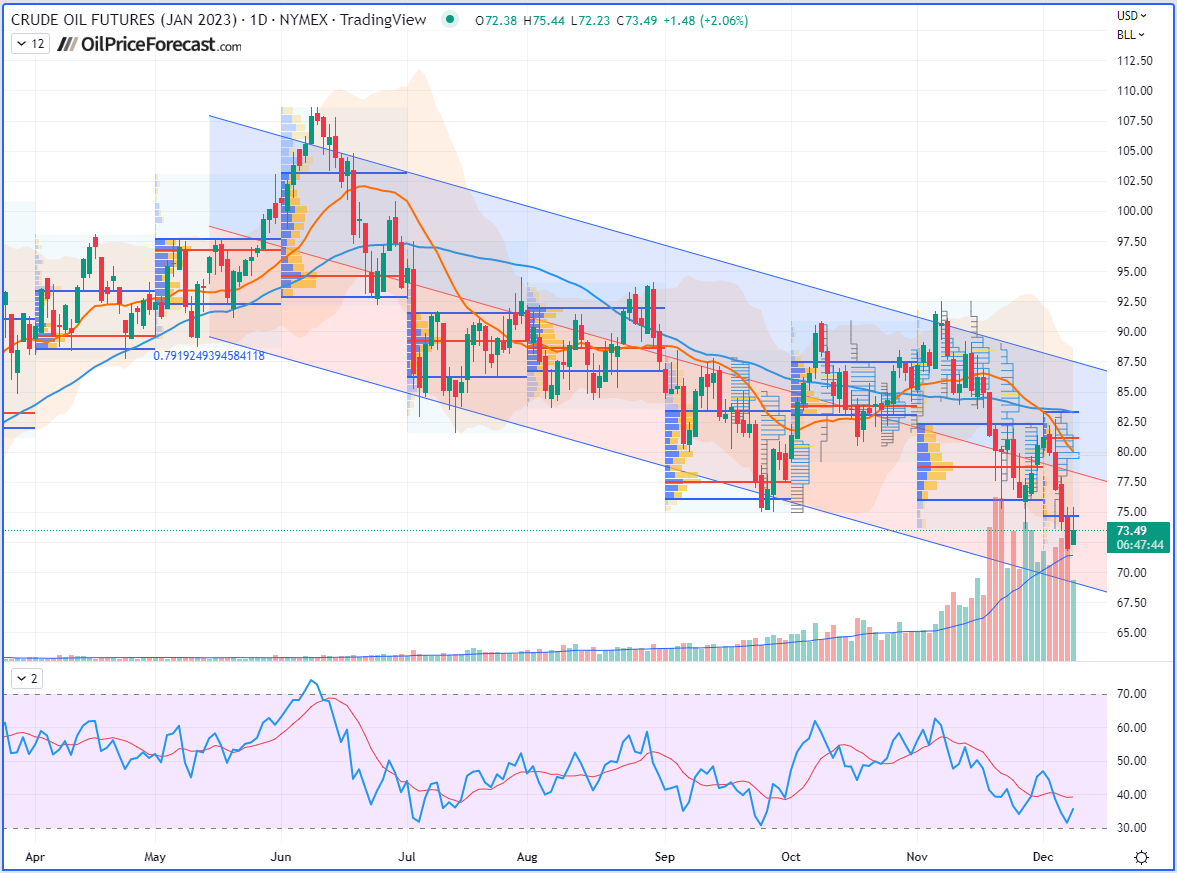

Technical Charts Crude Oil Futures Daily Chart

Crude Oil Futures Daily Chart

Crude Oil Futures 4-Hour Chart

Crude Oil Futures 4-Hour Chart

RBOB Gasoline Futures Daily Chart

RBOB Gasoline Futures Daily Chart

CFDs on Brent Crude Oil Daily Chart

CFDs on Brent Crude Oil Daily Chart

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

[ad_2]