Crude Oil Dives Below $70, Eyes 50s: Inflation Set to Follow Suit?

2023.12.07 02:53

Stocks finished lower as risk-off seemed to be a theme yesterday, with prices slumping below $70. Oil has been a harbinger of all things these days, and the best thing that can happen with oil, at least over the next 6 to 12 months, is to do nothing. Rising oil could stoke more while falling oil suggests global growth is a real concern. Oil above $70 and below $90 would be ideal, but unfortunately, that is not happening.

If oil is in a retracement of the rally from the 2020 lows, it could still have more to fall as it completes a wave “C” down; at least, that’s what it looks like. I had been bullish on oil for some time, but after it fell below $83, it seemed like the 70s were a possibility, and now it looks like it could go lower into the $50s.

CFDs on Crude Oil-Daily Chart

CFDs on Crude Oil-Daily Chart

The other piece is that is getting walloped after trying to break out. When copper and oil fall, it tells us that the market is worried about slowing global growth.

5-Year Inflation Breakevens yesterday fell sharply to a new cycle low, dropping to 2.07%, a level not seen since early 2021. It could be nothing, but this is something to watch because if oil keeps falling, then inflation expectations will keep falling. Falling inflation expectations aren’t just an indication of inflation falling but also a sign of growth slowing.

5-Year Inflation Breakeven

5-Year Inflation Breakeven

China CSI 300 Falls to Pre-Pandemic Levels

I guess that the decline in China to levels not seen since before the COVID pandemic isn’t helping the matter and could even be driving some of those concerns.

CSI 300 Index-Daily Chart

CSI 300 Index-Daily Chart

Dollar Index Continues to Rise

Additionally, we are seeing the continue to push higher and through that 104 level, which sets up a potential test of resistance at 104.50; after that, the could run to around 105.60.

US Dollar Index-4-Hour Chart

US Dollar Index-4-Hour Chart

Volatility Increases Significantly

1-week 50 delta options have seen implied volatility increase significantly over the past few days, rising over 12 from around 8. So quietly, on the surface short-dated, implied volatility has risen. It could merely be due to the jobs report on Friday. It is hard to say, but it has been growing for a few days, and that has been telling me, at least, that the rally in equities was likely to struggle.

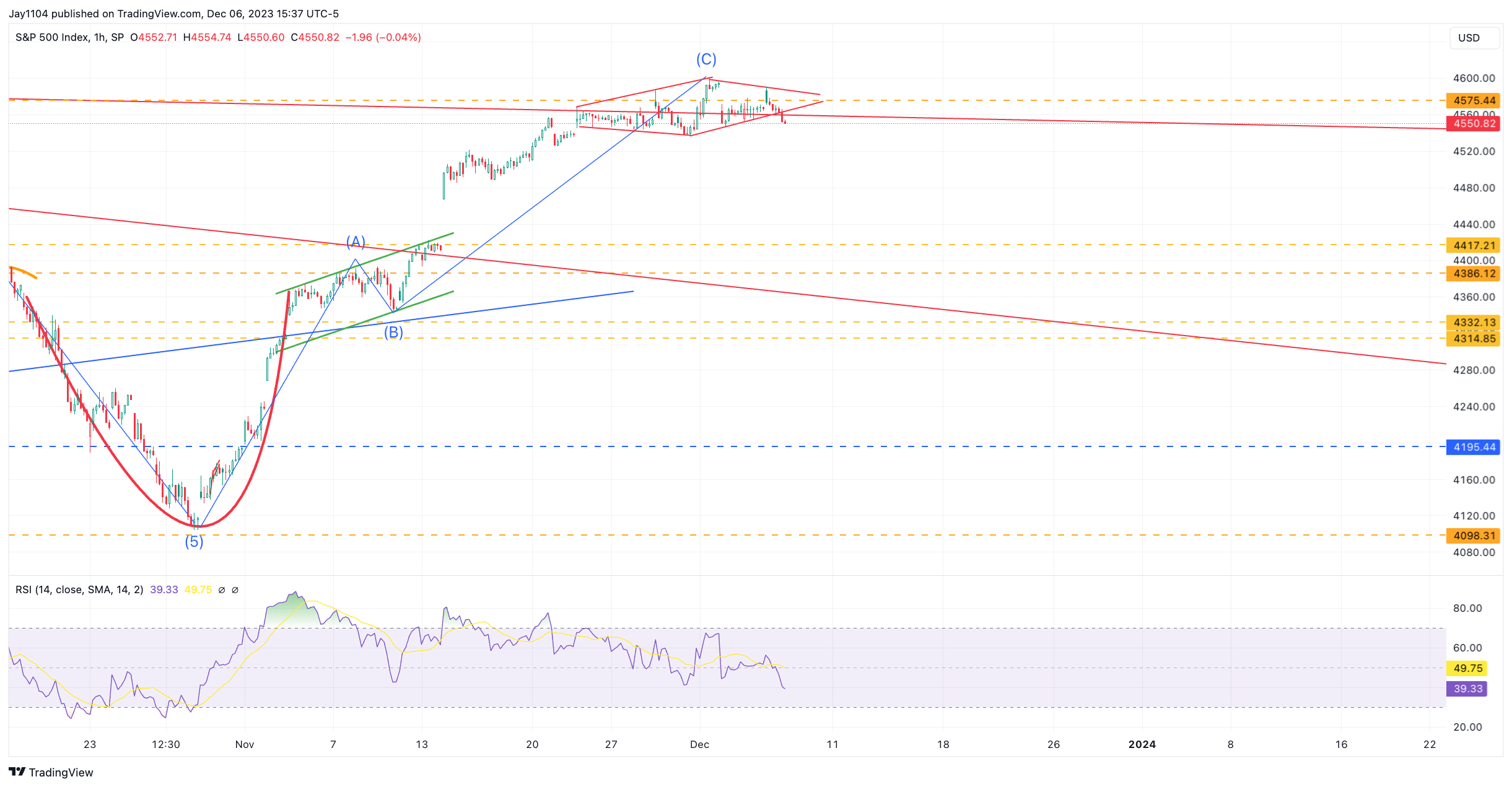

S&P 500 Breaks Lower

In the meantime, I have used this exact wave count for some time, and yesterday, it looked like the diamond reversal pattern formed over the past few days broke lower this afternoon.

S&P 500 Index-1-Hour Chart

S&P 500 Index-1-Hour Chart

Again, as I have noted, the dynamics that took the market higher off the 4,100 level in late October are the same dynamics that could now take the S&P 500 back to 4,100. The rally off the low was due to a short-gamma squeeze, which boosted the index higher and forced systematic funds that were short to cover and then go outright long. Based on my research and readings, those dynamics are in place if the index starts to drift below 4,500.

Since the S&P 500 never passed the July highs, it is quite possible that what we have witnessed from July to October was wave one down, and the rally since October was wave 2, and if this wave three down, then the lows of October low will not only be reached but undercut.

Original Post