CPI Preview: Data to Settle Whether Fed Will Cut Rates by 25 or 50 bps Next Week

2024.09.11 05:59

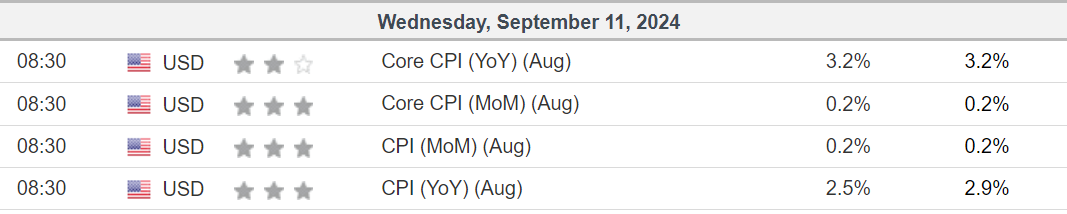

- The highly anticipated U.S. August CPI report comes out on Wednesday morning.

- Headline annual inflation is seen rising 2.5% and core CPI is forecast to increase 3.2%.

- The CPI print could potentially tip the scales between a 25 or 50 basis point Fed rate cut next week.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $9 a month!

As the Federal Reserve gears up for its pivotal September meeting, investors and analysts alike are keenly awaiting Wednesday’s U.S. Consumer Price Index () inflation report.

Source: Investing.com

Set to be released at 8:30 AM ET, the August inflation reading could provide the final piece of the puzzle for the Fed’s next interest rate decision, helping determine whether policymakers opt for a more moderate 25 basis point (bps) cut or go for a more aggressive 50bps reduction.

While markets are leaning toward a 25-bps cut, a softer-than-expected CPI print could strengthen the case for a larger 50-bps move. Currently, the market is pricing in a of such an outcome, as per Investing.com’s Fed Monitor Tool, but all eyes will be on inflation numbers to determine whether those odds increase.

Key Expectations for August CPI

With the stakes high and markets in flux, the August inflation report is poised to be one of the most consequential data points of the year.

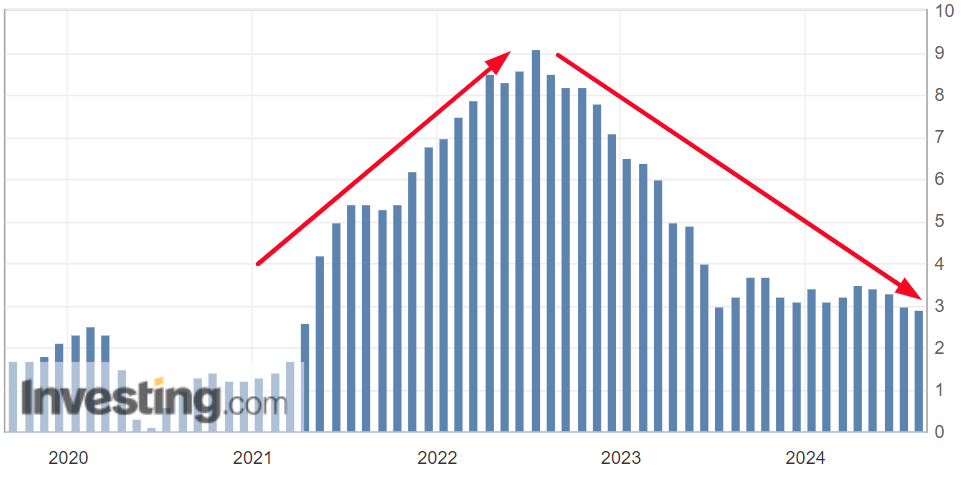

According to economists surveyed, the headline for August is expected to increase by 0.2% on the month, matching July’s gain. On an annual basis, inflation is forecast to ease to 2.5%, down from July’s 2.9%. If that is confirmed, it would mark the lowest annual reading since March 2021.

Source: Investing.com

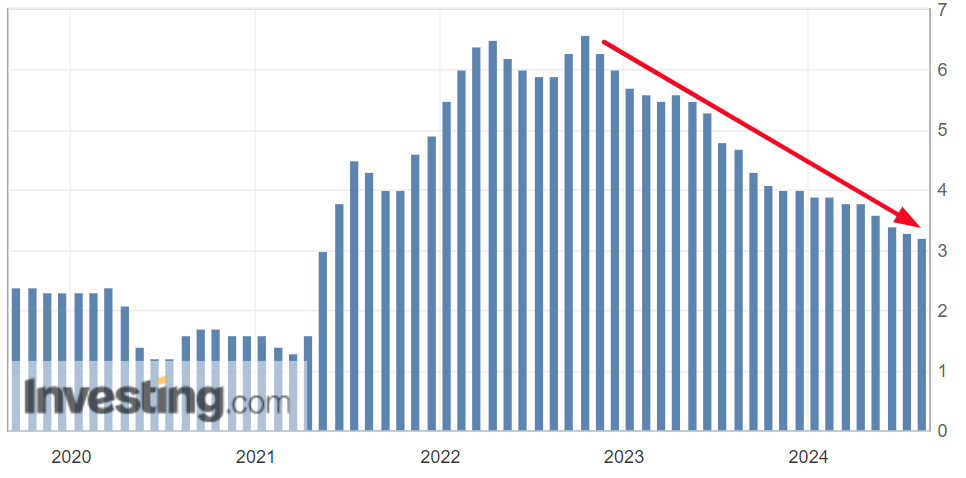

, which strips out the more volatile food and energy sectors, is predicted to remain steady at 3.2% year-over-year.

Source: Investing.com

If inflation comes in lower than expected, this could bolster the case for a 50-bps cut, providing more room for Fed doves to push for aggressive action to stimulate the economy and fend off a recession.

On the flip side, if inflation holds steady or rises, the Fed may stick to a more cautious 25bps cut, balancing inflation risks with its dual mandate of promoting maximum employment.

Market Reactions and Implications

The August CPI report carries significant weight, not only for the Fed’s decision-making but also for broader market sentiment.

A weaker inflation print could signal further weakness, continuing the trend seen in recent weeks, while boosting equities. Conversely, any upside surprise in inflation may lead to a stronger dollar and heighten volatility in stock markets.

Historically, inflation reports have been crucial in determining the direction of monetary policy, and this release will be no exception. Whether the Fed opts for a larger-than-usual rate cut, the CPI data could serve as the key tiebreaker between a 25 or 50 bps rate cut – setting the tone for the rest of 2024.

What to Do Now

Fed Chair Jerome Powell emphasized at Jackson Hole that inflationary pressures have eased, but Wednesday’s CPI report will be the final major data point before the Fed convenes.

Investors should brace for possible market swings after the CPI release as financial markets adjust their expectations for the Fed’s next move. The data could also offer clues on the Fed’s long-term rate path as it navigates the complex balance between cooling inflation and stabilizing the economy.

As Wall Street braces for the Fed’s next steps, Wednesday’s inflation report may provide the tiebreaker that tips the balance in favor of a more substantial rate cut.

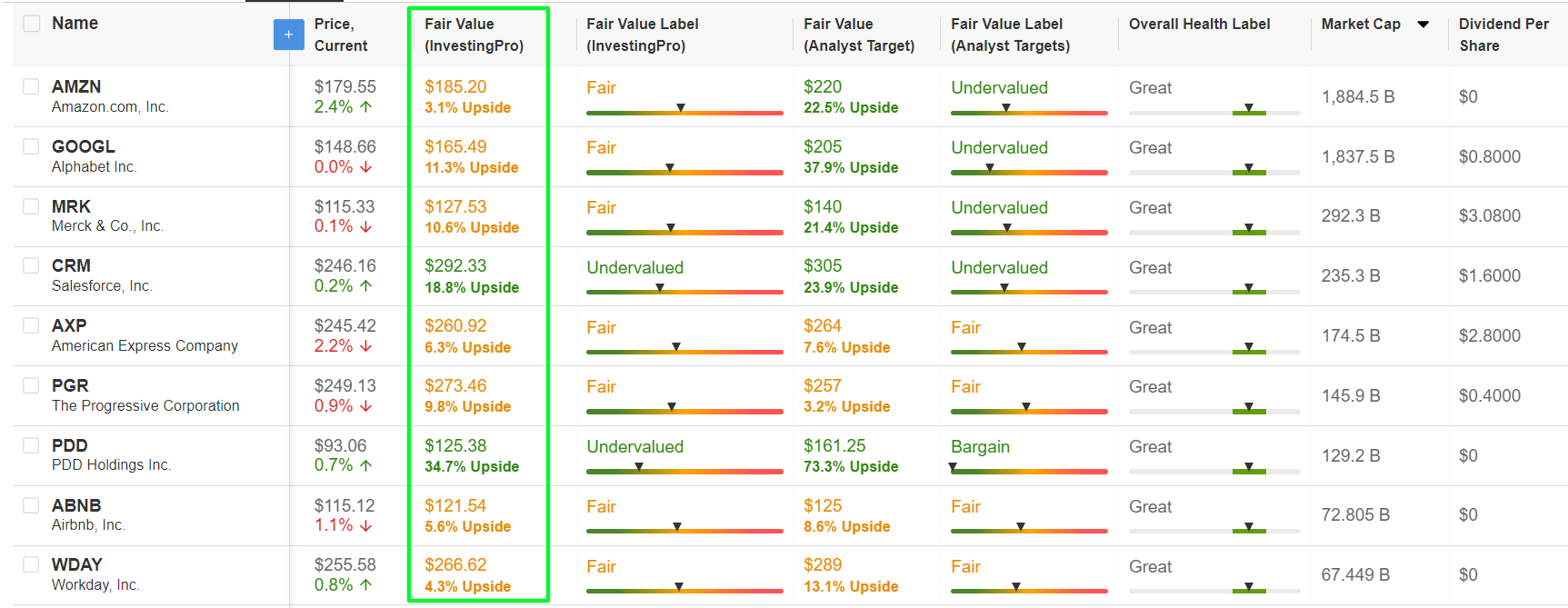

To navigate the current market volatility, I used the Investing.com Stock Screener to build a watchlist of high-quality stocks that are undervalued and have healthy growth prospects.

Not surprisingly, some of the notable names to make the list include tech-heavyweights such as Amazon (NASDAQ:), Alphabet (NASDAQ:), Salesforce (NYSE:), Workday (NASDAQ:), and Fortinet (NASDAQ:).

Meanwhile, Merck, American Express (NYSE:), PDD Holdings, Airbnb, Marriott International (NASDAQ:), Lennar (NYSE:), and United Rentals (NYSE:) are a few consumer-sensitive stocks to make the cut.

Source: InvestingPro

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now with an exclusive discount and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.