Could US CPI Report Finally Seal the Deal on the Fed Pivot?

2024.07.09 06:57

-

Further decline in headline CPI is expected in June

-

The labour market is also showing signs of a slowdown

-

Will Thursday’s report (12:30 GMT) convince the Fed it’s time to cut?

-

Ahead of that, Powell testifies on Tuesday (14:00 GMT)

Fed Still Not Convinced

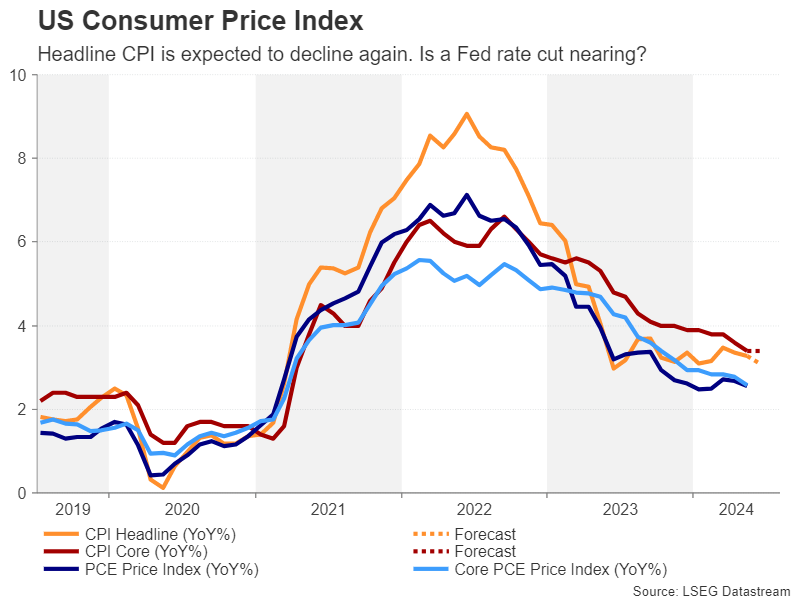

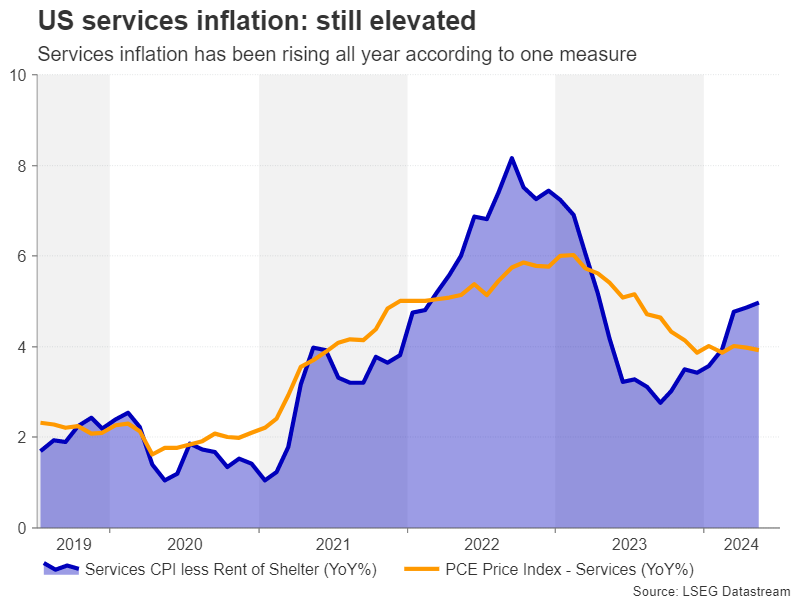

After several months of upside surprises earlier in the year, CPI inflation finally seems to be moving in the right direction. There’s been somewhat better progress in inflation, but services inflation under both the CPI and PCE measures has been stubbornly high. When put against the backdrop of a still-tight labour market, the Fed’s ‘higher for longer’ stance is not only justified, but there was even a strong case to hike rates further at the beginning of 2024.

But patience may now be paying off, as not only are inflationary pressures on the wane again, but evidence is also mounting that the hot labour market is cooling. In the June jobs report, the unemployment rate ticked up to 4.1% – the highest since November 2021, while annual wage growth eased to just below 4.0%. Payrolls rose by slightly more than expected but there was a downward revision of 111k for the prior two months.

Headline CPI to Likely Fall Again

With the jobs market slowing in a more convincing manner, the Fed has less reason to be cautious, and so further progress in the consumer price index might just tip the balance in favour of the doves

The headline CPI rate is expected to have moderated from 3.3% to 3.1% y/y in June, though the month-on-month pace is anticipated to have picked up to 0.1% from 0.0%. No change is forecast for the core CPI rate, however, with both the monthly and yearly figures expected at 0.2% and 3.4% respectively.

Sticky Services CPI May Delay a Dovish Pivot

Aside from those key numbers, the Fed will also be watching closely what happens to services inflation. Specifically, a core measure of services CPI that excludes shelter costs has been accelerating all year, hitting 5.0% y/y in May. The Fed would ideally want to see this particular metric head lower, probably for at least two consecutive months, before lettings its guard down on inflation.

Hence, even if all the various CPI metrics decline in June, it might not be enough for the Fed to start signalling that the time has come to cut interest rates just yet. This would rule out the July meeting for any policy shift, but it’s a different story for September. After this week’s CPI data, there will be another two CPI and PCE inflation reports to be released before the September FOMC, which leaves plenty of time for all the pieces to fall into place.

Powell Testimony to Test Market Nerves

Yet, with two rate cuts already fully priced in for 2024, how much can the data move the markets? Those investors hoping for some kind of a game changer might place their bets on three rate cuts this year or much more aggressive easing in 2025. For that to happen, though, there would have to be a significant deterioration in the labour market and Fed Chair Jerome Powell might shed some light on just how worried policymakers are about a sudden freeze in hiring or a jump in layoffs.

Powell is due to testify before the Senate Banking Committee on Tuesday and before the House Financial Services Committee on Wednesday. His prepared remarks typically get published a little before his speech starts but investors pay as much attention to the question-and-answer session with lawmakers that follows.

How Worried is the Fed About a Cooling Jobs Market?

Fed officials have already expressed concern at some of the small cracks appearing in the labour market and Powell himself warned that “the labour market unexpectedly weakening is also something that could call for a reaction” when taking part in a panel discussion in Portugal last week.

Should Powell elaborate on those comments in his Congressional hearings this week, spurring speculation about a swift policy response in the event of a shockingly bad jobs report, the could come under fresh pressure.

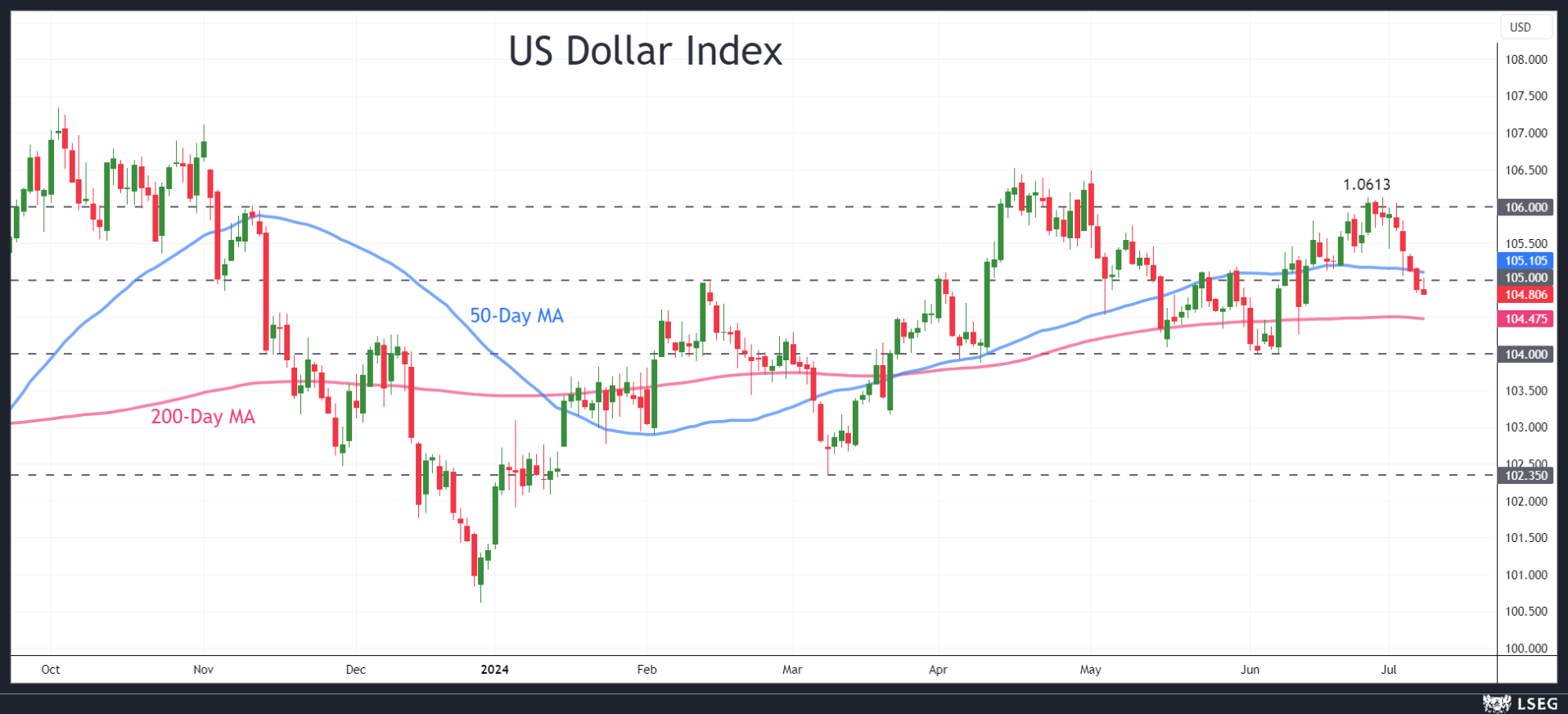

Dollar Bears Eye 200-MA

The could also extend its latest pullback if the CPI numbers are softer than expected. Having already broken below its 50-day moving average (MA), the next stop could be the 200-day MA at 104.47, after which, the 104.00 level would come under scrutiny.

However, if Powell fails to offer any new clues on the possible timing of a rate cut or there’s an upside surprise in one or more of the CPI readings, the dollar index could crawl back above the 105.00 level to reclaim the 50-day MA. Higher up, the next challenge would be the June peak of 106.13.

On the whole, all the signs are that the US economy is losing steam, which bodes well for the odds of a September rate cut. The problem for dollar bears is the possibility of a second Trump presidency, which may limit the downside for Treasury yields.