Commodities Set to Rally as Weaker Dollar, El Nino and Disruptions Take Hold

2023.11.29 06:01

- November has seen a broad uptrend in commodities driven by weather conditions and trade restrictions, with silver, rice, and cocoa in focus.

- The silver market has shown a bullish trend, influenced by the weakening US dollar and an anticipated Fed pivot, potentially challenging this year’s highs.

- Rice prices have surged due to India’s ongoing export restrictions, impacting global markets, while cocoa prices have risen amid adverse weather conditions in West Africa, aiming for historic highs.

- Missed out on Black Friday? Secure your up to 55% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

November marks the continuation of rising prices for most essential food, industrial, and precious metal commodities, with the exception of and . The primary drivers for this trend are weather conditions and trade restrictions, exerting pressure on commodity prices in global markets.

One prominent factor influencing this scenario is the phenomenon known as “El Nino,” an atmospheric event that primarily develops in the Pacific waters but has a noticeable impact on global weather patterns.

1. Silver Sustains Bullish Momentum

Amid progressing deflation and the anticipated Fed pivot in May of the coming year, the weakening of the continues. A weaker dollar sets the stage for the rise in prices of metals such as and , where a clear upward trend is observed. Currently, the silver price is approaching a strong resistance zone around $25.40 per ounce.

Silver Price Chart

If the demand side manages to break through this region, it opens the path to challenge this year’s highs around $26.40 per ounce. Considering the lack of arguments for the strengthening of the dollar in the context of incoming macroeconomic data, the upward scenario appears most likely. It is also essential to monitor potential levels to join the upward trend in the event of a correction, with local support around $24.10 per ounce being noteworthy.

2. India Maintains Rice Trade Restrictions

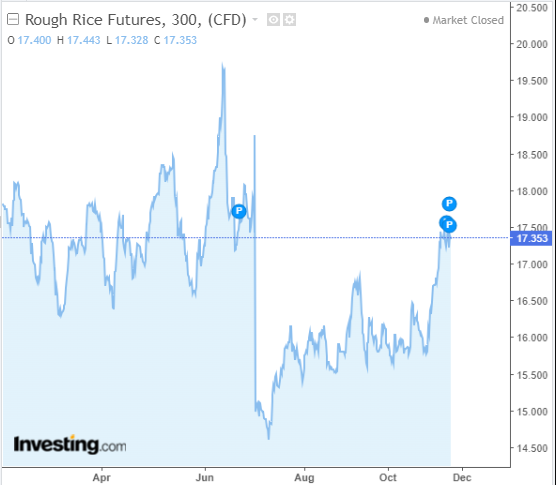

Among basic food commodities, the price of has experienced the most significant percentage increase, reaching nearly 8% in the past month. One of the contributing factors is the ongoing export restrictions by India concerning rice (export bans on varieties other than basmati) until at least the beginning of the next year.

This is linked to the rise in domestic market prices, especially in the lead-up to upcoming elections. Economist Sonal Varma of Nomura Bank warns that restrictions may persist even after the elections if prices remain too high. This naturally sustains demand pressure, which may lead to an attack on the next technical target around local highs from June and July of this year.

Rice Price Chart

In recent years, India has become one of the world’s largest rice producers, making any disruptions in its market globally impactful.

3. Unfavorable Weather Conditions Could Cause Cocoa Shortage

West Africa, specifically Ivory Coast and Ghana, plays a pivotal role in global production, cultivating approximately 75% of the global volume of this commodity. This year, adverse weather conditions, such as dry and warm weather during a critical growth period, are attributed to the “El Nino” phenomenon. Therefore, since the beginning of the month, cocoa prices have risen by just over 10%, reaching the highest levels in decades.

Cocoa Monthly Chart

Where to look for target levels for the demand side? It appears that buyers have ample room for further growth, with the primary target being the highs from the 1970s in the vicinity of $5300.

Conclusion

In summary, November sees continued upward momentum for various commodities, driven by weather-related factors and trade restrictions. Silver, rice, and cocoa stand out as notable performers in this month’s commodity landscape.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 55%), by taking advantage of our extended Cyber Monday deal.

Black Friday Sale – Claim Your Discount Now!

Disclosure: The author does not own any of the securities mentioned in this report.