Clean Sweep Of Losses For Major Asset Classes Last Week

2022.09.19 10:02

[ad_1]

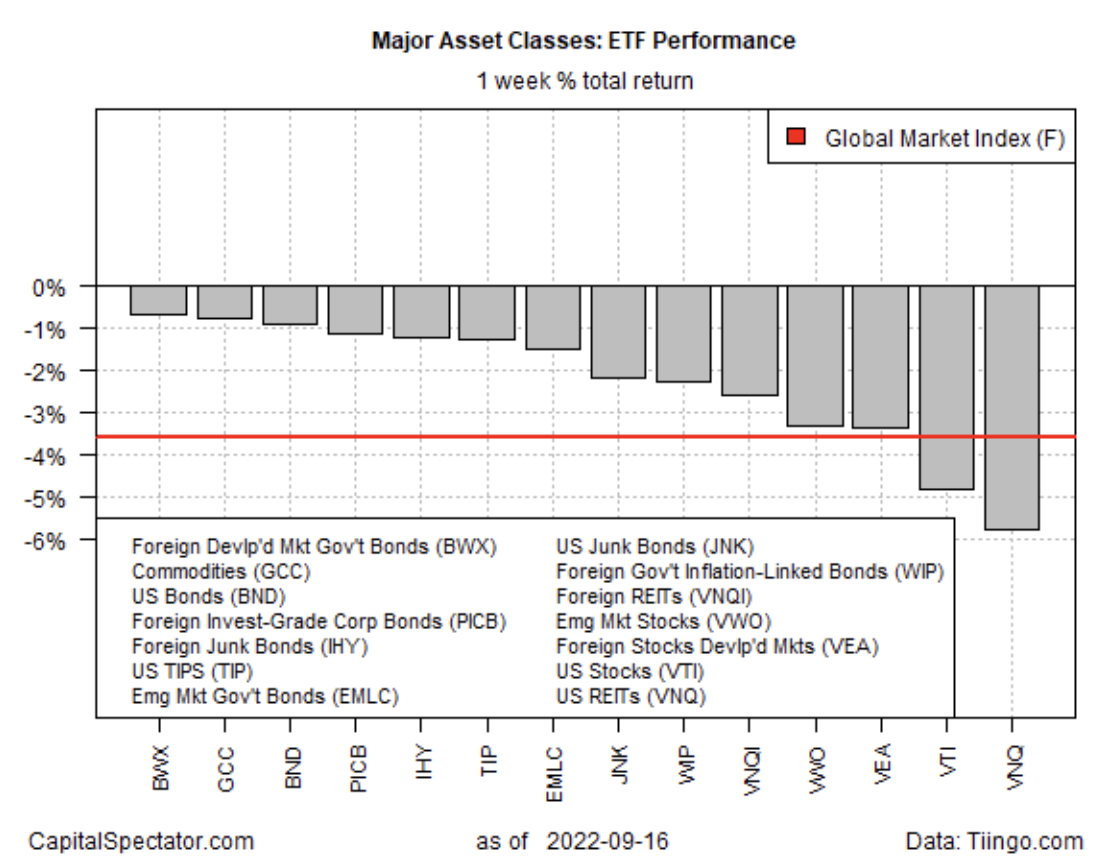

Bearish expectations for growth, interest rates and took another toll on markets around the world last week, based on a set of proxy ETFs representing the primary asset classes as of Friday’s close (Sep. 16).

Government bonds in developed markets ex-US offered a relative haven by posting the smallest setback last week. But relative strength doesn’t change the fact that the price trend remains deeply bearish for SPDR® Bloomberg International Treasury Bond ETF (NYSE:), which has lost ground in each of the past five weeks.

The combination of high inflation, ongoing interest rate hikes, decelerating growth expectations continue to weigh on markets. Bloomberg notes:

“Central banks are intent on driving the world economy perilously close to a recession. Late to see the worst inflation in four decades coming, and then slow to crack down on it, the Federal Reserve and its peers around the globe now make no secret about their determination to win the fight against soaring prices — even at the cost of seeing their economies expand more slowly or even shrink.”

US stocks (Vanguard Total Stock Market Index Fund ETF Shares (NYSE:)) and US real estate investment trusts (Vanguard Real Estate Index Fund ETF Shares (NYSE:)) posted last week’s biggest losses for the major asset classes: declines of 4.8% and 5.8%, respectively.

Widespread losses took a bite out of the Global Market Index (GMI.F), which shed 3.6% — the fourth weekly loss in the past five. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive index for multi-asset-class portfolio strategies overall.

Major Asset Classes 1-Week ETF Performance

Major Asset Classes 1-Week ETF Performance

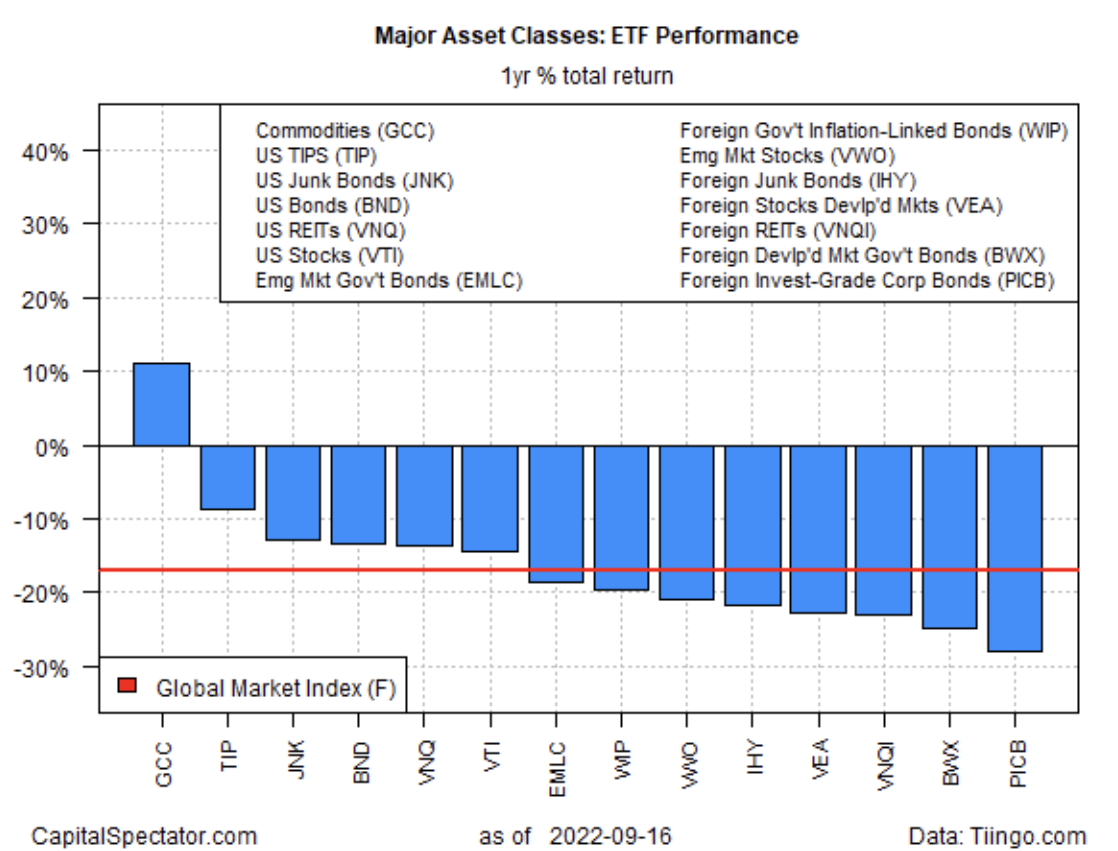

For the one-year window, commodities remain the only asset class with a gain. WisdomTree Commodity ETF (WisdomTree Continuous Commodity Index Fund (NYSE:)) is up 11% over the trailing 12-month window (based on 252 trading days).

The rest of the major asset classes are underwater. Foreign corporate bonds (Invesco International Corporate Bond ETF (NYSE:)) continue to post the deepest one-year loss: a steep 28.0% haircut.

GMI.F is down 17.1% for the past year.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

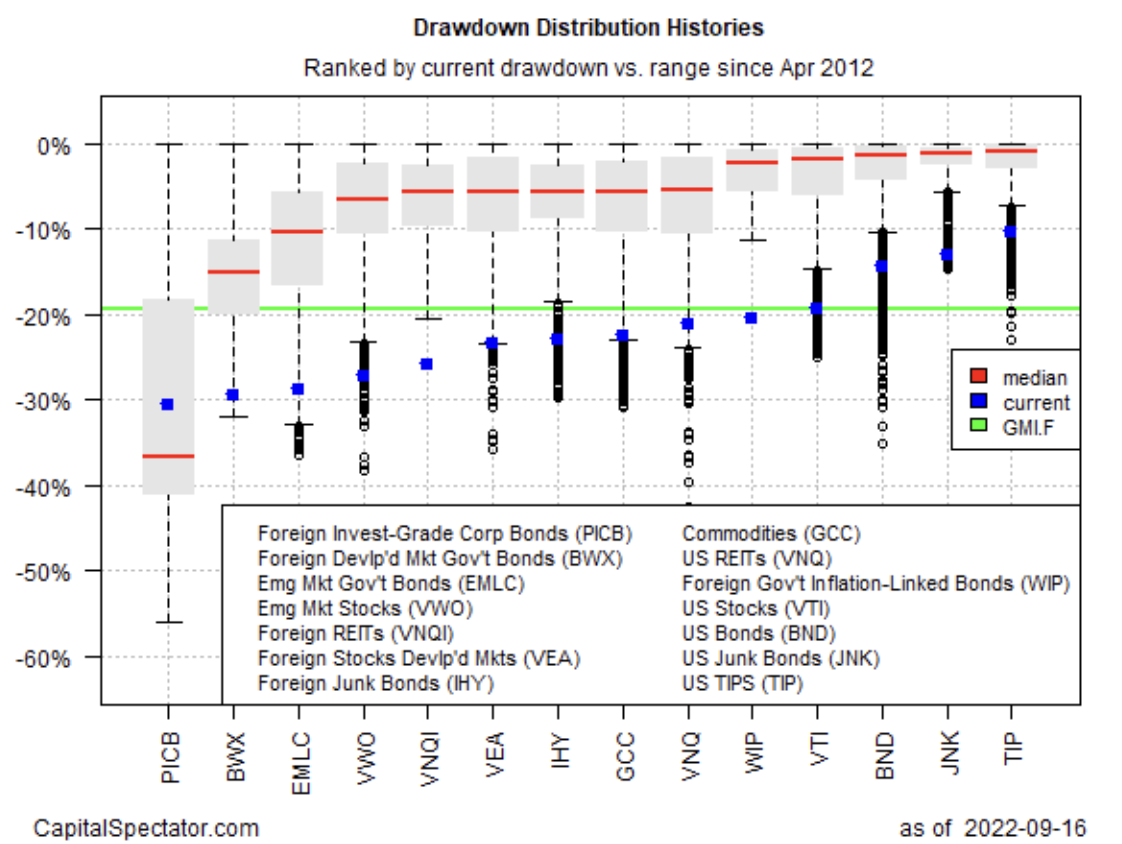

Using a drawdown lens to review price trends shows that all the major asset classes are posting peak-to-trough declines deeper than -10%. The smallest drawdown at last week’s close: a relatively modest 10.4% slide from the previous peak for inflation-protected Treasuries (iShares TIPS Bond ETF (NYSE:)).

GMI.F’s drawdown: -19.4% (green line in chart below).

Drawdown Distribution History

Drawdown Distribution History

[ad_2]

Source link