China Worries and Rising Yields Dampen the Mood

2023.08.16 06:31

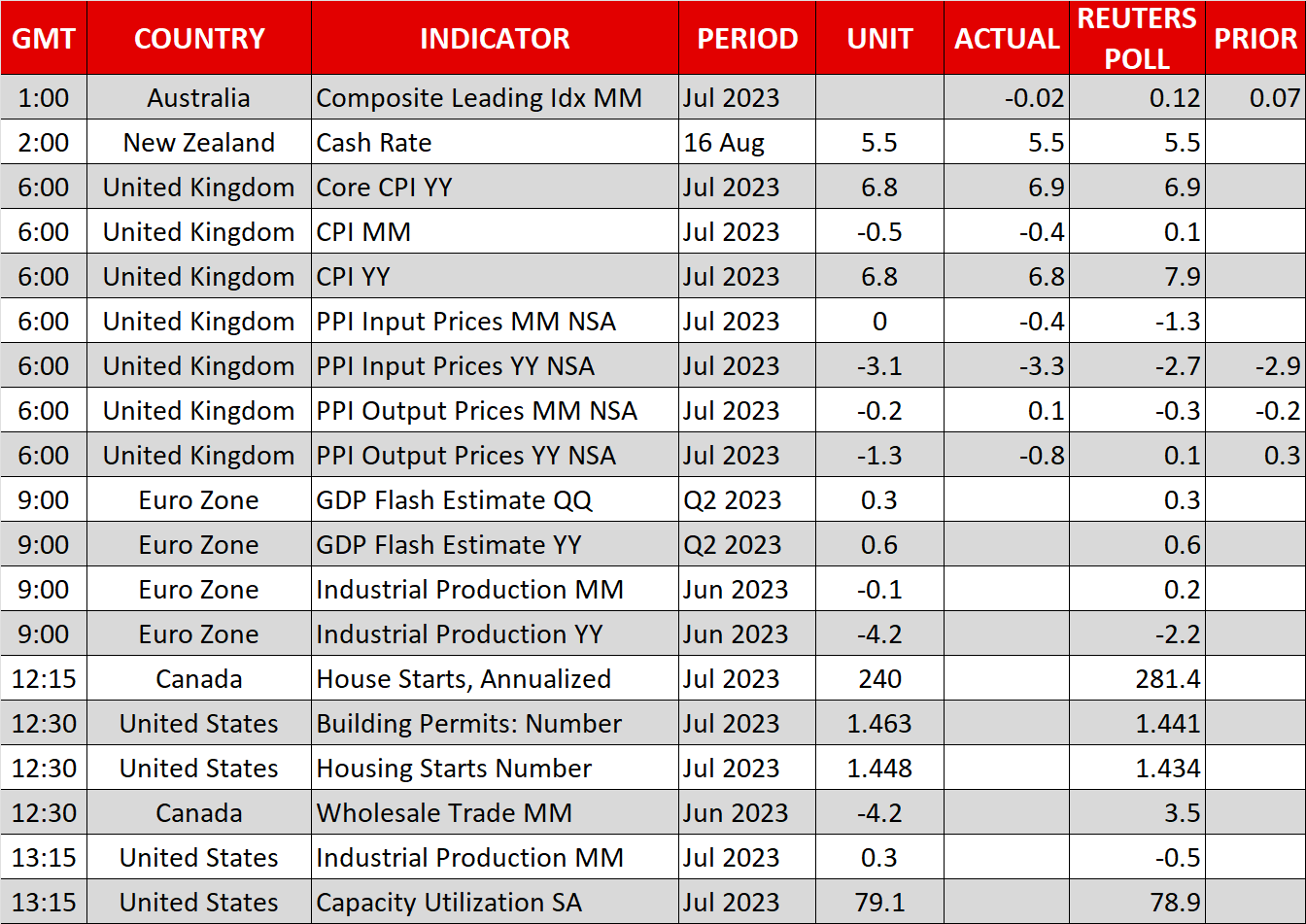

- Markets in volatile mood as China, yields, and liquidity worries combine

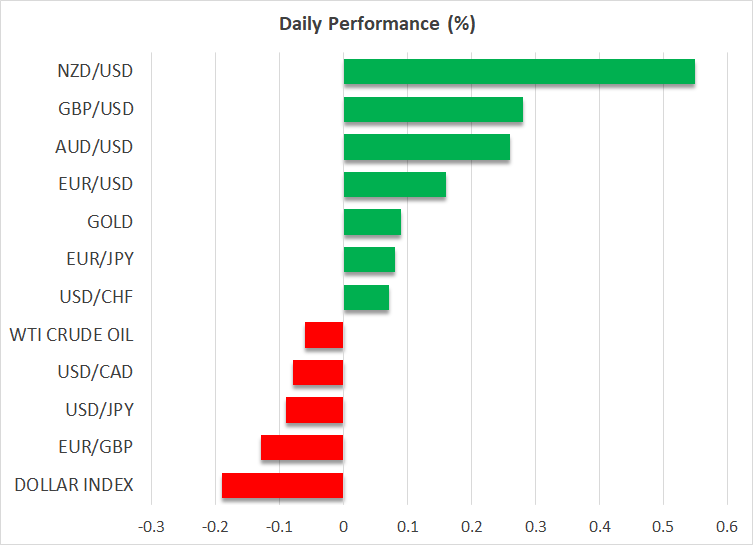

- Dollar bounces back after stellar US retail sales, gold drifts lower

- British pound gains after hot inflation report, FOMC minutes eyed

Stocks slide as China concerns strike back

A tense atmosphere has engulfed global markets as a combination of concerns around the Chinese economy, soaring bond yields, and poor liquidity conditions have joined forces to dampen the mood.

Incoming data continues to paint a picture of a Chinese economy that is rapidly losing steam, amid a slump in global manufacturing and a raging property crisis. House prices declined by 0.2% m/m in July, adding to a series of gloomy indicators. And despite the pressure on Beijing to roll out powerful stimulus measures, authorities have been reluctant so far, mostly due to concerns about already-excessive private debt levels.

Adding to investor nerves is the potent rally in US yields. With the Treasury boosting its debt issuance, the Fed continuing to shrink its balance sheet, and signs that the US economy remains resilient following a blowout retail sales report, real 10-year yields went through the roof yesterday to hit their highest levels since 2009.

Rising real yields exert a strong gravitational pull on riskier assets, and when combined with the risks surrounding China and thin liquidity conditions amid the summer doldrums, this cocktail was toxic enough to drag stock markets down. The S&P 500 fell just over 1% yesterday to close below its 50-day moving average for the first time since March, which is not an encouraging sign.

US retail sales smash estimates, gold suffers

It is becoming undeniable that the United States is the superior economy at this stage, especially when compared to China or even the Eurozone. US retail sales for July smashed estimates, with the retail control group that is used in GDP calculations clocking in at 1% in monthly terms, double what forecasts implied.

The Atlanta Fed GDP tracking model was revised higher after this release and currently estimates US annualized growth at 5% this quarter, which is astonishing. The housing sector has fired up again, the labor market remains robust, and cooling inflation means that real wage growth has returned to positive territory, giving consumers some of their spending power back.

Naturally, the US dollar received a boost on the news, although it lost some of its shine early on Wednesday as yields took a step back, without any clear news catalyst.

In the commodity arena, gold has been drifting lower this month, stuck below a short-term downtrend line as the forceful rally in real yields and the dollar’s revival have taken the shine out of the precious metal. One could argue that gold being just 8.5% away from record highs despite the sharp spike in real yields is encouraging in itself, but equally, it’s difficult to envision what will slingshot bullion back higher in the absence of a recession.

Sterling jumps, RBNZ stands pat, FOMC minutes eyed

In the UK, the latest inflation stats came in slightly hotter than expected, cementing expectations that the Bank of England will deliver another three quarter-point rate increases in this cycle, and by extension boosting the pound. The issue is that while rate bets are supporting sterling for now, the higher rates go, the greater the risk of a recession that ultimately comes back to bite the currency.

Elsewhere, the Reserve Bank of New Zealand kept interest rates unchanged today but it revised its projected rate path a shade higher, putting the prospect of a future hike on the table, which helped to lift the dollar that has been battered by China concerns.

The remainder of the economic calendar is low-key today. Most of the focus will fall on the minutes of the July FOMC meeting, which are unlikely to contain any shocking revelations given the recent ‘data dependent’ commentary from various Fed officials.