Can We Finally Say Inflation Has Peaked?

2022.11.11 10:06

[ad_1]

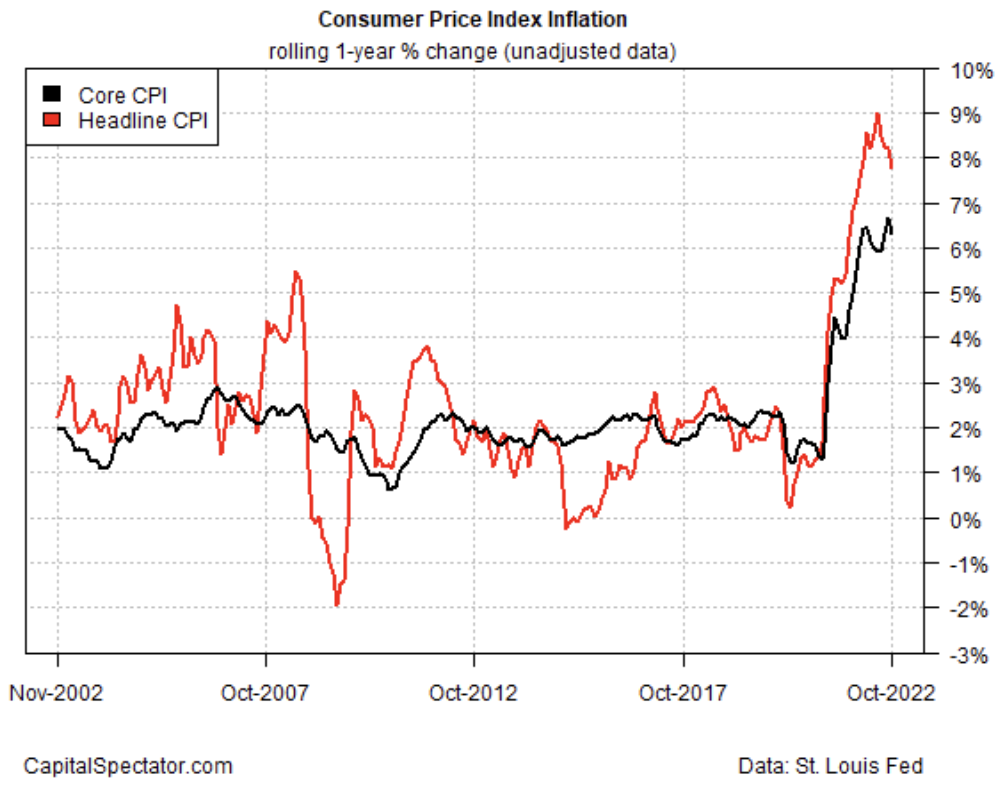

US eased in October, posting a softer-than-expected increase and spurring fresh expectations that pricing pressure has peaked. Even if that’s true, inflation still looks set to remain high and the Federal Reserve remains on track to continue raising interest rates, perhaps at a slower pace than recently forecast. But in the wake of yesterday’s report, there’s a new reason to think that the inflation surge has crested.

Consumer prices rose 7.7% in year-over-year terms for the headline measure through October, an encouraging retreat from September’s 8.2% increase. Notably, , which the Fed watches closely, also eased, dropping to 6.3% from 6.6% previously.

The softer inflation data was cheered on Wall Street. The stock market surged and Treasury yields fell sharply. The caveat, of course, is that one inflation report could be noise. A key test is how the next inflation report compares.

Meanwhile, the Fed remains on track to raise its target rate again at the upcoming FOMC meeting on Dec. 14. But after yesterday’s inflation news, Fed funds futures dramatically repriced expectations in favor of a softer 50-basis-points hike rather than a 75-basis-points increase.

Yet some Fed officials cautioned against reading into the latest CPI numbers. “One month of data does not a victory make, and I think it’s really important to be thoughtful that this is just one piece of positive information, but we’re looking at a whole set of information,” says San Francisco Fed President Mary Daly.

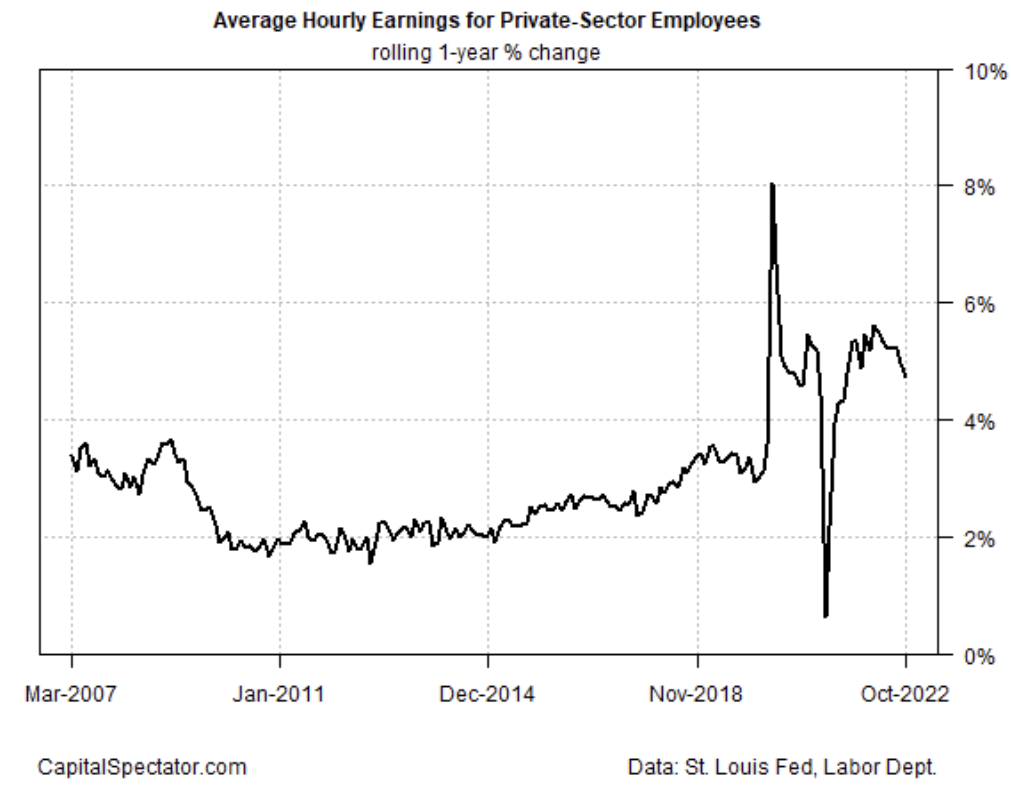

Although a cautious outlook for inflation’s path is still prudent, several other measures of pricing pressure appear to be rolling over. Earnings for private-sector workers, for example, continue to retreat from the recent peak, suggesting that wage inflation is moderating.

Average Hour Earnings For Private-Sector Employees

Average Hour Earnings For Private-Sector Employees

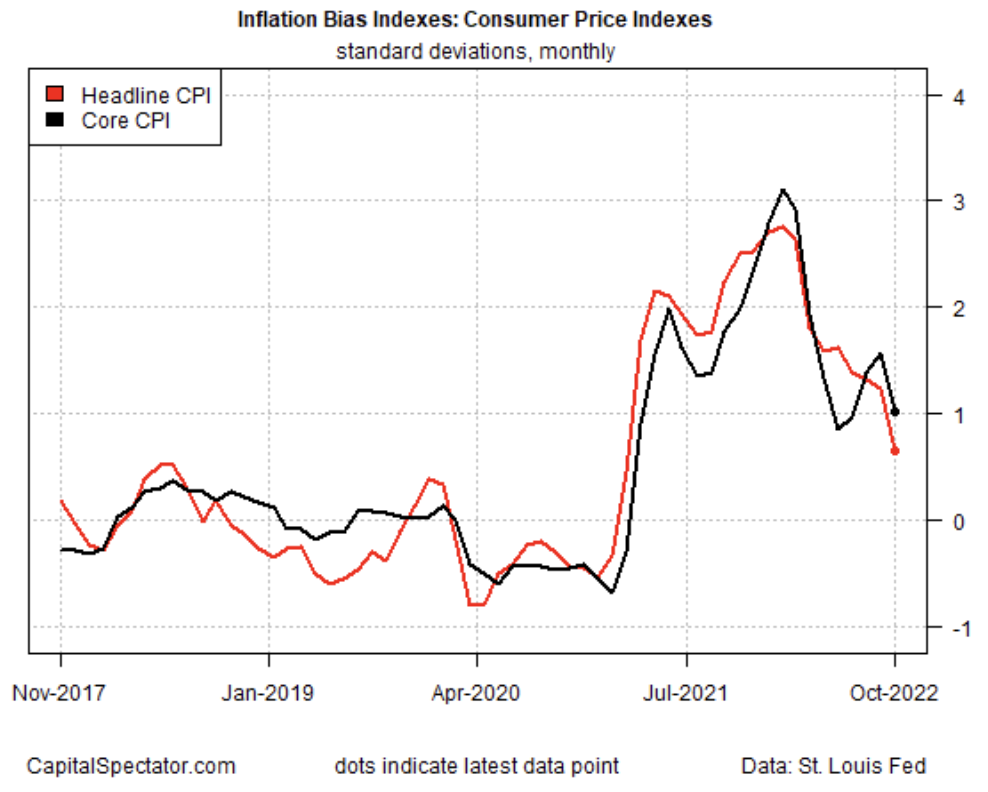

Another encouraging sign is the downturn in CapitalSpectator.com’s Inflation Bias Indexes for CPI. (The methodology takes a standard inflation index, calculates the one-year change and then computes the monthly difference and transforms the results into standard deviations around the mean. This measure offers a way to develop some quantitative insight for deciding which way the inflationary wind is blowing.)

Inflation Bias Indexes for CPI

Inflation Bias Indexes for CPI

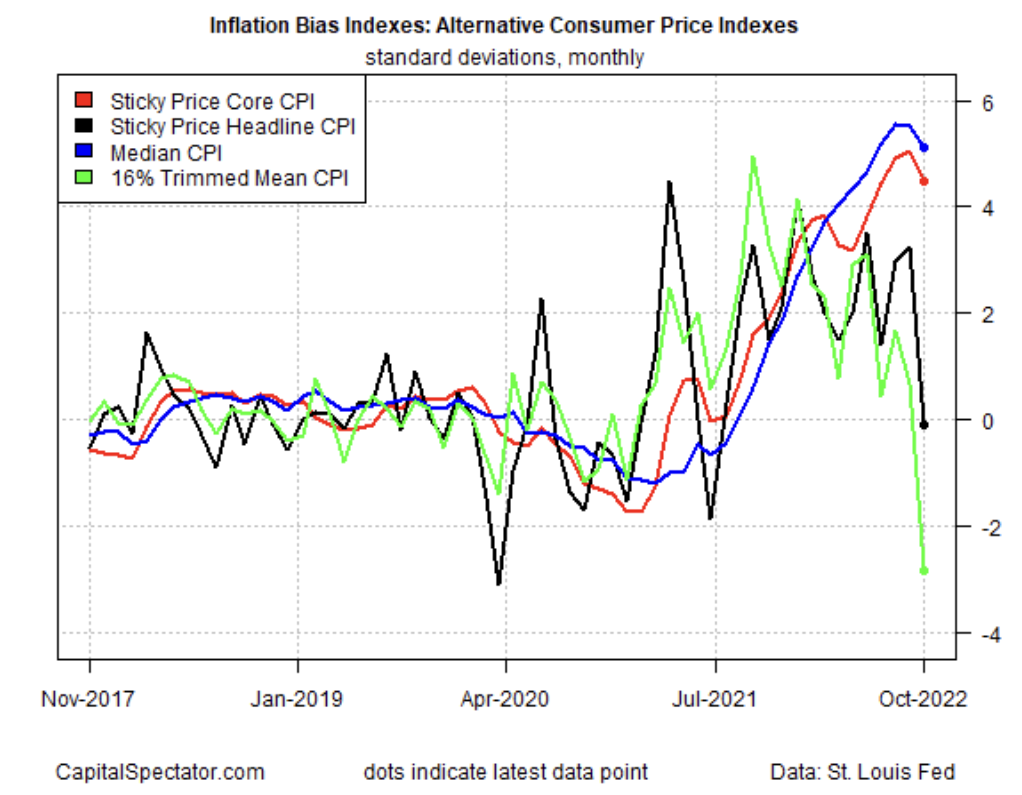

A similar profile applies to an alternative (and arguably more robust) set of consumer inflation measures published by several regional Fed banks. The downturn in the bias readings for all four metrics suggests that the softer inflation readings for October mark the peak for pricing pressure.

Inflation Bias Indexes for Alternate Consumer Price Indexes

Inflation Bias Indexes for Alternate Consumer Price Indexes

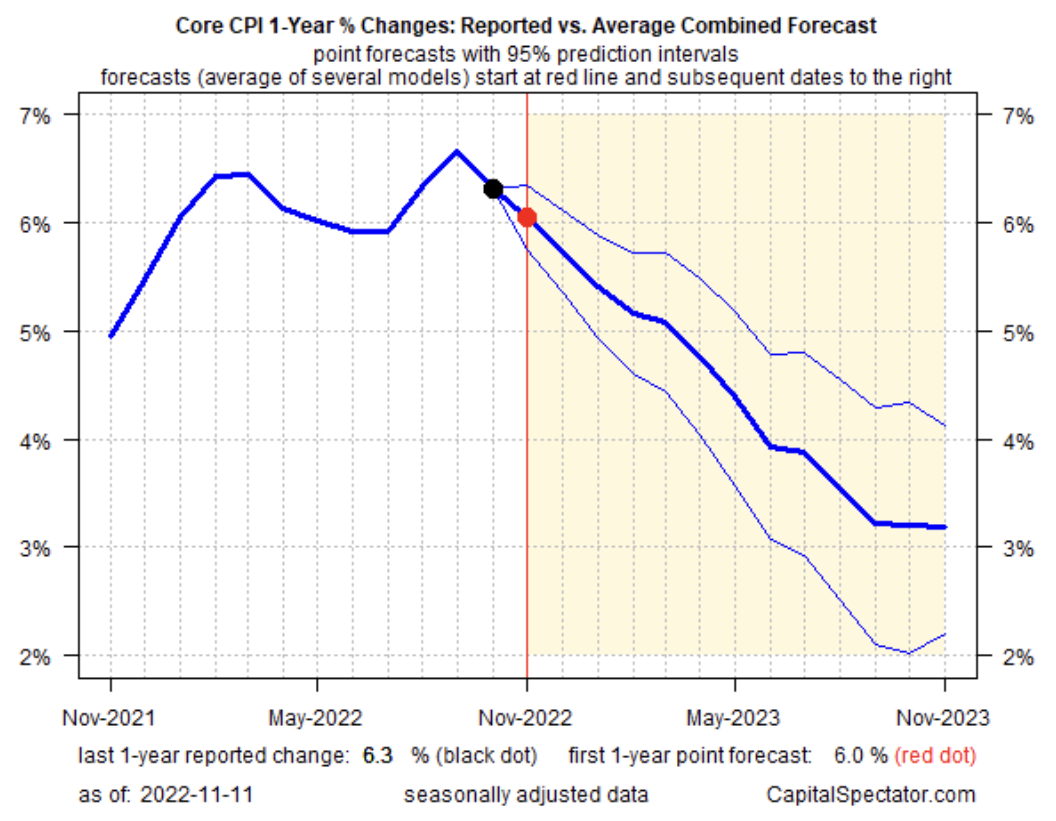

Finally, the outlook for core CPI points to further easing in the months ahead, based on CapitalSpectator.com’s combination forecasting model. This forecasting system correctly identified the softer rise in core CPI and today’s revised outlook for November and beyond points to ongoing declines.

Core CPI 1-Year Change Vs. Forecasts

Core CPI 1-Year Change Vs. Forecasts

Despite encouraging inflation news and future estimates, uncertainty remains high about how fast pricing pressure will ease. Fed officials are also eager to downplay expectations that rate hikes will soon end.

Dallas Fed President Lorie Logan says:

“[Thursday] morning’s CPI data were a welcome relief, but there is still a long way to go.”

[ad_2]

Source link