Can Semiconductor Stocks Continue to Lead the Market Higher?

2023.11.24 01:51

In the 1995 film, Home for the Holidays, family reunions are explored.

Using both drama and comedy, the film illustrates how we outsiders looking in never really know the love and the madness that goes on inside family’s homes during Thanksgiving.

Happily, our Economic Modern Family tends to be transparent.

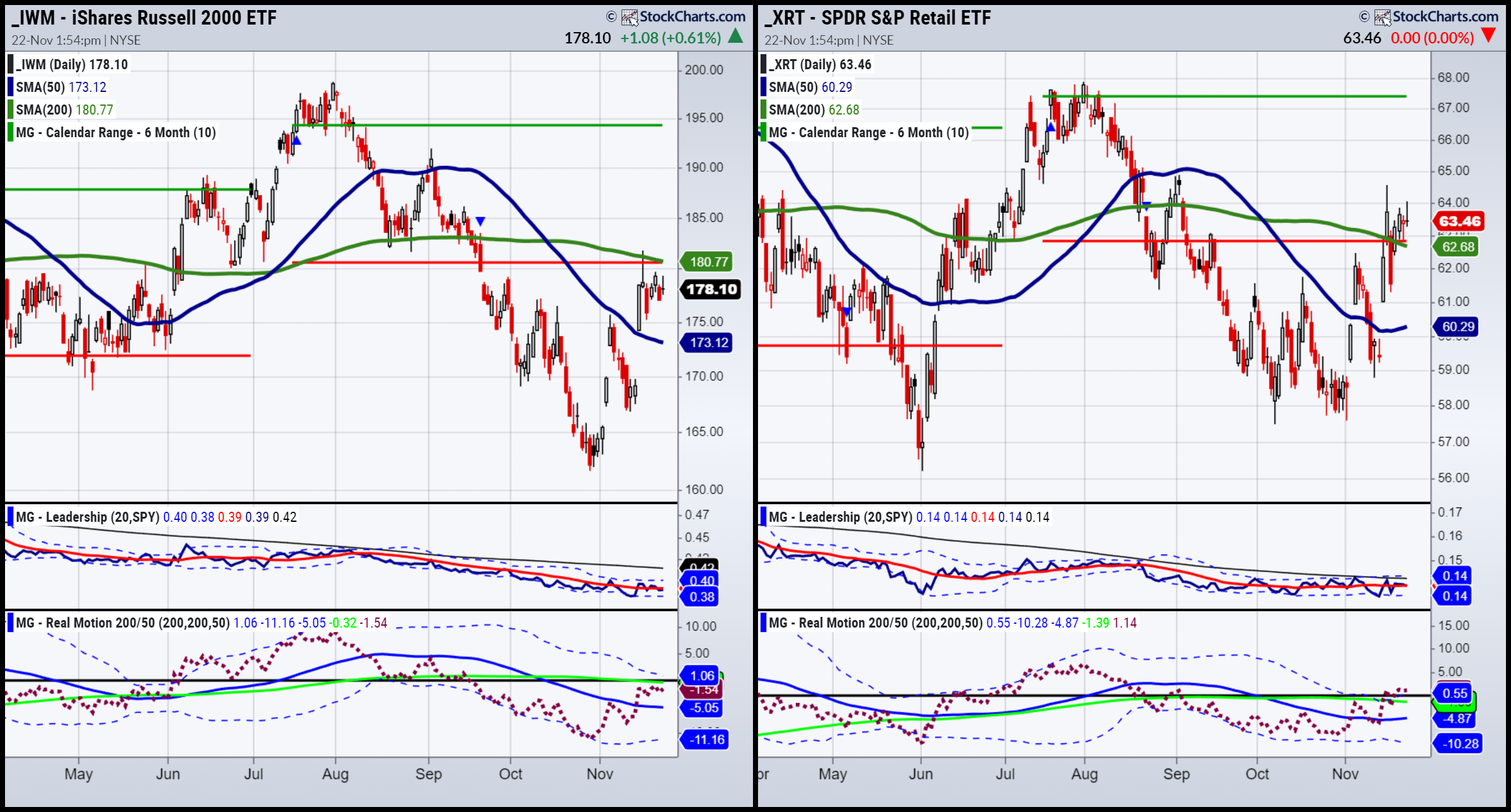

Beginning with our patriarch and matriarch, we see 2 different phases, similarities in leadership and divergent momentum.

The () is in a recovery or recuperation phase. IWM trails behind the .

Momentum matches the price movement. Both momo and price are struggling to clear key resistance.

Furthermore, Granddad remains under the July 6-month calendar range low, certainly not a bullish sign.

Gramps’ holiday leans more toward underscoring the market madness we see in .

Granny Retail , has fared better since October 2023.

Granny is in an accumulation phase. She is slightly outperforming the SPY and her momentum is gaining traction.

Granny is well beneath the July 6-month calendar range high but has managed to clear back above the July 6-month calendar range low.

The consumers’ holiday mindset is one of cautious optimism.

In Home for the Holidays, it is up to the mom and dad to hold the family together.

Hence, if we look to Granddad and Grandma to hold our economic modern family together, we must also examine the impact, or lack thereof, that relationship has on some of the other key family members or their grandkids.

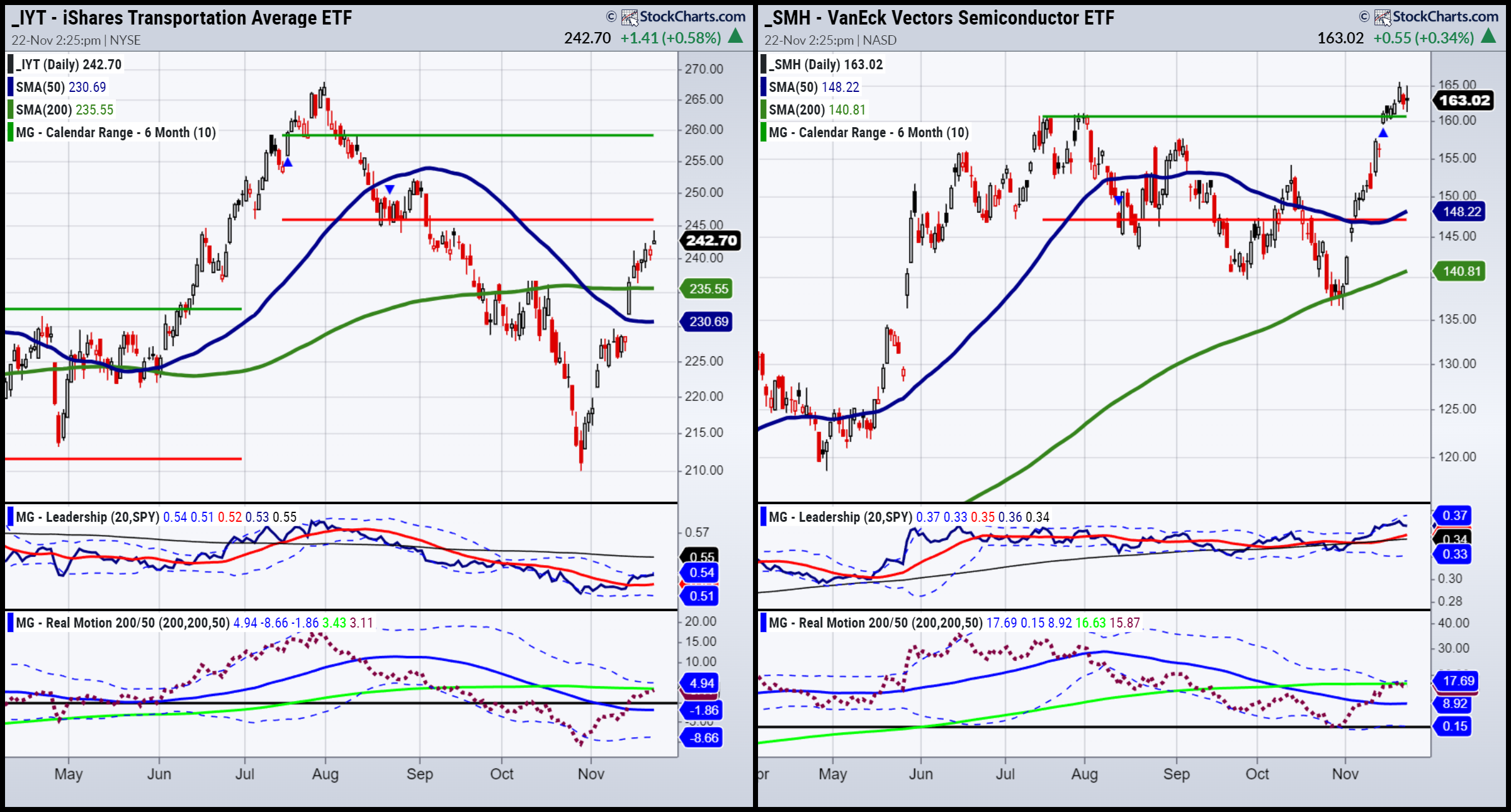

Conveniently, Tommy in the film is a good representative for our Transportation brother. Side note-The dad in the film is a retired airport maintenance man.

Tommy is complicated. His cracked sense of humor disguises a softer heart.

In IYT, our “Trains, Planes and Automobiles,” speaking of movies, is also complicated.

Through strikes, inflation, higher rates, and economic slowdowns, IYT is looking for love.

In an accumulation phase, IYT has a way better performance relative to the SPY.

Yet, IYT remains in a downtrend, under the July 6-month calendar range low.

Momentum is in a bearish divergence to price as it has yet to clear its 200-DMA while price has.

Is IYT more inclined to lead or follow from here?

That is a big question and one that we should watch for the answer to so we can assess if this rally is sustainable.

Sister Semiconductors can be compared to the Holly Hunter character in Home for the Holidays.

In the film, Holly Hunter supplies the point of view. And, like SMH, she tells us that the mania we see is not anything new.

SMH is rallying beyond the rest of her family, clearly NOT for the first time.

The question is, can SMH continue holding up given her grandparents and sibs remain mixed up?

SMH is in a bullish phase. It is trading in an uptrend above its July 6-month calendar range high.

SMH outperforms SPY. BUT momentum shows us a bearish divergence.

On Real Motion, the phase is recuperation as opposed to bullish in price.

Furthermore, the red dots which exhibit momentum, are below the 200-DMA and have a sell-side mean reversion.

If you put these four charts all together, we get a reunion that is filled with the makings of a family breakdown.

While Granny XRT and Sister Semiconductors SMH give us investors reasons to feel good about gorging ourselves, the rest of the Family (IWM IYT) remind us not to eat what we cannot digest.

ETF Summary

- S&P 500 (SPY) 450 support 465 resistance

- Russell 2000 (IWM) 181 resistance 174 support

- Dow (DIA) 360 resistance 346 support

- Nasdaq (QQQ) 388 now pivotal support

- Regional banks (KRE) 45 big resistance

- Semiconductors (SMH) 160-161 pivotal support

- Transportation (IYT) 235 support

- Biotechnology (IBB) 120 pivotal

- Retail (XRT) 65 resistance and 60 pivotal support