Can Nickel, Palladium Catch Up to Gold and Outperform in 2024?

2023.12.21 05:26

- The metals market has seen divergent returns as oversupply has impacted Nickel and Palladium

- On the other hand, iron ore and gold prices have fared much better, sitting on double-digit YTD gains.

- Nickel is currently struggling with oversupply, while Palladium, unaffected by recent sanctions, eyes a potential short-term surge to $1,600.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn more here

The past year in the metals market has witnessed divergent price movements. While energy and agricultural commodities have experienced consistent price declines relative to the beginning of the year, metals show clear disparities.

On one hand, we observe gains in the range of 11-14% for , while and have lost 44% and 33%, respectively.

The primary reason for such significant declines is the considerable oversupply of these metals, particularly influenced by the automotive industry.

What prospects lie ahead for Nickel and Palladium in the upcoming year?

Central Bank Policies Have Put Prices Under Pressure

Central Bank policies matter concerning metal prices. Monetary policy, alongside overall demand and supply levels, is a key factor influencing metal prices.

In a high-interest rate environment, a strengthening , and a weakening economic outlook, the metal segment is particularly vulnerable to price declines, as observed in metals commonly used in industrial applications.

Conversely, easing policies and potential interest rate cuts make the US dollar theoretically cheaper, favoring demand.

However, this assumption may not hold if rate cuts are a response to a potential recession and economic slowdown, which ultimately reduces industrial demand.

From this perspective, 2024 appears optimistic. A scenario where both Europe and the US avoid a deep recession, coupled with deflation and interest rate cuts, aligns with a soft landing.

Assuming an economic rebound in the second half of the year, global monetary policies may support commodity price growth.

Nickel: Oversupply to Push Prices Even Lower?

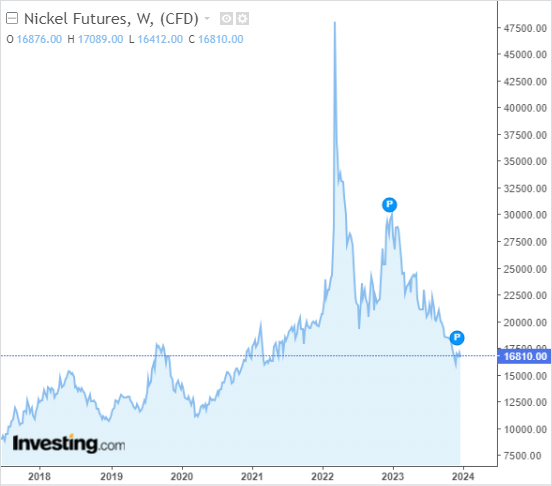

After nickel prices shot up last March following Russia’s aggression against Ukraine, we have seen a consistent downward trend, which has pushed prices to their lowest levels since the first quarter of 2021.

Nickel Weekly Chart

The reasons for this are lower-than-expected demand for electric cars mainly in China and a large oversupply of the raw material due to a strong 31% increase in Indonesian output in January-July 2023.

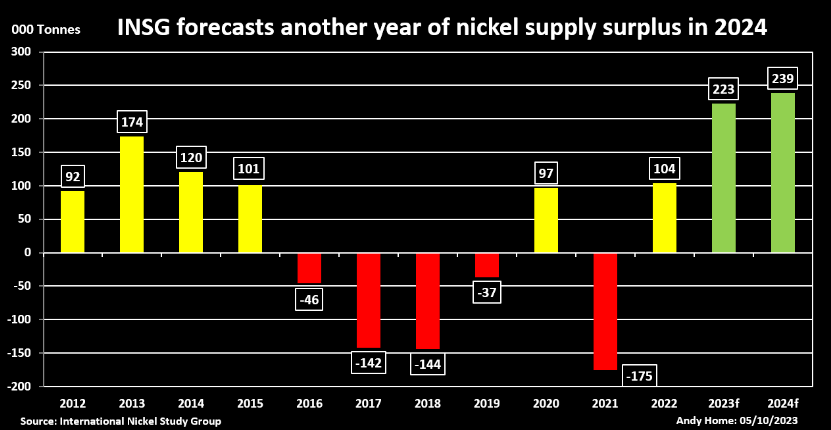

According to the International Nickel Study Group, the surplus next year could be as high as 239,000 metric tons.

Nickel Demand and Supply Balance

Nickel Demand and Supply Balance

Source: INSG

While downward pressure may continue over the next several months, in the longer term from 2025 the demand side should accelerate and balance the oversupply.

Palladium: Sanction Loopholes to Boost Prices

Palladium is one of the rarest metals, which significantly limits its supply.

On the demand side, the main consumer is the automotive industry, which generates more than 80% of global demand mainly through the production of catalytic converters.

Counting from the beginning of the year, Palladium quotations, like Nickel, are losing, reaching the lowest levels since 2018.

Palladium Price Chart

However, the upward impulse of the last five days, which resulted in a rebound of less than 25%, attracted attention.

This is due to the decision of the United Kingdom to impose another package of sanctions on Russia, from which Palladium was specifically excluded.

Under these conditions, the commodity’s valuation has a good chance of starting a rally, which from a technical perspective has a chance of reaching as high as $1,600 in the short term.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users.

Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Join now and never miss another bull market by not knowing which stocks to buy!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.