Bubble Denial

2022.09.28 16:54

[ad_1]

Investors have an ability to delude themselves for extraordinary lengths of time.

For instance, the worst annual performance for investment grade corporate bonds occurred in 2018. It was a minuscule -3.8% loss for IG corporates (via iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:)).

Here in 2022? IG corporates are down approximately -22.0%.

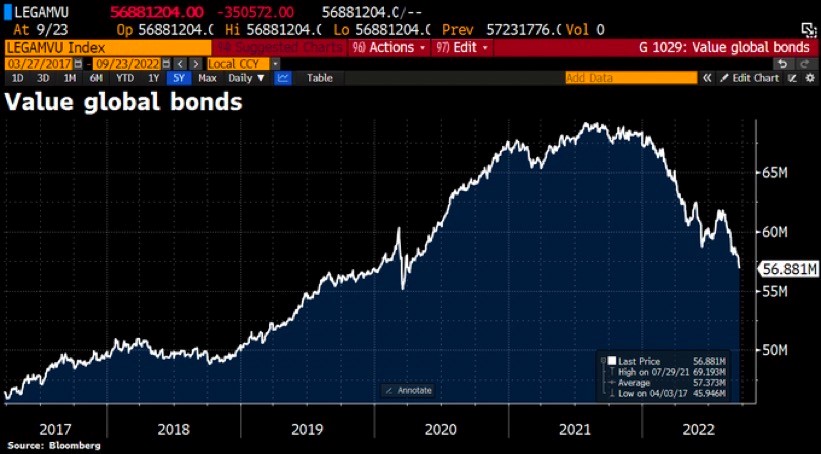

The global bond market has suffered in similar fashion. Few ever could have imagined the bond carnage clear across the world.

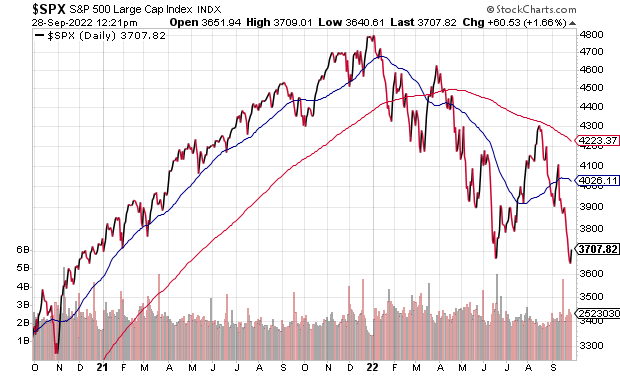

In a similar vein, the bulk of the financial media told people that the bear for stocks had ended in June. It did not. Stocks in September fell below previous summertime lows.

Nevertheless, a relief rally is likely. Sentiment has been so awful, nearly any piece of “they’re bailing us out” news will send stocks back up.

Note: The Bank of England (BOE) did just that today (9/28) by defending its long-dated sovereign debt as well as stabilizing its currency by purchasing its own longer-term maturities.

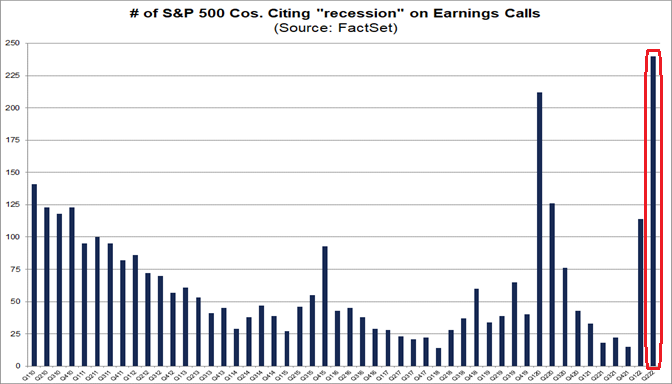

However, if one steps back just a bit, he/she should realize that the coming recessionary pressure will damage the earnings of corporations. Until now, price losses have largely been a reaction to the Federal Reserve’s aggressive fighting campaign. Yet, Wall Street analysts have yet to fully account for a wave of profitability concerns for most publicly listed entities.

Consider the following realities for corporate profitability:

1. Higher interest rates mean debt servicing takes a bite out of the bottom line.

2. Tax rates that are no longer falling can no longer boost profits going forward.

3. Recessionary pressure and/or stagflation also hurt(s) corporate earning power.

4. Higher labor costs mean lower profits as well.

In aggregate, when the “E” in P/E is going down, even prices that are 20% off their highs will prove to be “overvalued.”

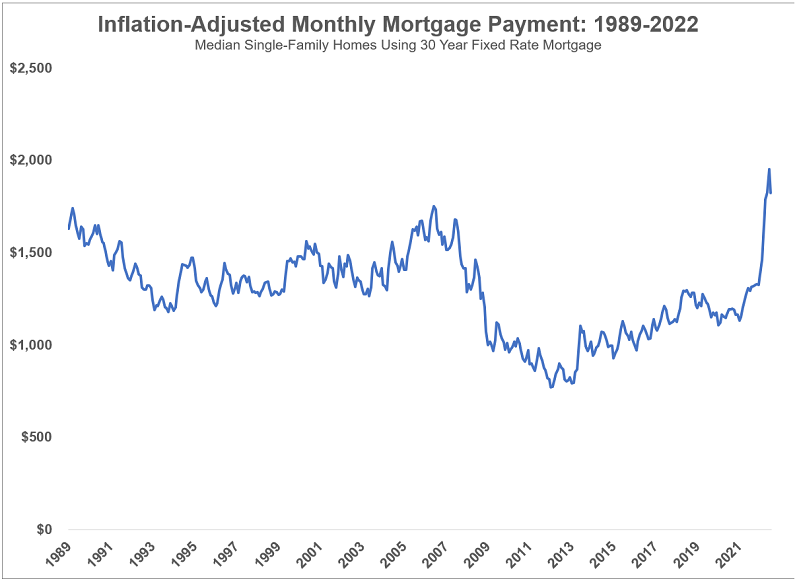

Well, surely the housing market could not represent a bubble that is about to burst? Unemployment is exceptionally low. Loan quality is rock solid. And real estate is a hedge against inflation.

More Bubble Denial.

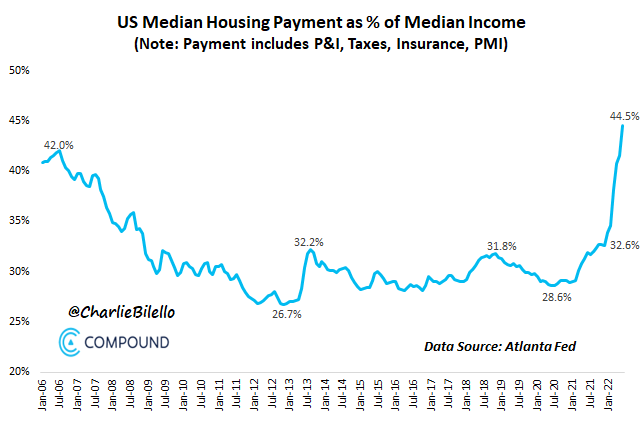

Inflation-adjusted mortgage payments have never been higher. Ever. And when you incorporate taxes as well as insurance, the median housing payment is worse than it was during the heart of the mid 2000s real estate bubble.

Inflation-Adjusted Mortgage Payment

Inflation-Adjusted Mortgage Payment

US Median Housing Payment/Medium Income

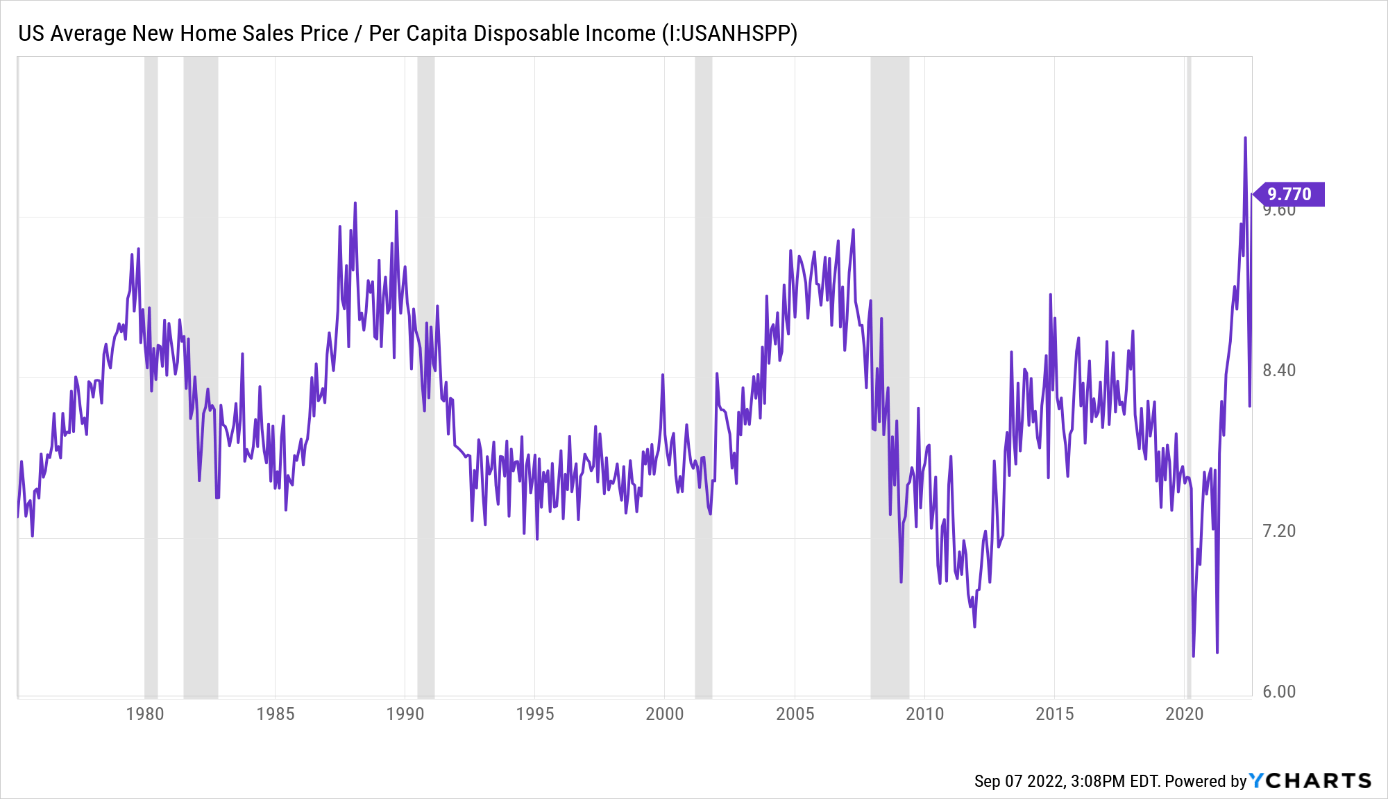

There is yet another way to look at the unaffordability dilemma. Currently, new properties sell for 10x disposable income. That ratio is the highest that it has been at any previous point in the last 50 years. (Absent ultra-low interest rates, people simply cannot afford to buy anymore.)

US Average New Home Sales/Income

US Average New Home Sales/Income

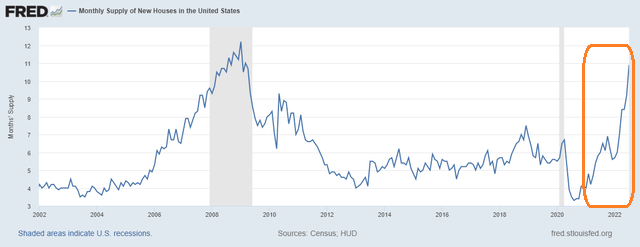

But Gary… there’s no inventory. There are no properties to sell anyway.

Look again. In July, there were 11 months of supply… a bona fide glut. Excess supply will require price cuts just to get supply and demand back in line.

Monthly Supply Of New Houses In The US

Well, people have great mortgages. They’re not going to sell or cut prices in existing homes. They’d only be shooting themselves in the foot if they give up a current low rate mortgage.

Maybe so. Yet many can still move out of state or downsize or move to a new property where incentives help with the interest rate issue. In some states, those over 55 can take their mortgage rates with them. Still others may not have a choice if they lose their jobs as the Fed continues to fight inflation and force corporate layoffs.

Not so sure? According to Zillow and Case-Shiiler, the price declines are already starting.

[ad_2]

Source link