BoJ Hikes but Fed Could Make a Dovish Tilt

2024.07.31 07:04

- BoJ announces rate hike and bond tapering

- Focus turns to US data and the Fed

- Australian CPI fails to record a significant downside surprise

- Gold and oil jump higher due to Middle East developments

BoJ Hikes Rates and Announces Bond Tapering

The Bank of Japan confirmed market expectations and announced a 15bps rate hike earlier today. This is the second tightening move after the March 10bps hike. Citing stronger services inflation, a positive annual change in import prices, solid wage growth and rising inflation expectations, seven members of the policy board voted in favor of the rate hike.

Despite the hawkish commentary, the quarterly BoJ projections saw little change with the exception of the rate excluding fresh food revised higher to 2-2.3% for 2025, a significant jump from April’s forecast for an 1.7-2.1% increase.

As preannounced, it was unanimously agreed to gradually taper the pace of the monthly bond purchases with a target to buy around 3 trillion yen in April 2026. The BoJ intends to review the plan and adjust it, if deemed necessary.

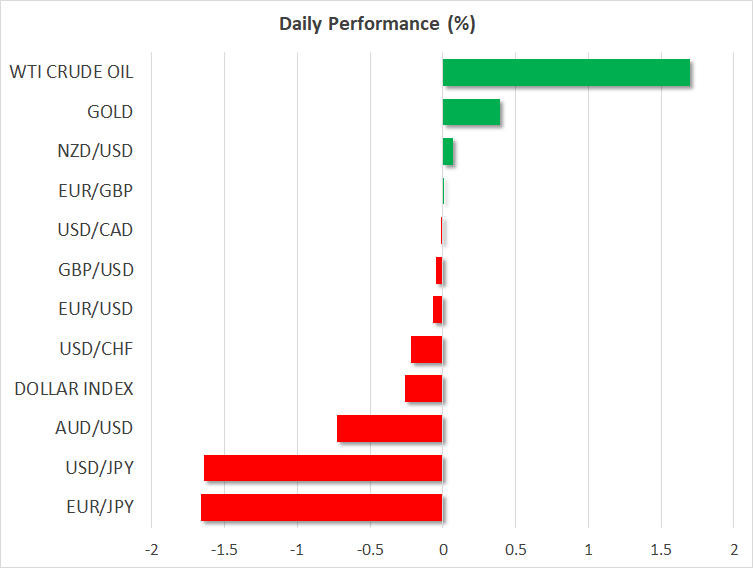

The yen was in the red earlier today against the , as the rate hike was essentially priced in by the market and a more aggressive reduction of the bond purchases was probably expected.

However, the new top FX diplomat at the Ministry of Finance has apparently opted for a more aggressive strategy of currency interventions compared to its predecessor, pushing to the lowest level since mid-March.

Fed Meeting Today but Key US Data First on the Menu

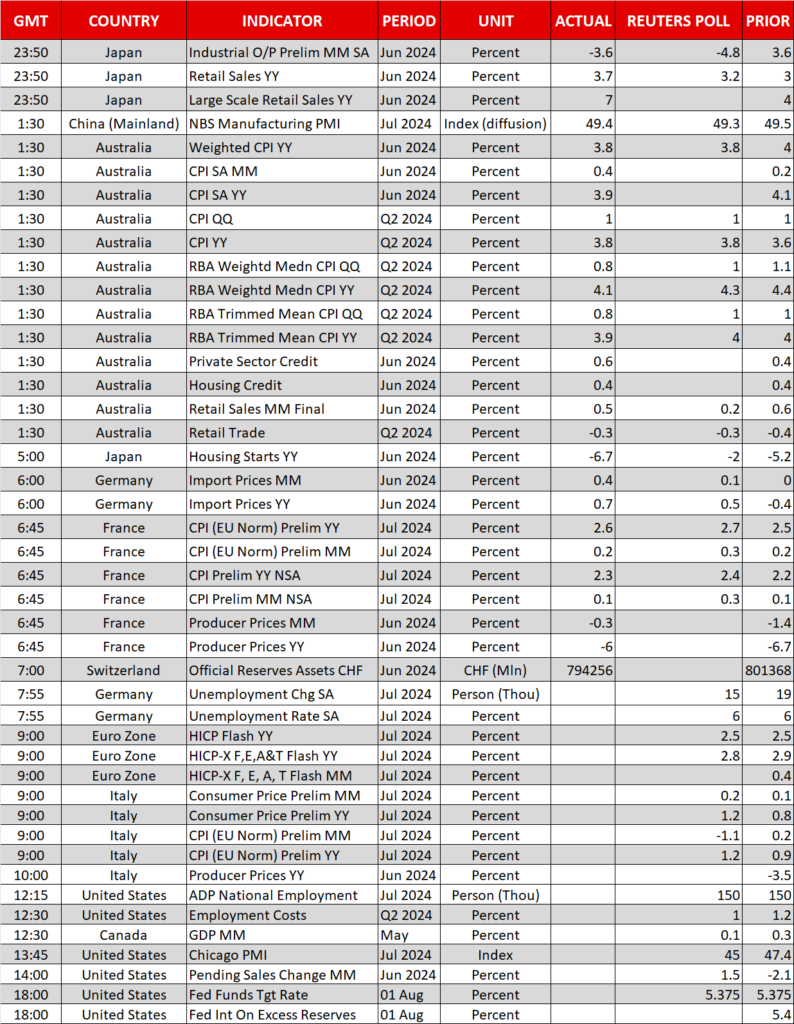

The focus later today will turn to the US as the will be published at 12.15 GMT and the Fed will announce at 18.00 GMT its decisions after the two-day meeting. The market is expecting a 150k increase in the former, unchanged from the June print, a result that doesn’t point to a significant softening in the US labor market.

More importantly, barring a major surprise, the Fed is not anticipated to announce its first rate cut today. However, the market is eagerly waiting for any signs regarding the September rate cut that is currently fully priced in the market.

The latest data has been mixed but several officials, including Chair Powell, have highlighted that the data are bolstering their confidence that price pressures are on a sustainable path to remain low.

Having said that, the chances of a dovish shift remain low, which could, in the margin, disappoint the market, keeping stocks under pressure. The Fed will have more opportunities to announce its rate cut intention starting with the Jackson Hole symposium in late August.

However, should Chairman Powell et al feel that it is the correct moment to pre-commit to a September rate cut, we could see the dollar underperforming against the euro, but US stocks are probably going to benefit.

Following yesterday’s mixed Microsoft (NASDAQ:) results, Meta (NASDAQ:) will report its earnings for the second quarter of 2024 after the market closes.

Australian CPI Remains a Problem for the RBA

While most central banks are announcing rate cuts or preparing for the first crucial easing step, the RBA is still facing elevated inflation. The monthly June CPI figure, and more importantly, the Q2 inflation report failed to surprise to the downside with the notable exception of the trimmed mean CPI. Coupled with the stronger retail sales, the door remains open for a rate hike at next week’s gathering despite the market reacting negatively to today’s figures and pushing the to a 3-month low against the dollar.

Middle East Development Result in a Bid for Gold

Following the assassination of Hamas’ political leader, a possible retaliation to the weekend’s attack in the Golan Heights, and are trading higher.

The former has managed to reclaim the $2,400 level and it now looks on course to test last week’s local peak at $2,431.