Balance Sheet Recession Looms for Chinese Economy

2023.06.23 03:43

China’s economy is seemingly stuck. And it shouldn’t come as a surprise.

The Chinese consumer is anemic. Debt has soared. Deflation mounts. Private business investment is eroding. Youth unemployment is at historic levels. And banks are squeezed at record-low margins while dealing with increasing non-performing loans.

It’s clear that things don’t look good. And while many pundits touted the ‘reopening’ as a boon for the global economy, they clearly weren’t looking at China’s severe structural imbalances.

I’ve touched on some of China’s (BRICS in general) imbalances before (read here). But there’s a bigger problem mounting now.

And that’s the risk of falling into a balance sheet recession (BSR).

And because of this balance sheet recession, China’s recent interest rate cuts may not work.

Instead, it will likely only amplify the current imbalances.

Japan fell into this same problem back in the early-1990s. And so did the West after 2008. And monetary easing proved pretty useless for growth (only created asset bubbles).

Now China appears to be on the same path.

So, let’s take a closer look at all this. . .

What Exactly Is a Balance Sheet Recession?

Put simply, a balance sheet recession refers to an economic situation in which the main problem affecting an economy is the excessive debt burden of households, businesses, or both.

It’s a concept popularized by the economist – Richard Koo – and particularly focuses on the context of the economic challenges faced by countries stuck in deleveraging (repaying debt) and, thus, anemic credit demand.

In a balance sheet recession, the focus shifts from traditional demand-side factors – such as interest rates or government fiscal policy – to the balance sheets of individuals and companies (private sector).

Typically, these balance sheets are burdened with high levels of debt, often resulting from a speculative bubble in real estate or other assets that have burst, and consumers shy away from credit.

And during a balance sheet recession, the primary concern of households and businesses is to repair their damaged balance sheets by paying down debt rather than spending or investing.

And this results in reduced consumption, decreased business investment, and a lack of overall demand in the economy. As a consequence, economic growth becomes sluggish or negative, and unemployment may rise.

Sound familiar?

Now, monetary policy – which often involves lowering interest rates to stimulate borrowing and spending – becomes less effective in this situation because the focus is on reducing debt rather than taking on new loans.

Meaning if individuals are deleveraging (paying down debt) and avoiding new loans, rate cuts are meaningless.

“But isn’t paying down debt a good thing?”

Yes. In general, it is.

The problem here is when everyone does it at once.

This is known as the fallacy of composition – aka the error of assuming that what is true of a member of a group is true for the group as a whole.

So as individuals consume less to repay debts, the savings rate increases.

And when individuals and businesses save more and spend less, it reduces aggregate demand in the economy, leading to decreased consumption and investment. This, in turn, can contribute to a prolonged period of sluggish economic activity, deflation, and low growth rates.

Meanwhile, low demand for new loans causes interest rates to sink lower (if there are more savings than new loans, rates will decline until an equilibrium is found). Making it more difficult for central bankers to stimulate growth.

And on and on.

Thus because of this backdrop, China’s interest rate cuts will most likely only aggravate this dilemma.

Here’s why. . .

China Is Teetering Into A Balance Sheet Recession – And Rate Cuts May Make It Worse

In economic and monetary theory, when growth is sluggish, cutting interest rates should spur demand.

The idea is that ‘rational’ actors will take advantage of lower interest rates to further consume and invest.

But in the real world, it doesn’t work like that in many instances (just look at Japan and Europe).

In fact, cutting interest rates will likely make the imbalances worse.

There are two big reasons for this.

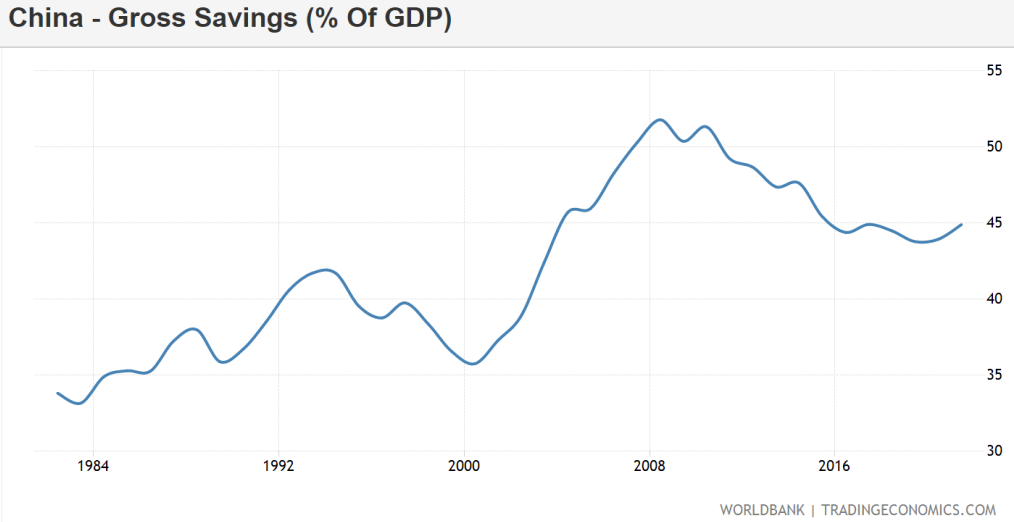

1. China has an excessively high gross savings to (gross domestic product) at 45%. Meaning that the Chinese save far more than they spend.

China Gross Savings (% of GDP)

China Gross Savings (% of GDP)

Because of Beijing’s focus on exports and SOEs (state-owned enterprises), consumer demand remains repressed so that there’s an ample pool of savings to fuel investment.

And while this worked when China was grossly under-invested in the early-2000s, they’ve now hit the law of diminishing returns. Meaning that much of the investment is unprofitable and wasteful.

China’s macro-leverage ratio – which hit an all-time high in Q1-2023 of 290% – indicates this.

To put this into perspective, if economic growth and returns were increasing in tandem, the ratio of debt to GDP wouldn’t be increasing.

This shows us that China’s economy is unbalanced and must instead focus on its own domestic economy. But so far, China has only stimulated further supply-side (exports and infrastructure). Making the problems worse.

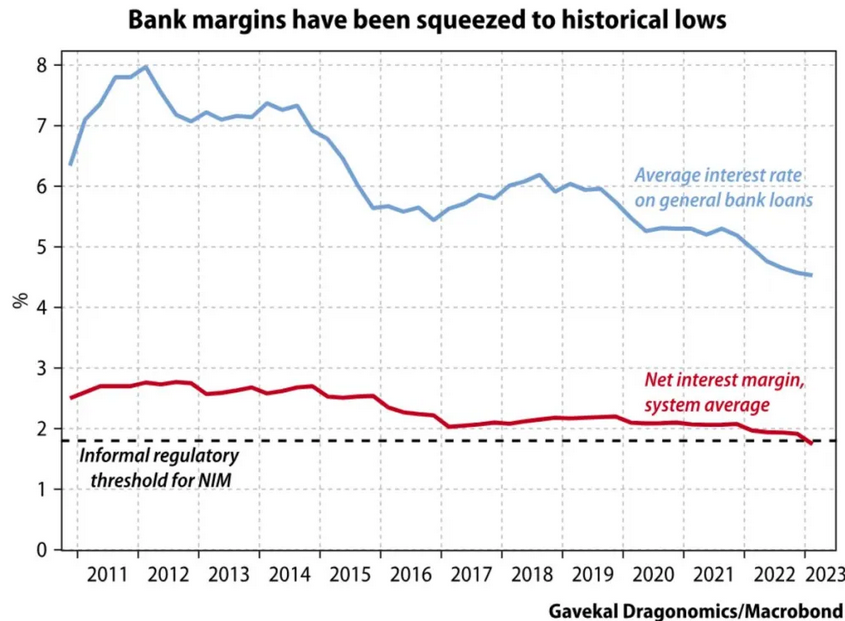

2. Chinese banks – already under stress – have seen their net interest margins (NIMs) sink to very low levels.

According to Bloomberg, Chinese banks’ NIMs have declined to just 1.74% as of Q1-2023.

This is important because NIMs are how banks make a profit (it’s the difference between loan incomes and the costs to lend).

Chinese banks have already seen increasing non-performing loans (NPLs) – hitting a record 3 trillion yuan in June 2022. And Moody’s expects this to only increase over the next one-to-two years.

“New NPL formation will likely remain high amid the challenging adjustment to the exit from zero-COVID,” the report said. “We expect banks to steadily dispose of bad debt over the next 12-18 months to keep the NPL ratio stable at the current level of 1.63%.”

So in theory, lower deposit rates should help bank NIMs. But in an environment with rising toxic debt and unprofitable investment, it may make things worse.

The bigger issue here is that because of the high gross savings – lower deposit rates will generate less returns for consumers. Thus weighing down their spending further (as we saw in Japan and Germany).

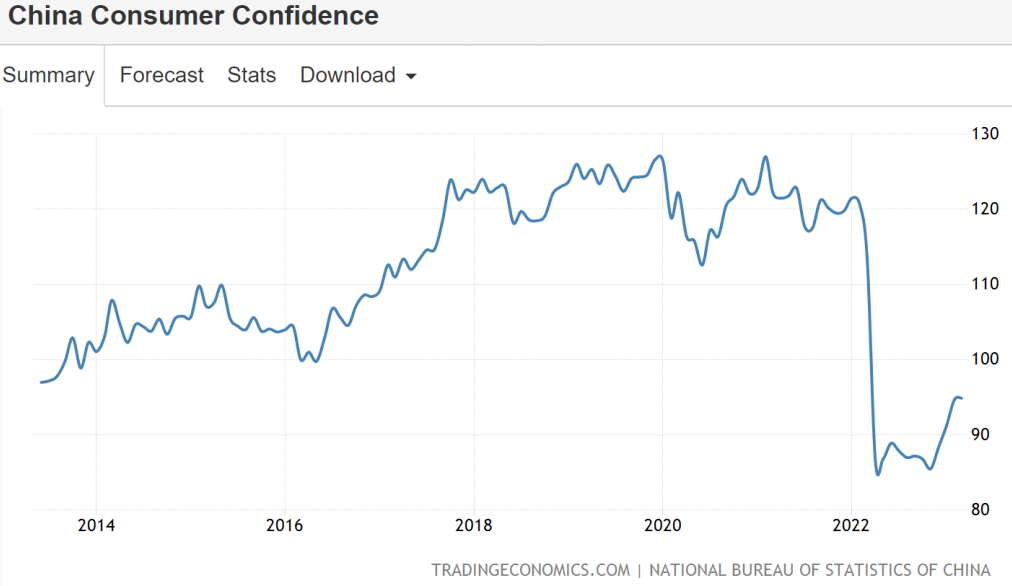

Chinese consumers are already dealing with weak confidence. And although it’s rebounded after reopening, it’s still relatively low.

China Consumer Confidence

China Consumer Confidence

This anemic consumer confidence combined with lower returns on savings may tip households into further hoarding. Meaning they shy away from new credit and spending.

And this is what we’ve seen.

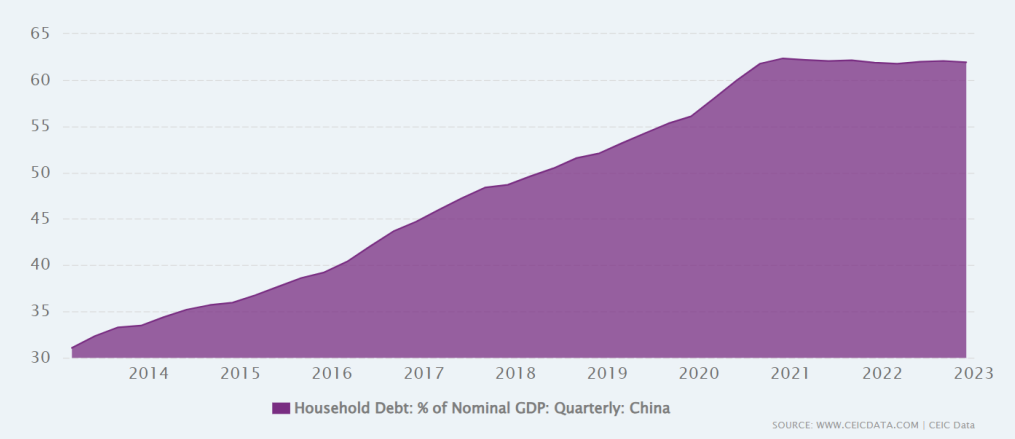

China’s household debt-to-GDP is already relatively elevated at 63% as of Q1-2023. But it’s been essentially flat for three years straight (after more than doubling over the previous decade).

China’s Household Debt-to-GDP

China’s Household Debt-to-GDP

It appears that the appetite for credit among consumers has declined as property prices began falling – leading to more saving and deleveraging.

It’s important to note that China lacks the social safety nets that places like the U.S. have. Meaning they have weak social security programs, no 30-year fixed mortgages, etc.

Thus individuals must save more (consume less) to prepare for retirement and healthcare costs later in life.

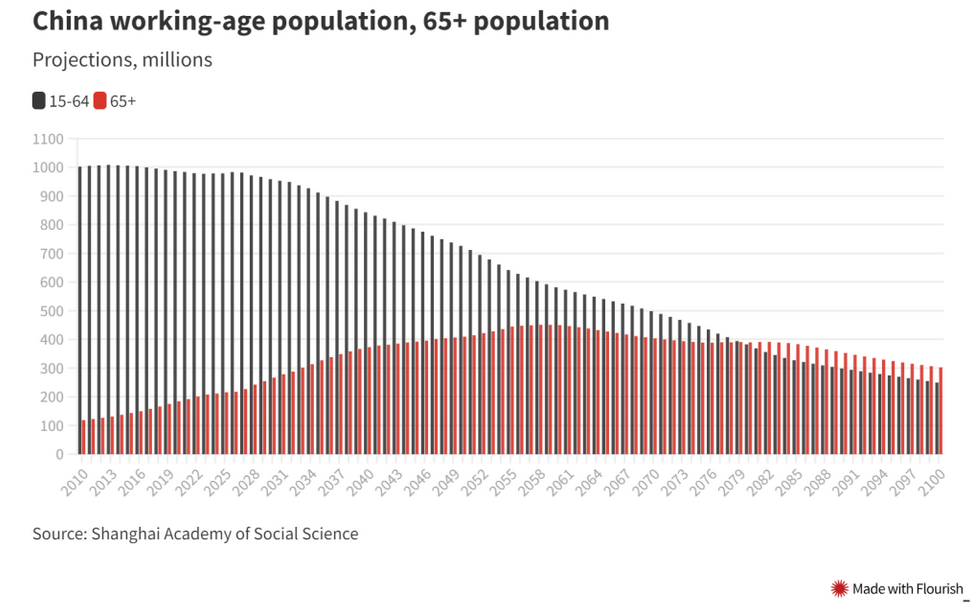

And since there’s a surging number of Chinese retiring in the coming decades, this savings trend looks to only increase.

China Working-Age Population

China Working-Age Population

With this backdrop in mind – an aging population paired with risk aversion – cutting interest rates may prove useless. And instead, make things worse.

This is very similar to what happened in Japan. Leaving the Bank of Japan pushing on a string.

Thus China must find a way to do two things – revive consumer confidence and stimulate domestic demand.

But things look to be going in the opposite direction.

For instance, the dollar-to- conversion has increased by 7% over the last year. Meaning that the yuan has depreciated significantly.

Remember, this is a tax on the Chinese consumer as it raises the costs of imports and subsidizes exports.

China’s manufacturing exports to GDP are already around ~15%. Meaning they are offloading a massive amount of unconsumed goods abroad.

If China wanted to promote greater domestic demand, it must allow the yuan to rise, run deficits, restructure bad debts, and stimulate wage growth. Essentially policies that promote domestic consumption compared to exports.

But with such structural imbalances, it would prove extremely difficult politically and cause economic pain in the short term. Neither things Beijing wants to deal with.

Thus the risk here is that the longer this current situation goes on, the more entrenched a balance sheet recession becomes (as we learned from Japan).

Things look very fragile in China.