Aussie Climbs Despite Weak Mfg. Data

2022.11.02 18:40

[ad_1]

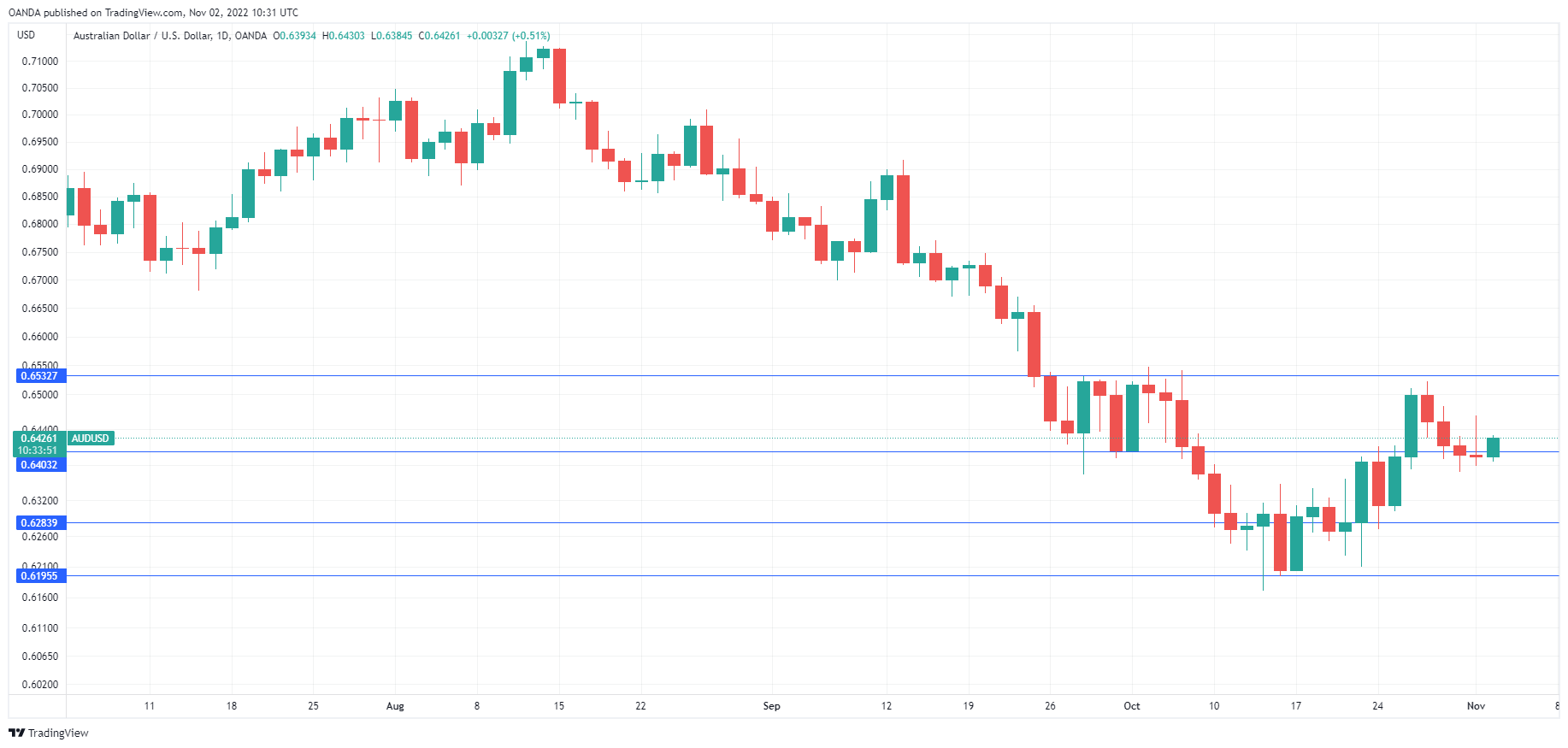

has posted strong gains today. In the European session, the Australian dollar is trading at 0.6424, up 0.48%.

The Australian dollar rose as much as 0.80% after the Reserve Bank of Australia raised rates by 25 basis points on Tuesday, but couldn’t consolidate and ended the day virtually unchanged.

Lowe urges caution

The RBA rate hike raised the cash rate to 2.85%, its highest level since April 2013. The RBA has raised rates by a steep 275 basis points since May but has now downshifted, with small increases of 25 bp in October and November. The slower pace is noteworthy because remains red-hot. Governor Lowe said on Tuesday that he expected to raise rates further in order to tame inflation, and acknowledged that the central bank was on a “narrow path” which required “striking the right balance between doing too much and too little.”

Inflation remains the RBA’s number one priority, even if the price is a recession. At the same time, Lowe is well aware that soaring inflation and high interest rates are taking a toll on businesses and households, and Lowe seems eager to limit rate increases to 0.25% or even pause, if possible. The RBA’s rate policy will be data-dependent, and so far the economy has shown that it can withstand steep tightening. Still, there are signs of a slowdown, such as in manufacturing. The October PMI slowed to 49.6, down from 50.2. This marks a third successive month of flat results, with readings close to 50.0, which separates expansion from contraction.

All eyes are on the Federal Reserve, which winds up its 2-day policy meeting later today. The Fed is widely expected to hike rates by 0.75%, which would bring the benchmark rate to 4.0%. The Fed is likely to raise rates to 5% early next year, which means the tightening cycle will continue into 2023. Investors will be listening closely to Fed Chair Powell’s comments, looking for clues as to whether the Fed plans to ease in December, or will we see another 75 bp hike.

AUD/USD Technical

- AUD/USD continues to test resistance at 0.6403. Above, there is resistance at 0.6532

- There is support at 0.6283 and 0.6196

Original Post

[ad_2]

Source link