Are Gold and Silver Getting Ready to Roar?

2023.03.15 03:21

Folks are calling the FED opening swap lines on the entire US Banking deposit base to the tune of $17.6 trillion as QE infinity.

Moody’s cut its outlook on the banking system to negative, saying that it is a rapidly deteriorating operating environment.

The market generally focused on the .

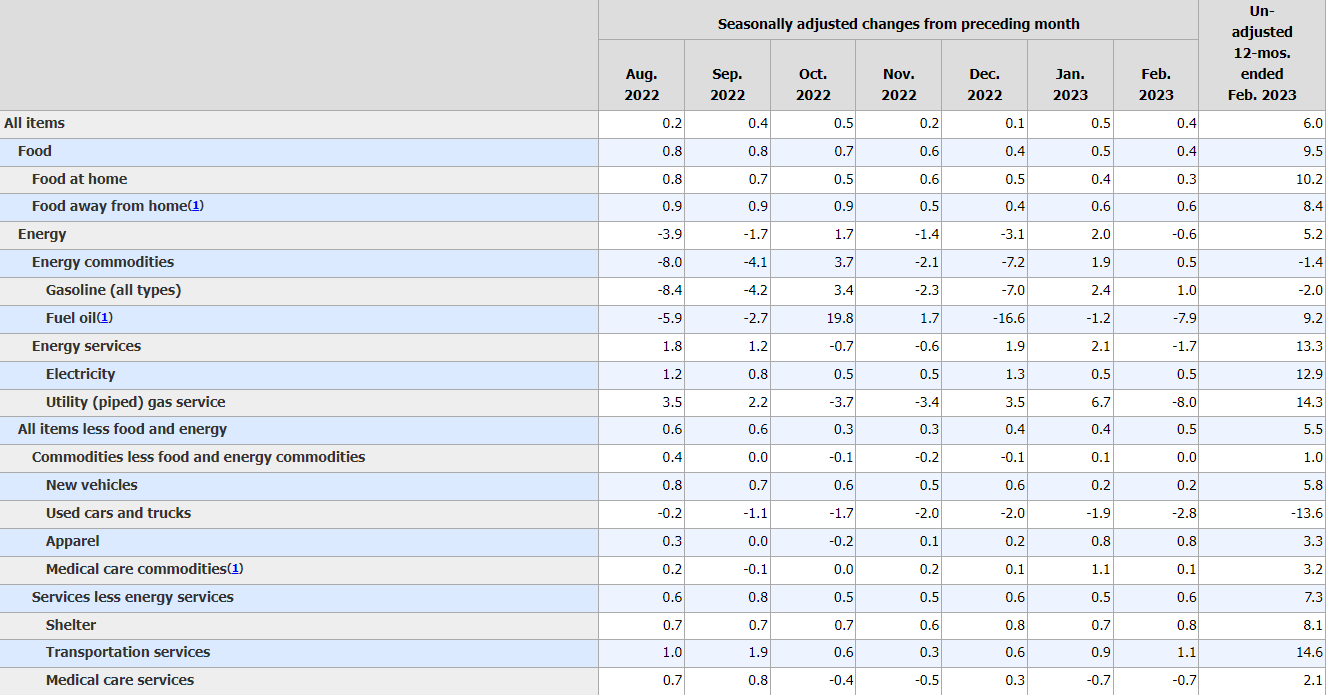

CPI came in as expected at 6.0% and softer. though, came in at 0.5%, a little higher.

The chart shows you the areas of inflationary growth versus decline. Nevertheless, the metals shone all around.

Our GEMS Global Macro or Global ETFs Stocks Macro and Sectors model signaled a buy in gold last week.

Now, gold miners, based on the strength of this sector, signaled. Monday’s reported on the reasons to watch the -to- ratio.

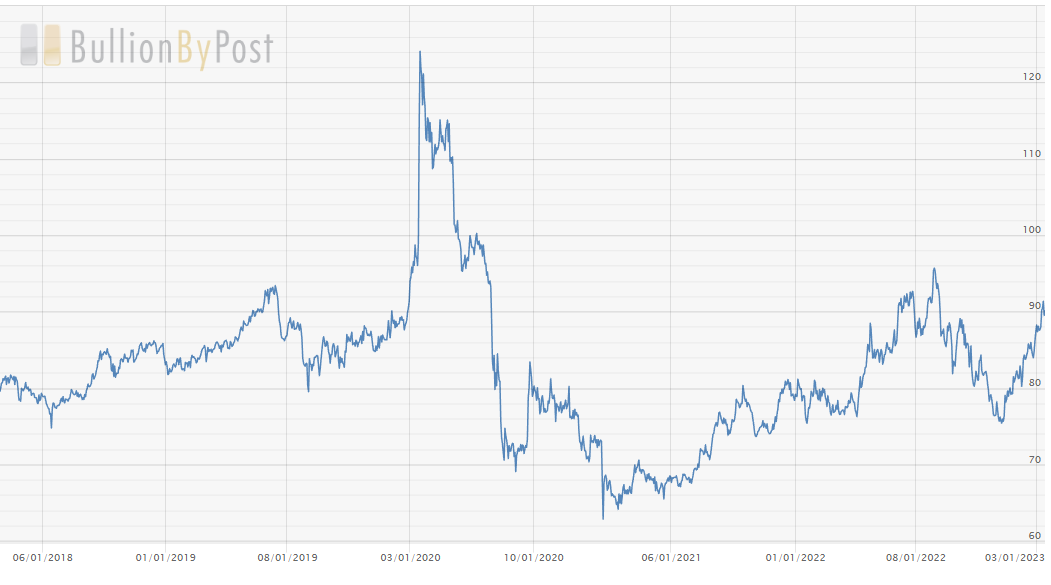

A 5-year historical look at the gold-to-silver ratio shows a move over 90 (bullish), while our Leadership indicator shows silver equally performing the gold.

That tells us that the precious metals are getting ready to roar.

Even with oil prices falling today, GDX (NYSE:) held steadfast. GDX now outperforms the .

Momentum has a positive divergence where the red dots are not in line with the 50-DMA (blue line).

Meanwhile, the price sits below its 50-DMA yet well above the 200-DMA or in a caution phase (an improvement from a distribution phase.

Should the price clear the 50-DMA in price, the phase returns bullish.

ETF Summary

- (SPY) 390 remains highly pivotal, especially on a closing basis

- Russell 2000 (IWM) Calendar range support level at 172.00 and resistance 180

- Dow (DIA) 310 support 324 resistance

- Nasdaq (QQQ) 290 the 50-DMA support 294 the 50-WMA resistance

- Regional banks (KRE) Tested near the 50 resistance level and closed just slightly above 44 support

- Semiconductors (SMH) 240 pivotal support-strongest yet still below the 2-yr biz cycle

- Transportation (IYT) Confirmed the Distribution Phase and weak close under 219 trouble

- Biotechnology (IBB) 126.50 moving average resistance

- Retail (XRT) 60 big support and 64 big resistance