Another Week Of Across-The-Board Losses For Major Asset Classes

2022.09.26 12:27

[ad_1]

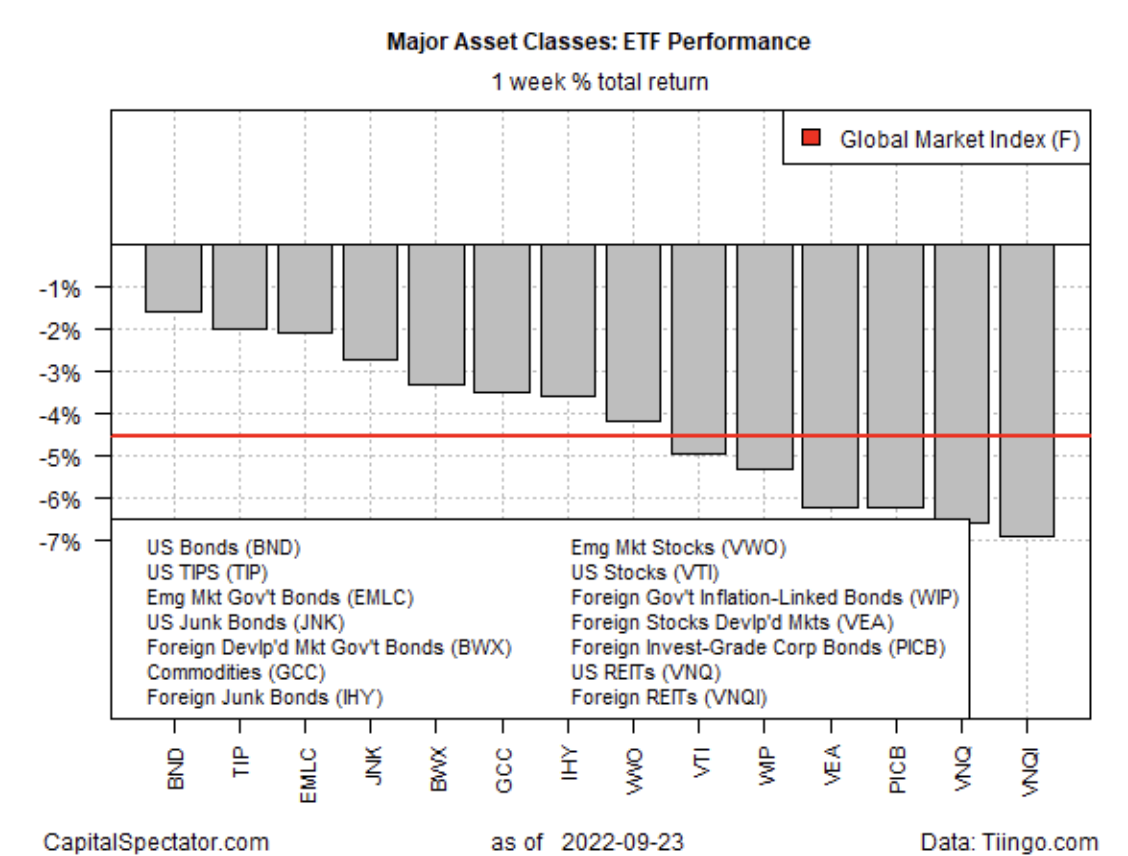

For a second straight week, all the major asset classes fell in trading through Friday’s close (Sep. 23), based on a set of ETF proxies. From bonds to stocks, along with real estate shares and commodities, red ink swept across global markets.

US bonds posted the softest loss, based on Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:). This broad portfolio of governments and investment-grade corporates fell 1.6%, marking the ETF’s sixth consecutive weekly decline.

The key catalyst, of course, is ongoing rate hikes by the Federal Reserve, which announced another hefty 75-basis-points increase last week. Fed funds futures are currently pricing a 70%-plus probability of a repeat performance at the next FOMC meeting on Nov. 2, according CME data

Peter Boockvar, chief investment officer at Bleakley Advisory Group, says:

“Bottom line, all those years of central bank interest-rate suppression — poof, gone.

These bonds are trading like emerging market bonds, and the biggest financial bubble in the history of bubbles, that of sovereign bonds, continues to deflate.”

The deepest loss last week: real estate shares ex-US: Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:) fell nearly 7%.

A second week of losses weighed on the Global Market Index (GMI.F), which fell 4.6% — the fifth weekly loss in the past six. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive index for multi-asset-class portfolio strategies overall.

Major Asset Classes 1-Week ETF Performance

Major Asset Classes 1-Week ETF Performance

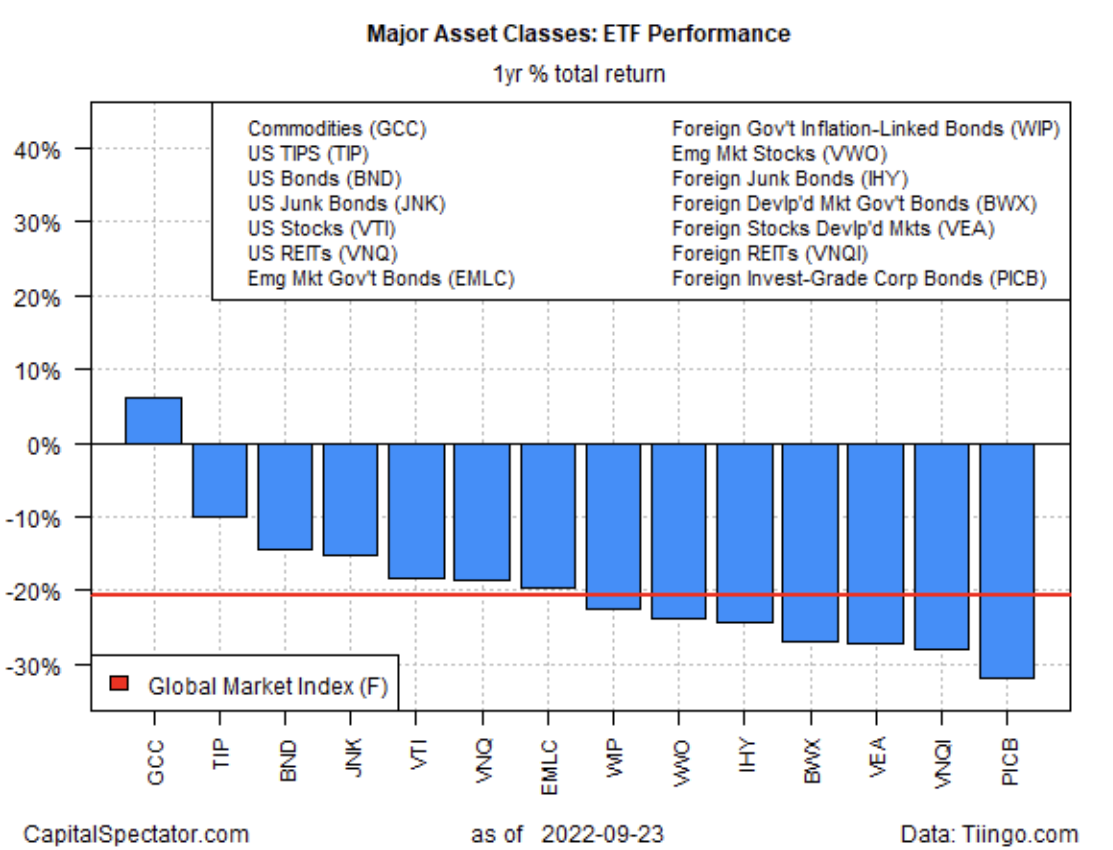

For the one-year window, commodities (WisdomTree Continuous Commodity Index Fund (NYSE:)) are holding on to a moderate gain — the only asset class that’s still up for this trailing period.

The rest of the major asset classes remain in the red. Foreign corporate bonds (Invesco International Corporate Bond ETF (NYSE:)) continue to post the deepest one-year loss: a steep 30%-plus decline.

GMI.F is down a bit more than 20% for the past year.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

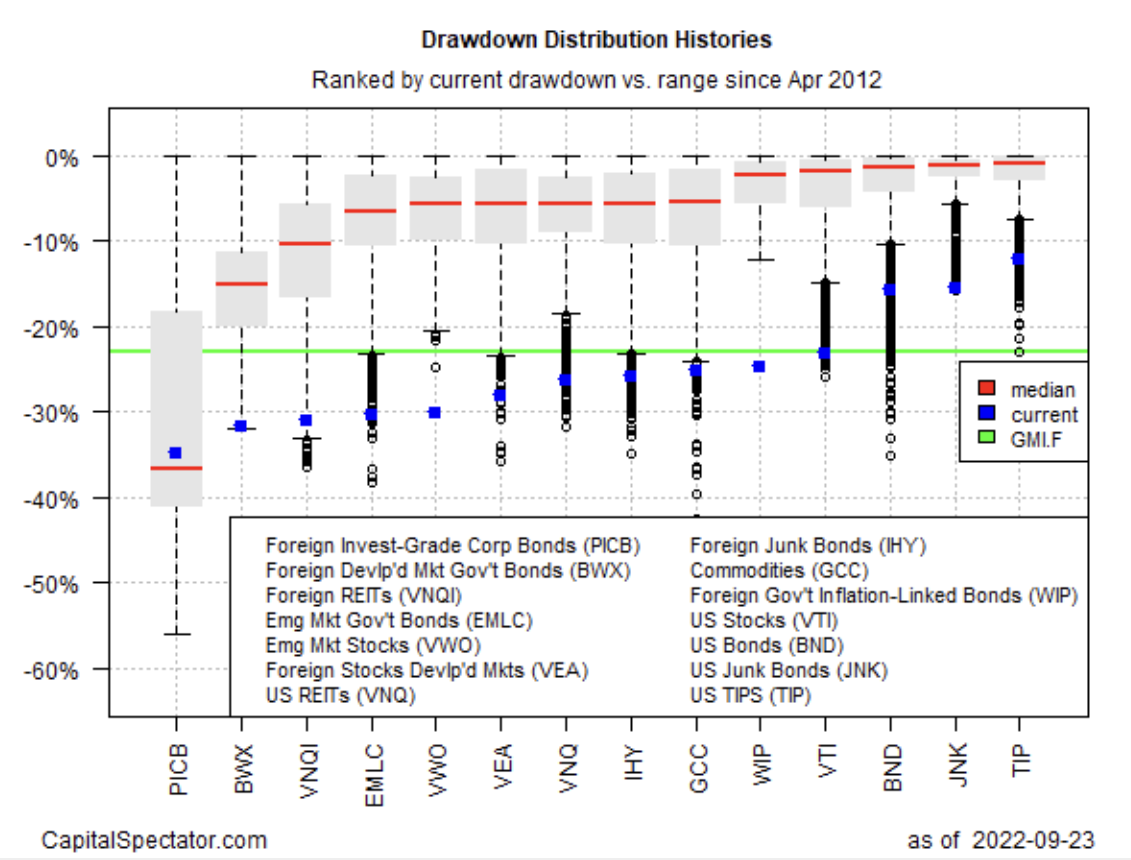

Using a drawdown lens to review price trends shows that all the major asset classes are posting peak-to-trough declines deeper than -10%. The smallest drawdown at last week’s close: a relatively modest 12.1% slide from the previous peak for inflation-protected Treasuries (iShares TIPS Bond ETF (NYSE:)).

GMI.F’s drawdown: -23.0% (green line in chart below).

Drawdown Distribution Histories

Drawdown Distribution Histories

[ad_2]

Source link