All Major Asset Classes Delivering Gains So Far in 2023: What Lies Ahead?

2023.07.31 08:39

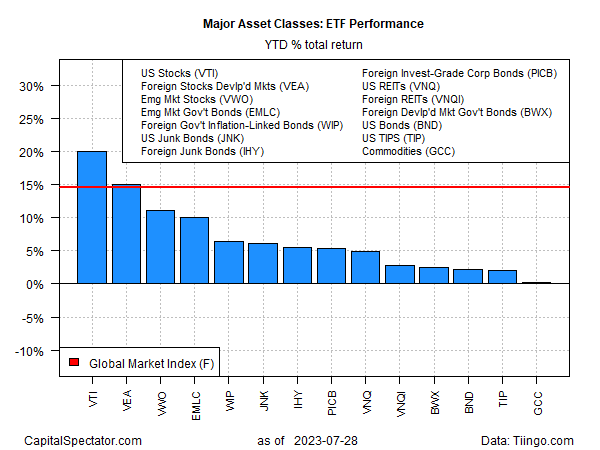

Commodities have joined the party. After last week’s rally that lifted a broad measure of commodities, all the major asset classes are now posting gains for the year to date through Friday’s close (July 28), based on a set of ETFs.

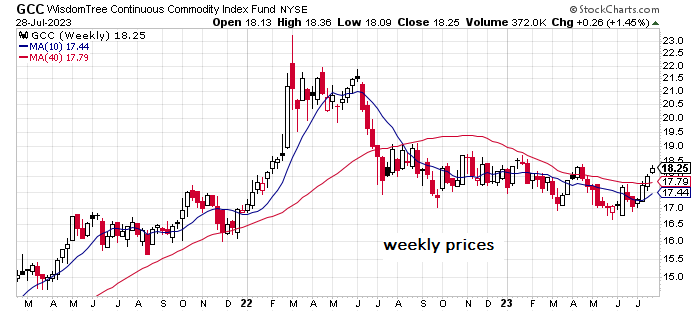

WisdomTree Continuous Commodity Index Fund (NYSE:) rose 1.5% in the past trading week. The gain marks the ETF’s fourth straight weekly advance, a boost that lifted the fund in positive terrain for year-to-date results, albeit fractionally, for the first time since April.

Several other broadly defined commodity ETFs are also posting year-to-date gains, including iShares S&P GSCI Commodity-Indexed Trust (NYSE:), which is up 1.0% in 2023.

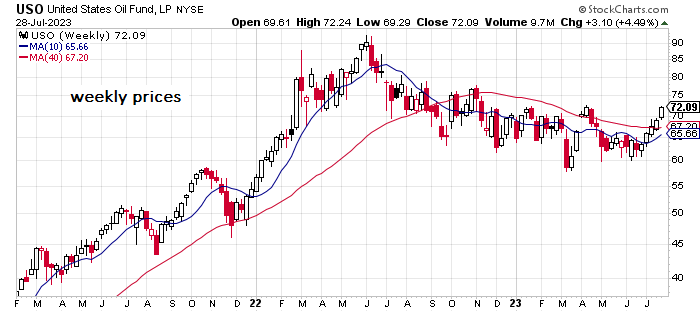

Higher energy prices have been a key driver of recent strength in broad commodity indexes. (), for instance, is on track to record its biggest monthly gain in more than a year.

“Oil prices are up 18% since mid-June as record-high demand and Saudi supply cuts have brought back deficits, and as the market has abandoned its growth pessimism,” note analysts at Goldman Sachs in a research note published July 30.

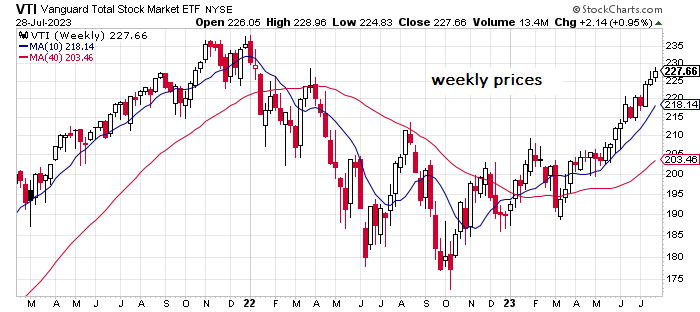

The renewed strength in commodities translates into across-the-board gains for the major asset classes. One thing that hasn’t changed: US stocks continue to lead global markets by a wide margin.

ETF YTD Total Returns

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:) has rallied 20.0% this year. Last week’s 1.0% gain for the ETF is the third straight increase, lifting the fund to its highest close since January 2022.

The Global Market Index (GMI) is also enjoying a strong year-to-date performance. GMI is up 14.6% through Friday’s close, a sizzling gain for a multi-asset-class benchmark. This unmanaged index (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios.

This year’s broad-based rally in markets suggests that most investment strategies are sitting on handsome gains, too, in no small part due to a solid tailwind. For strategies that are underperforming or underwater, the likely explanation is bad luck or incompetence. Any active strategy can suffer in relative and/or absolute terms, but it takes extraordinary effort to stumble at a time when everything’s rallying.