A Plunge in Short-Term Interest Rates Is in the Offing

2022.12.23 03:15

[ad_1]

Market interest rates always lead to Fed-controlled interest rates at important turning points. Therefore, when trying to figure out whether interest rates have peaked or troughed, don’t look at what the Fed is saying; look at what the markets are saying.

The above statement is illustrated by the following chart comparison of the Fed Funds Rate (the green line), an overnight interest rate totally controlled by the Fed, and the T-Note Yield (the blue line), a short-term interest rate that is influenced by the Fed but ultimately determined by the market.

The chart shows that at cyclical trend changes since the mid-1990s, the 2-year T-Note yield always changed direction in advance of — usually well in advance of — the Fed Funds Rate (FFR).

For example, focusing on the downward trend changes, we see from the chart that:

- The 2-year yield reversed downward in Q4-2018, and the FFR followed in mid-2019

- The 2-year yield reversed downward in mid-2006, the FFR followed in mid-2007

- The 2-year yield reversed downward in Q2-2000, and the FFR followed in Q4-2000.

When the 2-year T-Note yield reversed downward in 2018, 2006, and 2000, the Fed had no idea that within 6-12 months, it would be slashing the FFR.

Fed Rate Daily Chart

Right now, J. Powell thinks the Fed will hike its targeted interest rates 2-3 more times and hold them at 5% or more until well into 2024. However, that’s nothing like what the Fed will do if the stock market, the growth numbers, the , and the employment data do what we expect over the next few quarters.

Our view is that the US stock market and economy are about to tank due to the decline in the monetary inflation rate that has already occurred, causing market interest rates to fall across the yield curve. Furthermore, the longer it takes for the Fed to wake up to what’s going on, the worse it will be for both the stock market and the economy, and the more rapid the decline in market interest rates will be.

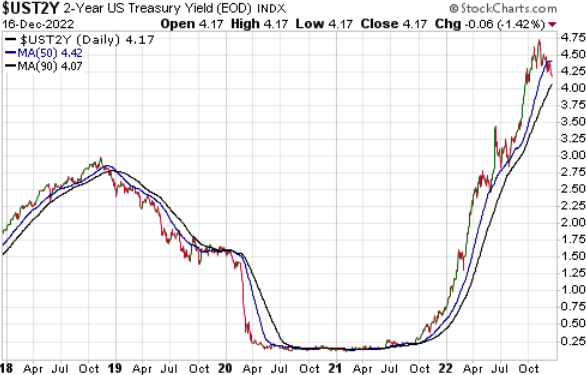

The Fed is asleep, but the market has begun to discount the ‘inflation’ collapse and the negative economic news to come. Evidence is the pullback in the 2-year T-Note yield from its high in early November to below its 50-week MA (the blue line on the following chart).

This is the first sustained break below the 50-week MA since the upward trend was established in 2021. A break below the 90-week MA (the black line on the chart) would signal that the 2-year yield’s cyclical trend has changed from up to down.

US 2-Yr Yield Daily Chart

Based on the leads and lags of the past three decades, if the early-November high for the 2-year yield proves to be the ultimate high for the cycle, which it very likely will, then the Fed has made its last rate hike and will be cutting rates by the final quarter of next year. We guess the Fed’s first rate cut will occur during the second or third quarter of 2023.

[ad_2]

Source link