A Partial Recovery For Global Markets Last Week

2022.10.10 09:26

[ad_1]

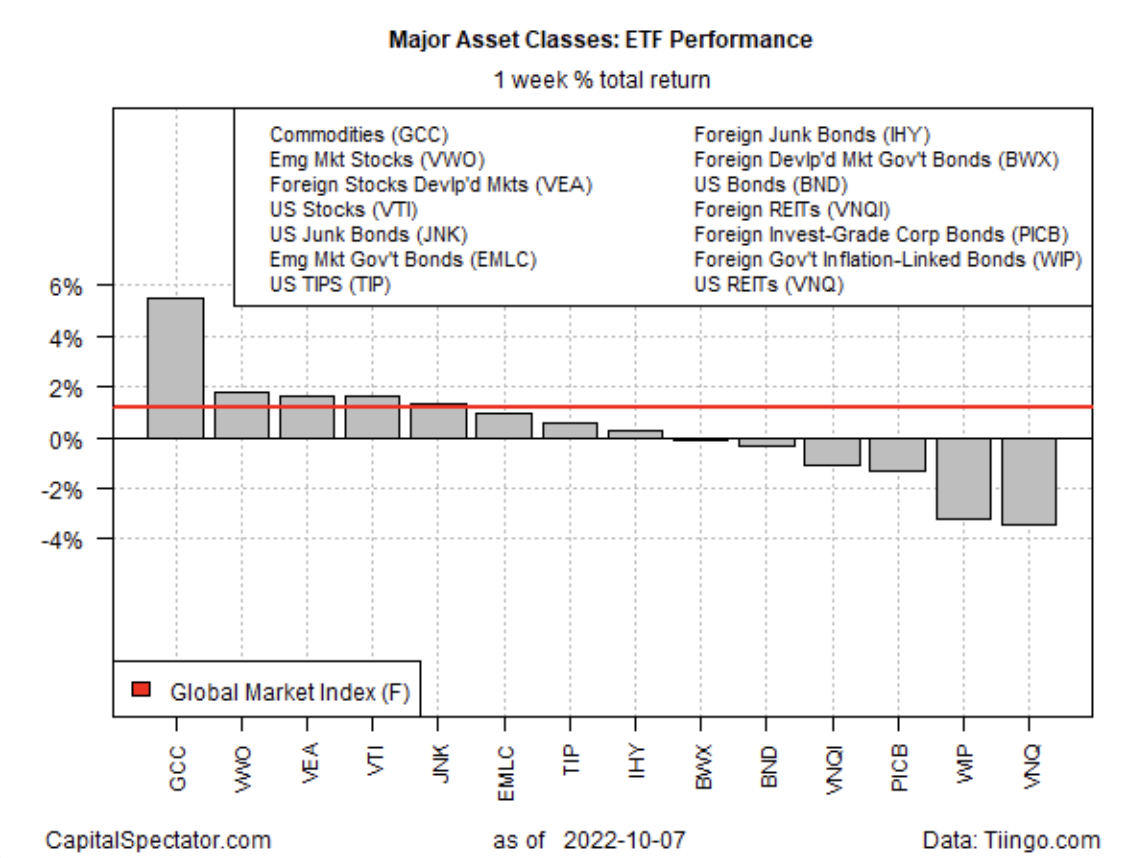

Global markets posted a mixed run in last week’s trading, but the general trend continues to skew negative, based on a set of proxy ETFs through Friday’s close (Oct. 7).

A broad measure commodities was the big winner for the major asset classes. WisdomTree Continuous Commodity Index Fund (NYSE:) popped a hefty 5.5% last week, the ETF’s first weekly gain in a month. But the rebound doesn’t change the technical bias, which still skews negative.

A headwind for sentiment in the commodities space is a renewed focus on China’s slowing economy, the world’s second-largest consumer of after the US. Stephen Innes, managing director at SPI Asset Management, advises in a research note:

“Oil … is getting hit with the triple whammy of China’s economic weakness, US monetary policy tightening and Biden administration SPR intervention.”

US stocks (Vanguard Total Stock Market Index Fund ETF Shares (NYSE:)) participated in last week’s rally, but a broad measure of US bonds (Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:)) continued falling.

Last week’s biggest loser: US real estate investment trusts via Vanguard Real Estate (Vanguard Real Estate Index Fund ETF Shares (NYSE:)), which closed down 3.4%, the fourth straight weekly loss.

Market action was a net positive last week for the Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies overall. GMI.F rose 1.2%, the benchmark’s first weekly gain in the past four.

Major Asset Classes 1-Week Performance

Major Asset Classes 1-Week Performance

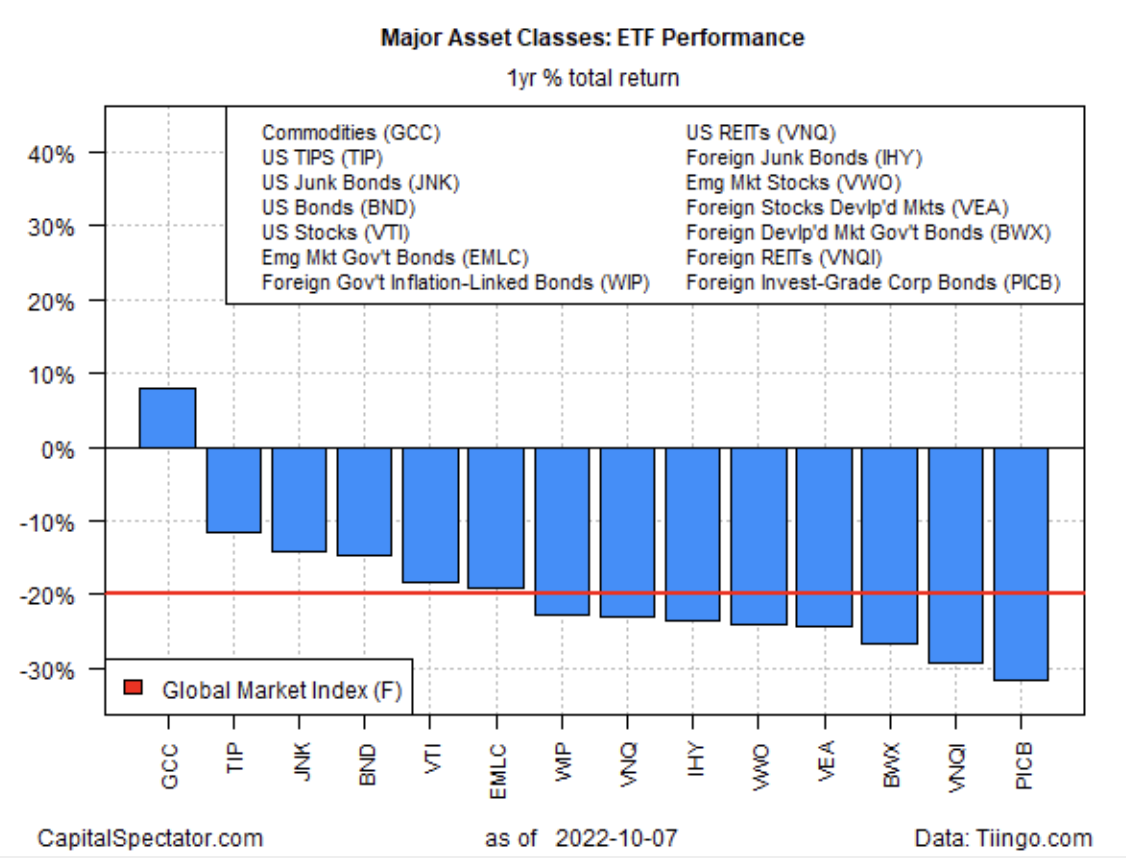

For the one-year window, commodities continue to hold on to the only gain for this time window among the major asset classes. GCC closed up 8.0% on Friday vs. the year-earlier price.

The rest of the major asset classes are still in the red for one-year results. Foreign corporate bonds (PICB) continue to post the deepest one-year loss: a steep 31.5% decline.

GMI.F is down 20.0% for the past year.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

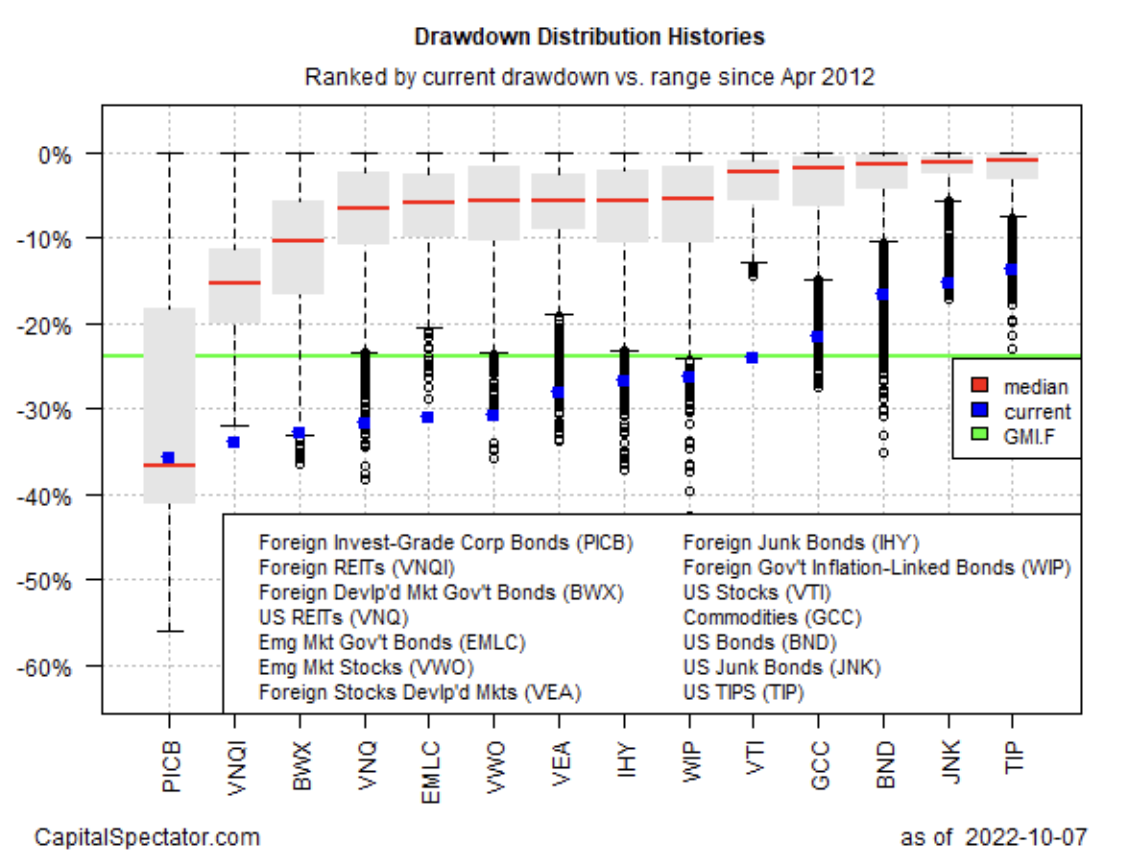

Using a drawdown lens to profile the major asset classes continues to show a range of steep peak-to-trough declines. Inflation-indexed US government bonds (iShares TIPS Bond ETF (NYSE:)) are still posting the softest drawdown: -13.8%. The steepest is currently in foreign corporate bonds (Invesco International Corporate Bond ETF (NYSE:)) via a 35.7% drawdown.

GMI.F’s drawdown: nearly -24% (green line in chart below).

Drawdown Distribution History

Drawdown Distribution History

[ad_2]

Source link