A Generational Opportunity In Commodities

2022.10.13 11:25

[ad_1]

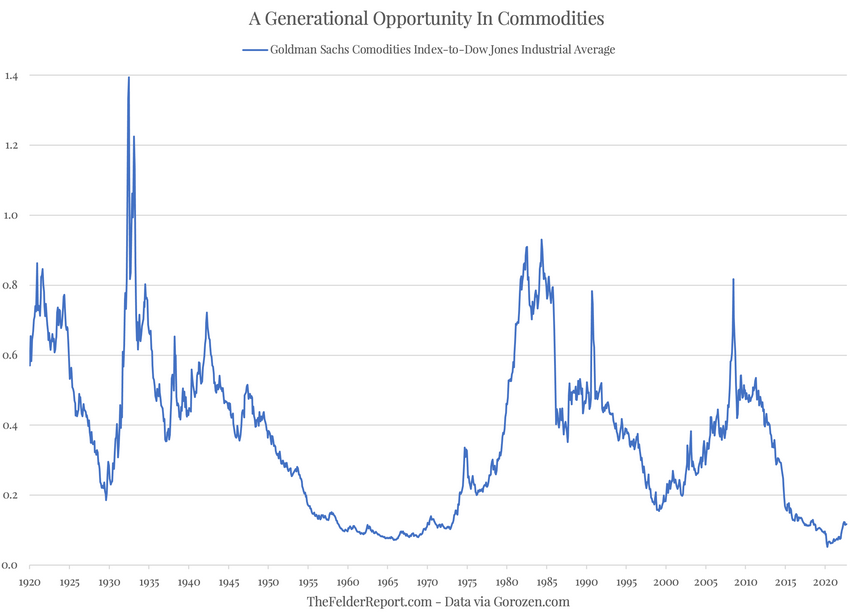

Even after their correction over the past few months, commodities have been one of the best-performing asset classes in the markets this year and over the . As a result, many investors have come to the conclusion that they have missed the trade. The truth, however, is that the bull run in commodities is probably still only in its early innings.

From a fundamental standpoint, commodities are still dramatically undervalued relative to equities. This suggests that the outperformance they have seen over the past two years still has plenty of room to run. There is also the crucial fact that in recent years represent a tremendous tailwind to the rise in this ratio which, due to the long lag time associated with these trends, will persist for years to come.

GS Commodities Index To DJIA Chart

GS Commodities Index To DJIA Chart

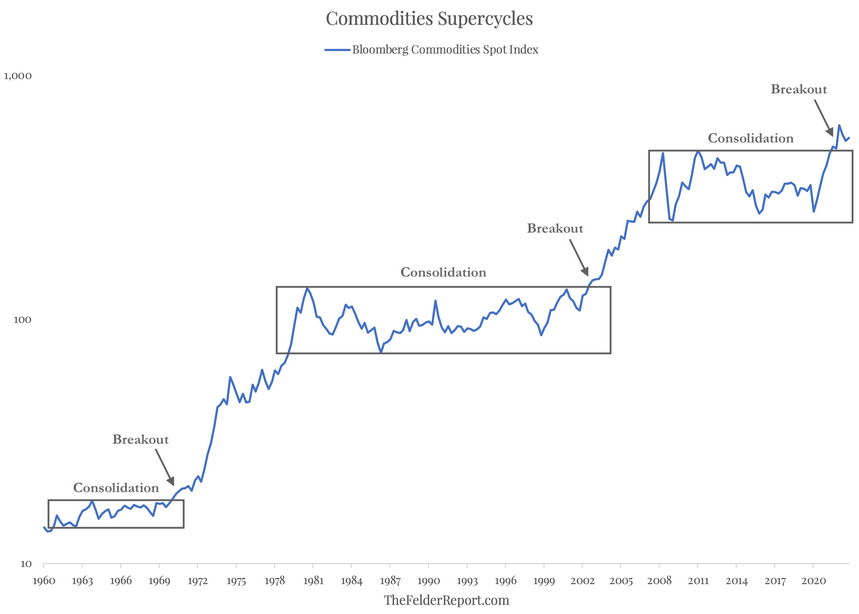

From a technical standpoint, the Bloomberg Commodities Spot Index broke out to new all-time highs this year after a period of consolidation that lasted well over a decade. As once said, “When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion,” and the history of previous breakouts in the index confirms this analysis.

Bloomberg Commodities Spot Index

Bloomberg Commodities Spot Index

So while most investors continue to shun the asset class in favor of financial assets due to hindsight bias created by the long consolidation period over the past decade or the misperception that commodities are now somehow overvalued after their stellar performance over the past two years, the fundamentals and technicals continue to tell an increasingly bullish story. shouldn’t have to strain to hear it.

[ad_2]

Source link