A Big Week For Gold: Fed, BOJ, & Jobs

2024.07.30 15:56

The news for is becoming more positive.

For example, last week’s import tax cut in India is a new pillar of support for demand and Friday’s PCE report increased the odds of a September rate cut from the Fed.

This week brings key central bank rate decisions from both the and the on Wednesday. In addition, the US is scheduled for Friday.

US corporations are reporting a lot of disappointing sales and earnings… and this week’s jobs report is likely to reflect the slump.

The BOJ appears set to hike rates and reduce its monthly bond purchases.

That should send the yen surging through the key 66 resistance zone. That could be the catalyst for the next collapse in the DXY (the ).

Tomorrow, the Fed is likely going to sound very positive about an imminent rate cut.

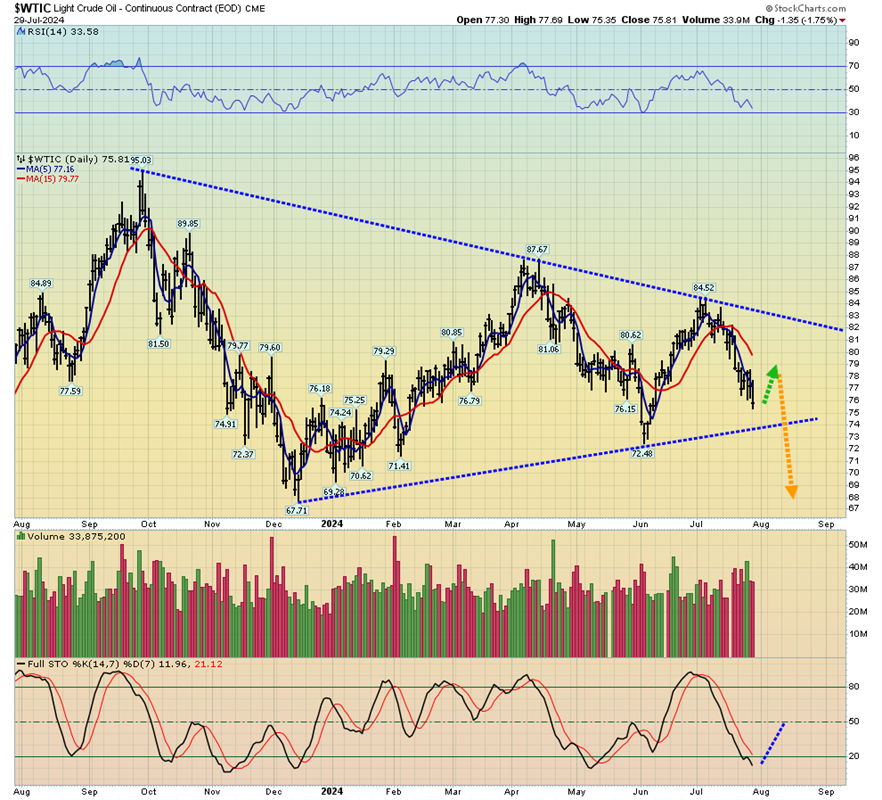

is sinking while Israel’s IDF and Hezbollah trade significant barbs… and bombs.

That can only happen if the global economy is softening. Fed chief Jay is likely now more concerned about the collapsing demand for key commodities than about sticky inflation.

The exciting and gold synergy chart. The Dow sports a very bullish flag-like rectangular drift and gold looks “eager” to burst out of its rectangle formation… and begin a surge straight towards $2600.

With Aug1-Oct31 stock market “crash season” dead ahead, the Invesco QQQ Trust (NASDAQ:) (Nadaq ETF) has an ominous H&S top.

In contrast to gold and the Dow, the Nasdaq and are perhaps best described as stock market “riff raff” indexes.

They follow “Daddy Dow” around like children, spurting ahead at times, then collapsing… and wiping out a lot of silly investors who tried to outperform the Dow while failing to embrace gold.

Speaking of gold, the greatest money in the history of the world, the fabulous daily chart. The RSI oscillator tends to move between 70 and 50 in a strong market, and that’s what it’s doing now.

Stochastics is moving towards the oversold zone and our latest buy alert (of modest size) issued for the $2385-$2365 zone looks fantastic.

There’s more good news for gold bugs and here it is: While demand is collapsing for growth commodities like oil, there is no collapse in the demand for gold. There are pockets of weakness in the jewellery sector, but there’s much more strength elsewhere.

The love trade for gold gets most of the press in the East, but there’s a massive fear trade there too.

Coin and bar sales are surging in China and so is Shanghai futures market volume. That’s the fear trade at work in Asia… and at work with size.

What about ? The Stochastics lead line is approaching one of the most oversold levels of the past several years…

And it’s doing so as the price is on the outskirts of massive support. My suggested approach for aggressive and excited silver bugs is a three point buy program:

Buy one tranche right now. Buy a second one after the Fed and BOJ announcements and buy a third one after the jobs report is released on Friday.

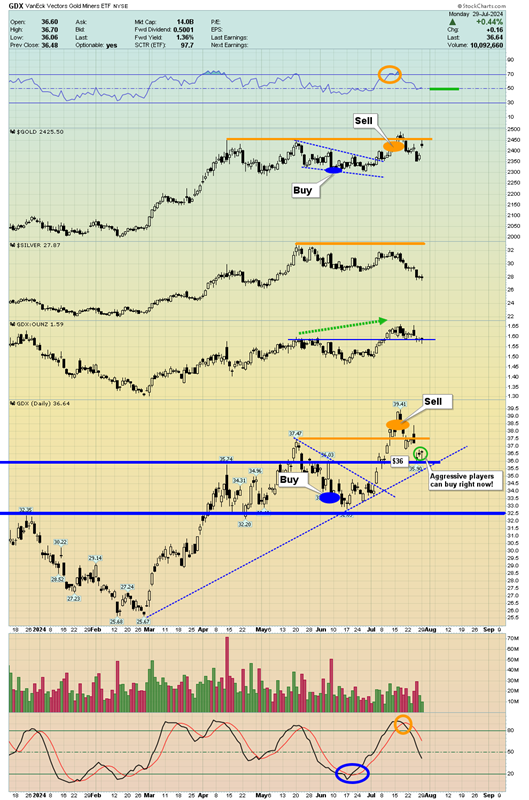

A look at the miners, the GDX (NYSE:) daily chart. Stoploss enthusiasts could buy now with a $35 stop. More conservative investors should wait for the jobs report before they buy.

The Indian tax cuts, the rise of the Chinese fear trade, collapsing energy prices, and of course the incredibly comical actions of debt-obsessed governments… all in all, it’s a phenomenal time to be involved with gold, silver, and some great mining stocks around the world.