Week Ahead: CPI Report Threatens to Destabilize Rates

2025.02.10 04:10

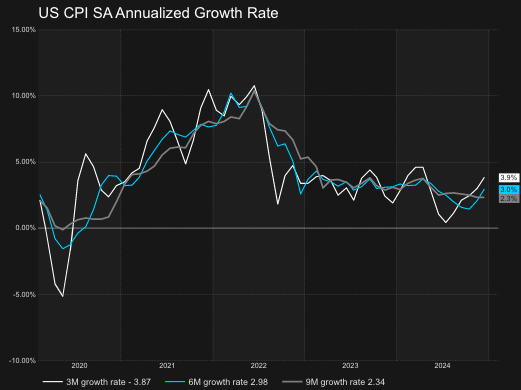

This will be a hectic week. Earnings season is winding down, of course, but we have lots of economic data, starting on Wednesday with the , which is expected to rise by 0.3% m/m from 0.2%. Meanwhile, core CPI is expected to increase by 3.1% , compared to 3.2% last month. Headline is expected to rise by 0.3%, down from 0.4% last month, and headline CPI is projected to be 2.9%, the same as last month.

Then, on Thursday, we’ll get PPI, and on Friday, retail sales. We’ll also see some key Treasury bond auctions this week. On Tuesday, February 11th, we’ll have the auction. On Wednesday, February 12th, the will be auctioned, and on Thursday, February 13th, the . These will be important to watch, especially given the recent volatility in the bond market.

Strong Jobs Report

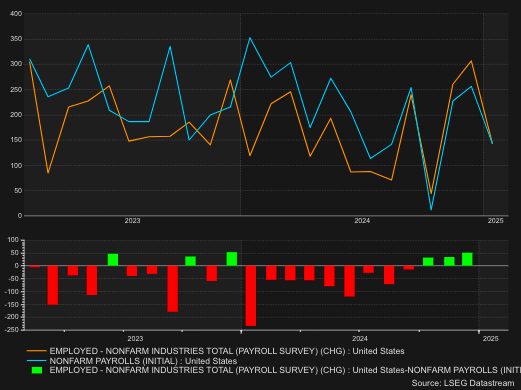

Looking back at some of last week’s economic data, the was much stronger than expected, especially when considering the overall nonfarm payroll numbers. We discussed benchmark revisions the previous week, which were better than expected. Last month’s figure was revised significantly higher, from 256,000 to 307,000.

While this month’s report did miss estimates—coming in at 143,000 versus expectations for 170,000—the upward revisions from last month explain some of that weakness.

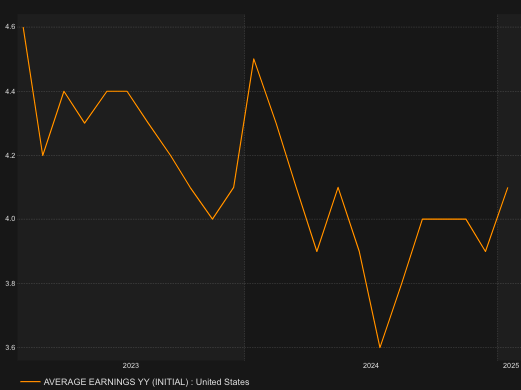

The rate fell to 4.0%, compared to the 4.1% estimate. Average hourly earnings increased by 0.5%, well above the 0.3% estimate. Year-over-year, average hourly earnings rose to 4.1%, easily beating the 3.8% estimate. Last month’s number was also revised from 3.9% to 4.1%. These were substantial numbers overall, especially when viewed in the context of job creation, a declining unemployment rate, and rising wages.

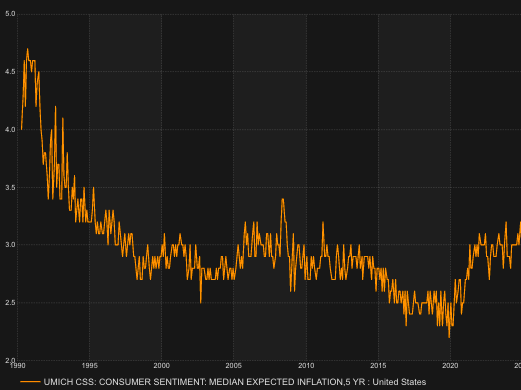

The numbers were also notable. One-year inflation expectations jumped to 4.3% from 3.3% last month—a 100-basis-point increase. Five-year expectations rose to 3.3%. We’ve seen this 3.3% figure in the preliminary numbers before, and it has typically been revised down to 3.2% in the final reading. If the final number does come in at 3.3%, it could mark a significant breakout.

Inflation is, in many ways, psychological. When people expect higher inflation, they tend to spend more sooner and become more accepting of price increases. If consumers raise their expectations for future prices, the Fed may be losing its grip on keeping inflation expectations anchored.

The recent rise in inflation expectations and survey data from businesses and regional Feds suggest rising inflationary pressures. January inflation swaps were priced at around 2.92%, slightly above expectations. These numbers can shift as we get closer to the release date, but if core and headline CPI both come in at 0.3%, it would indicate that inflation has accelerated over the past six months, diverging from the Fed’s target.

The key question is whether this trend will reverse in the next three to six months, but right now, inflation swaps and bond markets suggest concern. Two-year inflation swaps have moved back up toward the 2.64% area, near the upper end of their range. A breakout above 2.70% could signal a move toward 3.0%.

All of this will impact interest rates. On Friday, the 10-year yield bounced back to around 4.5%. We discussed last week how the 61.8% retracement level was acting as support, and so far, that level has held. If the 10-year yield moves higher again this week, it would be another warning sign.

Equity financing costs continue to struggle, with little improvement. February contracts are trading at just 39 basis points above, while March contracts are at 52.5 basis points—down sharply from their 180-basis-point peak before the Fed meeting. Demand for leverage has faded, which may explain why equities have struggled recently. The market appears more cautious about taking on leverage at these levels.

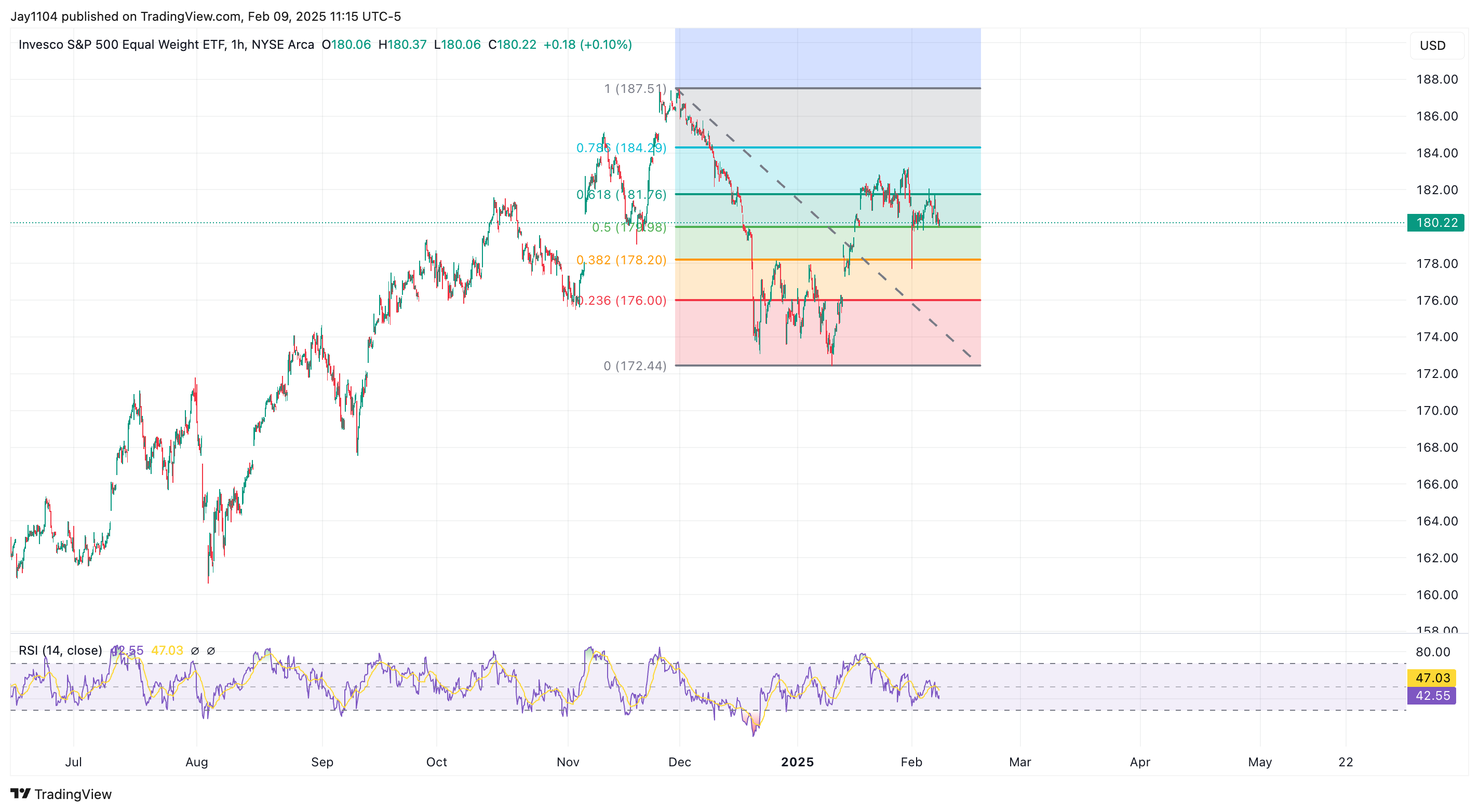

Looking at the , we’ve seen lower highs forming—January 24th, January 31st, and last week—along with lower lows since January 21st.

The has yet to surpass its December 16th high, and even this year’s high remains the January 24th level, reinforcing the pattern of lower highs.

The looks weak as well, dropping on Friday. It hit the 61.8% retracement level on January 17th, stalled, attempted a breakout, and is now moving lower again.

The was hit hard on Friday, dropping nearly 3% following the jobs report, highlighting its sensitivity to rising interest rates.

One last key data point: December 2025 Fed funds futures are trading around 3.98%, just a few basis points below the 4.06% upper range in mid-January. If we get a hot CPI report this week, those futures could move back above 4.0%, signaling that the market is pricing out rate cuts entirely. Given last week’s stronger-than-expected wage data, rising labor costs, and declining productivity, inflation risks remain elevated. Historically, rising labor costs and falling productivity have been associated with higher inflation.

Anyway, have a great weekend, and I’ll see you on Monday. Bye!

Terms By ChatGPT

1. Inflation Swaps

A derivative contract used to hedge or speculate on future inflation. One party pays a fixed rate, while the other pays a floating rate based on actual inflation. The two-year inflation swap rate reflects market expectations of average inflation over the next two years.

2. 61.8% Retracement Level (Fibonacci Retracement)

A technical analysis concept where 61.8% is considered a key retracement level based on Fibonacci ratios. It suggests a potential support or resistance level where prices may reverse.

3. Treasury Auctions (3-Year, 10-Year, 30-Year Notes)

U.S. Treasury securities are sold at auction, and their demand affects interest rates. The bid-to-cover ratio (not mentioned but relevant) indicates how strong demand is.

4. Core CPI vs. Headline CPI

Core CPI: Excludes food and energy prices, which are volatile.

Headline CPI: Includes all items in the consumer price index.

5. PPI (Producer Price Index)

Measures inflation at the wholesale level, showing cost changes for businesses before reaching consumers.

6. Fed Funds Futures (e.g., Dec 2025 Contracts at 3.98%)

Derivatives that predict future Federal Reserve interest rates. A higher price implies lower expected rates, while a lower price suggests higher rates.

7. Repo Market (Repurchase Agreements)

A short-term borrowing market where securities are sold with an agreement to repurchase them later. A decline in repo activity suggests lower demand for leverage (borrowed money to invest).

8. Nonfarm Payrolls (NFP) & Benchmark Revisions

Nonfarm Payrolls: Measures U.S. job growth, excluding farm workers and some other sectors.

Benchmark Revisions: Annual adjustments to employment data, which can significantly change prior months’ reports.

9. RSP Index (Equal-Weighted S&P 500)

Unlike the regular S&P 500, which is weighted by market cap, the RSP index gives each stock an equal weight, showing how all stocks (not just the largest) are performing.

10. Fed Cutting Rates vs. Market Pricing Out Rate Cuts

Cutting rates: The Fed lowers interest rates to stimulate economic growth.

Pricing out rate cuts: Market expectations shift away from expecting lower rates, often due to strong economic data or higher inflation risks.

Original Post