Brent Outlook Under Pressure Amid Deteriorating Global Growth Outlook

2025.02.04 09:08

Market Overview

continues to face downward pressure, reflecting growing concerns over the global economic outlook. China’s recent retaliatory tariffs on US imports have deepened uncertainty in international trade, dampening growth expectations and reducing oil demand prospects.

Meanwhile, despite direct pressure from US President Donald Trump to increase production and curb energy prices, OPEC members opted to maintain current output levels during their Monday meeting. This decision has kept supply unchanged, forcing Brent crude into a battle between weakening demand sentiment and a stable production outlook. As a result, Brent is testing new support levels, with investors looking for cues from US crude inventory reports for further direction.

Technical Analysis

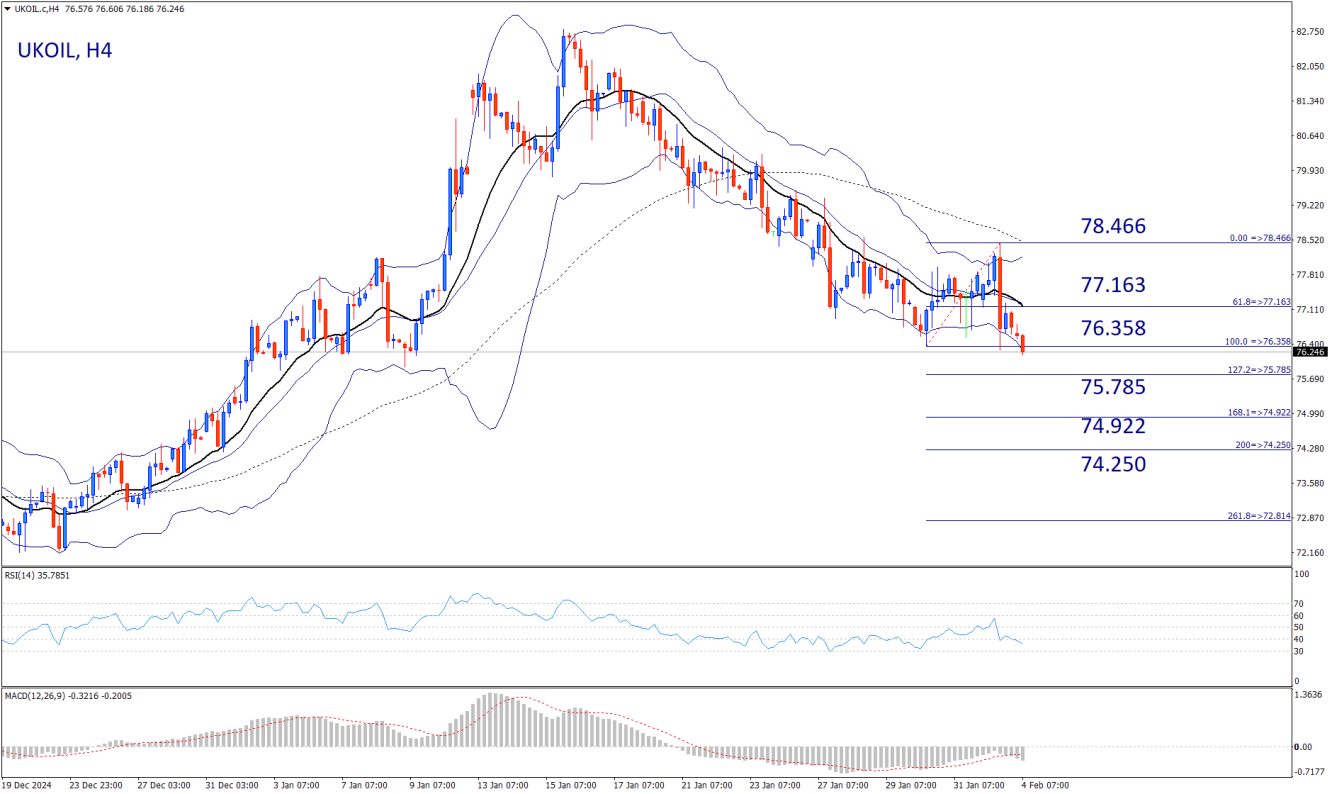

On the four-hour chart, Brent crude remains in a persistent downtrend, with price action now challenging the key support zone at $76.358. Sellers are attempting to break this level for the second consecutive time, aiming to extend the bearish momentum.

A sustained break below this level could trigger further downside toward $75.785, $74.922, and $74.250, aligned with 127.2%, 168.1%, and 200% Fibonacci extension levels, respectively.

Momentum indicators confirm the bearish sentiment. RSI remains in the oversold zone, signaling continued selling pressure. MACD is declining, showing growing bearish momentum. Bollinger Bands exhibit downward divergence, with price clinging to the lower band, reinforcing the negative outlook.

If buyers attempt a rebound, the immediate resistance stands at $77.163. A break above this level could expose $78.466, a critical resistance zone that would invalidate the current bearish scenario.

Key Technical Levels

- Resistance Levels: $77.163, $78.466

- Support Levels: $76.358, $75.785, $74.922, $74.250

Fundamental Factors Driving Oil Prices

Investors now turn their attention to the American Petroleum Institute (API) crude stockpiles report, set for release later on Tuesday. If US crude inventories decline more than expected, it could signal stronger demand, potentially supporting prices. Conversely, a larger-than-anticipated inventory build would reinforce oversupply concerns, keeping oil under pressure.

Conclusion

Brent crude remains under sustained selling pressure, with a potential breakdown below $76.358 paving the way for further declines. However, a recovery above $77.163 could ease bearish momentum and shift short-term sentiment.