Gold: Bullish Bias Amid Tariff Uncertainty and FOMC

2025.01.28 16:52

prices dropped yesterday as markets digested a host of factors which included tariff threats and a market shock thanks to Chinese AI startup DeepSeek. The precious metal has edged its way higher since printing a low of $2730/oz to trade around $2750/oz at the time of writing.

Yesterday’s price drop in Gold may also have been down to some profit taking following an impressive rally last week. Given the US Federal Reserve interest rate meeting is tomorrow, market participants may have opted for some profit taking ahead of a potentially volatile Wednesday.

Tariff Threats Back in Focus – Bessent vs Trump?

The threats of tariffs came back to the fore yesterday as well. The Financial Times reported that new Treasury Secretary Scott Bessent is pushing for a gradual increase in universal tariffs, starting at 2.5% and possibly going up to 20%. President Trump later said he wants even higher tariffs and is considering specific taxes on products like steel, , and semiconductors.

This goes against market expectations that tariffs would be applied on a case-by-case basis, like with Colombia, rather than across the board. Since these plans are being actively developed by the Treasury and not just hinted at by Trump, the US Dollar has been making moves with a lot of whipsaw price action experienced by the Dollar Index (DXY).

FED Meeting Ahead – Extended Pause?

The meeting tomorrow should result in an extended pause given the ongoing uncertainties around tariffs. Despite Fed Chair Powell’s comments in the lead up to the December meeting that policymakers do not concern themselves with the political side of things, the meeting minutes showed that policymakers are concerned about tariffs.

The threat of tariffs continues to shake markets when mentioned, and strengthens the US dollar. The impact on inflation however, is where the concern lies for the Fed with Trump’s comments yesterday around specific taxes on products like steel, copper and semiconductors likely to lead to an increase in price pressures down the line.

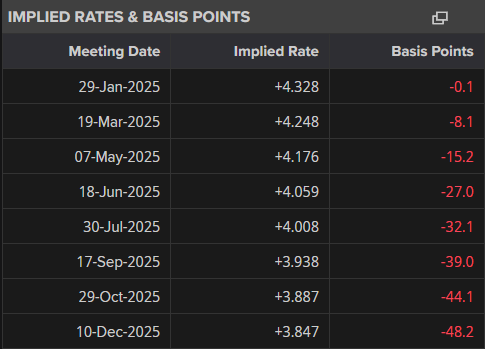

Markets are now pricing in around 48 bps of rate cuts from the Fed through December 2025.

Source: LSEG (click to enlarge)

Final Thoughts

Personally I still maintain a bullish bias on Gold largely from the fact that the uncertainties around tariffs and their impact will keep safe haven flows elevated. As we saw yesterday, the US Dollars safe haven appeal may be waning with the JPY and CHF faring better during the DeepSeek inspired market rout.

Geopolitical and growth concerns may also factor in and thus lend a supporting hand to Gold prices in the days and weeks ahead.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, this analysis is a follow up from the technicals last week.

‘s breakout after President Trumps inauguration fell short of the al time highs as the precious metal rejected at the 2785 handle.

Yesterday’s selloff has not resulted in a trend change with bulls coming back in to push prices above the 2750 handle.

Gold (XAU/USD) Daily Chart, January 28, 2025

Source: TradingView (click to enlarge)

Dropping down to a H4 chart and as you can see below, the trend has changed to bearish with a lower high followed by a lower low. However there is a descending trendline in play with the swing high resting at 2770.

A candle close above the descending trendline, could lead to a retest of the 2770 ahead of the FOMC meeting.

A 4-hour candle close above the 2770 handle could be seen as a pre-cursor for fresh all-time high for the precious metal.

Keep an eye out for comments around tariffs or any other geopolitical comments from the Trump administration as this could have a knock on effect on global markets.

Gold (XAU/USD) Four-Hour H4 Chart, January 28, 2025

Source: TradingView (click to enlarge)

Support

Resistance

Original Post