Markets Crave Another Quiet Session

2024.12.30 08:49

- Markets remain in holiday mode.

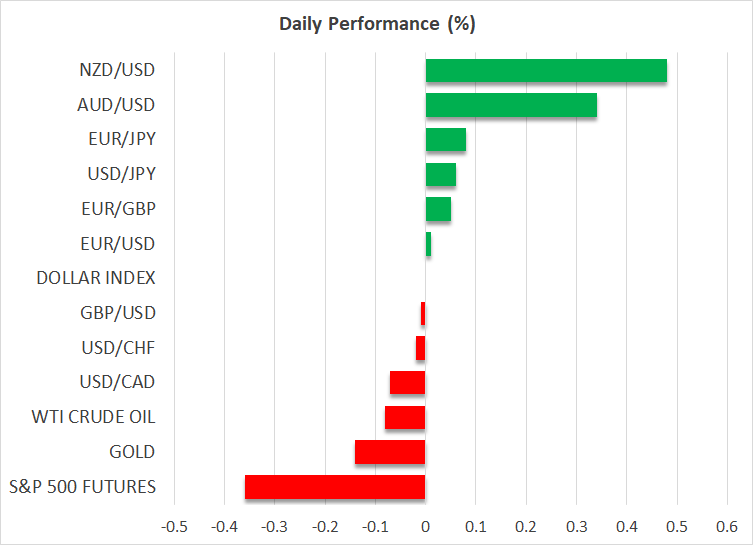

- Dollar maintains most of last week’s gains.

- Yen and bitcoin suffering continues.

The final full trading session of 2024

The last full trading session of 2024 is already underway, as both the US bond market and New York Stock Exchange will observe an early close on New Year’s Eve. Low liquidity, confusion about the outlook and range-trading have characterized the last few sessions of the year, with the giving back only a tiny fraction of its post- gains against the .

The euro cannot catch a break, as there is a plethora of negative news regarding the eurozone. Germany is preparing for the February general election, with political tensions rising exponentially following the recent terrorist attack on a Christmas market and Elon Musk’s opinion in favour of the AfD party. Meanwhile, Ukraine is preparing to restrict the flow of Russian , provoking ire from its neighboring countries like Slovakia, which are still using Russian and gas, potentially threatening the flow of economic and military assistance from the bloc.

Stocks are probably not enjoying uncertainty at this stage

Stock indices probably had the most interesting week, managing to withstand Friday’s weakness to finish in the green on a weekly basis. The debt ceiling story has returned to the spotlight, with the climbing to 4.6%, the highest level since May 2024. President-elect Trump has already talked about abolishing this limit. While this is slightly far-fetched considering the US Constitution, some legal experts point to loopholes that could be exploited, if needed, by Trump.

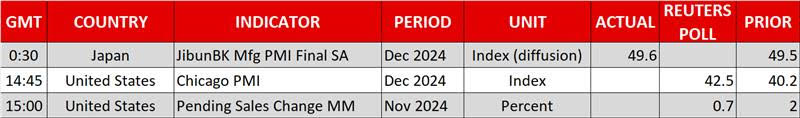

With most senior market participants on holiday, leaving the juniors in charge of the trading desk with strict orders to do as little as possible amidst a very challenging period, the low liquidity environment is expected to persist in today’s session. The calendar is light today, with some US data such as the December Chicago Purchasing Managers’ index and the November pending home sales potentially generating a few pips’ worth of moves in the FX space.

Yen underperformance continues

Meanwhile, the remains under pressure, with dollar/yen hovering slightly below the 158 level. Despite a solid set of Japanese data lately, such as last Friday’s and data, the market is once again testing the patience of Japanese officials, with Finance Minister Kato responding with a barrage of verbal interventions on Friday. As a guide, in April, the first intervention of 2024 took place when dollar/yen traded aggressively above the 158 level.

Gold trades sideways, bitcoin tests recent lows

has been trading sideways lately, hovering between the 50- and 100-day simple moving averages, and thus pointing to an almost perfect balance between buyers and sellers. This price action is essentially revealing the lack of appetite for any sizeable positioning in the market.

The same cannot be said for the crypto market, which continues to suffer from extensive profit-taking. is trading a tad below $94k, almost $15k below its all-time high, with the remaining major cryptocurrencies suffering greater losses. Bitcoin remains, though, around 40% above its pre-US presidential election level, and around 120% up in 2024, making it one of the strongest years in its history.